| An updated version of this post is now available. Read the 2020 version of the $120K credit card showdown here |

In July 2017, I wrote a post called The $120K Credit Card Showdown, which till today remains one of the most-read articles on The Milelion. In it, I weighed the pros and cons of six cards in the $120-150K income bracket: the Citi Prestige, OCBC VOYAGE, Maybank Visa Infinite, SCB Visa Infinite, HSBC Visa Infinite and AMEX Platinum Reserve.

It’s only been 18 months, but quite a lot has happened in the meantime. Benefits have been revised, new competitors have entered the market and I think it’s well worth revisiting the topic.

What is the $120K segment?

The Singapore credit card market is broadly segmented into three main tiers.

At the entry level, you have cards like the DBS Altitude, Citi PremierMiles Visa and UOB PRVI Miles. The income requirement here is $30K, the MAS-mandated minimum to hold a credit card. Expect nothing much in the way of benefits, other than perhaps a couple of Priority Pass lounge visits.

At the top end, you have cards like the DBS Insignia, Citi ULTIMA and AMEX Centurion. Membership is either by invitation, or requires income in excess of $500K a year. Annual fees are four digits, but include perks like beck-and-call concierge services and invitations to society events where people put Esq. on their name cards.

In between those two segments you have the mass-affluent tier, otherwise known as the $120K segment. Now despite the name, the income requirement for cards here actually ranges between $120-150K. These may not be as posh as the segment above, but still carry useful perks like unlimited lounge access and complimentary airport transfers.

In this post we’re going to benchmark the following offerings from the $120K tier:

|

|

*Why no AMEX Platinum Charge? Because its annual fee is easily 3X any of the cards in this segment, plus it requires a minimum income of $200K. In my mind it occupies a strange segment in between the $120K and $500K offerings.

Also note that I’m talking about the “base” versions of each of these cards. For example, the OCBC VOYAGE has three different versions- the “base”, the Priority Banking version and the Private Banking version. Each has different benefits.

Annual Fee and Welcome Gifts

The general rule is that cards in the $120K segment don’t provide annual fee waivers. There are exceptions of course- if you’re a Citi Gold Private Client, for example, you might get the Citi Prestige’s annual fee waived. But generally speaking, it isn’t like cards in the $30K segment where you call up the hotline, press a few buttons and get an instant fee waiver.

Annual fees in the $120K segment range between $488 and $650 a year, a significant step up from the $200 to $250 you’d pay for a $30K card. Fortunately, most of the cards soften the blow by offering miles in exchange for the annual fee.

[table id=14 /]

Do note the distinction between what you get in the first year versus second year:

- The Citi Prestige and OCBC VOYAGE offer the same number of miles each year

- The SCB Visa Infinite gives you 35,000 miles in the first year, but a much lower 20,000 miles in the second year (and only if you ask)

- That’s still better than the HSBC Visa Infinite, which does not give any miles from the second year onwards*

*Some cardholders report being able to get some miles with renewal, but that’s only after a whole lot of phone calls and negotiation. It’s safe to say this is a YMMV situation.

On a pure cents per mile basis, you’ll get the most bang from your buck as a first-year HSBC Visa Infinite cardholder with HSBC Premier status. Otherwise, the SCB Visa Infinite has the most compelling offer at 1.68 cpm (remember that you can get $100 of cash by signing up with SingSaver as a new-to-bank customer, which further reduces the cost to 1.40 cpm).

However, if you’re looking to acquire a large number of miles quickly, then you might want to consider the OCBC VOYAGE. This card allows you to buy a large quantity of miles at one go through the $3,210 annual fee option, albeit at a relatively unattractive 2.14 cpm.

