OCBC finally launched a mass market miles card in August 2019, and it’s safe to say that the OCBC 90N (I’ve given up typing the °) has given miles chasers much joy in the time since.

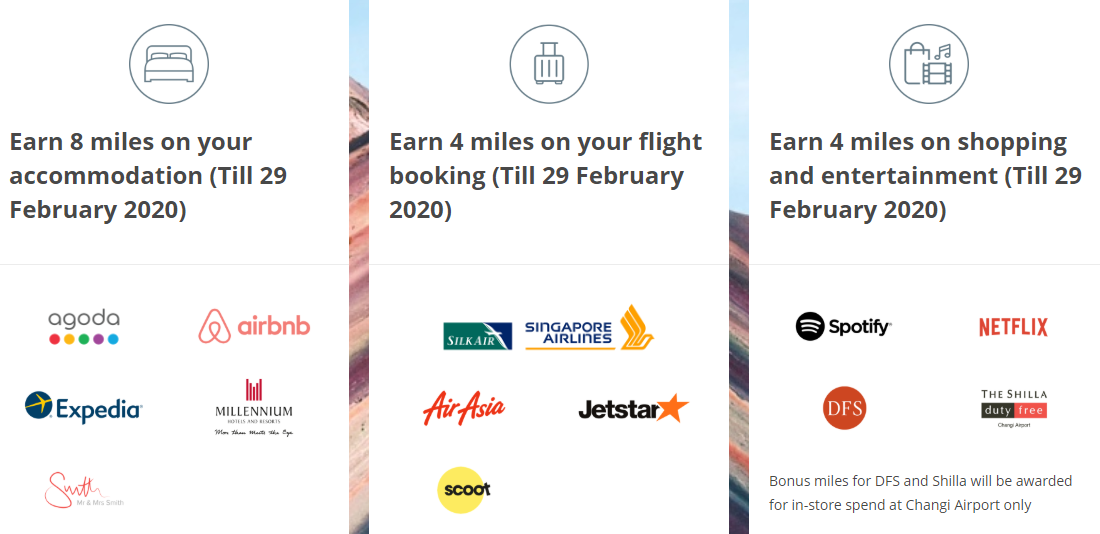

Cardholders could earn an uncapped 4 mpd on all foreign currency (FCY) spending, plus:

| Airlines | Duty Free & Subscriptions |

|

|

In addition to that, they’d also earn an uncapped 8 mpd on the following OTA and hotel bookings:

- Agoda, via www.agoda.com/ocbc90n

- Airbnb

- Expedia, via www.expedia.com.sg/ocbc90n

- Millennium Hotels & Resorts

- Mr. & Mrs. Smith

These bonuses are ending on 29 Feb 2020

Unfortunately, these bonuses don’t last forever. 29 Feb 2020 marks the last day to enjoy them, and from 1 March 2020, OCBC 90N’s earn rate reverts to a flat 1.2 mpd on local spending and 2.1 mpd on FCY spending.

This means you’ll want to revisit your miles optimization strategy, swapping in other cards with higher earning rates.

FCY Spending

Finding a replacement card for FCY spending will be a high priority on many people’s lists. Fortunately, there are still a few ongoing FCY promos that continue into March.

| Offer Description | Ends | |

SCB X Card SCB X Card |

3 mpd |

30 June 2020 Read More |

| Min S$2K spend/month | ||

| No cap | ||

| No reg required | ||

DBS Altitude (all versions) DBS Altitude (all versions) |

4 mpd | 31 March 2020 Read More |

| Min S$2K FCY spend | ||

| Capped at S$7K FCY | ||

| Reg Required | ||

AMEX Platinum Charge AMEX Platinum Charge |

4.53 mpd | 31 March 2020 Read More |

| No min spend | ||

| Capped at S$1K FCY | ||

| Reg Required | ||

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

3.2 mpd | 31 March 2020 Read More |

| No min spend | ||

| Capped at S$500 FCY | ||

| Reg Required | ||

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

3.1 mpd | 31 March 2020 Read More |

| No min spend | ||

| Capped at S$500 FCY | ||

| Reg Required |

If you’ve missed the boat on registration, or don’t own any of the cards above, here’s the best of the rest.

| Do note that UOB will increase its FCY fee from 3.1 to 3.25% from 9 March; I’ve reflected the post 9 March rate in the table below. |

