A couple days ago Citibank launched an absolutely insane promotion with Apple Pay that let you earn up to 20X (8 mpd) points when you used your Citibank Rewards, Citibank Prestige or Citibank Ultima card.

In my post I mentioned that it was quite clear to me that this 20X promotion was distinct from the 10X promotion that Citibank Rewards runs year round for purchases at department stores, bags, shoes and clothes. That promotion is capped at S$12,000 of spend every membership year. The T&Cs of this Apple Pay promotion did not mention any cap at all.

But miles chasers, being who they are, started worrying and getting paranoid. A couple even called up Citibank to ask whether the 20X promotion was also subject to the same cap as the 10X, and unhelpfully, some CSOs told them “yes” (rule #1: CSOs don’t always have the right answers).

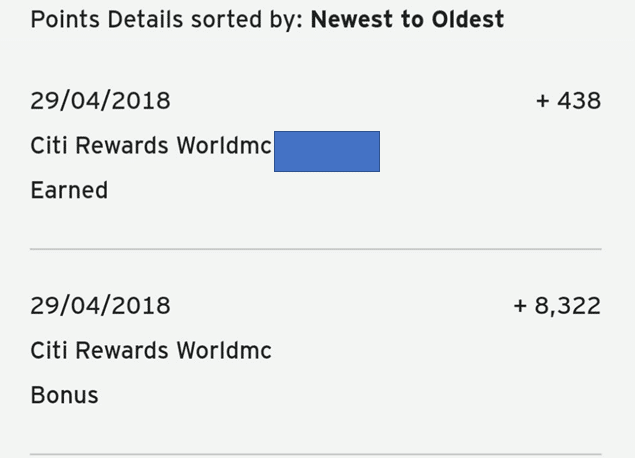

Fortunately, we have empirical evidence that this is untrue, as there are numerous reports on the Telegram Group of users who had already maxed out their Citibank Rewards cards on the 10X promotion getting 20X with the Apple Pay promotion. I do not have an Apple phone, but I’ve been able to independently verify this with a friend who uses Apple Pay as well.

Unlimited 8 mpd everywhere is bonkers

Every once in a while we get a promotion that seems too good to be true. The HSBC Advance’s unlimited 4 mpd on dining and online spending and the OCBC Titanium Reward’s 12 mpd on IKEA purchases are a couple in recent memory. There’s little doubt in my mind that this Citibank Apple Pay promotion will go down in the same league as those.

I predict a riot among Citibank cardholders with Apple phones over the next couple of months. I know more than a few who plan to frontload all their grocery shopping for the rest of the year by buying NTUC vouchers. Do remember however that if a merchant already earns 10X under the year round Citibank Rewards promotion, you will not earn 20X if you use Apple Pay (eg buying Taka vouchers won’t work). There is no such restriction if you hold the Citibank Prestige or Citibank Ultima cards.

What a time to be alive!

In the light of maximising this promotion, anyone knows how you can Apple Pay for hotel bookings? I read that you can do so for Hotels.com (perhaps Expedia too) but when using the iOS app, there does not seem to be an option. Is this only for US users? Thanks!

Try using Expedia on Safari browser on your phone, but make sure you go to Expedia.com, but not Expedia.com.sg, and that option will turn up. I haven’t tried to book any hotels yet as I’m finalising my hotel choice, but I know that Apple Pay option is there. Do note that you will be charged in USD if I’m not wrong.

Promotion is ONLY for Singapore dollar transactions.

Oops sorry. I thought it only specified Ultima, Prestige, and Premiermiles that is restricted to transactions in Singapore dollar as mentioned by Aaron in his original post. I was thinking of the Rewards card where the Terms and Conditions did not specify such a condition.

Rewards cards earn 20x overseas

air ticket considered retail purchase via apple pay? SQ app allows apple pay i think

I read that SQ app allows Apple Pay but there is no such option at the payment page when I tried today :/

I’m on the latest SQ app version with iOS11.4 on ip6.

Use the expedia app, apple pay is a payment option.

What’s the limit per txn for Citi’s Apple Pay?

Citi doesn’t impose any limit. All limits are merchant dependent. People have successfully paid $2000+.

time to buy a rolex watch…

If you find out which AD accepts Apple pay, do let us know? Thanks

Other than NTUC vouchers, are there any things that people usually pre-buy to chalk up miles during promos like this?

Depends on your spend pattern. SingTel kiosk payments, Qoo10 gift cards, even anything at 7-11 etc

Singtel Kiosk??

You mean we can use applypay for our singtel bills?

of course. anywhere that accepts contactless.