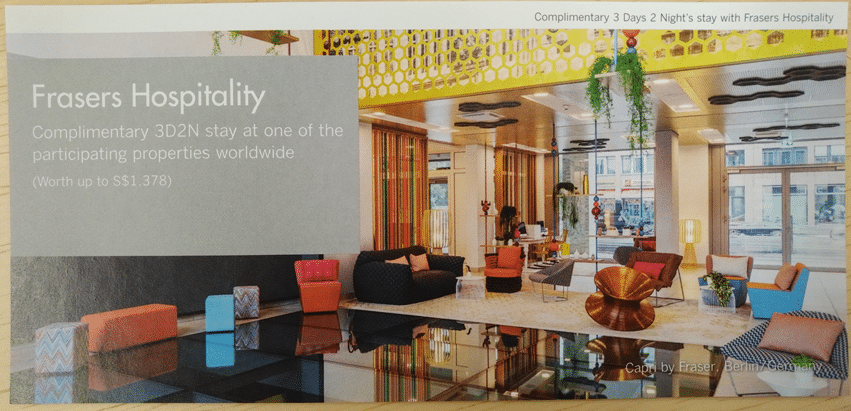

If miles don’t appeal to you (why are you here then?), the AMEX Platinum Reserve might appeal to you with its welcome gift of a free two night stay at selected Frasers Hospitality properties around the world.

The Maybank Visa Infinite is the exception in this group- there’s no welcome gift, but there’s no first year fee either. If you’re just in this for a free Priority Pass (see below), this might be the one for you.

| Winners (at least for the first year) |

Miles Earning Rates

[table id=18 /]

Welcome miles are one thing, but how do these cards perform on a day-to-day basis?

Assuming you spend more than $2K each month, the SCB Visa Infinite is undoubtedly the best of the lot with 1.4/3.0 mpd on local/overseas spending (do note, however, that SCB’s foreign currency transaction fee of 3.5% is the highest in the market).

Which card takes second place depends on what your overall local/overseas spending ratio is. If you spend more locally, than the Citi Prestige wins at 1.3/2.0 mpd on local/overseas spending. If you spend more overseas, then the OCBC VOYAGE wins with its 1.2/2.4 mpd local/overseas spending rate.

| Technically, the OCBC VOYAGE earns VOYAGE miles. These can be converted into KrisFlyer miles at a 1:1 ratio with no admin fee, or redeemed against the cost of revenue flights. This makes 1 VOYAGE Mile worth more than 1 KrisFlyer mile. We won’t go into the analysis here, but you should check out this article if you’re interested in learning more |

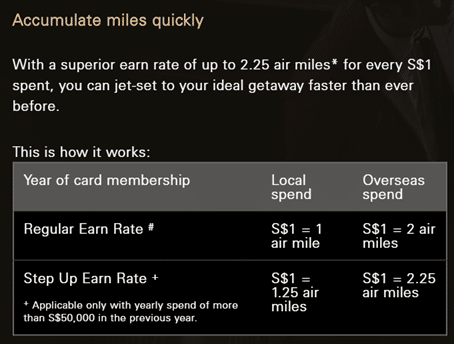

I’m not a fan of the HSBC Visa Infinite because it offers an anemic 1/2 mpd on local/overseas spending in the first year. You’d need to spend $50K in a year to unlock the “enhanced” tier of 1.25/2.25 mpd in the following year, and even that’s not impressive given that cards in the $30K segment (UOB PRVI, BOC Elite Miles) can offer better.

The AMEX Platinum Reserve is at the bottom of the pack with a ~0.69 mpd rate on both local and overseas spending. You only earn a points bonus at Platinum EXTRA merchants, mainly a collection of high-end places where you won’t be shopping every day. That said, AMEX has the most generous points policy of all the banks in Singapore- they’ll award points even on things like insurance payments, government and utilities bills and donations. This makes it a “card of last resort” when you suspect a payment might be ineligible for points with another bank.

| Winners |

Lounge Access

If it’s lounge access you’re looking for, the good news is that the majority of cards in the $120K segment offer unlimited visits.

[table id=12 /]

When evaluating lounge benefits, be sure to check out who the provider is. The Citi Prestige, HSBC Visa Infinite and Maybank Visa Infinite partner with Priority Pass which has more than 1,200 locations worldwide. This ensures that wherever you’re almost certain to find a lounge, wherever you’re headed.

