Using your credit card for foreign currency transactions can earn you a whole load of bonus points, assuming you’re willing to pay the additional fees involved. As a recap, here’s the foreign currency transaction fee each bank currently levies:

[table id=3 /]

Despite the fees, I find it’s generally worth it to use my credit cards overseas, especially if I can earn 4 mpd (e.g UOB Visa Signature on all FCY, Citi Rewards Visa/Citi Rewards Mastercard on shopping). The ultimate maths all depends on how you value a mile, of course.

One thing that stops some from using their cards overseas is the uncertainty involved in currency conversion. After all, calculating the exact amount a bank will charge for a given foreign currency transaction is a tricky exercise. You could get a ballpark figure by taking the XE rate and adding a few percentage points to cover the fees, but thankfully, there’s a more accurate way of approaching this.

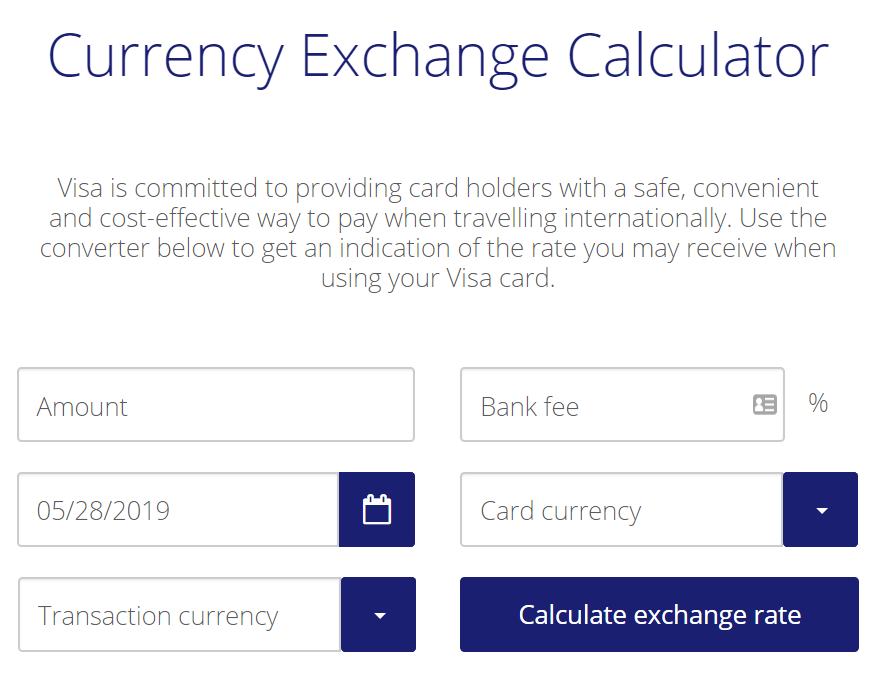

Both Visa and Mastercard offer currency exchange calculators on their websites which allow you to estimate the cost of your transaction.

Visa

Visa’s currency exchange calculator is very simple to use. All you need to provide is:

- Foreign currency type

- Foreign currency transaction amount

- Date

- Bank fee (refer to the table above)

- Card currency (pick SGD)

To check how accurate it is, I compared the output against a few of my credit card statements.