| Best Cards for FCY Spending from March 2020 |

|||

| Earn Rate | FCY Fee | Cost Per Mile | |

UOB Visa Signature UOB Visa Signature |

4.01 | 3.25% |

0.81 |

BOC Elite Miles BOC Elite Miles |

3.0 | 3.0% | 1.0 |

SCB Visa Infinite SCB Visa Infinite |

3.02 | 3.5% | 1.17 |

HSBC Visa Infinite HSBC Visa Infinite |

2.253 | 2.8% | 1.24 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

2.0 (Jun & Dec) | 2.95% | 1.48 |

AMEX KrisFlyer Blue AMEX KrisFlyer Blue |

2.0 (Jun & Dec) | 2.95% | 1.48 |

DBS Treasures AMEX DBS Treasures AMEX |

2.4 | 3.25% | 1.35 |

UOB PRVI Miles (all versions) UOB PRVI Miles (all versions) |

2.4 | 3.25% | 1.35 |

OCBC VOYAGE OCBC VOYAGE |

2.3 | 3.25% | 1.41 |

OCBC 90°N Card OCBC 90°N Card |

2.1 | 3.25% | 1.55 |

DBS Altitude (all versions) DBS Altitude (all versions) |

2.0 | 3.25% | 1.63 |

Citi PremierMiles Visa Citi PremierMiles Visa |

2.0 | 3.25% | 1.63 |

Citi Prestige Citi Prestige |

2.0 | 3.25% | 1.63 |

| 1. Min S$1K Max S$2K FCY spend in a statement month 2. Min S$2K spend in a statement month 3. Min S$50K spend in the previous membership year |

|||

Once I’ve exhausted the bonus cap on my AMEX Platinum Charge, I’m going to toggle between the UOB Visa Signature (in periods where I know I’ll definitely be spending more than S$1,000) and BOC Elite Miles (when I’m feeling masochistic)

Do remember that if your spending is made online and in FCY, you can just as well use other cards like the DBS Woman’s World Card or Citi Rewards Visa for 4 mpd, subject to the usual conditions and caps.

Air Tickets

Although I’ll miss the OCBC 90N’s no-cap 4 mpd on Singapore Airlines, SilkAir, Scoot, AirAsia, and Jetstar tickets, the good news is there are alternatives.

If you’re flying with the following airlines, consider booking through Expedia with the DBS Altitude or UOB PRVI Miles card for 6 mpd.

| Participating Airlines for Expedia Promo | |

| •Air Macau • Air Mauritius • Air Niugini • Cambodia Angkor Air • China Eastern • China Southern • Finnair • Garuda • Hawaiian Air • Korean Air |

• Lao Airlines • Myanmar International • Qatar Airways • Saudia • Shenzhen Airlines • Sichuan Airlines • THAI • Turkish Airlines • Xiamen Airlines |

- DBS Altitude cardholders earn 6 mpd when booking through this link, capped at S$5,000 per month, until 31 Mar 20

- UOB PRVI Miles cardholders earn 6 mpd when booking through this link, until 30 Apr 20

UOB PRVI Miles cardholders can also enjoy 6 mpd on bookings with the following airlines through UOB Travel, until 31 Dec 20.

| Participating Airlines for UOB Travel Promo |

||

| •Air China •Air France •Air New Zealand •ANA •American Airlines •Asiana • British Airways • Cathay •China Airlines • China Eastern |

•China Southern •Emirates •Etihad •EVA •Finnair •Garuda •JAL • KLM • Korean Air • LOT Polish |

• Lufthansa • Malaysian Airlines • Philippine Airlines • Qantas • Qatar • Royal Brunei • SWISS • THAI • Turkish Airlines • United |

Otherwise, you can use the cards below to maximize the miles earned on air ticket purchases:

| Best Cards for Air Tickets from March 2020 |

||

| Earn Rate | Remarks | |

DBS Woman’s World Card DBS Woman’s World Card |

4.0 | Capped at S$2K per month |

UOB Lady’s Card & Lady’s Solitaire Card UOB Lady’s Card & Lady’s Solitaire Card |

4.0 | Capped at S$1K/ S$3K for the Lady’s/ Lady’s Solitaire Card. Travel must be chosen as your bonus category |

DBS Altitude (all versions) DBS Altitude (all versions) |

3.0 | Capped at S$5K per month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3.0 | For Scoot, SilkAir, Singapore Airlines |

| 2.0 | For SilkAir and Singapore Airlines | |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.0 | Min S$300 card spending in a month |

For the table above, I’ve assumed the air tickets are charged in SGD. If they’re in FCY, you can refer to the table from the previous section.

Although air tickets are online purchases, you cannot use the Citi Rewards card for 4 mpd as the T&Cs explicitly exclude travel transactions.

Hotels, Airbnb & OTAs

Here’s the current ongoing promotions for OTA bookings.

|

|

10 mpd on Kaligo, 7 mpd on Agoda |

| 10 mpd on Kaligo, 6 mpd on Expedia (until 31 Mar 20), capped at S$5K per month. Only works if your reservation is fully prepaid online | |

| 6 mpd on Agoda, 6 mpd on Expedia (until 30 Apr 20), 6 mpd on UOB Travel | |

| All promos valid till 31 Dec 2020 unless otherwise stated | |

Otherwise, use the following cards:

| Best Cards for Hotels & OTAs from March 2020 |

||

| Earn Rate | Remarks | |

DBS Woman’s World Card DBS Woman’s World Card |

4.0 | Capped at S$2K per month, reservation must be fully paid online |

|

|

4.0 | Capped at S$1K/ S$3K for the Lady’s/ Lady’s Solitaire Card. Travel must be chosen as your bonus category. Hotel need not be paid online |

DBS Altitude (all versions) DBS Altitude (all versions) |

3.0 | Capped at S$5K per month, reservation must be fully paid online |

For the table above, I’ve assumed the hotel costs are charged in SGD. If they’re in FCY, you can refer to the table from the previous section.

