If you want a credit card that offers unlimited lounge access, you’ll need to earn at least $120K a year (or plough ~$2.5K into crypto). If you don’t qualify, or aren’t willing to pay the non-waivable ~$500 annual fees, then the best entry-level ($30-50K income) miles cards offer just 2-4 free visits a year.

| Card | Income Req. | Annual Fee | Lounge visits |

Citi PremierMiles Visa Citi PremierMiles Visa |

$30K | $192.60 (first year free) | 2 per calendar year |

Diners Club Cards Diners Club Cards |

$30K | Varies, as low as $28 (first year free) | 1 visit between 1 Apr and 31 Mar |

UOB JCB Platinum Card UOB JCB Platinum Card |

$30K | $64.20 (first year free) | 2 per calendar year |

DBS Altitude Visa DBS Altitude Visa |

$30K | $192.60 (first year free) | 2 per membership year |

KrisFlyer Ascend KrisFlyer Ascend |

$50K | $337.50 (annual fee must be paid) | 4 per membership year |

| For a full listing of credit cards that grant lounge access, check out this reference guide |

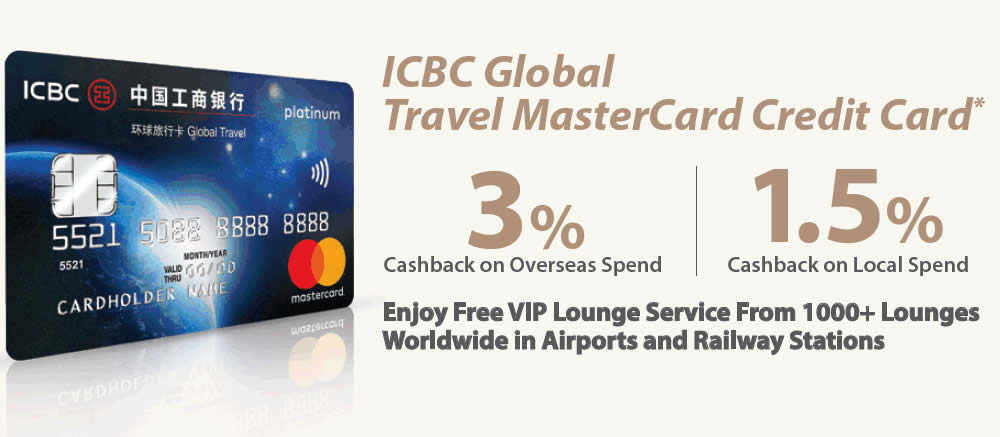

But perhaps you’re looking in the wrong place. Intriguingly enough, the best entry-level card for lounge access is a cashback card. The ICBC Global Travel Mastercard offers six free Dragon Pass lounge visits, has an income requirement of $30,000, and waives its $150 annual fee for 3 years.

If you choose to spend on this card, you’ll earn 3% cashback on overseas spending and 1.5% cashback on local spending, with no minimum spend or caps. ICBC’s foreign currency transaction fee is 2.5%, which means your effective rebate on overseas spending is 0.5%.

What’s the catch?

First, the Dragon Pass lounge access is a promotion, not a permanent feature. All six lounge credits expire on 31 December 2019, and it’s not clear yet whether the promotion will be renewed for 2020.

Second, ICBC card fulfillment is a lot slower than other established banks. As per reports on HWZ, people have waited up to 2-3 months to get their cards. I applied on 8 October, got approved on 4 November, and received my card on 14 November- a total of five weeks.

