It looks like DBS is really making a push for online spending. In addition to its recently-launched “Go Online” promotion, the bank has rolled out another offer just for DBS Altitude cardholders: earn up to 4 mpd on online spending from 3 March till 30 June 2020.

Unfortunately, it’s not terribly compelling.

How it works

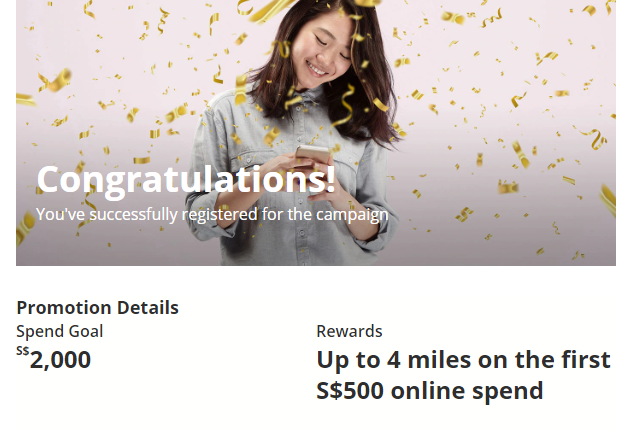

First, you’ll need to be among the first 10,000 DBS Altitude AMEX or Visa principal cardholders to register via this link (unlike UOB promotions, you’ll know upfront when this cap has been hit).

Then you’ll receive a personalized spend goal and reward. Only transactions made from the date of registration will count, so be sure to register, even if preemptively.

My spend goal was S$2,000, for which I’d earn up to 4 mpd on the first S$500 of online spending.

Based on data points from readers, there’s another offer floating out there with a S$4,500 spending goal, which offers up to 4 mpd on the first S$1,000 of online spending. There’s also a S$9,000 spending goal with up to 4 mpd on the first S$4,000 of online spend.

Based on data points from readers, there’s another offer floating out there with a S$4,500 spending goal, which offers up to 4 mpd on the first S$1,000 of online spending. There’s also a S$9,000 spending goal with up to 4 mpd on the first S$4,000 of online spend.

You’ll notice I’ve been saying “up to 4 mpd”. That’s because of how the promotion is structured.

| Local Currency Online | FCY Online | |

| Base | 1.2 mpd | 2.0 mpd |

| Bonus | 1.2 mpd | 2.0 mpd |

| Total | 2.4 mpd | 4.0 mpd |

In other words, you only earn 4 mpd if you spend online in foreign currency. This is, for all intents and purposes, a double miles promotion.

This promotion is available for a total of 4 months, and your spending goal/reward cap applies per month.

| Month | Qualifying Period |

| 1 | 3-31 March 2020 |

| 2 | 1-30 April 2020 |

| 3 | 1-31 May 2020 |

| 4 | 1-30 June 2020 |

For example, if I spend S$2,000 in Month 1, I’ll be eligible to receive the bonus miles on the first S$500 of online spending in Month 1. I can then choose to skip Months 2 and 3, before repeating the promotion again in Month 4. Do note that there’s no need to register multiple times; your registration is valid for the entire promotion period.

Bonus miles will be credited within 90 days from 30 June 2020. The full T&C can be found here, and FAQs can be found here.

| Separate offer for new cardholders |

| If you don’t already hold a DBS Altitude card, and have not cancelled one in the past 12 months, you’re eligible for a separate offer. Your spending goal will be S$4,500, for which you’ll receive up to 4 mpd on the first S$1,000 of online spending. All the other details such as spending periods and exclusions are the same as for existing customers. Remember that DBS is currently offering a sign up bonus of 10,000 miles when you spend S$6,000 in the first 90 days of approval. That offer can be stacked together with this one. |

What kind of spending qualifies?

Your spending goal can be met by any kind of retail spending, either online or offline, in local or foreign currency. The usual exclusions for cash advances, balance transfers, AXS payments, SAM bill payments and fees apply.