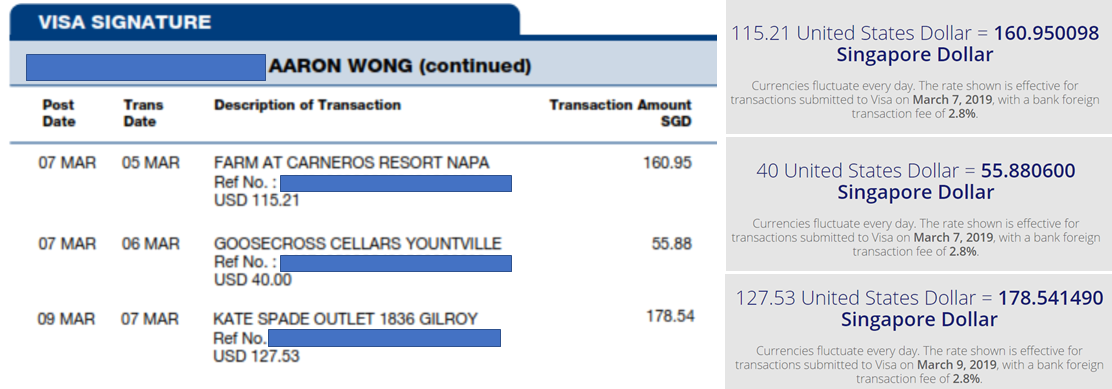

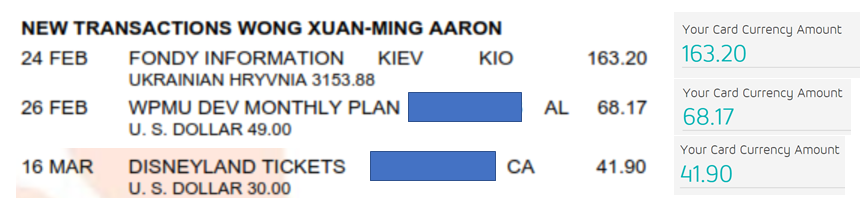

UOB Visa Signature

The first card I tried was my go-to for foreign currency spending: the UOB Visa Signature, which earns 4 mpd on FCY spending, provided you spend a minimum of $1K and a maximum of $2K in a statement period.

A quick word about the “date” field. If you’re looking at this ex-post (perhaps you’re playing around with the calculator and want to match it to your statement), you may run into some confusion about whether to use transaction versus posting dates.

It seems intuitive to use the transaction date, because that’s the date the transaction is booked. However, when trying the Visa calculator with my UOB Visa Signature card, I matched the calculator figures with my statement by using the posting date in the date field.

I can’t quite explain why this should be the case, but there is a note at the bottom of the Visa calculator which says…

Rates apply to the date the transaction was processed by Visa; this may differ from the actual date of the transaction.

…so perhaps that explains that. Anyway, if you’re using the calculator ex-ante, you can really only use the transaction date. That’s because you have no idea when exactly a given transaction will post (typically 1-3 days after, although there are instances where it takes longer). The good news is this really won’t make that big a difference to your calculation, barring some overnight collapse of a country.

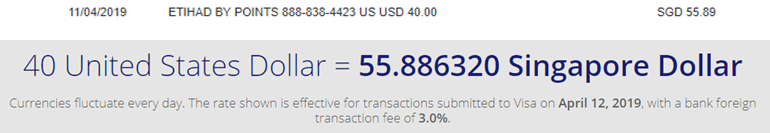

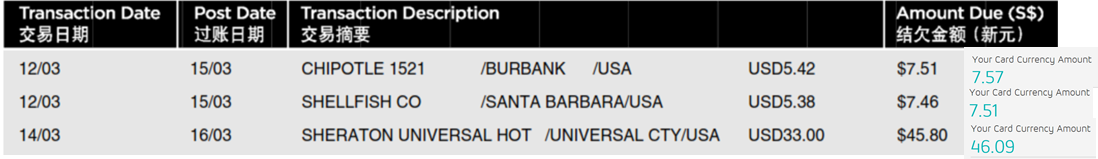

Citi Rewards Visa

Next up, I tried the Citi Rewards Visa, which I’d use for online transactions in foreign currency, and shopping at bags/shoes/clothes/factory outlets overseas.

Again, there were issues with what date to use. Citibank only lists the transaction date, and I wasn’t able to match the figures exactly until I started offsetting the transaction date by a day or so.