Any idea how to overcome the 100 dollars limit for NFC payments at NTUC?

Is the 20x promotion applicable if I were to buy something through the iOS Apple Store app and pay via Apple Pay?

yes, in-app use of apple pay (e.g. Uber) qualifies for 20x.

What a great idea to front load voucher first! NTUC, Cold Storage. What other vouchers can we buy to front load?

Can we buy CapitalLand Voucher too?

only capitacard is accepted for purchase of capitaland voucher

Anybody knows of car rental in Australia that accepts Apple Pay? Specifically upon arrival at Sydney Int’l Airport. Thanks!

Don’t know.. but just so you know, no 20X Rewards on overseas spend.. SGD only..

I thought overseas spend is only available for Citi Rewards cards?

where did you get this info? It’s not mentioned anywhere. Have you tried?

you can get this info if you read the article on this same page again.

You can also get this info if you bothered to read the T&Cs instead of waiting to be spoonfed.

For Premiermiles, Prestige and Ultima cards, clearly stated that the bonus miles will not be awarded if charged in other currencies:

The additional 2.8 Citi Miles will not be awarded for retail purchases retail purchases charged in a currency

other than Singapore Dollars and/or merchants participating in existing accelerated miles promotions

No such reference for Rewards card.

what if you ask the overseas merchant (say a hotel) to charge you in SGD – you know they often ask in local currency or SGD.

I’m guessing that’s ok, except you get stung on the merchant’s exchange rate

Hmm, since the incremental miles per dollar (ie 6 mpd, being the difference between 8 mpd when charged in SGD for non-CR cards and 2 mpd when charged in foreign currencies for the same card) is worth about 12 cents (at 2 cpm valuation), as long as you are paying less than 12% extra after DCC, my calculations say it’s okay? Did I get my maths right?

Meanwhile citibank is still not available on Google pay

CONSPIRACY.

When citibank launched their cards on Samsung Pay they had 20X pts too, and now same for Apple Pay. Here’s hoping the trend continues for Google Pay.

Hi Aaron, is it true that we can buy ntuc voucher and enjoy 20x? I am happy even if there’s 10x. Please advise and i will go buy a few thousand $ immediately.

I believe you do get 20x. Some users have reported it on The Million telegram group.

Thank you – I will go buy some vouchers today and report back if it works.

Does it work?

hi, i just got the voucher today so I wont know until later. Will keep everyone updated.

@DK Did NTUC allow you to pay the few thousand $ with Apple Pay in a single transaction?

I only bought the minimum amount to see if I could get the 20x rewards. If confirm can get then I will get more vouchers. Anyway, I am sure they will allow you to separate the payments if they cant do a single large transaction.

I can confirm that I received 20x rewards on Fairprice voucher purchase using Applepay.

The additional Citi Dollars awarded … will not be and/or merchants … in existing accelerated …participating in existing accelerated Citi Dollars promotions.

Are there existing promo/merchants with Citi Prestige Card.? Thank you.

A few Citi Prestige transactions have shown up on the ThankYou page (some still pending). No bonus awarded. Strange…

Same here.. $12.90 txn yield only 39 citi dollar. Engaging the Csa via secured message in online banking already.. Weird

not sure about the prestige users, but it’s coming out ok for rewards. definitely worth checking with cust svc

i’ve just renewed my contract with M1. I paid with apple pay for the $1400 bill that was split up into 7 payments (merchant limit of $200 per apple pay transaction) and i can confirm that i got the 8mpd for the purchase when i checked this morning.

How are you able to check the points so fast? If I log on I can’t see

it takes a couple of days to get posted so relax. i completed the purchase on Labour day and only got the points this morning (4/5/18). you can go to the rewards section and it clearly states points earned and bonus points under points summary.

Aaron, you wrote above: “Do remember however that if a merchant already earns 10X under the year round Citibank Rewards promotion, you will not earn 20X if you use Apple Pay (eg buying Taka vouchers won’t work). There is no such restriction if you hold the Citibank Prestige or Citibank Ultima cards.” But if one is thinking of using the Citibank Prestige card to buy Taka vouchers, he/she will run into this sentence from the Promotion’s T&Cs: “The additional 16.75 Citi Dollars awarded under this Promotion will not be awarded for…merchants participating in existing accelerated Citi Dollars promotions.” Since Taka… Read more »

