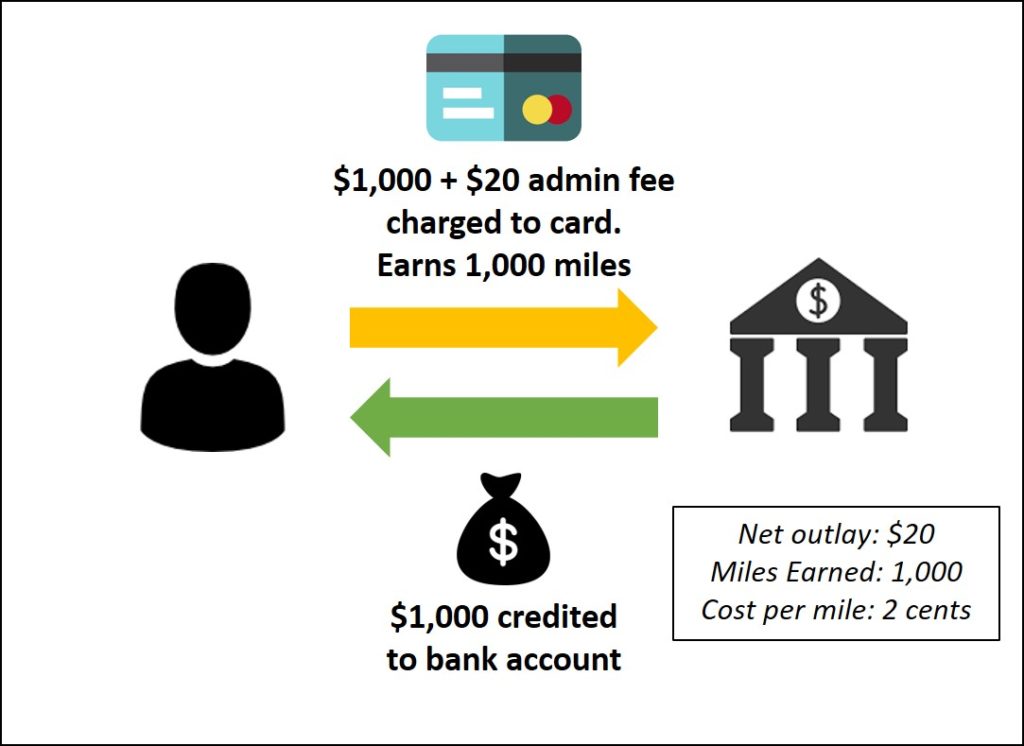

If you’re willing to pay out of pocket for miles, then payment facilities are one way of acquiring a large number of miles at a relatively low price.

Simply put, payment facilities are arrangements where the bank credits a lump sum of cash to your bank account before charging the corresponding amount to your credit card, plus an admin fee. You’ll earn miles for the amount charged, and (presumably) repay the amount due on your credit card with the cash, meaning your net outlay is simply the admin fee.

Many banks already offer payment facilities for tax, and UOB goes one step further by offering a “pay anything” facility, which is basically a no-questions-asked way of buying miles.

OCBC has traditionally offered a tax payment facility for VOYAGE cards, but has just launched an additional VOYAGE Payment Facility that is essentially a “pay anything” approach.

VOYAGE Payment Facility

The VOYAGE Payment Facility awards 1 VOYAGE mile per $1 charged to the card, and is available at the following rates:

- $10,000-$150,000: 1.95% fee (1.95 cents per mile)

- $150,000 and above: 1.90% fee (1.90 cents per mile)

The only limit to the number of miles you can purchase is your credit limit. For example, if you have a $15,000 credit limit, you can only purchase 15,000 VOYAGE miles. That said, the OCBC VOYAGE Card has a minimum income requirement of $120K, which means most cardholders will have very high credit limits.

Worse come to worse, you can do your miles purchases in batches- max out your limit to purchase the first batch, repay the outstanding amount as soon as the cash hits your bank account (typically four business days), rinse and repeat.

Income Tax

In addition to the VOYAGE Payment Facility, OCBC has relaunched the tax payment facility for YA2019. Cardholders can submit their NOAs to OCBC and get their tax due amount credited to their bank account, before settling the outstanding balance with IRAS themselves.

There are two repayment modes for income tax, and presumably miles chasers will want to do the first

- One-time repayment: 1.9% (1.9 cents per mile)

- 12 months repayment: 2.85% (2.85 cents per mile)

The tax payment facility has a lower administrative fee, but unlike the VOYAGE Payment Facility it requires documentary proof of the amount owed to IRAS. In other words, if your tax bill is $5,000, you can’t request $10,000 worth of miles.

VOYAGE miles, not regular miles

The most exciting thing to me about these payment facilities is that you earn VOYAGE miles, not regular miles. What’s the difference?

- VOYAGE miles can be converted to KrisFlyer miles at a 1:1 ratio with no conversion fee

- VOYAGE miles can be used to offset the cost of revenue tickets on any commercial flight

In other words, 1 VOYAGE Mile is worth more than 1 KrisFlyer mile, because of the additional flexibility.