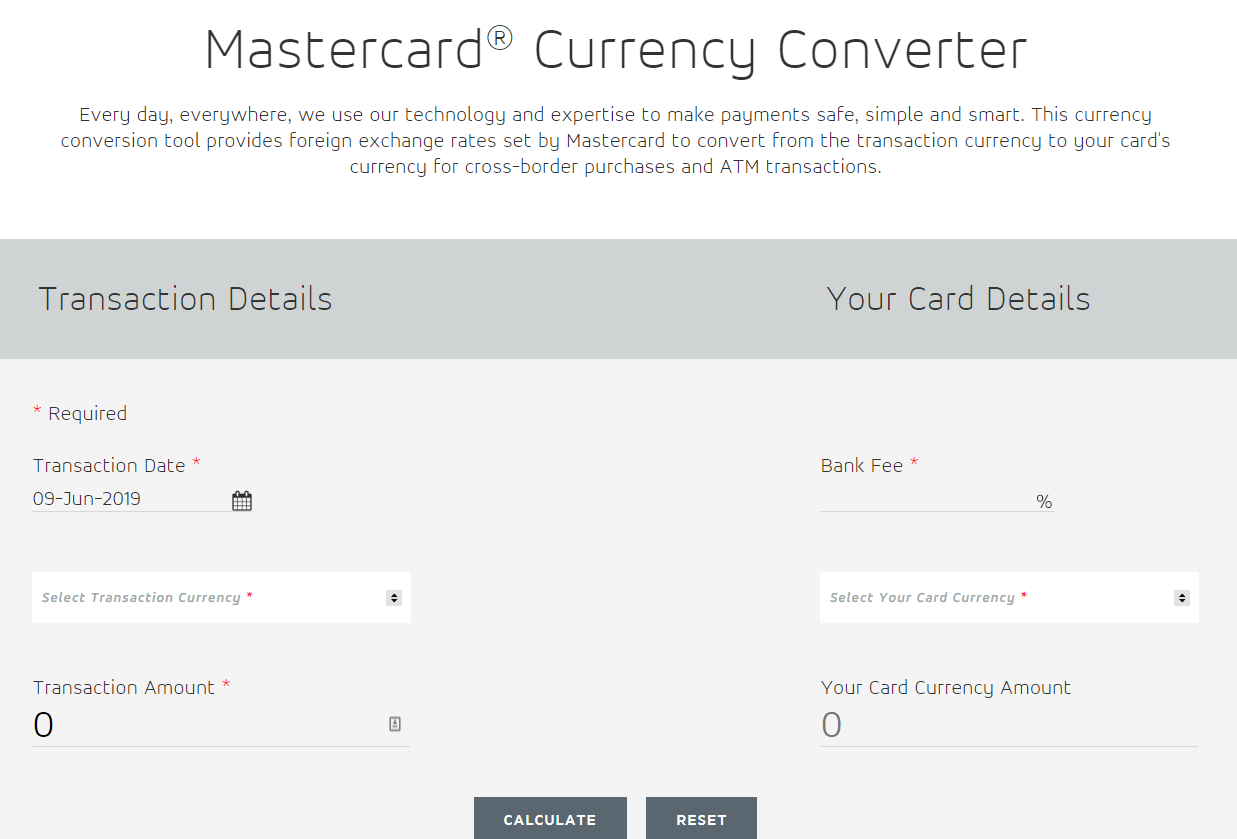

Mastercard

Mastercard’s currency converter uses the same inputs as the Visa converter. The website gives the following disclaimer:

The foreign exchange rate and the converted FX amount are indicative only and inclusive of the bank fee you entered. Your bank may or may not use Mastercard foreign exchange rates to bill you and may impose additional fees in connection with foreign currency transactions. Foreign exchange rates are specific to the date and time Mastercard processes the transaction which may be different from the transaction date

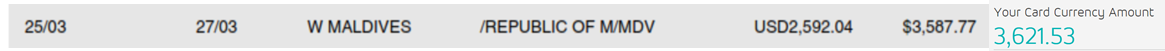

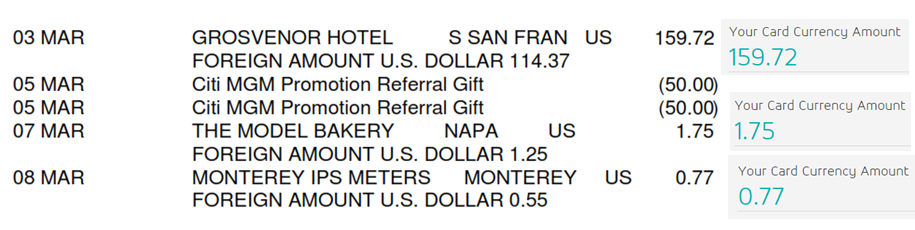

DBS Woman’s World Card

The DBS Woman’s World Card is a good substitute for the Citi Rewards Visa when it comes to online foreign currency spending, thanks to its higher cap on 4 mpd of $2K per month.

