It’s an understandably taboo topic, but have you ever stopped to ask yourself what would happen to your miles and points should you die?

I mean, if that happens, you’d like to think your loved ones would have more important things to do than search for saver award space or plan a resort getaway. But let’s be honest- your miles and points are as good as money. They were acquired for a cost, either implicit or explicit. It therefore stands to reason, that like any other financial asset you have, you should have a plan for what happens to your miles and points when you pass. I’d certainly want my family to enjoy whatever I’ve earned even when I’m not around.

So just what happens to your frequent flyer account when you die? I’m going to use KrisFlyer as an example, although the exact same policy applies for Asia Miles. Here’s the specific portion of the KrisFlyer terms and conditions that addresses the death of a member:

C (6): Membership will terminate immediately upon death of the member. Miles and rewards earned but not redeemed at the time of death, as well as benefits and privileges, will be automatically forfeited on the death of the member. Miles and rewards do not constitute personal property and may not be bequeathed or otherwise treated as personal property.

There you have it. In the eyes of KrisFlyer, your miles aren’t yours to bequeath. If you die, your miles pass with you.

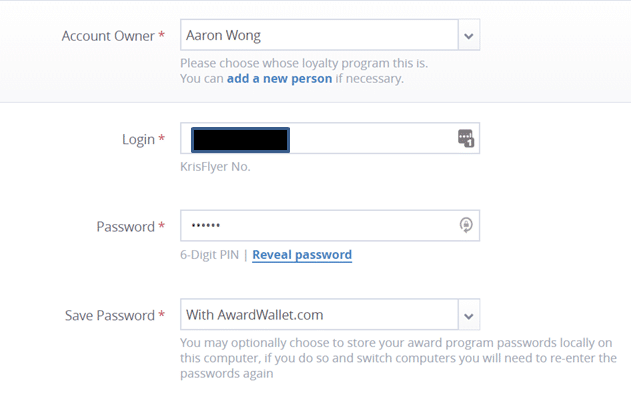

Of course, there’s a practical consideration here. The airline won’t actually know you’re dead, unless someone tells them. This implies that a simple way of avoiding the forefeiture of your miles is to keep an “FFP will” of sorts: have your frequent flyer login and password stored somewhere secure so that your loved ones can use your miles even after you’re gone. KrisFlyer allows you to nominate up to 5 individuals who can fly on tickets redeemed with miles from your account. Asia Miles has a very similar system, also for 5 nominees.

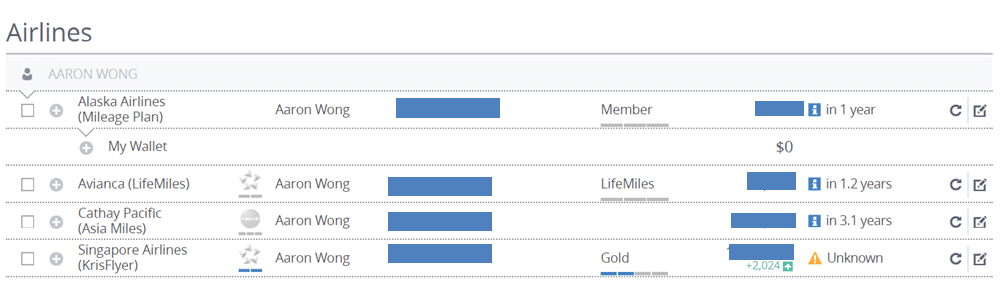

If you have multiple rewards accounts, it might make sense to use AwardWallet to track all of them. If you do, you just need to give your next of kin your AwardWallet password, and he/she will be able to see all your miles and points assets in one place.

AwardWallet also serves as a password vault where you next of kin can look up your login credentials for individual programs. Don’t worry, the service encrypts your logins and has 2FA available as an option too (although if you have 2FA enabled then your next of kin would need that token to gain access to your account too).

Therefore estate planning, insofar as it relates to miles and points, is actually a very straightforward matter that can be addressed with some simple prior planning.

The real problem is if you pass and no one knows your login credentials. In that case, it’s a very different situation. Airlines in the US are generally more understanding when it comes to death. Most have a policy to transfer your miles to a specified nominee upon the presentation of a death certificate (the exact policies for each airline will differ, so be sure to read this article if you hold membership in any US airlines).

However, as we just saw, the terms and conditions of both KrisFlyer and Asia Miles give them the right to deny such requests. I’m not saying it’s strictly enforced in practice- I would like to believe that exceptions are made. What I am saying is that the absence of an official transfer mechanism means it’s important to come up with an “FFP will” in case the worst happens.

FYI, unlike your miles, there’s nothing that can be done about your frequent flyer status. If you were a PPS member, for example, there’s no way to transfer that to your next of kin, because the benefits strictly accrue to the person whose name is on the card.

