When a loved one passes away, I’m sure that credit card points will be the last thing on your mind.

However, when all the more pressing matters have been settled, the fact remains that credit card points are valuable. But unlike your property, cash, shares, investments and insurance, they don’t form part of your estate and can’t be bequeathed in a will. This means that miles chasers need a legacy plan to ensure their hard-earned points don’t expire along with them.

Even though the bank T&Cs are quite clear that credit card points can’t be transferred (though OCBC and StanChart allow for it), they’re silent as to what happens when a cardholder dies. So I reached out for some official answers, and here’s what I found.

Can’t I just give my login details to my next-of-kin?

You might be wondering why this is an issue in the first place. Isn’t it a simple matter of giving your ibanking logins to a spouse or family member so they can transfer out your points in the event of your demise?

Not quite. While it’s relatively straightforward to hand over control of a frequent flyer account to a next-of-kin (something I’ll discuss in a separate post), bank accounts are more complicated.

Once upon a time, I thought the legacy plan for my points would be giving The MileLioness my ibanking passwords through a system like LastPass Emergency Access, and registering her fingerprints on my phone. Then, should I go home before she did, she could access my bank account, approve herself with 2FA via my phone, transfer the points to my KrisFlyer account (which she’d also have access to) and redeem them for herself as a redemption nominee.

But there’s a lot of potential complications here.

First, your phone is a vital link in this process. But what if it goes missing along with you? Or what if it’s damaged beyond repair in the event which leads to your death?

Second, what if the person to whom you entrust this information perishes in the same event as you? I guess you could have a conga line of backup nominees, but it’s much simpler to entrust this to one person.

Third, even if your phone were fully intact and accessible by the desired next-of-kin, the standard procedure is for the bank accounts of the deceased to be frozen, pending distribution by the executor.

*Upon tagging of “Account Frozen”, all operations of the account will be restricted i.e. no withdrawal will be permitted from the account, including GIRO arrangements and other payment arrangements.

-DBS

I would imagine that this extends to rewards points transfers too, but even if not, there could be complications if family members or other beneficiaries of the will find out that you’ve logged into the deceased’s account, even if you didn’t touch the cash or investments. In any case, I don’t think it’s a good idea to deliberately keep the bank in the dark about the death of a family member.

Because of this, it’s quite likely you’ll need the help of the bank to access the deceased’s points.

What did the banks say?

I sent media enquiries to all the banks which issue points-earning cards in Singapore, except for Bank of China, where I don’t have a contact. I skipped CIMB, DCS, ICBC, Maribank and Trust because they only issue cashback cards.

The essence of the question was “What happens to the credit card points of a deceased cardmember?”

American Express

|

|

| “When a basic Card Member passes away, the executor or administrator of the Card Member’s estate may contact American Express for assistance. We understand this is a difficult time and we will do our best to provide the necessary support.” | |

Citibank

| “In general, credit card miles and points are non-transferrable and can only be redeemed by the primary cardholder.” | |

DBS

|

“In the event of one’s passing, the bank follows a formal legal process in handling estate matters. To begin this process, an appointed executor/administrator of the estate or next-of kin will inform the bank with relevant documentation as required by law. The bank helps to facilitate financial matters, including the closure of bank accounts and review of liabilities such as outstanding credit card balances. Credit card points may be evaluated as part of this procedure, and if applicable, they can be used to offset any unpaid balances.” |

|

HSBC

|

HSBC did not reply to a request for comment for this article. However, their previous official response from August 2018 stated the following: ” We advise that the points are not transferrable but can be redeemed by the next of kin after we receive the letter and death certificate of the deceased. Once the documents have been successfully validated, the relevant team will contact the next of kin.” |

|

Maybank

| “Upon a Cardmember’s demise, the Maybank credit card account will be closed and any outstanding card bill amount will be offset by the cashback earned on the account. All related TREATS/reward points earned will be considered as expired. However, Maybank does consider exceptions on a case by case basis.” | |

