We’ve known for a while that Singapore Airlines has been working with KPMG Digital Village to build a blockchain-powered digital wallet app. Back in June, a little bird told me that the wallet would be called KrisPay and debut with Esso as a launch merchant.

Well that day has come, and KrisPay is now available for download on both Apple and Android phones.

Everyone seems to be loving the app so far, based on the 7 five star reviews it’s garnered so far on the Google Play store. So what if most of the reviewers work at KPMG Digital Village 😉 ?

What do I think of KrisPay? In a word: confusing. Not because the app isn’t well designed (it is) or the user interface isn’t intuitive. More because I don’t understand what Singapore Airlines wants to accomplish with KrisPay.

I’ll explain in a bit- first the tour of the app:

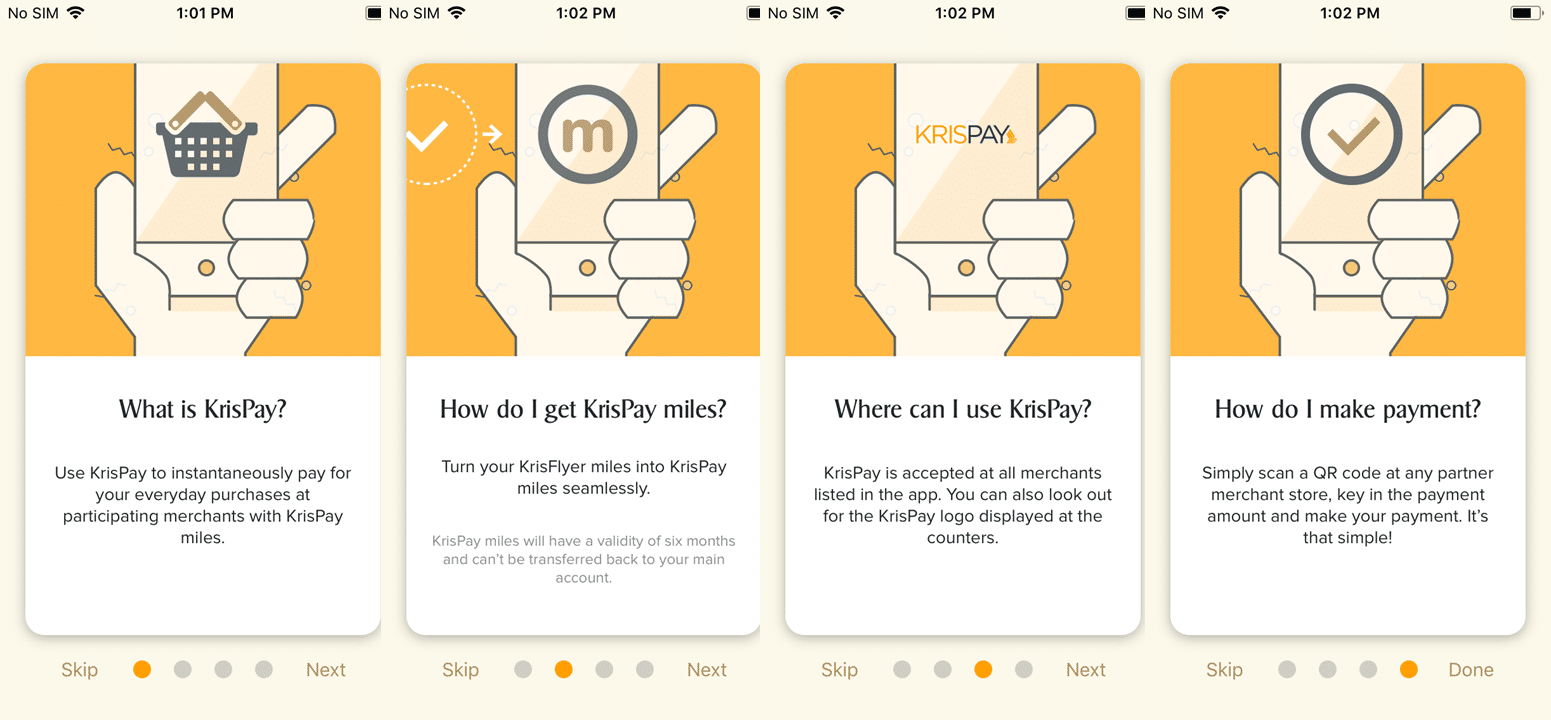

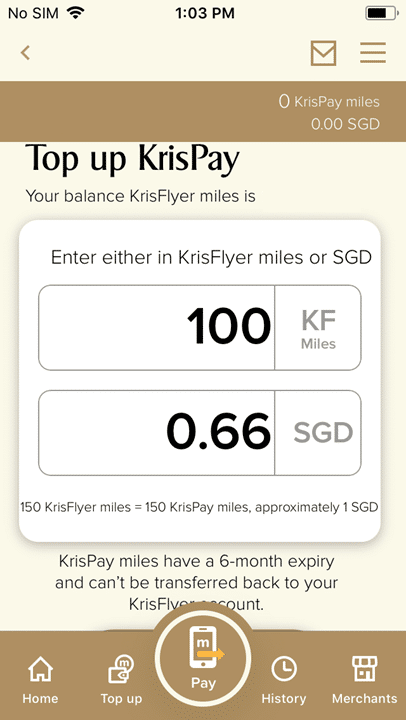

KrisPay functions as a QR-code based mobile wallet. You grant access to your camera, scan the merchant’s code and enter the amount to pay. In order to use KrisPay, you need to first load your balance with miles from your KrisFlyer account. Tapping the “Top up” button brings you to the following screen.

Which leads to a few important observations:

Transfers to KrisPay are one-way only

First, this is a one-way transfer. Once you’ve transferred KrisFlyer miles to KrisPay, there’s no going back. The FAQs urge you to be careful here, saying that KrisFlyer will not process any reversals.

Miles in KrisPay are valid for 6 months

Second, once transferred, your KrisPay miles are valid for 6 months. The FAQ state that there is strictly no extension on validity.