So if you haven’t already done so, take fifteen minutes to set up an AwardWallet account or at least store your credentials in a secure password manager like LastPass and grant emergency access to a loved one. It might be useful down the road.

Master passwords must never be entrusted to anyone.-even loved ones. Aaron, have a look at the emergency access function in Lastpass. That’s what you should be recommending.

Never knew about this function, but it makes sense. Will update

With the introduction of 2FA on SQ for adding of nominee and miles redemption, might need to have your e-mail account and mobile phone number on hand as well.

What about uncoverted points eg Citi PM miles, DBS points etc?

this is actually a very good question and I’d be curious to know the answer.

Same concept applies as per my longer post.

Another great heads-up, Aaron.. and you’ve also (you may or may not have anticipated this) opened up that proverbial can of.. hmm.. worms, would be too mild.. I’d say you’ve opened a can of whoopass..

Yes, I did read a bit about miles and points after coming across an article on a US site.. and yes, US carriers are immensely more compassionate than SQ (and now it seems, other Asian carriers) where SQ explicitly tells you (if you do look it up) that your miles aren’t really yours and therefore not avail for you to give or bequeath in event of your bye bye..

My point is this.. People!!! Meaning EVERYONE reading this.. Aaron.. has again put out a PSA.. and the truth is, EVERY airline may have different takes on this.. and there are A LOT more banks out there than there are airlines.. SO GO DO YOUR OWN HOMEWORK AND FIND OUT FOR YOURSELVES WHAT POLICIES YOUR OWN BANK(S) HAVE.. there is NO WAY that Aaron can possibly know how every bank in SG, let alone the world, would looks at this..

…would look* at this..

Legally speaking, it may not be entirely accurate to say that the miles are gone when one dies. The statement in the terms is effectively trying to set out an alleged point of law that miles are not choses in action. For obvious reasons, one does not hear about any litigated disputes as to the true legal nature of miles, whether the airline can unilaterally declare them not to be choses. So legally speaking the position is not clear. Unlike my usual emphasis on terms, the issue here is different, i.e. whether the courts will hold that miles possessed by an individual are choses in action, I.e. intangible property. If they do, then the miles, as far as the law is concerned, are the estate’s property and whatever the airline says is irrelevant. It is akin to A issuing an indemnity in favour of B but stating in the terms that such indemnity is not a chose in action, which won’t get very far at all. So the personal property can then be the subject of a will and/or even intestate distribution principles.

Very much a legal issue up for determination, which probably will never happen, but any lawyer worth his salt would be slow to issue an advice that airline miles are definitely extinguishable or are not property, so to speak simply due to the krisflyer terms.

And if faced with a hypothetical letter of demand from the executor, what think SQ would do. Cost of even taking a dispute like this to a state courts trial, minimum $100,000. Cost of coming to a compromise and taking into account value of likely miles balance? Probably no more than a few hundreds or few number of thousands in most cases. But obviously, for those executors who are not properly advised, then woe betide them if they blindly accept the krisflyer blanket statement.

I do not know what Ken is talking about though in relation to going to check with your banks. Please, don’t muddy the waters and don’t spread undue worries. There is not even any question about what happens to ones assets with a bank. The position is trite. Are you even suggesting that ones assets held with a bank could be invalidated or extinguished by your death???

Not assets with banks.. credit card points..

Oh.. and “legally”, is up to the Courts to decide.. all I did was to state what SQ states (in this case) and which is what Aaron found too.. and what a few US carriers state in their Ts & Cs.. and yes, any entity can state this and that, and it’s up to any individual whether or not he/she wants to accept or dispute it.. that’s doesn’t tentamount to one not being able to dispute/ ask for/ fight for in the form of Lawyers’ letter(s) or the Courts.

Banks, have their own Ts & Cs too, and this was what I was simply putting out there, so that everyone does simply ask, “Hey, what about my points from my credit cards, from abc bank..”, then xyz.. then bbb, then ggg etc., which one individual here had already done so, and (maybe coincidentally) no one else has since.. which is that if anyone here wants to know, to find out for one’s self, and not line up, one by one, asking Aaron, what about me? What about me? And me?

In the case of the US, from what I read, many (or several) banks and card issuers aren’t even completely clear.. so, no, I’m not trying to muddy waters.. the waters are muddy..

I am using Dashlane + yubikey. If i passed on, they can unlock my dashlane account with the physical yubikey to access all my randomized passwords.

Thanks, just signed up. Here is a Googled coupon code for a free upgrade to the AwardWalletPlus: ViewFromTheWing.

what did you parents leave you in their will?

1: a condo

2: a watch

3: 540 kris flyer miles

[…] few weeks ago I wrote an article about what happens to your airline miles when you pass away. The short answer is that neither Singapore Airlines KrisFlyer nor Cathay Pacific Asia Miles allow […]