On the other hand, OCBC VOYAGE cardholders only get access to the much smaller Plaza Premium lounge network (~70 lounges worldwide). Plaza Premium lounges are generally of higher quality than your average contract lounge, but almost all of them are accessible through Priority Pass anyway.

It’s also important to think about the guest benefits each card provides for principle and supplementary cardholders:

| Card | Principal Cardholder | Supplementary Cardholder |

| Citi Prestige | Unlimited visit Priority Pass (+1 guest) | None |

| HSBC Visa Infinite | Unlimited visit Priority Pass | Same as principal |

| Maybank Visa Infinite | Unlimited visit Priority Pass | None |

| OCBC VOYAGE | Unlimited visits to Plaza Premium lounges (+1 guest) | Same as principal |

| SCB Visa Infinite | 6 Priority Pass visits | None |

| UOB Visa Infinite Metal Card | 4 Dragon Pass visits | None |

| AMEX Platinum Reserve | None | None |

OCBC VOYAGE is the most generous in terms of guest access, allowing both the princpal and supplementary cardholders to bring one guest each (but keep in mind the smaller lounge network).

Citi Prestige allows you to guest whoever you happen to be traveling with into the lounge, but your supplementary cardholder does not get any lounge pass of his/her own.

HSBC Visa Infinite does not come with guesting benefits, but supplementary cardholders get an unlimited visit Priority Pass of their own.

| Winners |

Airport Limo

[table id=16 /]

Back when I wrote the original $120K cards piece in 2017, the Citi Prestige undoubtedly had the best limo benefit. By spending $1.5K in foreign currency within a quarter, you’d unlock four rides to or from the airport.

That was extremely generous, but unfortunately Citi’s gone and nuked it into oblivion. From 1 April 2019, you need to spend $20K (not a typo) in a quarter to unlock two rides. It’s so insane that for all intents and purposes, the Citi Prestige does not in my opinion offer a limo benefit anymore.

Of the remaining options, the HSBC Visa Infinite probably has the most generous limo policy: just by paying the annual fee, you get two complimentary airport transfers a year- no spending required (HSBC Premier members get four). You subsequently unlock an additional ride with just $2K spending.

The OCBC VOYAGE edges the Maybank Visa Infinite for me because it allows you to unlock a limo ride for $1.5K of FCY spend (versus $3K for the Maybank), plus you get up to 24 free rides per year (versus 8 for the Maybank).

| Winners |

Other Travel Perks

In addition to the usual lounge and airport limo perks, certain $120K cards offer unique travel perks.

Fourth night free- Citi Prestige

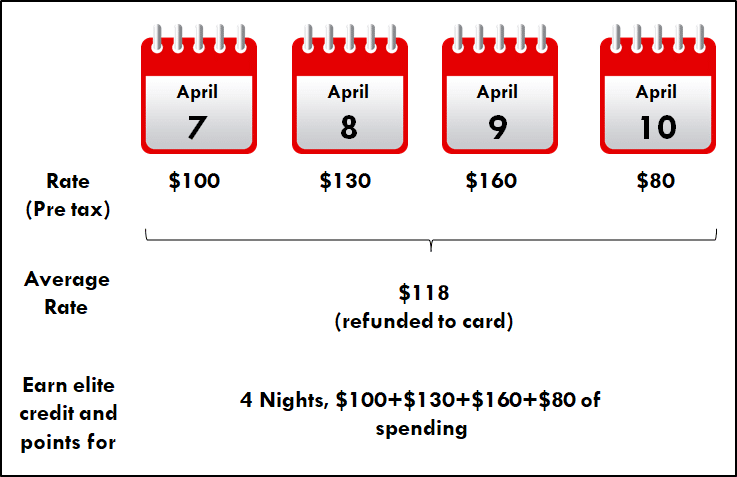

Citi Prestige cardholders get the fourth night free on any hotel booking made through the Citi concierge.

