In the surest sign that we will all one day be drinking Grab cola while talking on a Grab mobile plan en route to our Grab psychiatrist (who will be calibrating our Grab neuro-implant), Grab has added yet another service onto its platform: travel insurance.

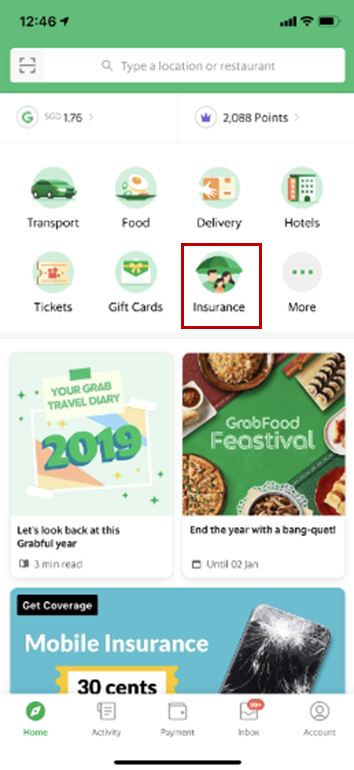

The insurance policy, also known as Travel Cover, is underwritten by Chubb. You can find it on the home screen of your Grab app, under “insurance”

How much does it cost?

The regular price for Travel Cover is listed below:

| Region | Price per day |

|---|---|

| ASEAN | S$2.50 |

| APAC | S$3.25 |

| Worldwide excluding USA, Canada, Cuba | S$4.40 |

| Worldwide excluding Cuba | S$4.90 |

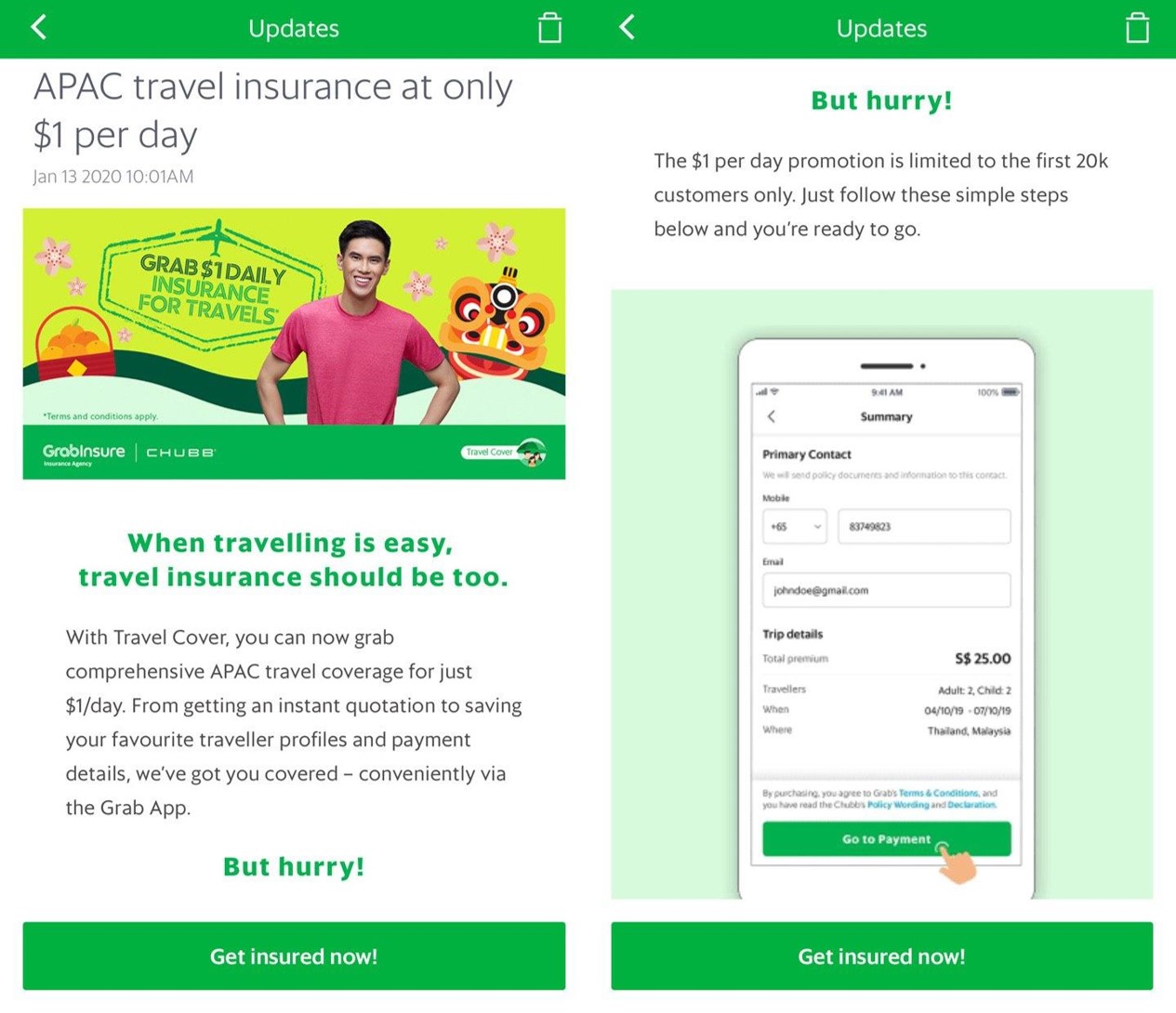

To mark the launch, the first 20,000 customers can purchase Travel Cover at S$1/day until 29 Feb 2020, for trips within the Asia Pacific region. Asia Pacific is defined as Australia, China, Hong Kong, India, Japan, Macao, Mongolia, New Zealand, South Korea, Sri Lanka, Taiwan and Timor-Leste. Curiously, ASEAN countries are excluded from this promotion.

What does it cover?

Here’s the policy limits on Travel Cover.

| Benefit | Coverage | Sum Insured |

|---|---|---|

| 1. | Personal Accident | Up to S$200,000 |

| 2. | Overseas Medical Expenses – Maximum S$750.00 for Traditional Chinese Medicine Expenses |

Up to S$150,000 |

| 3. | Medical Evacuation and Repatriation | Unlimited |

| 4. | Repatriation of Mortal Remains | Unlimited |

| 5. | Overseas Hospital Visit | Up to S$4,000 |

| 6. | Overseas Compassionate Visit | Up to S$5,000 |

| 7. | Loss of or Damage to Personal Property and Baggage – Maximum S$150 per Article or set of Article – Maximum S$300 for Money – Maximum S$1,000 for Laptop |

Up to S$3,000 |

| 8. | Baggage Delay – S$200 per 6 consecutive hours |

Up to S$400 |

| 9. | Travel Delay – S$200 per 6 consecutive hours |

Up to S$400 |

| 10. | Journey Cancellation | Up to S$1,000 |

| 11. | Journey Curtailment | Up to S$1,000 |

| 12. | Credit Card Indemnity | Up to S$5,000 |

| 13. | Personal Liability | Up to S$500,000 |

| 14. | Child Education Grant | S$2,500 |

| 15. | Home Guard | S$5,000 |

| 16. | 24-Hour Travel Assistance | Included |

| 17. | 24-Hour Medical Assistance | Included |

| 18. | Terrorism Extension | Included |

The areas of coverage are pretty standard as far as travel insurance goes, but the absolute coverage amounts are lower, perhaps on account of the policy’s price.

Only S$200K is covered for accidental death and disablement, compared to S$1M which is quite standard even on the complimentary travel insurance policies that come with credit cards (so tell your next-of-kin which policy to claim on, in case something happens to you).

Medical expense coverage is S$150K, lower than the S$250K+ you usually see on entry-level policies for other providers. On the plus side, extreme sports are covered without needing to purchase an additional rider.

I don’t see any coverage for rental car excess, which may be an issue if you’re planning to drive while overseas. Likewise, it’s not explicitly mentioned whether miles and points are covered; we know that other Chubb insurance policies do, but I’m checking whether similar coverage applies on this one.

| Update: A Chubb spokesperson provided the following quote: “In the event of trip cancellation, if the customer experienced a loss of frequent flyer miles/points, he/she can submit a claim based on the retail value of these points, up to the cancellation benefit limit of $1,000. The customer will be required to provide supporting documentation on the retail value of the frequent flyer miles/points.” |

Think of Travel Cover as basic coverage. It’s good enough should the odd travel disruption happen, but if you want complete peace of mind, consider getting something more comprehensive.

A way to earn 4 mpd on insurance…for now

Most credit cards don’t earn points or cashback on insurance payments. To my knowledge, only the BOC Elite Miles World Mastercard, HSBC Revolution (for online payments) and American Express cards do.