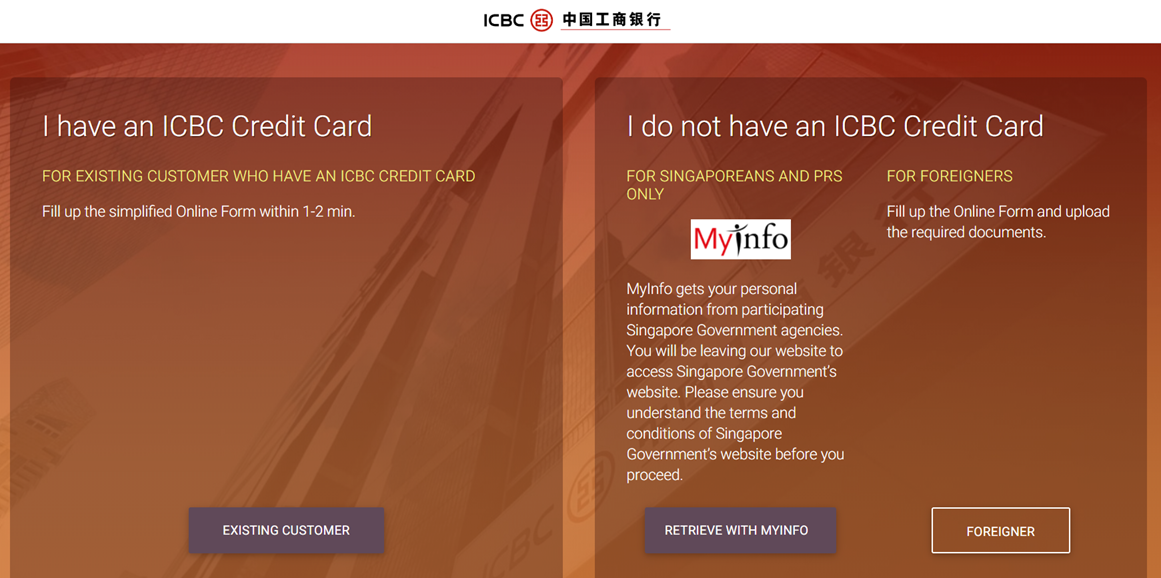

The good news is that ICBC has a new online application portal that’s integrated with SingPass MyInfo. In theory this should speed up the approvals process, but it’s so new that we don’t have any data points yet (I applied under the old system).

I suppose if you’re hard up for lounge access it doesn’t hurt to try, since there’s no annual fee for the first 3 years. In a best case scenario, your card arrives before the end of 2019 and the program gets renewed for 2020, giving you 12 lounge passes to use in quick succession.

Third, ICBC’s internet banking setup is a bit of a mess. You need to go to a branch to register, and accessing it via desktop requires downloading and installing a special piece of software. From what I’m reading on HWZ, it doesn’t exactly have award-winning UX either, but this is more of an issue if you intend to transact regularly on the card.

Activating your Dragon Pass

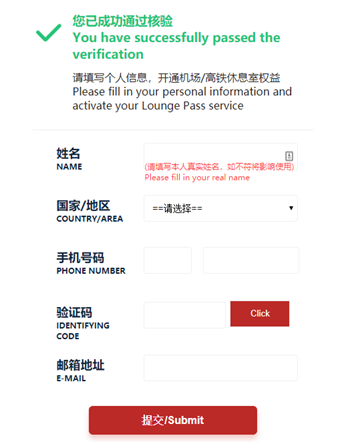

Once you get your card, you can visit this webpage to activate your Dragon Pass.

Fill in your card number and agree to the T&C.

You’ll then be brought to the next screen. Fill in your name, country and phone number, then click the “Click” button to get an OTP (“identifying code”). Enter the OTP and your email and click “submit”.

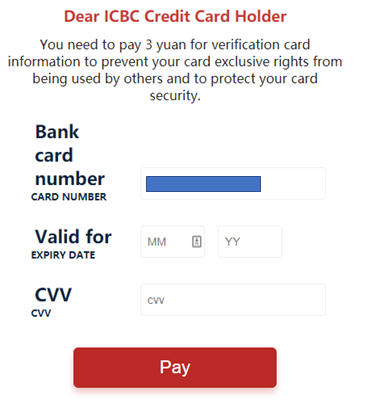

You’ll be prompted to enter your card details for an RMB 3 charge (~S$0.60) to verify your account. At first I thought this was a temporary charge that gets refunded once verification is complete, but apparently it’s an actual transaction. This means that even if you only intend to use the card for lounge access, you’ll still need to make sure your first bill is paid properly (you can pay ICBC card bills at AXS machines).