I don’t really see this as a problem, because transfers from KrisFlyer to KrisPay are instantaneous and there’s no real reason to pre-load your balance. Moreover, KrisPay does not have any minimum top up blocks, so you can transfer any quantity you please. If you plan to use KrisPay, it only makes sense to top up the exact amount you need.

150 KrisFlyer miles= S$1 (0.66 cents per mile)

In my previous article on KrisPay, I speculated that there’d be “variable value” where less popular merchants would accept a higher valuation for KrisFlyer miles (in exchange for the customers that KrisPay would presumably drive to them).

That hasn’t happened, and across the board 150 miles= S$1 is the rate used. This values 1 mile at 0.66 cents, which is really, really low. For comparison’s sake, here’s what other options would yield for your KrisFlyer miles:

| Option | Valuation |

| Award Tickets/Upgrades | 2-6 cents, depending on cabin class |

| Pay with Miles | ~1 cent |

| KrisShop | 0.8 cents |

| KrisFlyer vRooms | 0.8 cents (marginal value, paying with fewer miles yields higher value) |

| KrisPay | 0.66 cents |

You know what’s also interesting? Remember TapForMore points, that currency you use at Cold Storage, Giant, Guardian and a couple other places? 150 TFM points are worth $1, and you can convert 1 KrisFlyer mile to 1.1 TFM points.

Therefore, if your goal is to monetize your KrisFlyer miles, it actually makes more sense to convert them to TFM points, because 3,000 KrisFlyer miles would yield 3,300 TFM points worth $22, better than the $20 you’d get with KrisPay.

