Back in September 2018, DBS started offering sign up bonuses on its Altitude cards once more, after a hiatus of almost two years. This offer has gone through several iterations, but DBS has just extended the current bonus till 30 Sept 2019, and added an additional bonus on the DBS Altitude AMEX.

Get up to 10,000 bonus miles with the DBS Altitude card

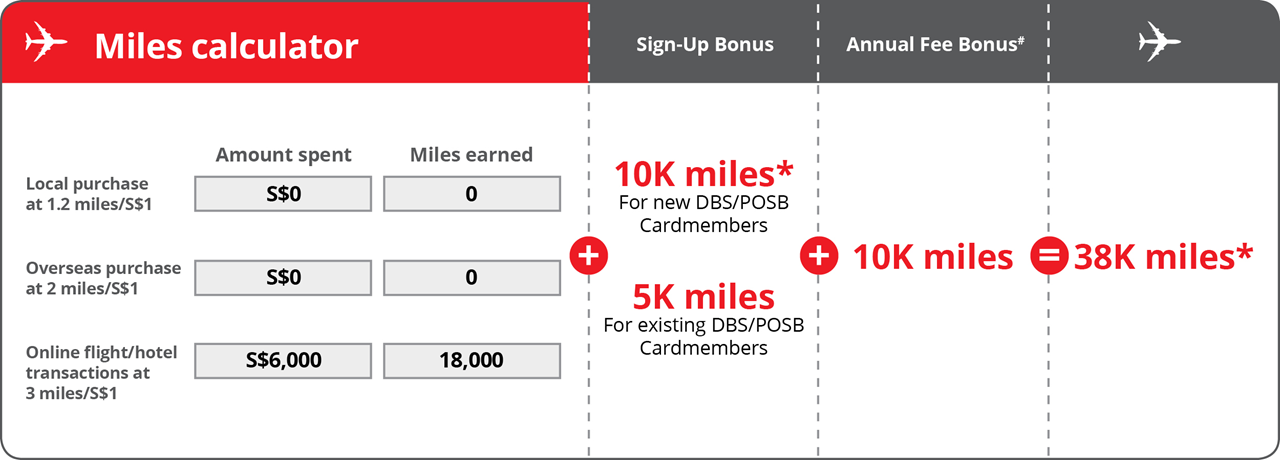

Let’s start with the extended sign up offer. From now till 30 Sept 2019, approved new-to-bank DBS Altitude AMEX/Visa cardholders who spend a minimum of $6K in the first 3 months get 10K miles.

| Existing customers will get 5K miles. DBS defines a new-to-bank customer as one who does not currently hold a DBS/POSB principal credit card, and has not in the past 12 months |

Although DBS markets the sign up bonus as 38K miles, that figure needs a bit of elaboration. It’s derived from the following:

- Paying the $192.60 annual fee to get 10K miles

- Spending $6K in 3 months on online air tickets/hotels to get 18K miles

- Hitting the sign up bonus of $6K in 3 months to get 10K miles

In other words, if you spent the $6K on local spending, you’d earn 7.2K miles (@ 1.2 mpd) for a total haul of 27.2K miles (assuming you paid the annual fee).

The first year’s annual fee of $192.60 is waived by default on the DBS Altitude cards, but you have the option to pay the fee to earn 10K additional miles. To do so, you’ll need to enter the promo code ALTAF in the online application form. You’ll need to decide for yourself if it’s worth paying 1.926 cents per mile, given that I now value KrisFlyer miles at about 1.8 cents each.

To be eligible for this offer, you need to apply for the DBS Altitude card through the website, ibanking or Digibank. Offline applications will not be eligible.

Earn 50% bonus miles on the DBS Altitude AMEX

In addition to the sign up bonus, DBS Altitude AMEX cardholders can enjoy a 50% bonus miles on all spending made in the first 3 months, capped at 10K bonus miles. To qualify for this bonus, you must spend at least $6K in the first 3 months.

| Regular Rate | +50% Bonus | |

| Local Spending | 1.2 | 1.8 |

| Overseas Spending | 2.0 | 3.0 |

| Online air ticket & hotels | 3.0 | 4.5 |

You’d max out the bonus cap of 10K miles by spending (assuming all your spend is in a single category):

- Local: $16,666

- Overseas: $10,000

- Online air ticket/hotel: $6,666

This is above the $6K spending threshold needed for the sign up bonus, so you could be looking at as many as 50K miles, assuming you spent all $6K on air tickets and hotels, and paid the annual fee.