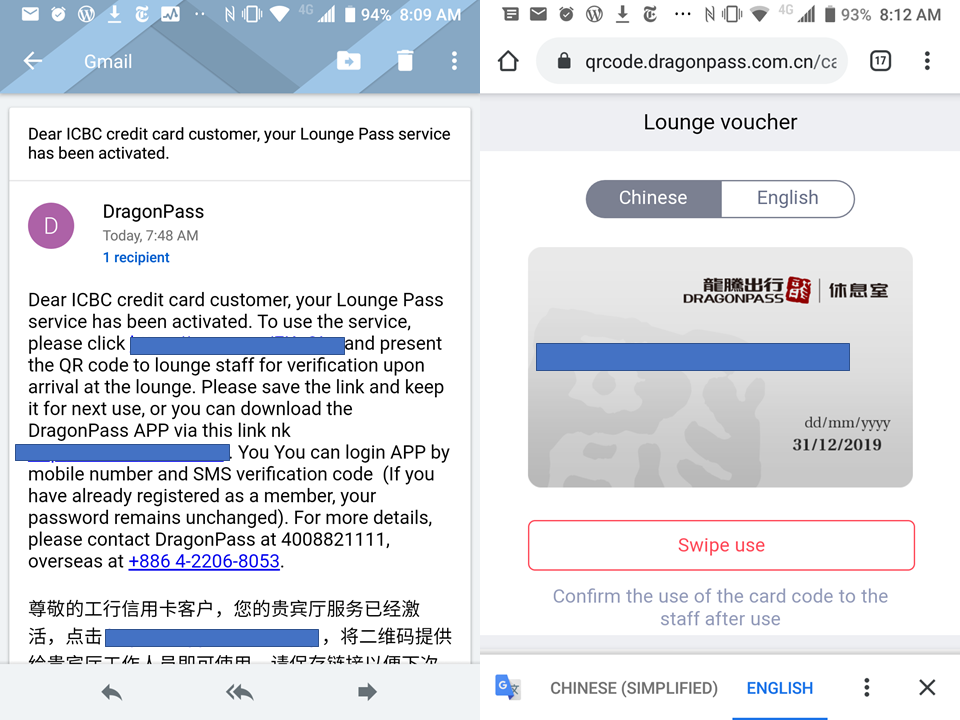

Once that’s done, your Dragon Pass membership number will be generated. Note the expiry date- all six lounge passes expire on 31 December 2019. If ICBC opts to extend this program, you’ll need to register again for 2020.

You won’t be able to link this membership to the Dragon Pass app; instead, you’ll receive an email with a URL that you click to generate your lounge pass each time you visit.

Conclusion

The Dragon Pass promotion has been going on since early 2019 so I’m very late to the game, but hopefully it gets extended for 2020. I can see this being a great option for a husband-wife team who travel with family in tow. Each person applies for a card, and then you have 12 lounge passes to cover inbound and outbound visits for up to 6 people.

There’s no reason why you can’t stack these visits with the free ones you get from other entry-level cards too, and get up to 13 visits per person (ICBC-6, DBS Altitude-2, Citi PremierMiles Visa-2, UOB JCB-2, Diners Club-1) without having to pay an annual fee.

So the main question in my mind is whether this gets extended. If so, then maybe miles chasers finally have a good reason to hold a cashback card.

It starts in 2018, I believe. And you can use app, only the Chinese version(it has English), not the international version.

Are you able to download the Chinese version though? Or must sideload

In IOS App Store, search “dragon pass”, choose the one with longer name with Chinese.

Don’t Android to test Google play store.

How exactly do you do this? Have a bank-issued dragonpass as well and am getting tired of finding the link every time…

The link provided shows 2 cards…. if apply both does it mean will get 12 passes?

After the BOC Elite Miles experience, I’ve had enough. No number of free lounge visits can persuade me to apply for another card by another Chinese bank with comparable archaic processing inefficiency. I value whatever hair I have left (and frankly you should too, Aaron!) without having to feel like I wanna pull them all out dealing with them.

ICBC used to offer unlimited access to airport-operated lounges in China. Only recently this was “downgraded” to six visits with dragon pass.

Only those operated by ICBC and in China. How useful to the rest of the world? Many are in 2nd-tier or 3rd-tier cities.

Hmm… very interesting to learn that in order to activate the Dragon Lounge Pass, a RMB3 had to be paid in order to prevent fraud, as if the fraudster can be deterred by the 3 RMB payment.

I hear that this ICBC is worse than BOC in terms of their banking and iBanking processes… 🙁

i don’t think the quantum of the charge is supposed to deter a fraudster, it’s just like why most apps charge a token $0.20 or so to your card when you add a new one. the idea is that this triggers an OTP, and reduces the chance that someone found your card on the street and is trying to use it. what’s unclear to me is why the 3 RMB amount isn’t refunded after verification.

My experience with ICBC Global Card

1. I received email in late october for unathorized transaction on early october (1 month late) and lucky that transaction cant go through, ask for new card after almost 1 month still not received (find out later they send to wrong address)

2. their internet banking only work on after u go down to the bank to register and only work on old internet explorer (not chrome, not edge) and later if u install some of their internet banking plugin, it will be recognized as malware

Just wondering for cards that you ask for the annual fee waiver, do you still get to enjoy the lounge benefit?

Yes, except for Amex krisflyer ascend. If they waive af on that card (which is rare), you don’t get lounge vouchers

Actually u r aBle to link the membership to the Dragon Pass app;

Just tried registering again today and got another 6 visits for 2020. Yay!

Anyone tried applying recently ?

The link doesn’t works when I click submit.