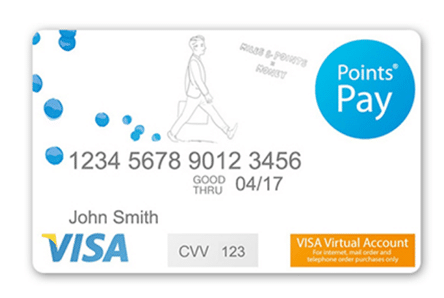

How does KrisPay’s valuation measure up to what we see elsewhere? The only other benchmark I can think of is Etihad Guest and PointsPay. For those of you who don’t know, your Etihad Guest miles can be converted into a virtual Visa card via PointsPay, which allows you to spend them as you would money.

The conversion rate for PointsPay isn’t always constant, but generally ranges between 0.7-0.8 US cents per Etihad Guest mile. TPG values Etihad Guest and KrisFlyer miles at 1.4 US cents each, which means that KrisPay offers significantly worse value even if you benchmark it to similar programs out there.

KrisPay can be used for partial payment if your mileage balance isn’t large enough and you need a minimum balance of 15 miles (10 cents) to pay.

Burning only, no earning, at the 18 merchants on offer

For the moment, KrisPay only offers opportunities to burn miles, not earn them. This shouldn’t really come as a surprise, as it’s much easier to set up burning relationships than earning.

Here are the 18 merchants currently available on KrisPay:

Electronics and Technology: Challenger, M1

F&B: Cedele, Gong Cha, Greenwood Fish Market, Pizza Express, Toss & Turn, TWG Tea, Workspace, Xiao Ban Soya

Gifts & Souvenirs: LEGO

Others: Esso, Shangri-La (selected restaurants only)

Services: Browhaus, Strip, We Need a Hero, Qi Mantra, Spa Esprit

That’s…quite the hodgepodge. I can’t make out any overriding theme here, except someone at the KrisPay merchant acquisition team really likes personal grooming. The choice of merchants is puzzling to me- it doesn’t strike me as particularly curated, more like the team tried to sign up anyone who was interested.

It’s important to note that there are exclusions within KrisPay merchants as to what KrisPay can be used for. Esso only allows KrisPay to be used for fuel purchases, M1 doesn’t let you use KrisPay for prepaid Mastercards or M1 bill payments…you get the idea. Read the T&C carefully.

On the plus side, I now know that a full Brazilian wax is worth 9,300 KrisFlyer miles, which finally allows me to put to bed some nagging doubts I had about the value of my landing strip.

What is Singapore Airlines trying to do with KrisPay?

I’m sure the merchant list for KrisPay will grow over the next few months, but at the back of my mind I can’t shake off this question: what exactly does Singapore Airlines want to achieve with KrisPay?

Some cynics will say “oh, KrisPay is a ploy to trick people to burn their hard earned miles for inferior value”. The poor value may make it seem that way on the surface, but if you pause and consider the situation, KrisPay represents a significant investment of time and resources for the airline. If the idea was to get more people to burn miles at inferior value, there would be cheaper ways of doing so.

I can think of two kinds of people who would use KrisPay: those who have very few miles, or those who have way too many. Let’s ignore the latter, because if you think about your FFP numbers as a pyramid, those individuals would be a very small minority.

Think about the former, and you start to realise the problem: if KrisPay is meant to improve engagement among otherwise disengaged KrisFlyer members, then it’s going about it the wrong way. KrisPay is actually very valuable to a certain demographic of members- those who use cashback cards, don’t earn miles through partner programs and fly very occasionally. Such individuals would have orphan mile balances too small to redeem for a flight, which would normally end up expiring at 0 cost to the airline.

Now with KrisPay, these members have the option to cash out their miles. Yes, it’s at a sub-optimal value, but that’s still better than 0. Once they’ve cashed out, however, they’re not engaged any more. Cashing out is a one-time activity, and with no earn function on KrisPay, how does KrisFlyer expect to re-engage them? (KrisPay could add an earn function, but as I said before earning arrangements are more complicated, involving more detailed negotiations around commissions and who pays for what- so I wouldn’t expect to see this in the near term)

Therefore, it’s hard for me to understand exactly what the endgame is with KrisPay. The merchant collection is kind of all over the place. The valuation is so low that most well-informed KrisFlyer members wouldn’t use their miles for it. The app itself creates a further liability for the airline insofar as it encourages members to use balances that would otherwise have expired.