Spotify/Netflix

| Best Cards for Spotify/Netflix from March 2020 |

||

| Earn Rate | Remarks | |

DBS Woman’s World Card DBS Woman’s World Card |

4.0 | Capped at S$2K per month |

Citi Rewards Visa Citi Rewards Visa |

4.0 | Capped at S$1K per statement month |

This one’s pretty straightforward- think of it like any other online transaction, and use an online spending card. If you’ve added your OCBC 90N to your recurring billing arrangement for these platforms, be sure to switch it out come March.

Duty Free Shopping

| Best Cards for Duty Free Shopping from March 2020 |

||

| Earn Rate | Remarks | |

OCBC Titanium Rewards OCBC Titanium Rewards |

4.0 | Capped at S$12K per membership year |

Citi Rewards Visa Citi Rewards Visa |

4.0 | Capped at S$1K per statement month |

Be careful with duty free purchases, as DFS purchases generally get 4 mpd, but purchases of cosmetics & perfumes under The Shilla do not. FYI: DFS is set to close its stores in Changi by June 2020, to be replaced by Lotte.

The UOB Lady’s Card is another potential candidate, but there’s some confusion here. Although the website says that duty-free stores fall into the Travel category…

…the T&C make no such mention of this. Use this card at your own risk then.

Keeping the OCBC 90N as a general spending card

Although the OCBC 90N loses many of its superpowers on 29 Feb 2020, it doesn’t become completely useless. As a general spending card, it still performs favorably to other mass market options:

| Local MPD | FCY MPD | |

BOC Elite Miles BOC Elite Miles |

1.5 | 3.0 |

UOB PRVI Miles (all versions) UOB PRVI Miles (all versions) |

1.4 | 2.4 |

OCBC 90N OCBC 90N |

1.2 | 2.1 |

DBS Altitude (all versions) DBS Altitude (all versions) |

1.2 | 2.0 |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 2.0 |

It also has a few qualitative advantages over the competition; namely:

- Travel$ don’t expire (UNI$ and BOC points do)

- Minimum transfer block of just 1,000 miles

- No conversion fees

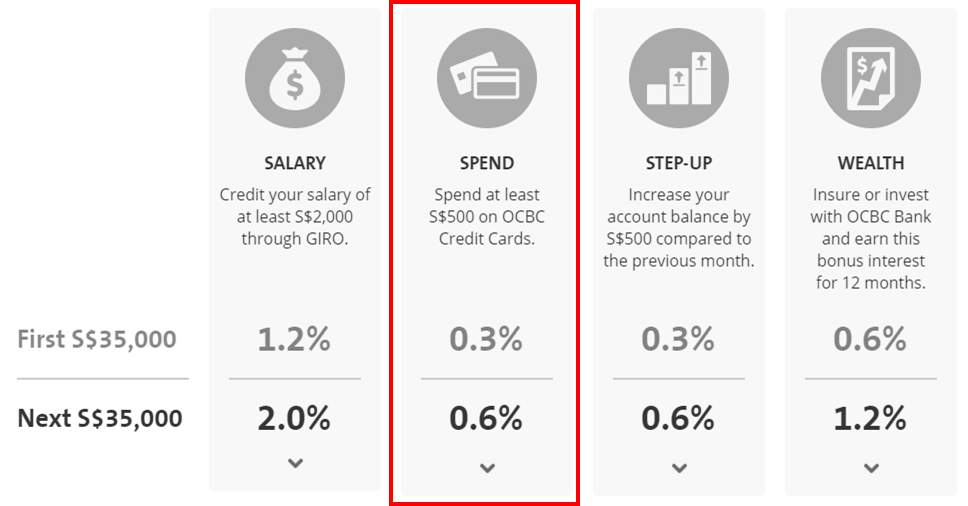

Moreover, for those using the OCBC 360 account, spending on the 90N will count towards the S$500 card spend required to earn 0.3% (first S$35K)/ 0.6% (next S$35K) bonus interest.

Conclusion

There will be more than a few tears shed at midnight on 1 March 2020 I’m sure, but yada yada something beautiful not because lasts but because happened yada yada.

I’m sure there’ll be more miles promos to come in the near future, because spending on travel and dining out must be way down on account of Covid-19. Until then, be sure to adjust your strategy accordingly.

This is certainly an excellent travel + FCY card. Thanks to your write up on this card, I have chalked up almost 100K miles on it. Would’ve been more if it weren’t for Covid-19 which led to a freeze on business travel.