OCBC

| “Upon submission of the necessary paperwork by the next-of-kin, OCBC will verify the documents and update the customer’s status. Following this, the customer’s remaining points can be converted into vouchers, which will be sent via SMS to an authorised person or next of kin.” | |

Standard Chartered

| “The Bank has established processes in place for managing bank account(s) of a loved one who had passed on, this extends to credit card accounts as well. The next-of-kin is advised to visit any of our branches as soon as possible on the passing of their loved ones with the relevant documents and these accounts/estate will be handled accordingly. This is aligned with industry practise and the Bank will help our clients’ next-of-kin during this difficult period.” | |

UOB

| “In general, benefits and privileges conferred to the principal cardholder’s UOB credit card, including rewards points, are non-transferrable and therefore will no longer be available upon the cardholder’s demise. This may be reviewed by the Bank on a case-by-case basis. Further details may be found via our Cardholders Agreement Terms & Conditions“ | |

Most banks reiterated their stance that credit card points are generally non-transferrable, though exceptions may be granted on a “case-by-case” basis. That’s somewhat vague, and I believe deliberately so- the last thing they’d want is to commit themselves to a position.

The banks which seem to offer the most leeway, at least publicly, are DBS, OCBC and possibly HSBC.

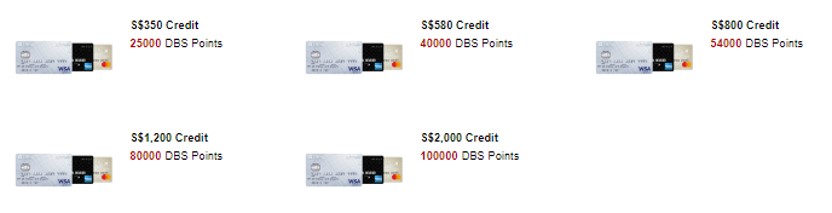

With DBS, the remaining credit card points of the deceased can be used to offset unpaid balances, which I take to mean they’ll convert them into statement credit. The rates vary depending on what denomination you redeem, but in general they’re quite poor: anywhere from 0.83 to 2 cents per DBS Point, or 0.42 to 1 cent per mile.