A local earn rate of 1.8 mpd would make the DBS Altitude AMEX the highest earning card in market, even higher than the uberluxe $500K cards like the DBS Insignia, Citi Ultima and UOB Reserve (1.6 mpd).

An overseas earning rate of 3.0 mpd would put the DBS Altitude AMEX alongside cards like the BOC Elite Miles and SCB Visa Infinite (3.0 mpd). In terms of foreign currency transaction fees however, DBS is much lower than SCB’s 3.5% (and on par with BOC’s 3%).

An earn rate of 4.5 mpd on online air tickets and hotels is as good as it gets, given the next best option is to use the DBS Woman’s World Card for 4.0 mpd. Remember that it’s also possible to earn 7.5 mpd on Expedia bookings and 11.5 mpd on Kaligo bookings with this bonus.

| Curious about how different cards measure up? Check out which card to use where in The Milelion’s credit card guide |

I distinctly remember that back in 2015, DBS had a similar 50% bonus miles promotion for the Altitude AMEX, but without any cap. That was pretty awesome, but I doubt we’ll see anything like that again (this was also when the DBS Altitude Visa had a spend $800 get 12,000 miles promotion- what a time to be alive!).

The T&C of both offers can be found here. Do have a read, as certain categories of spending do not count towards the $6K spending requirement (e.g. insurance, educational institutions and government services).

Other things to know about the DBS Altitude cards

In addition to Singapore Airlines KrisFlyer, you can also transfer DBS Points to Air Asia (but why?), Asia Miles and Qantas. There’s still a few days left to take advantage of the 20% transfer bonus to Qantas, but you may want to reconsider in light of some upcoming changes to Qantas’ FFP.

DBS Points pool across different cards, and those earned on the Altitude do not expire so long as your card is active.

If you want lounge access, only the DBS Altitude Visa has a Priority Pass with two complimentary visits.

How does this compare to other sign up bonuses?

We’re fast approaching the end of June, where a whole lot of credit card sign up bonuses will either expire, get renewed or be changed up. Here’s all the bonuses that are due to expire 30 June:

|

DBS has made the first move by extending their sign up bonus; let’s see who else follows suit.

Conclusion

The DBS Altitude cards are good general spending options, and the sign up bonus sweetens the deal for those who don’t already have DBS credit cards. I’d give some strong thought to the DBS Altitude AMEX in particular, especially with the 50% bonus miles in the first 3 months.

| Signing up for cards or making purchases through the links in this article may generate a referral commission that supports the running of The Milelion. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter (on the right of your screen) for the latest deals and hacks delivered to your inbox. |

Hi, just wondering, do only new to bank AMEX applicants earn 50% bonus miles or all applicants?

it seems like both new and existing, based on t and c.

Seems you have mistakenly swapped the descriptions of AMEX ascend and blue credit card in this post.

Only the part on annual fee.

thanks! fixed

Just counting the 50% bonus miles,

If I were to spend 6k on air tickets in a single purchase, I would get

5000 x 4.5

1000 x 1.8

For a total of 24300 miles? Am I correct to assume that after the $5000 cap on online bonus, the remainder gets classified as local spend?

yes that’s my understanding.

Where to find these unicorns who are new to dbs/posb bank???

Im wondering – Do existing posb customers count as new to bank?

can anyone advise is payment of hospital bills for government hospitals like KKH and SGH counted as payment to government institutions and services and thus excluded from being considered as qualifying spend? Thanks! 🙂

Hi. Using credit card payment via Cardup will be eligible for the $6k spending?

Keen to know too

Same question. Please post if anyone knows

Should count but can anyone confirm?

Looks like the AMEX 50% offer is still on, no ?

https://www.dbs.com.sg/iwov-resources/media/pdf/cards/dbs-altitude-card-miles-tnc.pdf