It shouldn’t cost you anything extra to book hotel rooms through the Citi concierge, given that they’re able to book any publicly available rate. Even better, bookings made through the Citi concierge are still eligible to earn hotel elite status credit and points, as if you were booking through the official site.

How the fourth night free benefit works is the average nightly pre-tax room rate for your four night stay is calculated and refunded to your card. This refund is on the back end, so you’ll still earn hotel points and elite credit for four night’s worth of spending.

It’s worth noting that Citi has started to tighten the fourth night free benefit in the US (where it’s now capped at two uses per year). Although this hasn’t yet extended to Singapore, it’s a nonetheless concerning development.

Priority Immigration- HSBC Visa Infinite

HSBC Visa Infinite cardholders who spend $2K in a month unlock complimentary fast-track immigration service at selected airports for themselves and a guest. Just like the limo benefit, two complimentary redemptions are provided each year with no minimum spend (four for HSBC Premier customers).

Depending on the airport, the fast-track immigration may also include meet and assist services, which escort you to/from the airplane.

JetQuay access- Citi Prestige & Maybank Visa Infinite

JetQuay is a private terminal at Changi for CIPs. You get dropped off at a private driveway, your check-in is handled by the terminal staff while you relax in the lounge and the only time you mingle with the unwashed masses is en route to your flight in a buggy. The full-fledged JetQuay Quayside experience normally costs ~$400, but if you have either the Citi Prestige or Maybank Visa Infinite, it can be yours for free.

| Check out my review of the JetQuay experience here |

Spending $3K in a month with the Maybank Visa Infinite unlocks your choice of two limo rides or a single JetQuay use.

The Citi Prestige doesn’t actually require you to spend anything to use JetQuay- so long as you’re within the first 100 World/World Elite Mastercard holders per month to make a booking, you’ll get in for free. You’re limited to a maximum of two complimentary JetQuay Quayside services per calendar year, regardless of how many World/World Elite Mastercards you hold.

Redeem miles for any flight- OCBC VOYAGE

The unique feature of OCBC VOYAGE is that VOYAGE miles can be used to redeem any flight in any cabin on any airline, provided you have enough of them. When used this way, your VOYAGE miles are used to offset the revenue cost of the flight. The value of a VOYAGE miles depends on which zone you’re flying to. I’ve written some extensive analysis on the topic here so I won’t get into it again, suffice to say it’s a useful feature to have.

Dining Perks

UOB Visa Infinite Metal cardholders get a complimentary Gourmet Collection dining membership. This sounds exciting initially, because UOB markets the benefit as “worth S$388 per annum”. This leads you to believe they’re offering the “$388 Tier 1” Gourmet Collection membership, which comes with:

However, card members have confirmed that you don’t get any of these vouchers- just the card, which offers 25% off the bill (excluding service charge) at participating restaurants and bars, and 15% off rooms.

That’s disappointing, but at least you get up to 50% off dining at the Grand Hyatt Singapore and access to 1 for 1 offers from UOB Gourmet Stories, featuring restaurants like Forlino, Man Fu Yuan, Alma and House of Mu.

Citi Prestige cardholders get periodic mailers about 1 for 1 gourmet dining experiences, held at high-end restaurants like Pollen and Dolce Vita. These typically cost ~$160-200++ per pair including wine pairing. Discounted sessions without wine are also offered at ~$110-130++. If these were places you were intending on dining at anyway, then the 1 for 1 offers can represent good value.

