On Tuesday last week I headed down to Techno Edge (the best canteen in NUS I’d dare say) for a nice cheap bowl of Bak Chor Mee. As I dashed into the canteen hoping to secure a seat during the busy lunch hour, something caught my eye, a blue and white standee conspicuously leaning against the yellow walls of Techno Edge. What’s that? A debit card and savings account that are miles ahead? It’s the KrisFlyer UOB account!

The friendly UOB agent chatted me up and in less than 5 minutes, I was convinced that I should definitely sign up for the KrisFlyer UOB account to receive some awesome perks. I was so excited that I went to inscribe my name into a picture of the card which they have on their website.

In all seriousness though, I really thought that UOB was finally marketing the card to students by making it a wee bit more attractive to them. I mean they’re exclusively offering NUS students these things :

- No initial deposit (meaning my account can be empty for a year)

- No fall below fee for 1 year (refer to above comment for implications)

- 2 years debit card annual fee waiver (I mean, seriously you’re charging people to use the card)

As a student, finances can be rather tricky, so not having an initial deposit to the account is a lifesaver as I wouldn’t have to scratch my head over whether to split my savings into two separate bank accounts. Also, having the fall below fee waived is also awesome as then, should I wish, I could just deposit some cash inside the account for my spending to earn some miles.

Also, the spending requirement for the free Economy Class ticket to Phuket with SilkAir is reduced to just S$300 and an MAB of S$3,000 instead of S$500 and S$5,000 MAB. So you’re effectively receiving a higher “rebate” from your spend should you get the ticket compared to regular folks (although you should note the extremely, extremely onerous T&C governing this free ticket as Aaron pointed out here).

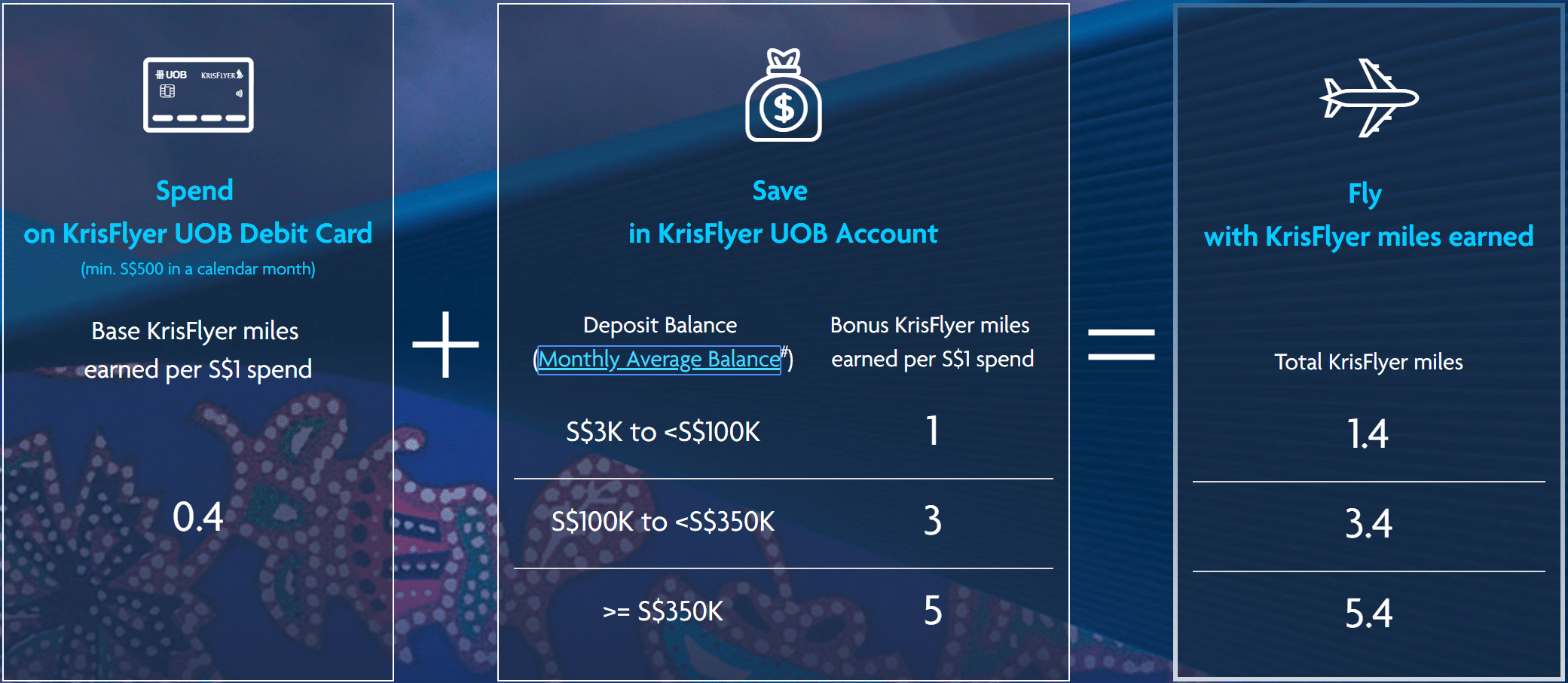

As a refresher, here’s how many miles you’d earn should you place spending on the UOB KrisFlyer card.