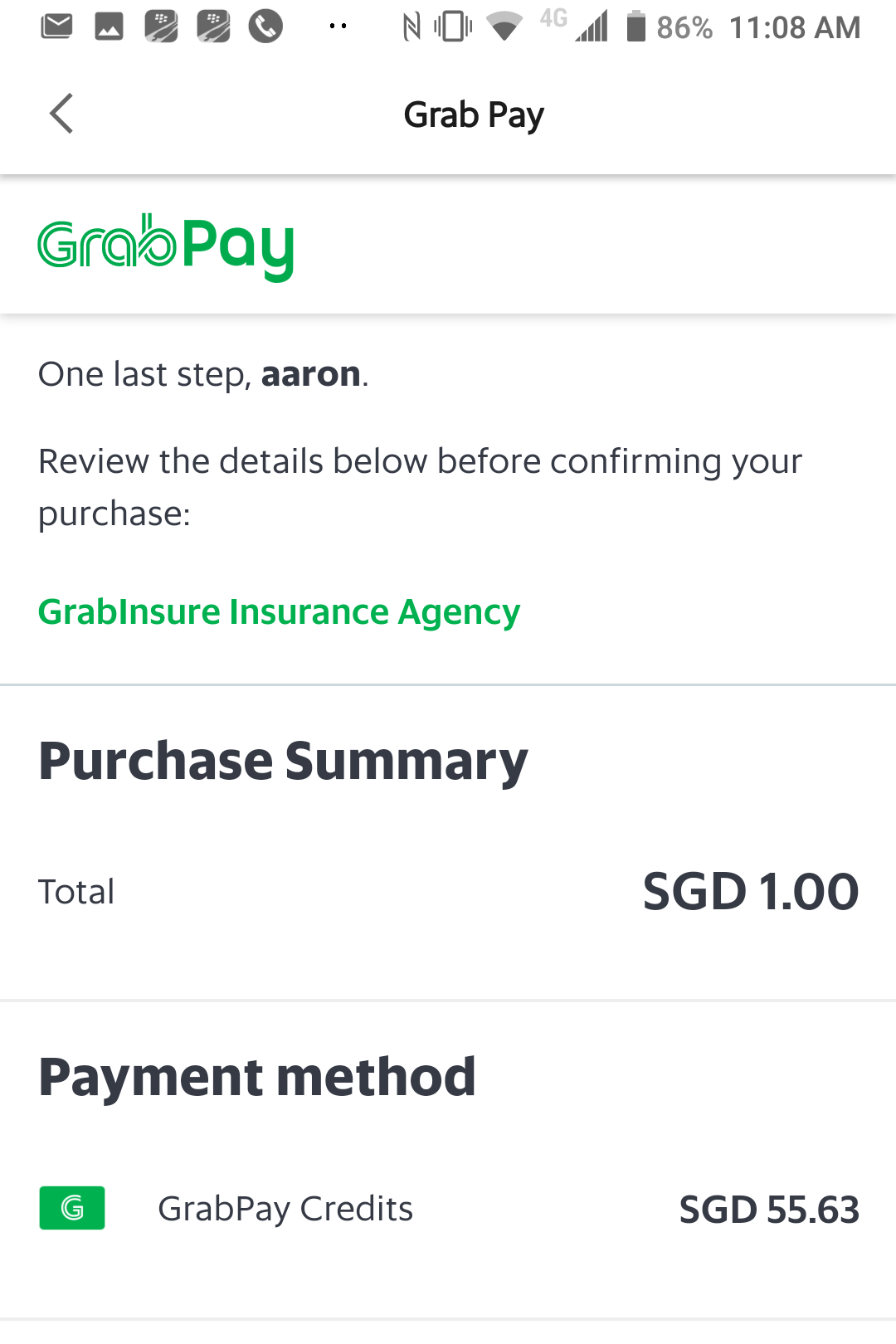

In that sense, this presents an opportunity to earn 4 mpd on travel insurance, albeit indirectly. Insurance purchases can be paid with GrabPay credits, so it’s simply a matter of identifying a card which still earns 10X on GrabPay topups.

Truth be told though, you could earn 4 mpd on any insurance policy simply by buying it with your GrabPay Mastercard. As I mentioned before, how long this continues depends on how long banks are willing to extend rewards to top-ups, so make hay while you can.

Conclusion

S$1/day travel insurance is hard to argue with, if you’re looking for basic coverage. It’s also a way to earn a few additional miles on travel insurance purchases, provided you use the right card for GrabPay top-ups.

Signing up for credit cards or making purchases through any of the links in this article may generate a referral commission that supports the running of the site. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter (on the right of your screen) for the latest deals and hacks delivered to your inbox.

It seems that Citibank reward mastercard no longer give any miles for grab top up. Verified with the cso after topping up grab pay without saving the card when the points was not credited.

woo~~~!!!

Mastercard changed the MCC for Grabpay. Amex too.

Thanks for the info, @EricTan.. What a bummer.. back to back bad news with first losing $3k a month with UOB Lady’s Solitaire and now $1k a month with Citi RMC.. ☹️

Crmc only $500 loss. If you have been topping up 1k per month, I feel for you

Kindly note, $1 per day promo only for one time use. Subsequently raised to $1.75 per day.

I managed to get it for Thailand.

How? have a trip around CNY.

got it. Though Thailand is not listed as one of countries in AP, it can be quoted the same $1 price.

On the part insurance premium counts for certain cards, does this include making insurance premium via cardup?

Let’s see if Grab starts pushing travel insurance to people taking trips to the airport.

Also doesn’t cover medical incurred back in Singapore which usual travel insurance has

Isn’t HSBC Revolution just 2mpd?

Underwhelming crappy product.

Can’t believe they took more than 1.5 years to launch this

Only good for random quick trips to JB