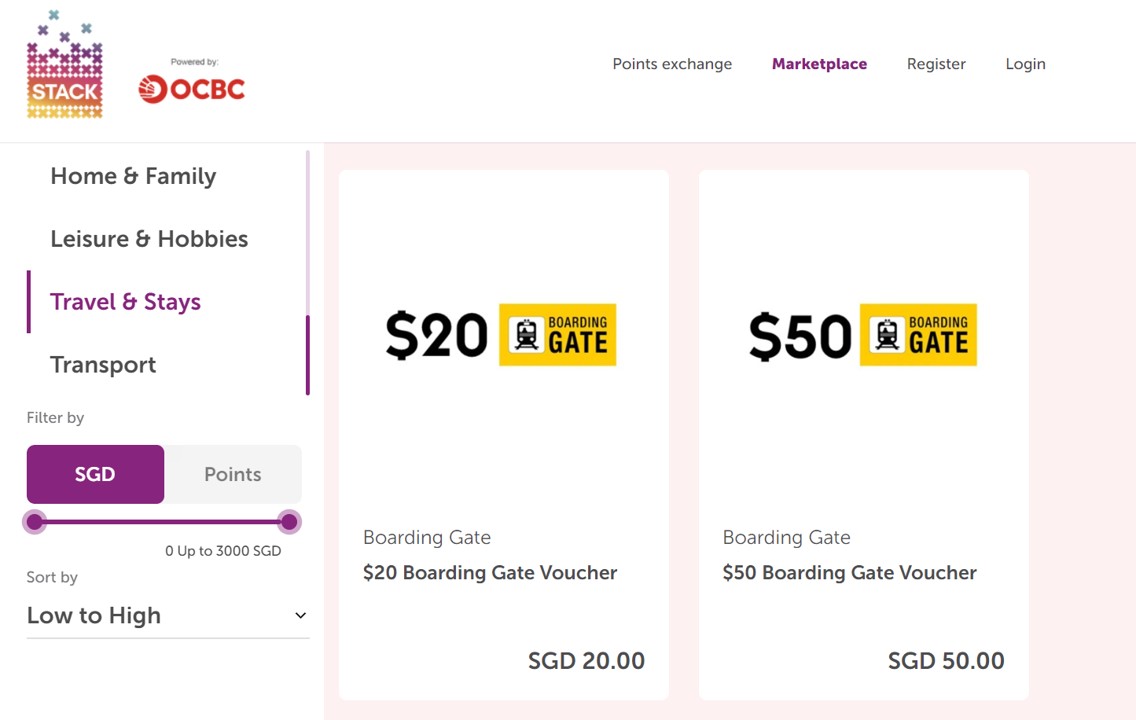

With OCBC, the remaining credit card points of the deceased can be used to redeem vouchers from the STACK Marketplace, where the value is roughly 0.26 cents per OCBC$, or 0.65 cents per mile.

HSBC declined to provide a response this time round, but I sure hope their 2018 policy is still in effect as it seems to be the most generous. The cardholder’s next-of-kin is given permission to redeem the points of the deceased, with no particular restrictions mentioned on what they have to redeem it for.

Conclusion

While credit card points are valuable, they’re not treated the same way as the rest of your assets in the event of your demise.

In an ideal situation, you would be able to grant access to a loved one so they can enjoy the points on your behalf, but in reality it could be hard to do. That means you may be at the mercy of the bank, and while some have explicitly stated that the next-of-kin can cash out points, the vast majority have not committed to any sort of policy.

In contrast, it’s significantly easier to hand over control of a frequent flyer account to a next-of-kin, because these don’t attract the same sort of attention that bank accounts do in a will. I’ve addressed that in a separate post, which you can find below.

What’s your legacy plan for your miles and points?

Another awesome write up/investigative piece of journalism, Aaron.. and, not so much because it’s also closer to what I’ve said along with your previous post on this subject, it’s also turned out that majority of SG banks are even worse than US ones.. and something that ALL miles/points-gatherers should really take note of.. especially when dealing with the tens of thousands or hundreds of thousands or millions of miles/points..

thanks ken! it’s heartening to see that hsbc/ocbc have consumer friendly policies though

Hi Aaron.. I actually feel that, even with HSBC and OCBC, their ‘compromise’ is hardly a consolation.. I mean.. maybe in the past.. before miles-hunting.. when credit card or airline points were.. to redeem the occasional oven-toaster.. or $20 Departmental Store voucher.. or Petrol Voucher.. sure.. I can understand that if I died, my NOK would simply write-off those vouchers.. and really, wouldn’t even think twice about them.. But.. in today’s day and age.. where, for most parts, include the likes of people who read/contribute to blogs like yours.. where I know of a fact that I personally bank more… Read more »

I remember reading that Westpac in Aus would in the event of death convert the cardholders points to cash credit at the rate equivalent to an annual fee rebate redemption. I remember thinking that’s quite nice of them.

I know your article was written in 2018; I think your Amex info needs updating. https://www.americanexpress.com/us/help/deceased-cardmembers.html

what you’ve linked to here is the US site though. policies differ by country.

how about frequent flyer miles when deceased ?

Not sure if you actually read the article, because the last paragraph is about it.

As long as the debts of the deceased are not handed / passed down to NOK

Appreciated this article, Aaron! From your article, it seems that Citibank Singapore is less friendly on this issue than Citibank Hong Kong. A Citibank Hong Kong’s bank officer provided a superb, fuss-free service on the miles’ transfer to the Next Of Kin (i.e., me), though the process was lengthy due to Probate issues.

Can you elaborate on your experience and circumstances please 🙏

And next up, what about miles already in FFP.