Other advertised benefits are the Grab vouchers, Changi WiFi discount codes and the S$10 convenience fee waiver for Scoot flights. All of which, are what students look for when going on holiday. Discounts, discounts and discounts. On the surface, it might seem nice.

But here’s where the fun ends.

Better interest rates to be found elsewhere

The KrisFlyer UOB account, like many other savings accounts offers a paltry 0.05% on your savings. That’s to say if you have S$10,000 in your account, you’ll only be earning S$5 each year. Which would probably not account for anything after factoring in inflation. Personally, I’m putting my savings into the CIMB Fast Saver account which earns me 1% interest. That’s way better than what UOB is offering. Granted my money could be grown some place else but I’m too lazy to do investments, thus the CIMB Fast Saver would be the best choice for me since I probably won’t qualify for Multiplier style accounts.

Already, this should be a clear sign you shouldn’t be parking your life savings into the KrisFlyer UOB account to earn miles which are capped at 5% of your MAB anyway. Your money is better off in a high interest earning account.

MAB and minimum spend requirements not waived for students

Similar to the standard KrisFlyer UOB account, you’d need to have a minimum expenditure of S$500 on the card before being eligible to earn any miles. This includes the base mile earning rate of 0.4mpd. Bonus miles are still capped at 5% of your MAB which must be maintained at above S$3,000 to earn the bonus miles. If you don’t hit the minimum spend of $500, you’ll be effectively be earning zero returns on all your expenditure. Yes, even worse than using a normal debit card issued by banks when opening a savings account with them.

Referring back to the sign up gift requirements for students, even though you spent S$300 to earn yourself(hopefully) the return Economy Class ticket, you still won’t be earning any miles unless you spend another S$200 more.

Unless you’re eating out 7 days a week at restaurants(think fast food), having McDonalds daily for lunch at Techno (bless your waistline) or heading to Zouk every Friday religiously for the dum zi dum zi and being generous by opening a table (not that I know what’s that), you’re probably not going to hit the S$500 minimum spend needed before you’ll even earn your first mile on the card.

To put things into perspective, here’s what my daily expenditure looks like :

- Transport to and from school : S$2.46

- Lunch : S$5 (if I’m feeling especially hungry)

- Coffee : S$0.80 – S$1.40

Of the amount specified above, the only thing that’s potentially miles earning would be the transport portion if I use the card for the Transit Link ABT program. Even then, I’ll definitely not hit the minimum spend of S$500 before being eligible to earn any miles, which is frankly ridiculous.

Cashback might actually make more sense for students

Fire and fury will rain down on me for saying this, but honestly you’ll be better off with a cashback debit card in the form of the DBS Visa debit, which almost everyone has. It’s sad that DBS has recently imposed a minimum spend condition of S$400 and your monthly cash withdrawals has to be less than S$400 before the 5% cashback is awarded, but it’s still better than what you’d get with the KrisFlyer UOB card. In addition, there’s currently a promotion where if you withdraw zero cash from the ATM and hit a minimum spend of S$400, you’ll be eligible for 10% cashback, capped at S$50 of course.

Here’s some figures that I obtained through my own calculations and with the help of UOB’s Miles Calculator assuming that you plonk S$10,000 into your KrisFlyer UOB account and maintain it at S$10,000 each month plus hit the minimum spends.

| Account Balance : | 10000 | Expenditure : | 500 | |

| KrisFlyer UOB | DBS Visa Debit | |||

| Miles Earned | 700 | Cashback Earned | 25 | |

| Total in a year: | 8400 miles | $300.00 | ||

With the 8,400 KrisFlyer miles earned in a year, there aren’t any good redemption plans to be made. Even if you consistently hit the minimum spend and maintain or increase your MAB in the account as time goes by, it’ll take you forever to accumulate enough for a decent redemption. And please don’t redeem them for Scoot vouchers, you’re not doing yourself a favour.

However, with the S$300 cashback that you’re getting with the DBS Visa debit, you already can have a trip up to Bangkok on SQ on their promotional fares which can be as low as S$228, and have some spare change for pigging out in Bangkok on Pad Thai and Green Curry. Not to mention you’re losing out on loads of interest by maintaining S$10,000 in the KrisFlyer UOB account whereas for the DBS savings account, I only need to maintain a MAB of S$500 to avoid getting slapped with the fall below fee and park the rest of my money in my CIMB account to earn 1% interest.

Even if you saved the S$300 cashback a year for three years as compared to saving up the miles for 3 years earned via the KrisFlyer UOB card, you’d be able to purchase a round trip Business Class ticket on Singapore Airlines/Cathay Pacific to Bangkok as compared to only redeeming a one-way Business Class ticket to Bangkok. As always, redeeming your miles for Economy Class just presents very very poor value as you’re losing out from the cost of acquisition (generally speaking).

Concluding thoughts

Personally, I’m earning all my miles through the use of supplementary cards since I’m not really interested in getting a secured credit line myself, hence I’l probably be using the KrisFlyer UOB for the S$10 Grab rides to the airport should I have a holiday. I doubt UOB would fully remove the MAB requirement for the earning of bonus miles nor the cap on bonus miles earned but if they just remove the minimum spend requirement for the card for students who signed up at their roadshows, I think the reception to it would be much higher especially since we’d effectively be getting zero returns on our expenditure with the KrisFlyer UOB card should we not the hit minimum spend currently.

I legit love the card design though. So kudos to UOB for that.