Citibank is offering Citi Prestige cardholders a chance to pick up miles at a very low price, provided they have some serious bill payments to make.

From 24 Feb to 31 Mar 2020, Citi Prestige cardholders can earn up to 27,500 bonus Thank You points (11,000 miles) when using the Citi PayAll facility. The usual fee of 2% applies, but some customers are occasionally targeted for lower rates.

As a reminder, Citi PayAll can currently be used to pay the following bills:

- Rent

- Education expenses

- Taxes

- Condo management fees

- Electricity bills

The full T&C of this promotion can be found here. There are two tiers to this promotion, and enrollment is not required for either.

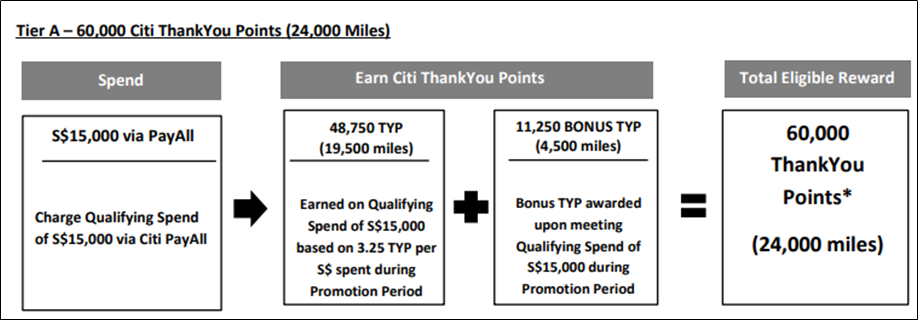

Tier A: Spend S$15,000, Get 4,500 bonus miles

With Tier A, you need to charge at least S$15,000 to your Citi Prestige card via PayAll. This will earn you 19,500 base miles (S$15K @ 1.3 mpd), and 4,500 bonus miles for a total of 24,000 miles.

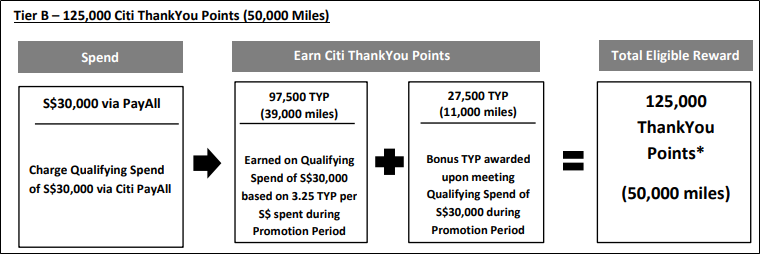

Tier B: Spend S$30,000, Get 11,000 bonus miles

With Tier B, you need to charge at least S$30,000 to your Citi Prestige card via PayAll. This will earn you 39,000 base miles (S$30K @ 1.3 mpd) and 11,000 bonus miles for a total of 50,000 miles.

You’re only eligible to receive either the Tier A or Tier B gift. If you meet the conditions, you’ll receive the bonus miles within 8 weeks from 31 March 2020.

What does this mean for your cost per mile?

Based on a 2% fee and an earn rate of 1.3 mpd, the usual cost per mile (CPM) when using the Citi Prestige with PayAll is 1.54 cents.

Thanks to the bonus miles, the CPM under this promotion is brought down to as low as 1.2 cents. That’s a very good price to buy miles at, assuming you’re able to meet the spending threshold.

| Regular CPM | CPM (Tier A) | CPM (Tier B) | |

Citi Prestige Citi Prestige |

1.54 | 1.25 | 1.2 |

| Based on 2% fee | |||

Do note that the above workings assume you hit S$15,000 and S$30,000 on the dot. If you spend beyond those amounts, your CPM increases towards 1.54. For example:

| Spend | CPM | Spend | CPM |

| S$15,000 | 1.25 | S$35,000 | 1.24 |

| S$20,000 | 1.31 | S$40,000 | 1.27 |

| S$25,000 | 1.35 | S$45,000 | 1.29 |

| S$30,000 | 1.20 | S$50,000 | 1.32 |

A way of paying income tax?

Let’s be clear: S$15,000 and S$30,000 are extremely high spending thresholds to meet from PayAll transactions alone. Maybe if you were renting a really swanky apartment, you might be able to squeeze in two rental payments in the time period and hit Tier A, but Tier B seems a bridge too far.

Another possibility is to meet the spending threshold via income tax payments. It’s still too early to receive your NOA (they’ll go out towards the end of April at the earliest), but selected individuals may be able to opt for early assessment.

I’m in the process of writing an updated article on how to earn miles paying taxes this year, so stay tuned for that.

Citibank has the widest variety of transfer partners in Singapore

Remember that your bonus miles under this promotion will be credited in the form of Citi ThankYou points. These can be transferred to 11 different frequent flyer programs and 1 hotel partner at a 5:2 ratio.

| Transfer Ratio | |

Singapore Airlines KrisFlyer Singapore Airlines KrisFlyer |

5:2 |

| 5:2 | |

| 5:2 | |

Etihad Guest Etihad Guest |

5:2 |

EVA Air Infinity Mileagelands EVA Air Infinity Mileagelands |

5:2 |

Flying Blue Flying Blue |

5:2 |

IHG Rewards Club IHG Rewards Club |

5:2 |

Malaysia Airlines Enrich Malaysia Airlines Enrich |

5:2 |

Qantas Frequent Flyer Qantas Frequent Flyer |

5:2 |

Qatar Airways Privilege Club Qatar Airways Privilege Club |

5:2 |

Thai Airways Royal Orchid Plus Thai Airways Royal Orchid Plus |

5:2 |

| 5:2 |

The wide variety of transfer partners allows you to access great sweet spots, like Turkish Airlines to Europe, British Airways short-haul awards, and Etihad Guest’s harem of partner airlines.

Conclusion

This won’t be a useful promotion for most folks, but it’s worth taking note of if you have an unusually high bill payment to make. For everyone else, I’m sure we’ll see some more tax payment promotions in the weeks to come, so sit tight.

(HT: sandyph)

Sorry, this may be a nitpicking and may have even been answered elsewhere: With the minimum Citi relationship bonus being 0.02mpd – Why not calculate with 1.32mpd for the Prestige in general just like 3mpd is being used for the UOB Krisflyer card even though that gets credited after year end?

Isn’t spending $15000 (+$515) on PremierMiles card a better promotion than spending $14000 (+$280 payall fee) on Prestige? Offer A nets you 70000 miles while offer B, a measly 24000.

You’ve got the $15k and $14k the wrong way around.. Anyway, if you compare apples to apples (i.e pay tax) then you should apply the 2% PayAll fee to premier miles promo as well so it becomes a worse offer. But if you already have $14k of retail spending then go for it. It really depends on your circumstances – it’s good to have more options. Even better if you can make use of both.