American Express has unveiled a refresh for the AMEX Platinum Credit Card, adding a new sign-up bonus and cardface in the process.

| Don’t confuse the AMEX Platinum Credit Card with the AMEX Platinum Charge. Despite the similarity in names, the former is AMEX’s entry-level Platinum card, the latter its its top tier. |

The new-look AMEX Platinum Credit Card offers 25K bonus Membership Rewards (MR) points with S$6K spending in Months 1-3, and a further 25K bonus MR points with S$6K spending in Months 4-6. On top of this, readers who sign-up through The Milelion’s MGM link receive a further 15K bonus MR points.

Get 15,000 bonus MR points when you apply for the AMEX Platinum Credit Card

Read on for the details.

Key Features: AMEX Platinum Credit Card

| Income Req. |

Annual Fee |

Miles from AF |

FCY Fee |

| S$80K | S$321 | None | 2.95% |

| Local Earn |

FCY Earn |

Special Earn |

Points Validity |

| 0.69 mpd |

0.69 mpd | EXTRA partners: 3.47 mpd |

No expiry |

The AMEX Platinum Credit Card carries an annual fee of S$321, and a revised income requirement of S$80K (up from S$50K previously).

| Although AMEX has raised the minimum income requirement, it’s unclear how strict they’ll be about enforcing it. For example, the AMEX Platinum Charge officially has an income requirement of S$200K, but in practice will accept applications with S$150K |

With an earn rate of 2 Membership Rewards points (MR points) per S$1.60 (0.69 mpd) both locally and abroad, it’s not exactly a miles-earning powerhouse. Even the bonus rate at EXTRA partners (3.47 mpd) is outgunned by other 4 mpd cards.

On the flip side, MR points don’t expire, and can be transferred to the following programs with no conversion fees.

| AMEX Transfer Partners (MR Points: Partner Miles/Points) |

||

| 450:250 | 450:250 | 450:250 |

|

|

|

| 450:250 | 450:250 | 450:250 |

|

||

| 450:250 | 450:250 | 1,000:1,250 |

|

||

| 1,000:1,000 | ||

| Note: AMEX Platinum Charge cardholders have access to a preferential miles transfer rate of 400:250; all other Platinum cards use the 450:250 rate | ||

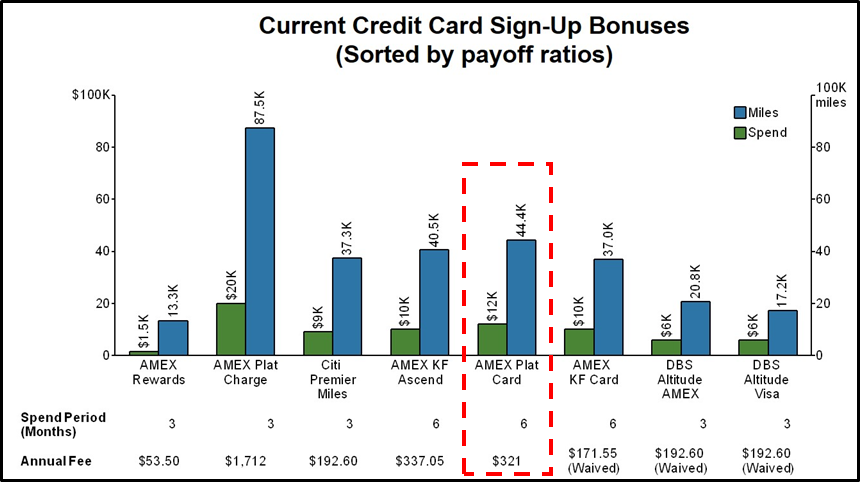

Sign-up Bonus: Spend S$12K, Get 44.4K miles

Although the AMEX Platinum Credit Card doesn’t have fantastic miles earning rates, it does pack a very decent sign-up bonus.

To be eligible for the sign-up bonus, cardholders must not have cancelled an AMEX Platinum Credit Card in the 12-month period before application. However, there’s no restriction on previous or current AMEX KrisFlyer/ AMEX Rewards cardholders- they’ll be eligible for the bonus.

Cardholders who are approved from now till 30 June 2020 and spend S$12K in the first 6 months of approval will receive a 65K bonus MR points (36.1K miles), which added to the 15K base MR points (8.3K miles) yields a total of 80K MR points (44.4K miles).