Online spending excludes the following:

| i. Online flight and hotel transactions made at merchants with main business activity classified as flights and/or hotels; ii. Bill payments and all transactions via AXS, SAM, NETs, eNETS; iii. Payments to educational institutions; iv. Payments to financial institutions (including banks, online trading platforms and brokerages); v. Payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); vi. Payments to hospitals; vii. Payments to insurance companies (sales, underwriting, and premiums); viii. Payments to non-profit organisations, charities and donations; ix. Payments made via online banking; x. Payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); xi. Payments made via telephone or mail order; xii. Payments to utility bill companies; xiii. Any top-ups or payment of funds to prepaid cards, any prepaid accounts and merchants who are categorized as “payment service providers” and/or “online payment gateway”, (e.g: MoneySend, Skrill.com, Matchmove.com, SmoovPay, CardUp, iPaymy, GrabPay, Youtrip; payment service providers, EZ-Link, NETS FlashPay and Singtel Dash; xiv. Payments made to CardUp, iPaymy, Mileslife and SmoovPay; xv. Any betting transactions (including Levy Payments to Local Casinos, Lottery Tickets, Casino Gaming Chips, Off-track Betting and Wagers); xvi. Any transactions related to crypto currencies; xvii. Instalment payment plan purchases, preferred payment plans, balance transfer, fund transfer, cash withdrawal, cash advances, annual fees, interest, late payment charges, bill payments via internet banking and all fees charged by DBS, miscellaneous charges imposed by DBS (unless otherwise stated in writing by DBS); and xviii. Any other transactions determined by DBS from time to time |

The particular exclusions to take note of are online flight and hotel transactions, as well as payments to CardUp, ipaymy and GrabPay.

It’s cute that DBS thinks Mileslife still exists, but otherwise all the other exclusions are pretty standard (hospitals, charities, gambling, crypto, insurance, education).

Is the promotion worth it?

Not really.

I don’t think you should have to jump through so many hoops to earn 4 mpd on online spending (and just foreign currency online spending, at that), when there’s an abundance of alternatives out there:

| Online Spending | Remarks | |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Capped at S$2K per month |

Citi Rewards Visa Citi Rewards Visa |

4 mpd | Excludes travel. Capped at S$1K per statement period |

OCBC Titanium Rewards OCBC Titanium Rewards |

4 mpd | For online shopping. Capped at S$12K per membership year |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

4 mpd | For online shopping and entertainment. Capped at S$1,110 per month |

Any of the cards above would give you 4 mpd from the first S$1, with more generous caps and fewer exclusions.

You also need to take into account the opportunity cost of using the DBS Altitude to hit the spending goal. If you hold the BOC Elite Miles World Mastercard, for example, you’re losing out on 0.3/1.0 mpd for every S$1 spent on local/FCY.

| Update: Monster Dino on the Telegram group has reminded me that DBS is running a separate promo on the DBS Altitude cards, offering 4 mpd on FCY spending with a minimum S$2K FCY spend. Assuming that spending can be double counted (and I see no reason why it can’t), and assuming you had already committed to spend at least S$2K FCY, then by all means register for this promo and double dip. Based on a spending goal is S$2K, you’d receive 2,000*2 (base miles) + 2,000 * 2 (bonus miles from FCY promo) + 500 *2 (bonus miles from online spending promo, in FCY)= 9,000 miles |

Conclusion

By all means register if you’re curious to see what your targeted spending goal is, but I just can’t see any scenario in which this would be worth switching away from your existing online spending card.

That said, I imagine a lot of people are shopping online on account of Covid-19, so hopefully this encourages other banks to put out competing promotions.

I wonder why DBS would bother with something so underwhelming with such hoops to jump through. You’d expect them to know the competition out there?

The banks know the competition outside. But, many customers still own and use DBS Altitude cards every day. Let’s remind them why DBS Altitude Cards are good cards so that they can easily block out other choices.

DBS has a lot of data on you. They can predict the amount of money you’ll likely spend on their cards, and if you have a bank account with them, the amount you’ll spend on other banks too. That’s why they can come out with these kind of personalized promo.

Spot on. That’s why our Milelion was capped at such low limit.

Low spenders (based on month-to-month) like me will get a high limit and I have to stress to spend. I’ll just stick with the alternative 4mpd cards

I don’t think low spenders get high limit. In fact, it’s probably a reachable target so you feel motivated to hit the target rather than just giving up altogether.

FWIW, Aaron probably doesn’t use his Altitude much because his gen spend is BOC EM. Maybe that’s why his target is low.

Low spenders wont have high spending goal, so its still okay