I would hope that most Milelion readers would know better than to burn their hard earned KrisFlyer miles on an option like this, because KrisPay makes even less sense if you’re actively buying miles through the various options available like credit card annual fees or Cardup.

Conclusion- a harmless option?

To the extent that KrisPay doesn’t mean a long term move towards a revenue-based program or the removal of other, better ways of spending miles, I guess it’s fairly harmless. Singapore Airlines will get some PR by virtue of using the word “blockchain”. KPMG Digital Village will have a nice project to add to their CV. Milelion readers will continue earning and burning through other means. The world goes on spinning.

I would certainly be very interested to see how KrisPay evolves over the next year or so- will people actually use it? Will merchants be willing to accept KrisPay if take up rates are low? Will more waxing solutions be added? The inquiring mind wants to know!

And come to think of it, why was blockchain necessary for this?

(Cover photo: Singapore Airlines)

There are a lot of interesting possible extensions to this.. more towards moving into a digital currency and digital wallet for the long run, hence the blockchain technology. Possibly this is a kickstart project to test the overall market and concept, and refinement about it. As a start, any company will need to establish an active marketplace and enrol as many participants into this eco-system as possible, once the market is established enough, it is rather straightforward to introduce the other missing puzzle pieces to the equation: the earning / buying of the currency into this ecosystem. Another possible frontier… Read more »

“And come to think of it, why was blockchain necessary for this?” – you could say this for pretty much anything blockchain.

How are you producing articles at such a timely manner!? (With original thoughts and analysis). The notification from SQ only arrived at my mail box several hours ago . Do you not need to work? Impressive. Maybe sq is just trying to jump on the blockchain and mobile pay bandwagon to develop some IP asset or diversified revenue source coz their main profit source aka flights is somewhat struggling. Maybe their goal could be establishing kris miles as a “ currency “? Many many parallels can be drawn btw miles and cryptos minus the tradeability. Ps: it’s called a boyzillian… Read more »

Silly poot. SQ sell at 5 cents a piece and have you wank out at 0.66. Unless SQ fly to alpha centauri, who’ll bite?

Singapore has yet to have a winner in the digital wallet sphere so sia with its branding thinks it can be the alipay of sg. There really is no other reason. Investing so much in technology, where other implementation could be used, they would need heaps of transactions to be successful and be a viable business model in a small 5.6 million population when using block chain for integrity. I have my doubts on the success especially with such poor rewards and returns and a management that has yet to understand millienias. Oh well time will tell and good luck… Read more »

KPMG probably sold this POS project as a freebie or side piece to SQ to be frank.

this is correct, i can confirm this, i am a low life analyst at kpmg

Lol , grabpay, krispay… paylah, some nets wallet. I don’t think our population is big enough to run a digital wallet. I think having a digital credit card wallet is enough…

[…] Airlines launched KrisPay yesterday which allows you to burn your miles at 18 local merchants. “Burn” was never a more apt […]

[…] Airlines waded into the world of blockchain with the launch of KrisPay earlier this week. The KrisPay app allows KrisFlyer members to spend their miles like money at 18 merchants across […]

This is when perhaps take a look at what Qantas Frequent Flyer is doing Down Under, and their journey with loyalty may provide a glimpse or two at what SQ is trying to do with KrisPay.

Anybody can advise what uses are there for 1000miles if transferred to Krispay?

[…] safe to say that KrisPay hasn’t exactly been setting the world on fire since it launched back in July this year. Singapore Airlines’ blockchain wallet is meant to let you spend KrisFlyer miles like money, […]