From time to time, banks make changes to their rewards programs and benefits. Sometimes, these are good. Sometimes, these are bad. Even where they’re the latter, banks love to call them “enhancements”. That’s really annoying, but maybe if you squint hard enough you can kind of make out a group of people who would benefit.

That said, it takes a certain kind of nerve to call the changes that Citibank made today to the Citi Prestige “enhancements”.

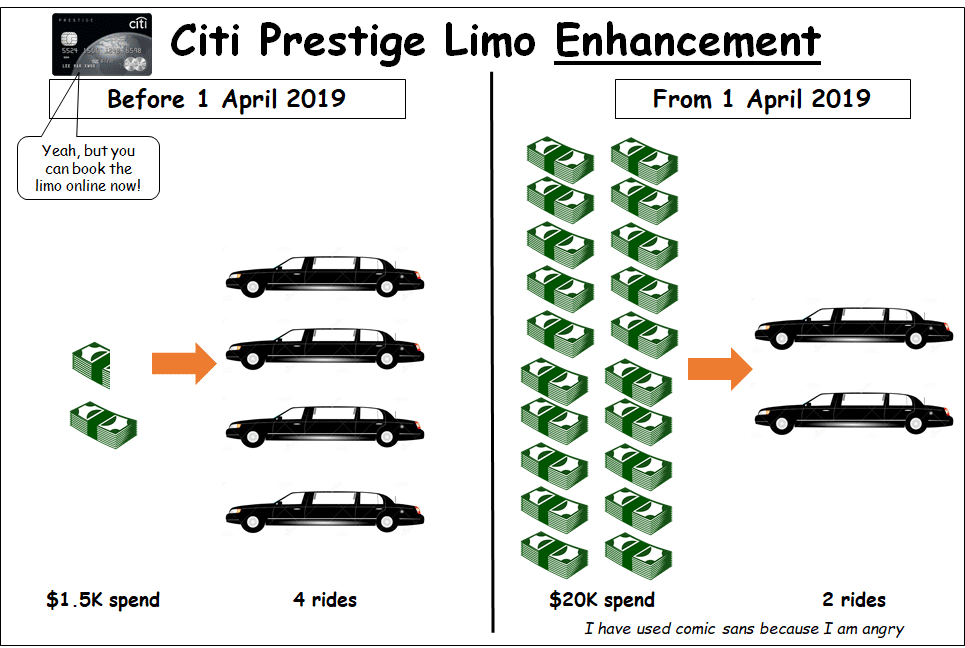

Citi has raised the limo spending requirement more than 13X, while cutting the entitlement by half

The Citi Prestige currently offers complimentary airport limo transfers for card members who spend at least S$1.5K in foreign currency within a quarter. Hitting this threshold unlocks four complimentary trips a quarter, and a maximum of eight per year.

Well, not anymore. Effective 1 April 2019, Citi has changed the T&Cs of the benefit such that you need to spend S$20K in a quarter to unlock two rides.

Let me state that again, lest people think it’s a typo. Citi has cut the allowance in half, while raising the spend requirement by 13X (Yes, I’m aware the new spending requirement can be in any currency, while the old was in foreign currency only, but anyone who quibbles over this point is missing the forest for the trees)