Here’s the detailed breakdown:

| MR Points | Miles | |

| Base points for S$12K spend | 15K | 8.3K |

| Bonus points for S$6K spend in M1-3 | 25K | 13.9K |

| Bonus points for S$6K spend in M4-6 | 25K | 13.9K |

| MGM Bonus Points (Available when applying through Milelion) |

15K | 8.3K |

| Total | 80K | 44.4K |

The above table assumes you apply through the MGM program, which gives you 15K bonus MR points for spending S$1,000 in the first 3 months. This spending will double count towards the sign-up bonus.

The bonuses in Months 1-3 and 4-6 are independent; you can spend S$6K in each period to get both, or S$6K in either period to get one. Bonus points will be credited to your account within 8-10 weeks after the spending threshold is met.

You must pay the S$321 annual fee to enjoy the sign up bonus.

| As part of AMEX’s unpublished “one annual fee” policy, AMEX Platinum Charge cardholders can get the Platinum Credit Card for free. However, they can only hold the Platinum Credit Card or the Platinum Reserve, and the latter is a much better option given its complimentary 2-night stay at selected Fraser Residences. |

When compared to the seven other credit card sign-up bonuses on the market at the moment, the AMEX Platinum Credit Card’s spend:miles ratio (a.k.a payoff ratio) ranks somewhere in the middle.

What spending counts?

The following transactions will not count towards eligible spending for the purposes of sign up bonuses:

| a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date; b) Cash Advances and other cash services; c) Express Cash; d) American Express Travellers Cheque purchases; e) Charges for dishonoured cheques; f) Finance charges – including Line of Credit Charges and Credit Card interest charges; g) Late payment and collection charges; h) Tax refunds from overseas purchases; i) Balance transfer; j) Instalment plans; k) Annual Card fees and Membership Rewards fees; l) Pay portion billed for a “Pay + Points” rewards, where the Card Member uses points along with paying a specific amount to redeem the reward; m) Amount billed for purchase of Membership Rewards points to top-up your points balance; n) Purchase and top-up charges for EZ-Link Cards using American Express Cards; o) Bill payments and all transactions via SingPost SAM kiosks and mobile app (with effect from 1 March 2020); p) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channels) (with effect from 1 March 2020); q) Payments to Singapore Petroleum Company Limited (SPC) service stations (with effect from 1 March 2020); r) Payments for the purpose of GrabPay top-ups (with effect from 1 March 2020); s) Charges at merchants or establishments that are excluded by American Express at its sole discretion and notified by American Express to you from time to time. |

The main transactions to take note of here are insurance, SPC, and GrabPay transactions. All other transactions (including charitable donations, interestingly enough), will be eligible.

Other Platinum Card benefits

All AMEX Platinum cardholders get access to the Love Dining program, which offers up to 50% off at selected 5-Star hotels and restaurants. Unfortunately, Love Dining does not apply to takeaway orders, so it can’t be used under the current Circuit Breaker conditions.

Likewise, Chillax benefits (which include 1-for-1 drinks at selected bars islandwide) can’t be used at the moment, until the restriction on bars is lifted.

|

|

| Hotels | Restaurants |

|

|

|

|

|

|

Conclusion

Although I certainly wouldn’t use the AMEX Platinum Credit Card as an everyday spending option, the sign-up bonus is worth taking a look at. It’s also the cheapest way of getting Love Dining and Chillax benefits.

However, there’s really no rush to sign up right now. The sign-up bonus is valid till end June, and if you really want to maximize the duration of your Love Dining/Chillax benefits, it’d be better to hold your fire until the Circuit Breaker is lifted.

Thanks Aaron. Would yoi know if holders of Platinum Charge card get grandfathered in, and qualify for this card without the annual fee?

Platinum Charge cardholders can anyway get the Platinum Credit Card/Platinum Reserve with no fee. however, it’s one or the other, and most people will go for the Reserve because of the 2n free Fraser’s stay

Edit: I see you answered it below. Trigger happy.

But if a Platinum Charge holder get the Platinum CC for free, would they still be applicable for the 44.4k (minus 15k MR due to non MGM) miles provided they hit spending? Would you know?

yup- must pay annual fee. no money, no honey.

I always think the essence of AMEX Platimum is the FHR programme, however this card cannot. sad

Hi Aaron, thanks for the article.

If one already has a Platinum Charge Card, is he eligible for this Miles Bonanza offer when he applies for this Platinum Credit Card under the “one annual fee policy” (i.e. not paying any subscription fee).

Thank you

annual fee must be paid, see T&C.

Hi Aaron, would cancelling the charge card and then apply this platinum card be eligible for sign up bonus?

Would there be any reason you will keep this card for? E.g. daily general spending to earn hotel points….

love dining? if you didn’t already have the platinum charge/reserve

This one is metal?