Here are list of excluded categories earning 8mp$ from T/C: “Qualifying transactions” means a retail purchase charged to an Eligible Card via Apple Pay which does not arise from any Equal Payment Plan purchases, refunded, disputed, unauthorised or fraudulent retail purchases, Quick Cash transactions and monthly transactions, transit-related transactions, cash advance, balance transfers, annual card membership fees, funds transfers using the Eligible Card as source of funds, (for example, payments via Citibank Online or via any other channel or agent (such as a third party agent for payment of bills) whether for bill payments or otherwise), interest, goods and services… Read more »

[…] Milelion recently blogged about the possibility of earning 8 miles per dollar through Citibank-Apple Pay 20X promotion. On the other hand, there is Samsung Pay that rewards users through their own points/rewards […]

Hi, is Apple Pay accepted in Expedia? It didn’t appear as an option for me though. Please advise if it is possible. Thanks.

I see it as an option when booking hotels, but not flights.

Tried for hotels too. Can’t seem to see it. Is it Expedia Singapore website?

Have a go at it via the Expedia app.

Has anyone tried to use Apple Pay Overseas using CR and gotten the 20X points? Wanted to be sure as T&C never mention only for SGD transactions.

It does, @xiezy88… page 3 and 4…

https://www.citibank.com.sg/gcb/landing_page/apple-pay-sg/assets/documents/apple_pay_promotion_terms_and_conditions.pdf

I tried in Thailand, got 20X

Interesting… because that contradicts their own ‘rules’.. did you get lucky, @freedom? or would this be correct for all..? I’m not being sarcastic.. had I have known, I would’ve used this a Citi promo in EU past weeks.. instead I used OCBC’s Ti 10X OCBC$ promo for shopping, for which when statement came, NONE of my shopping were given 10X OCBC$.. have called bank and went through line by line for all my shopping, now waiting for them to come back to me… I maxed out both my blue n pink cards for what I thought would be a total… Read more »

Sorry.. I went a bit off-topic when thread was abt Citi 20X.. but I guess it’s ‘kinda’ related….

There’s no SGD restriction for Citibank Rewards Card, which was what xiezy88 was talking about. The terms and conditions only stated the SGD only restriction for Prestige, Ultima and Premiermiles.

Thanks for that, @Zac.. my bad.. I didn’t realize that Citi Rewards Card’s Terms were different.. ??

How did you manage to convince the Thai sales associates to let you pay with Apple Pay? At every POS, I would ask if they took payment with the phone, and I would either get a befuddled look or an emphatic, “No”. Even at Big C, after eyeing the glorious Visa PayWave logo, and pointing to it when it came to payment, they just went, “Oh Visa? Visa, can!”. I waited for the cashier to punch her terminal and she waited for me to hand over my card for insertion. After what felt like eternity, I noticed was holding up… Read more »

I did my transaction at 7-11. It allows credit card payment for 300+ THB. The terminal is outside the counter. You are free to use your phone to pay.

Maybe I was just lucky?

Well done! I think 7-11 might be one of the few places where the terminal is within the customer’s reach so there’s the opportunity to try Apple Pay. What I’ve observed is that the contactless payment SOP appears to be to first key in the amount, then press “enter” (or whatever that large green button at the bottom right corner is) before presenting your phone. I think it’s the same for chipped cards but for some reason, Thai cashiers like to ask for the card, insert it into the terminal then key in the amount. (To be fair, before the… Read more »

? you are right aaron there isn’t any cap for this apple pay promo this month alone i have manage to accumulate 220,000 points.

what was ur spent?

11k bro

Just to share…. Received 20x promotion with my Airbnb booking. Airbnb accepts Apple Pay with USD currency only. Therefore, I had to change my currency from SGD to USD in order to enjoy the 20x promo.

I’m not so sure USD qualifies for the promotion.

foreign currency qualifies when you use Rewards card

For Citibank Rewards, it does and I can confirm that 20x points received and reflected in my statement.

Just want to make sure there is still no cap for 20X spendings? Due to Citi’s recent update on the jewellery exclusion, i’m a little paranoid!

There’s is a cap!!!! And Citibank does not reveal what is the cap. They say it’s internal guideline. I have already failed to use it !!!

There is a cap!!!!!

I have failed to use Apple wave and confirmed by their call center there is internal cap per trx but they cannot reveal what is their internal cap to consumers. The next day I tried, it failed again. So it’s not just per trx, but in fact is daily or a max. Cap. The funniest thing is they refuse to tell me what is the cap. It’s ultimate embarrassment and I could not make my purchase in the end!!!!

[…] the days that followed, however, it was confirmed that the promotion was, indeed, without cap. 8 mpd. Everywhere (fine, almost everywhere). Without cap. There’s something to be said […]