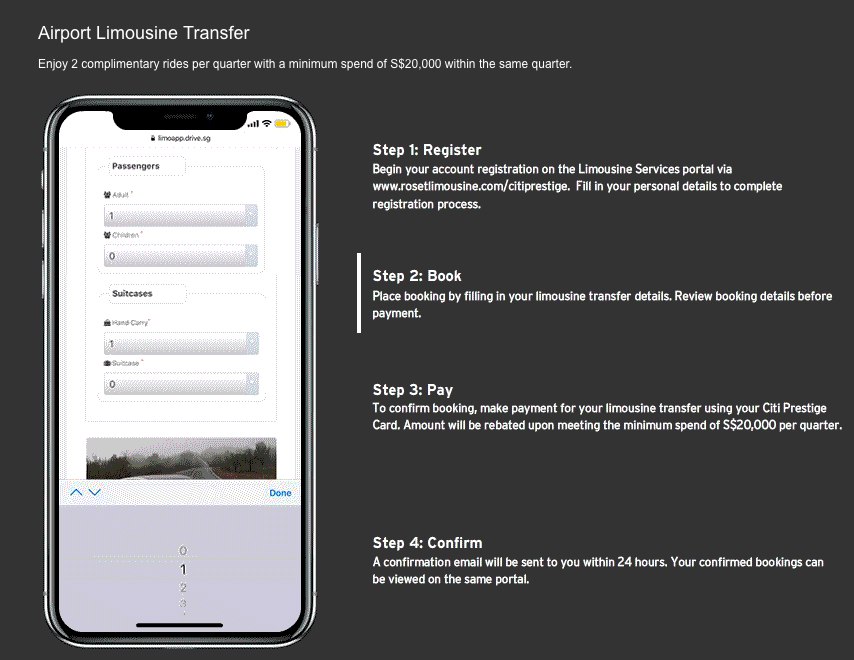

Perhaps I should also show it in infographic form, because it’s crucial everyone gets how absurd this is:

It’s the kind of change that makes you wonder if the team added an extra 0 by mistake, or mistook today for April Fool’s day.

But you’ve not even heard the punchline yet. Citi called this an enhancement. What’s enhanced? You can now book your limo rides online instead of through the concierge. Because technology.

The site will go live on 1 April 2019, and here’s the link for your convenience, but seriously…

How does the Citi Prestige’s new limo benefit compare to other cards?

With the impending changes, here’s how the Citi Prestige’s limo benefit measures up.

[table id=1 /]

While other banks require customers to spend anywhere between $1-3K to unlock limo transfers, Citi is asking for $20K.

If I were the product manager of the HSBC Visa Infinite or OCBC VOYAGE card, I’d be rubbing my hands in delight at the own goal Citi scored today.

Is the Citi Prestige card still worth keeping?

In my opinion, the two main benefits the $535/year Citi Prestige card has now is the unlimited visit Priority Pass and the fourth night free benefit.

We’re already seeing the fourth night free benefit get capped in the US, and one wonders if it’s a matter of time before those changes get rolled out here too. An unlimited visit Priority Pass is nice, but it’s something you could get with other cards at roughly the same price point.

If you enjoy other benefits like 1 for 1 dining experiences, or find the Citi Prestige concierge to be helpful, maybe you’ll grin and bear it. But what gets my goat about this is the tone-deaf way Citibank has presented the changes. Just look at this eDM.

“Unparalleled privileges”. “Enhanced experience”. It’s just insulting to the intelligence of your customers. It still amazes me that companies try to pass obviously negative changes off as enhancements- seriously, what do they think we are?

Conclusion

I’ve found the Citi Prestige sort of useful over the past year (attended a few 1 for 1 dining events and used the limo transfers), but I’ve already decided not to renew it the next time round. I haven’t even used the fourth night free benefit once, plus lounge access is covered by my AMEX Platinum Charge card. All this does is further confirm my decision to not renew, and I’ll get my limo transfers from the UOB PRVI if need be.

Citi has every right to change the terms and conditions of its Prestige card benefits. But please, don’t be disingenuous about it.

Yes, has the same sentiment. Going to cancel my card in this round.

I’m glad I chose Amex charge over Citi Prestige. Was tempted by the free hotel 4th night benefit. But the changes are ridiculous. My Malaysia colleague Citi Prestige allows free ride from KLIA to home by showing 3 receipts of any amount in foreign spending.

This ‘enhancement’ comes on the heels of the upcoming removal of the Citi 10% rebate which I am very upset about.

Seems like Citi doesn’t want retail clients in Singapore.

Tone deaf, you hit the nail on the head. I had to re-read the eDM i got in mail this morning, will definitely be looking for a new card. Talk about being your own worst enemy.

Is it worth booking a Limo booking now (past April) if one is sure of their dates? Does the old principle still apply?

Totally agree with you, this is insulting indeed! Love the sarcasm 😂

Minor point: $1500 unlocks one limo trip doesn’t it? So it takes $6000 to give 4 trips per quarter?

1.5k used to unlock a max of 4 trips per quarter

@Aaron – Is it worth booking a Limo booking now (past April) if one is sure of their dates? Does the old principle still apply?

my understanding is this: april is the start of a new quarter anyway, so if you consume your limo benefit in the april-jun quarter you are subject to the april-jun spending requirement. if i hit $1.5k in FCY for jan-mar, i get to use the limo up to 4x in jan to march, i can’t use that entitlement in april-jun.