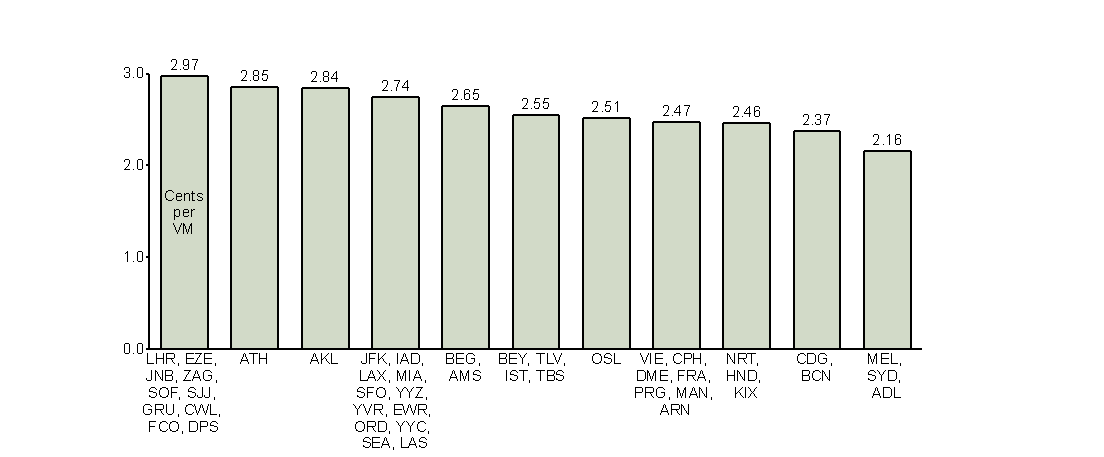

It gets better. I previously did some analysis on the value of VOYAGE miles, and the conclusion was that the value of a VOYAGE mile depends on what destination you redeem them for. You can get valuations in the high 2 cents by redeeming for destinations in North and South America, as well as selected European cities.

This effectively implies a form of arbitrage, because you could be buying VOYAGE miles for 1.9 cents each and redeeming them for 2.9 cents of value. That could save you about 35% on your revenue flights, although the actual utility will obviously depend on where you’re flying too. It creates interesting possibilities, if nothing else.

How does this compare to other payment facilities?

Assuming you want to convert your VOYAGE miles into KrisFlyer miles, then here’s how the VOYAGE payment facilities measure up against the competition.

[table id=24 /]

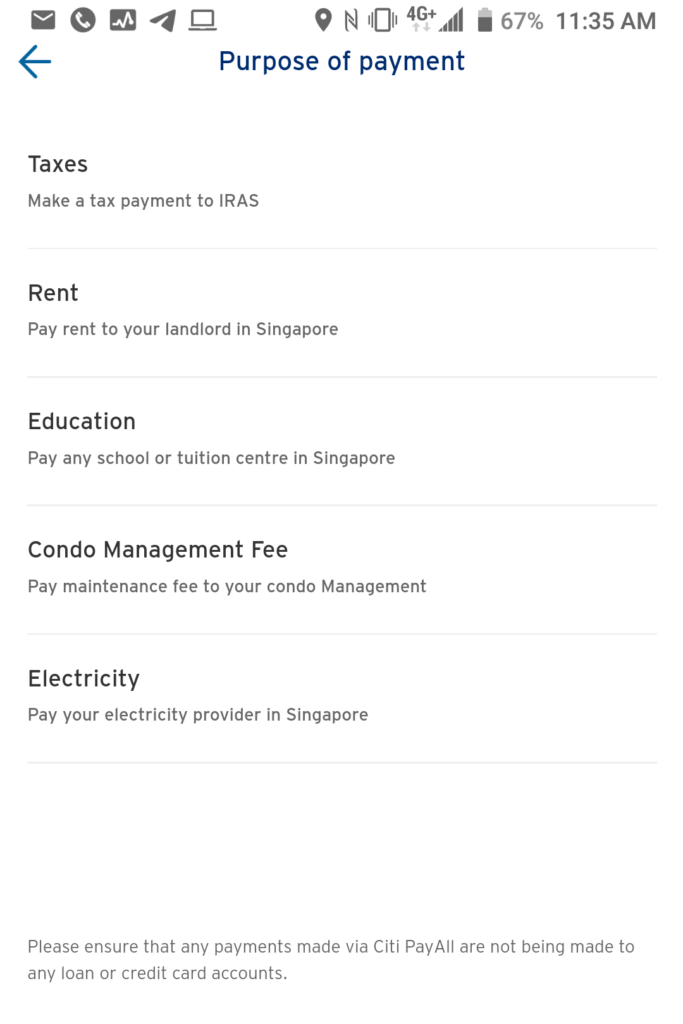

Citi has recently expanded its PayAll service to include tax payments (it seems that only Android users of the Citi app currently see this; iOS users may need to wait a few days for their update), and this offers a more competitive rate than VOYAGE’s tax payment facility. I suppose the question is how much of a premium you’re willing to pay for the added flexibility of VOYAGE miles.

Remember, Citi PayAll still requires you to have a bona fide transaction (education, rental, condo management fees, electricity bill) before you use it. VOYAGE has no such requirement.

Conclusion

OCBC VOYAGE cardholders will now be able to acquire VOYAGE miles at a much cheaper price than the annual service fee (2.14 cents per mile, based on the $3,210/150,000 mile option), and this can help those who are just short of a redemption.

On another note, the increased proliferation of sub-2 cent miles generation opportunities and the recent KrisFlyer devaluations have led me to wonder if I need to re-evaluate my 2 cent valuation of a mile. I’ll probably be exploring this in an upcoming post.

what are the repayment terms for this facility i.e if the interest rate? which is conspicuously left out of this article