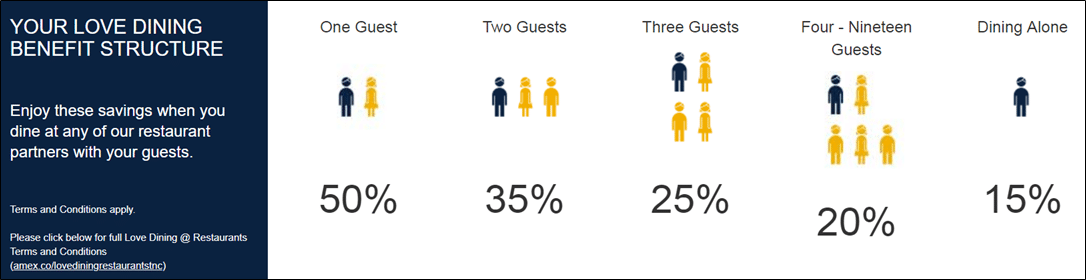

AMEX Platinum Reserve cardholders get access to the AMEX Love Dining program, which offers up to 50% off at selected high-end restaurants and hotels. Love Dining Hotels include the Conrad Centennial, the St Regis, the W, Marriot Tangs Plaza, the Fairmont and both Swissotels. That means you could dine with a partner at places like Skirt, Golden Peony, Skai, Prego and LaBrezza and get 50% off. Cardholders also receive a series of dining vouchers for the Marriott Tangs Plaza and the Tower Club in their welcome pack.

AMEX Platinum members can also take advantage of the Chillax Program, which gives either a complimentary or one-for-one drink at selected bars.

| Winners |

Club Access

Only the AMEX Platinum Reserve and the UOB Visa Infinite Metal card offer private club access.

The UOB Visa Infinite Metal card allows cardholders to access the dining facilities at the Tower Club and China Club. They also get complimentary parking. Do note that the T&C on the UOB page indicates this benefit is available until 31 Mar 2019, and I’m not sure if it’s been extended.

The AMEX Platinum Reserve grants access to the Tower Club’s dining and conference facilities, excluding the fitness centre.

Both AMEX Platinum Reserve and UOB Visa Infinite Metal cardholders need to pay a 10% surcharge on F&B expenditure at the Tower Club as reciprocal members.

| Winners |

Summing it up

The last time I reviewed the $120K cards, I declared the SCB Visa Infinite and Citi Prestige to be the winner. What’s changed since then?

The SCB Visa Infinite’s value proposition has remained largely the same, but I see it more as a utilitarian card than something with genuinely great benefits. I’d get it if I wanted the 1.4/3.0 mpd earning rate, plus the chance to pick up miles for cheap through the annual fee.

The main change to the Citi Prestige has been the (virtual) removal of the limo benefit. It’s a shame because the card is still pretty competitive with its miles earning rate, unlimited lounge access and fourth night free benefit (assuming it doesn’t get capped like it has in the US).

I’ve started to take a fancy to the OCBC VOYAGE now that I understand VOYAGE miles better. The limo benefit has been genuinely enhanced, it’s boosted the overseas earn rate and I understand from the VOYAGE Telegram Group that members are getting occasional mailers about complimentary Business to First Class upgrades on Etihad. What I don’t get is why OCBC doesn’t make the switch to the much larger Priority Pass network- the Plaza Premium lounges are nice and all, but most if not all of them are already available through Priority Pass.

The HSBC Visa Infinite might work for HSBC Premier banking members who can get a reduced annual fee, but I just don’t understand why they’re so stingy with the miles earning rates. 1/2 mpd in the first year just isn’t good enough, and you’d need to spend a whole $50K just to unlock (still uncompetitive) 1.25/2.25 mpd rates. Add to the fact that renewal miles are not offered, and I tend to want to pass on this.

The Maybank Visa Infinite might be an option for those who want the benefits of a $120K segment card without the fees- at least for the first year.

I’d avoid the UOB Visa Infinite Metal Card because I feel the annual fee they’re asking for is simply excessive given the benefits on offer (all style, all substance? Hardly). Similarly, I don’t feel that strongly about the AMEX Platinum Reserve because you could enjoy the same dining benefits with the cheaper AMEX Platinum Credit Card.

So to summarize, my picks:

Hi, what about UOB Ladies Solitaire Metal Card?

HSBC Visa Infinite’s limo benefit is per CALENDAR year and most peoples’ membership year won’t match the calendar year exactly.

Say your card was approved in April 2019 – you get 2 limo rides free from when your card was approved until December 2019, then ANOTHER 2 free limo rides from January to March 2020 (after which you have completed your membership year and presumably would terminate your card anyway, since normally there’s no renewal miles from second membership year).

