Christmas is around the corner, and I thought it might be helpful if we did a quick recap and evaluation of the different spend and redeem promotions that the banks have come out with.

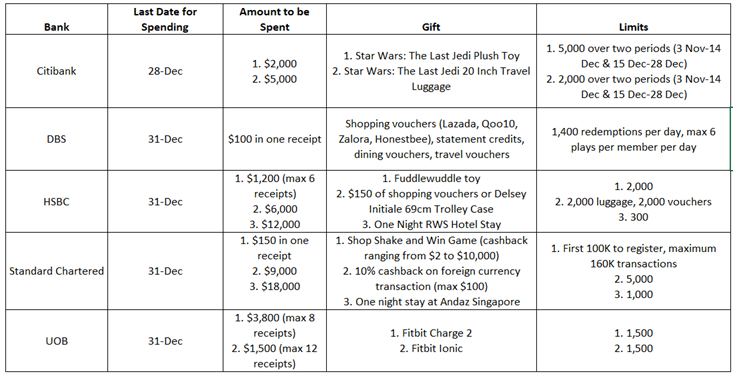

Here’s a summary table of what’s available:

And here’s a link to each promotion’s T&C:

[Update: As soon as I published this article I realised that UOB’s giveaway is fully redeemed too]

How can we analyze this?

Minimum spend requirements/ maximum receipts permitted

The minimum spend required to take part is a good measure of how “accessible” each promotion is. In that respect, DBS and SCB are clear winners with a minimum of $100 and $150 spending required respectively.

But UOB differs from other banks in that it sets a maximum number of charge slips that your spending can be spread out across (8 and 12 respectively for the Charge 2 and Ionic). HSBC has this limitation but it’s strangely only for the stuffed toy and not the higher value gifts.

Eligible spending types

As you might expect, each bank has a list of spending that doesn’t qualify towards this promotion. The usual suspects like quasi-cash transactions, EZ-link top ups and the like don’t qualify, although the exact wording that each bank has is different (DBS and UOB for example exclude donations to charity…come on guys, it’s Christmas) so it’s well worth checking out individual T&C.

UOB’s entire promotion and HSBC’s stuffed toy giveaway is only valid for spending that comes with a charge slip, i.e. online shopping doesn’t count .

Redemption limits/mechanisms

All of the above means squat for you if you can’t actually win something. The frustration with DBS’s horrible redemption app is well documented, and this is where I feel SCB has done a lot better than DBS because its Shop Shake and Win cashback game doesn’t require you to camp out on an app with your fingers crossed it doesn’t hang. Instead, you get an winning SMS so long as you’re within the first 160,000 eligible transactions.

Some gifts have…limited appeal

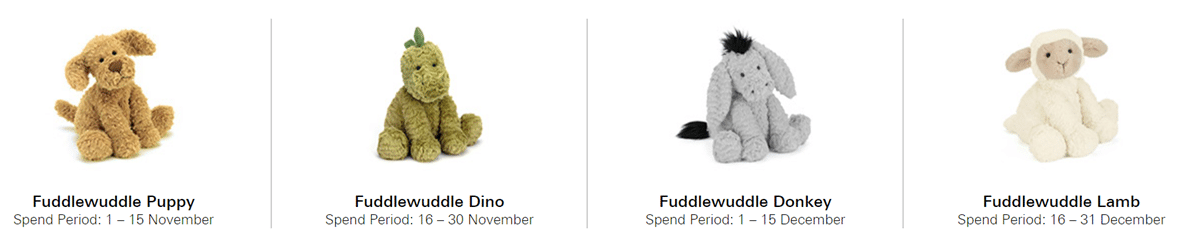

For the life of me I can’t remember what previous years gifts were but it seems this year the gifts have a bit more of a niche appeal. I’d have thought the banks would want to play it safe and give away things like statement credits, or shopping vouchers, or stuff with wide appeal. Instead, HSBC is giving away Fuddlewuddle stuffed toys, which well don’t rank very high on my want list.

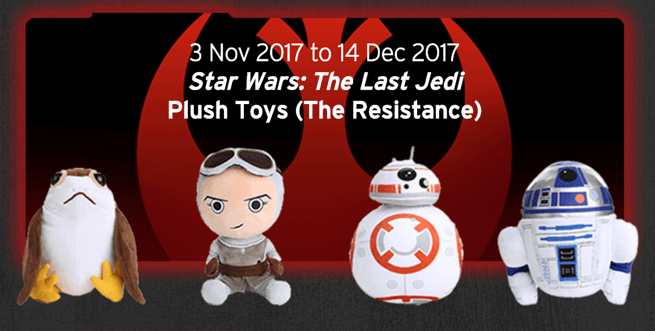

Similarly, Citibank is giving away Star Wars plush toys and luggage, but what if you couldn’t care less for Star Wars (go away then)?

DBS and SCB have probably opted for the safest gifts in that respect

Conclusion

I can’t imagine any of these promotions will last too long so hopefully this will arm you for your shopping ahead. Remember, if you’re not hot on the gifts available it may make more sense to optimize for a miles earning strategy instead of one that lets you qualify for something you don’t really fancy.

I got my fitbit ionic! the 3.8K charge to redeem this item is worth it! thank you Aaron for this write up!

lucky you! it looks gorgegous but it’s all gone now

Is there a mass typo here :

“It’s worth noting that It’s worth noting that Maybank too has a promotion but it’s been fully redeemed. but it’s been fully redeemed.” ?

Or to put it another way: yes, we know it’s been fully redeemed….don’t have to rub it in 🙂

stop cramping my style.