Seriously?! OMG sigh. Anyway that’s a moot point now

i spoke to citi CS before and they confirm that spending $1.5k unlocks 4 trips per quarter but to utilise the free limo, each trip is $1.5k overseas spending

Either CSO was mistaken, or there was some miscommunication – 1.5k would indeed unlock up to four complimentary rides per quarter. No need to hit that amount per ride.

(But yeah just one month left for this…)

If you think HSBC and OCBC card managers are rubbing their hands in delight, you would be right, except for the wrong reasons.

Ceding ground only gives greater incentive for competitor cards to introduce “enhancements” of their own. Just wait and see.

I agree. I doubt Citi would lose all that many customers because of this & the other product managers will see this as a sign of being able to cut the limo benefits of their own product without significantly impacting their competitiveness with Citi Prestige.

From Rewards card to set the monthly cap,

To Cash back card exclude the grab top up

And now Prestige card insulting our intelligence

Goodbye Citibank

Bear not bare?

I confuse my bare bears sometimes

Hello Aaron

Another great analytical article .

Need your opinion on this , both my prestige card and uob infinite Card are due soon , which card shall I keep ? Especially with the so called “enhancement “ of the prestige card which is very disappointing…

Hope to hear from you soon

you have the uob visa infinite metal card? if so, i’d actually keep the prestige. i dont find the uob visa infinite metal impressive at all- only four lounge visits, no airport transfer. but do yourself one better- consider the amex plat charge if your income allows. at least in the first year, i find the benefits worth it.

Thank you for the advice. I actually do have the charge card too. Shall I ditch both prestige & uob metal card , just keep the Amex Platinum Charge Card ?

Hear from you soon .

KeenanH, I believe you already have his answer from the article.

Brilliant expose article by Aaron! I’m getting quite annoyed by all these euphemistic “enhancements” that the credit card companies are shoving down our consumer throats. I already fedback to my Citibank contact earlier when they unilaterally altered their T&Cs to exclude insurance payments from earning miles/points. And the Citi Prestige has a pretty average mile earn rate of 1.3 miles per local S$1 spend and 2 miles per overseas S$1 spend. The SCB VISA Infinite card (provided you charge at least $2K/mth) and the BOC Elite Miles World Mastercard both triumph this earn rate. The benefit of UNLIMITED Priority Pass… Read more »

No forgreatjustice tag?

While other banks require customers to spend anywhere between $1-3K to unlock a limo transfer, Citi is asking for $10K.

Is it suppose to be $20k instead of $10k ?

talking about it on a per limo basis. 20k/2=10k

actually you’re right, it’s confusing. will update.

:))

I am not going to renew my Citi prestige in protest too despite having used the 4th night free benefit several times. I urge other readers to do so too. $20k for 2 rides? I won’t be so insulted if there had just removed the benefit altogether than to enhance it.

It’s more convenient to book a Grab when you actually want to go to the airport. Rather than having to preplan everything.

Time to update this showdown? https://milelion.com/2017/07/29/the-120k-credit-card-showdown/

I currently have the Citi Prestige, Amex Plat Charge, UOB PRVI Amex, HSBC Visa Infinite and SC Visa Infinite. Had thought I’d cancel all but the Prestige and Amex Plat this year, but now I’m not so sure! Any thoughts @Aaron Wong?

Would Payall count towards the spending? If so this may be part of a concerted effort to push cardholders to use Payall?

Fairly reasonable thesis – if indeed it is true, that would cushion the blow somewhat.

@Aaron any insight into this from your contacts at Citi?

My payall 10k a month. Hopefully it works

Screw Citi. Cancelling my card today

Hi there, I don’t want to continue with my prestige card but I don’t if I need to call them to avoid automatic extension or do I just underpay my last bill with the subscription fee which I guess they bill automatically? Any advice would be welcome! Thanks!

Call Citi

I have confirmed with Citi that PayAll DOES NOT count towards the 20k – it’s so bizarre!

Citi Prestige is just not competitive nowadays. Admirals Club access are long gone (even when Amex Platinum still gets you into Delta Sky Club), fourth night free became twice a year only and restricted by tons of terms, and literally every single premium card on the market has the TSA PreCheck/Global Entry credit every 5 years.

what is our best alternative?