I wasn’t even intending to write about DBS Altitude’s “More miles to Fly in Style” promotion (that name’s quite a mouthful) at first, but what the heck, it’s a slow weekend and I’m procrastinating putting together my Houston Polaris lounge review.

So here’s the short version of why this isn’t something to jump on.

The offer

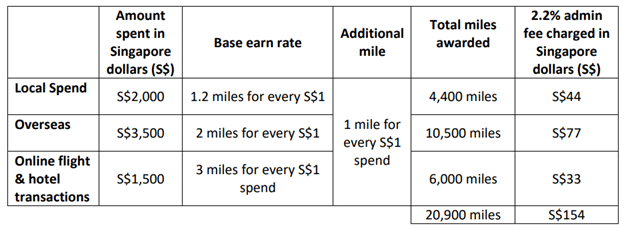

From now till 31 December, holders of a DBS Altitude Card (Visa or AMEX) can register to earn (here’s where I’d normally provide a helpful link to the registration page, but I think I’m doing a public service by refraining) an additional 1 mpd on their spending. This means you’ll earn:

- 2.2 mpd on local spending

- 3 mpd on overseas spending

- 4 mpd on online flight and hotel transactions

The catch

So far so good. What’s the catch?

The catch is that you pay a 2.2% admin fee in order to enjoy the additional 1 mpd. Here’s the illustration given from the T&Cs

The math by now should be abundantly clear- you’re paying 2.2 cents per mile, which is an abysmally poor rate to buy them at.

The alternatives

For comparison’s sake, here’s the other ways you could be buying miles

[table id=4 /]

(1) The HSBC website says that $1=0.4 miles for tax payment facility, but I have received reports that VI holders have received 1/1.25 mpd as per their relationship bonus

(2) The income requirement to get a HSBC Premier MC is $30,000, but you need $200K in deposits to open a HSBC Premier account

(3) SQ charges US$40 per 1,000 miles purchased. Price shown here is reflective of current exchange rates. The only way I could justify paying this is if I needed the miles right this minute, as SQ will credit them instantly

Look, if you’re really in need of miles, why don’t you just get them using the UOB PRVI Pay facility? That lets you buy unlimited miles at 2 cents each- the only cap is your credit limit. Or perhaps pay a bill via Cardup with your UOB PRVI miles card- at a 2.6% admin fee that’s 1.81 cents per mile, still way cheaper than the 2.2 that DBS is asking for.

If you’re rolling in the dough, why not apply for a Standard Chartered Visa Infinite card and get 35,000 welcome miles when you pay the annual fee of $588.50 (1.68 cents per mile)?

There’s just so many ways of buying miles at cheaper than 2.2 cents that I can’t think of any situation where you’d take advantage of this “deal”.

Conclusion

The price you’ll be willing to pay for miles depends on how you value them, so be sure to bone up on the topic here. What I find a bit silly is that the T&C of this promotion cap participation to 10,000 registered cardmembers. I mean, good to have caps and all, but I hardly think people will be breaking down the door to take part in this one (and if they are, I’ve probably failed as a person).

All things considered, the DBS Altitude is a useful card to have, and the current sign up bonus on the AMEX version (that was offered, capped, and then uncapped) is well worth taking advantage of. But this promotion? Better to put put it in your ignore pile.

I participated in the Suite Life campaign, but this new campaign is ridiculous

Well, to be fair, dbs has every right to offer it, just as customers have every right to ignore it

Your google ad banner is displaying this promo though, but I guess you don’t have much control over what’s served.

Heh Heh. It’s displayed uob krisflyer ads before too.

Hey Aaron, DBS seems to have lost the plot completely or have resorted to “let’s try and fool the customer and see if we can get away with it.” They had a bonus miles promo with Expedia and haven’t awarded the mileage multiple. They now claim that it was not booked through their link which is total BS (and I have the browser history to prove it. Have written to Expedia to see what they have to say about it. Not sure what the commercials are but with promos like this being so tedious, they are going to chase everyone… Read more »