I managed to get 100% accurate results matching the figures with my DBS Woman’s World Card statement. Even better- I didn’t need to do any date offset; I just used whatever date appeared in my card statement.

BOC Elite Miles World Mastercard

It’s hard to talk about foreign currency spending without bringing up the BOC Elite Miles World Mastercard. Even though it no longer earns the jaw-dropping 5 mpd it did when it first launched, it’s still a market leader at 3 mpd.

The amounts posted to my BOC Elite Miles World Mastercard were slightly off, despite trying both the posting and transaction dates.

These differences are generally immaterial with small transactions, but can be sizable on big ticket purchases.

In my observation, the calculator overestimates the cost of transactions with the BOC lite Miles World Mastercard. This could be because BOC doesn’t use the Mastercard foreign exchange rates, but I’m curious to know whether the overestimation is a systemic thing or just unique to the month I looked at.

Citi Prestige

Although I’ve chosen not to renew my Citi Prestige card, I was using it quite a bit back in March on the US leg of the Mileymoon in order to unlock my complimentary limo rides.

As was the case with the Citi Rewards Visa, I could only get the figures on my Citi Prestige statement to match the calculator by offsetting the transaction by one day.

AMEX

AMEX, unfortunately, does not have a similar feature for its cards. That said, I can’t imagine why the foreign currency rates that AMEX uses would be drastically different from Mastercard/Visa, so if you enter the relevant foreign currency transaction fee for your AMEX you should get a figure that’s not too far off.

Conclusion

The results, for me, were a bit of a mixed bag. Although I managed to perfectly replicate the actual posting values on certain cards, I had to play around with the dates on others to do so.

This means you may not get last digit accuracy ex-ante when working out the cost of a transaction. However, for most purposes, the Visa and Mastercard calculators should give an adequate estimate of the actual cost.

Unlike the US, we don’t have any “true” zero foreign currency transaction fee cards in Singapore (the BOC Visa Infinite used to waive the 1.5% bank fee, but still imposed the 1% levied by Visa/Mastercard). If these fees bother you, then perhaps you should consider a pre-loaded foreign currency card like YouTrip.

Would be useful if you could also provide the actual variance from the xe mid rate for the actual currency rate for the various cards? I imagine the actual variance is more than the actual bank fees (i.e. the table above).

Haha…maybe if I were still single with a lot of time. Married life demands are no joke

I did calculate for BOC card before, my conclusion was the transaction fee is 2.3%, they did say they revised it to 3% but then seems like on the transactions they did not charge as much.

Thanks for the data point! Are you sure it’s not just because they don’t use MasterCard rates?

Guess we will not know if BOC is using MasterCard rates or not, unless we confirm with the bank? but if they are charging less, i dont see why I would notify them about it 😛

You could calculate by using transaction date and 2.3% bank fees, for small amount transactions, they vary by a few cents but for the big amount it tallies.

I had one calculation based on txn date that ended up at 2.3% as well. I performed a few calculations based on txn date and the range was 1.67% – 2.3%, but nothing close to 3% so far (touch wood). There was one strange case where I transacted in CNY and actually got a -0.03% markup (yes, negative!) based on txn date and only 0.2% markup based on posting date. I used the Mastercard calculation website. Maybe BOC has access to favourable rates when transacting in CNY. If so, I will be using this card more often in China, where… Read more »

Did VISA/Mastercard see the irony of providing this calculator and having DCC service? DCC should be scraped.

Dcc is not provided by visa /mastercard. It is done by payment processing firms like first data and worldpay

Visa/Mastercard choose to allow it. Unlike AmEx.

If you have exhausted your mile earning options, there is the ICBC Global Travel MasterCard to fall back on. It gives 3% cashback for overseas spend. After deducting 2.5% of foreign exchange fees, the net cashback is 0.50%, with no minimum spend, and cashback is unlimited. Effectively, the “zero” foreign currency transaction fee card you’re looking for (negative fee in fact).

Please don’t suggest something like YouTrip. It offers no rewards, your balance is not protected, exchange rates are sometimes way off, and the flood of negative reviews (which they keep hiding) by users should be telling enough.