The 2 free limo rides double to 4 per calendar year if you’re a HSBC Premier member.

Just to add, if you make 120k pa, it’s quite easy to gain OCBC premier banking status thereby qualifying one for the premier voyage. And that’s 1.6 mpd on all sgd general spend.

Hi, is the requirement very stringent for ocbc premier banking ?

Criteria for OCBC premier banking is to have 200k in deposits/investments with them.

If you’re not after the joining bonus, willing to open a 360 account and credit your salary in, could try talking to the RM? Disclaimer: I don’t work in the banking industry. Just sharing a relatively accessible 1.6 mpd card.

Actually i got free waiver for OCBC voyage with premier banking for the first year. AND it is waiveable next year if spending more than 30k….

A Circular on Citi Prestige’s New Look: “A fresh new look with same great benefits We would like to inform you, that with effect from 15 April 2019, the Citi Prestige Card will sport a new look, aligned to a unified card design for Citi cards available worldwide. The new card designs reflect the bank’s modernity and bring a common brand identifier globally. Featuring the iconic Citi arc front and centre, the semi-translucent focal point is a symbol of Citi’s optimism, while the Citibank crest that nestles just below represents a nod to our 200 years of history, financial stability… Read more »

Yes…but sadly most cardholders will only get their metal card much later on!

Pro tip. Just call and say you have chip or magnetic stripe problems when using your card… and they should send you a replacement card in the new design.

Wowza! What a great tip to defraud Citibank.

Whyyyyyy? If you are a Citi Prestige card holder, you will get new card sooner or later unless you just got your card recently >_<

Actually, I think our ‘current’ design is better/ nicer than the ‘global’ one… and our current one in metal, would look better than what’s coming.. but that maybe just me.. or.. I may change my mind when it actual arrives.. but for now, I think ours is the nicer design.. Looks and feels aside, to me, the Citi Prestige Mastercard, even before the new free limo criteria, had already become the best credit card that you may never charge a cent on.. and I really haven’t in some time.. and that’s really what it’s been for me personally.. even the… Read more »

It will be really useful to see which card offers free limo rides for supp cardholders.

Citi Prestige used to allow it and I used to keep my free limo rides for my parents and my wife to use, while I use another card’s limo rides which only cater to main cardholder.

I am not sure Citi Prestige still allows for this after the revamp. Anyway 20k for 2 rides is useless now.

Thanks for the article. Appreciate it. Just share what I think about this. I don’t see real benefit of having these card other than the welcome bonus for people like me. I spend around $2500 per months. I use your guide “Which card to use” to get more miles (3 or 4 mpd) than these 120k card. “https://milelion.com/credit-cards/guide/”. My personal experience with SCB VI is that I have been struggle to mix between the basic card to get the maximum miles while maintain the 2k requirement of SCB VI. I have give up a lots of 3/4 miles opportunities in… Read more »

Does PayAll count for the 20K minumjm spend of Citi Prestige?

Thanks for the great article Aaron! The 2017 version of the showdown was the door opener for me to get in touch with Milelion. Time flies!

Thanks Hector! Had been meaning to update it for a while. Maybe the 2020 edition will bring more dramatic changes

got me interested in the VOYAGE card but Plaza Premium lounge selections are just…. sad….

OCBC Voyage Premier now offers 1.6mpd and access to Tower Club.

Do you have a link that says so? I can’t find any reference to OCBC voyage having access to tower club.

9. Tower Club Singapore (“Club”) Access Terms and Conditions (Applicable only for OCBC Premier Private Client VOYAGE Credit Cardmembers and Bank of Singapore VOYAGE Cardmembers only)

Applied the SC VI since there’s a promo now just for the welcome miles.

Voyage seems interesting… but need to track another mile type… lol

Hi Chris, aside from the standard 35000 miles offer, is there any other promo ongoing?

Hi Aaron! This is really helpful, thanks for the great post.

I was wondering if you are preparing for an updated version for 2020?

Looking forward to the new stuff!