| OCBC has extended the sign-up offer until 18 April 2019. Read more here. |

While browsing Facebook (yes that’s what millennials do), I came across a rather interesting advertisement from OCBC about the OCBC Titanium Rewards card.

Get 8,600 miles upon card approval, spend S$300 to get additional 4,200 miles

New-to-bank OCBC customers who apply through this link will receive

- a welcome bonus of 8,600 miles (21,500 OCBC$) upon card approval, and

- an additional 4,200 miles (10,500 OCBC$) by spending S$300 within one month of card approval.

You’re considered new-to-bank if you’ve not held any OCBC credit card within the past 6 months. If you are holding on to any other OCBC credit cards (Frank, VOVAGE, 365 etc.), you are not eligible to participate in this promotion. The full T&Cs can be found here.

To participate in this promotion, you must apply for either the OCBC Titanium Rewards Pink or Titanium Rewards Blue credit card between now and 21 March 2019 and be approved for the card by 30 April 2019.

For the welcome 8,600 miles, if your card was approved by OCBC in the month of March 2019, the bonus 8,600 miles will be deposited into your account by end April. If it was approved in April 2019, then the 8,600 miles will be credited to you by end May 2019.

For the spending bonus of 4,200 miles, if your card was approved in March 2019 you will have until end April 2019 to spend S$300 on the card. If it was approved in April 2019, you will have until end May 2019 to complete the spending. The additional miles will be deposited into your account by the end of the next month from the month you were supposed to clock the spend in.

The OCBC Titanium Rewards credit card comes with a 2-year annual fee waiver and OCBC$ have a 2-year validity window from the date of which the OCBC$ was earned.

Why I like the OCBC Titanium Rewards credit card

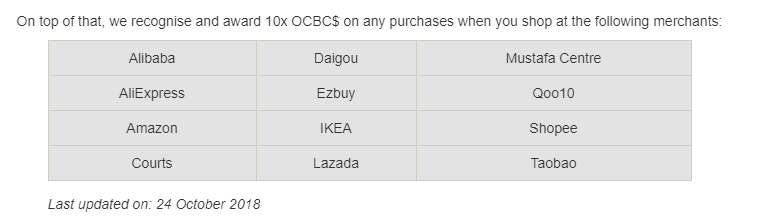

Even though OCBC killed off the 4 mpd for mobile payments in August 2018, it’s still a great card to hold as it offers 4 mpd (10x OCBC$) for spending on bags, shoes, clothes, at departmental stores and purchase of electronics (capped at S$12,000 per card per membership year)

This includes the following merchants:

You might think that the OCBC Titanium Rewards credit card has a great overlap with the Citibank Rewards card, and I agree with you. However, what gives it the added advantage at this point is that the cap on earning 4 mpd is a yearly cap instead of a monthly cap which is what Citibank has done to its Rewards card.

This means you can easily purchase a S$5,000 TV at Courts and still be able to earn the full 4 mpd when you charge the purchase to your OCBC Titanium Rewards credit card.

OCBC only partners with Singapore Airlines KrisFlyer and points can be transferred to miles at a transfer ratio of 25,000 OCBC$ to 10,000 KrisFlyer miles and an administrative cost of S$25 per transfer applies.

Concluding Thoughts

This is an excellent promotion that OCBC is currently having and if you do not currently hold onto any OCBC credit cards, I would strongly suggest applying for the OCBC Titanium Rewards credit card right now to take advantage of this excellent deal.

Remember that you need to apply through this link to take advantage of the bonus.

Thanks Matthew. Another great article and heads up. I will apply today. I was wondering if I could just ‘pay’ Grabpay $300 after i get the card. Would that count as $300 spend?

The T&C doesn’t seem to exclude it but that will also mean you will most likely only ear 0.4mpd for that.

it appears that the $300 spend is part of the promo and will not earn any extra miles beyond 12,800 miles?

Thanks Matthew for the info. However, when I click on the application link thru here, it is the same as the page that go direct from OCBC website, the promo is the ang bao promo…. get $168 cashback thingy….. I didn’t see the miles promo page…

Yes same here

I called OCBC bank, the CS can’t help me either. She keep saying the current promotion is the cashback thing, but I said it’s already ended right and what is March promotions? She keep asking me to refer to OCBC website, she said she can’t verify any ads on facebook….

I just spoke to CSO and confirmed my application was tagged to the promo correctly. They also mentioned it’s not “seen” online but you can just call in and verify. I’ve submitted my application but it’s not been approved. All the best!

Difference is the “sourceCode=NTCM01” at the end of the URL

What’s the source code for the miles promo then?

Yes, realized the end of source code… but how can we be sure that we get that free miles promotion? Any idea?

Yes that’s supposed to happen. It will redirect you to the OCBC website but there’s an additional “source code” in the URL after redirection.

TWS mentions that the promo is accurately tracked by OCBC.

Would anyone know how fast can we cancel the card after obtaining the signing up bonus ?

I am not only referring to this promotion but in general.

I realized i now have too many cards and would like to spring clean a bit..

Thanks

bank is 6 mths but i spoke with amex and they say 1 year

thanks @financialmtc for your feedback !

UOB & BOC, take a hint.

so as long as source code is “sourceCode=NTCM01” , we will be tagged to this promo?

I have applied with the link and called the bank for double check. They confirmed my applicaiton is linked to the promo. No worry

I applied online… asked to send CPF contribution statement to OCBC… received email from CPF that information has been sent to OCBC to download… but OCBC website kept saying that request was unsuccessful?! After clicking submit, it says we will get back to you in a few days. Still waiting. In contrast, I also applied for my spouse… received the same error message that CPF statement request was unsuccessful despite email confirmation from CPF that says the contrary. But after clicking submit, OCBC website asks to upload NRIC copies + CPF statement + print, sign and upload a declaration. Yet… Read more »

Hi Matthew, any idea is it possible to apply for both the blue and red card to get twice the promo?

Nope not possible

“”Qualifying Spend” refers to any retail transactions (including face to face or online purchases), but

exclude Transactions made via NETS, annual card fees, Cash on Instalment, Instalment Payment Plan,

Interest, Late Payment charges, Tax Payment, Cash Advances, Balance Transfers, Internet Banking,

AXS, SAM or any other payment network and all other bank fees and charges are excluded from the

calculation of the spend for this Promotion. ”

Payments for hospital bills/Grab rides counted as retail transaction?