News broke this morning that Avianca, the second largest airline in Latin America and second oldest in the world, has filed for bankruptcy protection.

In a way, it’s somewhat unsurprising. With airlines around the world bleeding money and seeking bailouts, it was only a matter of time before a major carrier tapped out. The IATA estimates that Covid-19 has caused a 90% decline in global passenger numbers, and will reduce industry revenues worldwide by US$314 billion.

Avianca has been unable to secure a bailout from the Colombian government, and filed for Chapter 11 protection after failing to meet a US$65 million bond payment deadline.

They’ve taken pains to emphasize that this was a voluntary filing, and are positioning it as a temporary measure to buy time for reorganization. That said, Avianca has not operated a regularly scheduled passenger flight since Colombia closed its international air space to passenger travel in late March, leading to an 80% fall in revenue.

Avianca has set up a website with resources on the reorganization proceedings (complete with the very inspirational URL aviancawillkeeponflying.com), and more information can be found here and here.

What about LifeMiles?

Today’s announcement is no doubt distressing to anyone holding LifeMiles, but to understand the impact, we first need to understand its relationship to Avianca.

LifeMiles is a separate legal entity, and is not involved in the Chapter 11 filing. This means that the reorganization will not be able to touch any of LifeMiles’ assets.

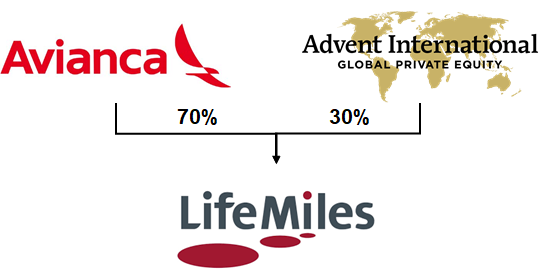

LifeMiles is 70% owned by Avianca Holdings, and 30% owned by Advent International, a private equity firm. Advent acquired its stake in 2015 for US$344 million, but has been looking to sell since 2018.

| ⚠️ The fact they’re looking to sell should not, in and of itself, be a concern. PE firms enter and exit positions all the time; it’s how they realise their profit (or, I suppose, cut their losses). The median holding period for a PE stake is usually between 3-5 years |

When you redeem an award ticket through LifeMiles, it’s LifeMiles’ (not Avianca’s) responsibility for paying the cost of rewards. Therefore, while Avianca’s current predicament will certainly impact LifeMiles (Avianca accounts for 27% of all LifeMiles’ gross billings), it won’t disrupt reimbursement payments to partner airlines per se.

It would be a very different situation if LifeMiles were not a separate entity from Avianca, because any payments made during bankruptcy protection need to be scrutinized for issues of of unfair preference (that’s what my one module on company law tells me at least- lawyers, feel free to let loose).

As a separate legal entity, LifeMiles issues its own debt instruments. Moody’s provides coverage, and during their most recent assessment on 15 April 2020, downgraded LifeMiles’ rating from B1 to B3 with a negative outlook. A new assessment is surely in the works given what’s happened to Avianca.

You can read the full report here, but these are some excerpts I found interesting:

LifeMiles relies on Avianca and its air partners for almost a third of its revenue

| LifeMiles has a strong business model that leverages third-party commercial partnerships (including co-branded credit card agreements with the largest banks in its core markets), but its single largest contributor to gross billings are miles sold to Avianca and its air partners, accounting for 32% of gross billings. As such, Avianca’s operating problems combined with the effects of coronavirus hurting consumer spending and air travel also hampers LifeMiles’ operation. |

However, lower air travel also reduces costs for LifeMiles

| Nonetheless, we note that lower air travel significantly decreases redemption costs, which represent over 80% of LifeMiles’ cash costs and operating expenses. Moody’s estimates that, absent additional indebtedness, for example to finance dividend payments, LifeMiles’ debt/EBITDA, as adjusted by Moody’s, will reach close to 4.5 times by year-end 2020. |

LifeMiles has adequate liquidity and can cover 1.6X short-term debt

| LifeMiles has adequate liquidity. The company cash and cash equivalents of $108 million as of December 31, 2019 (including $31 million of advance payment of reward seats) can cover 1.6x its short-term debt. LifeMiles has posted negative free cash flow (defined as cash from operations minus dividends and capex) in 2017, 2018 and in 2019 resulting from the high dividend payout. We expect the company will limit its dividend payout in 2020, at least while the coronavirus impact persists, to further strengthen its cash position. |

Other major revenue sources include cobrand cards; 20% of miles are never redeemed, 90% of redemptions are for air tickets

| LifeMiles’ largest contributors to gross billings are its financial partners, which include credit card cobrands (47%) and airlines (32%), being Avianca its largest customer, responsible for approximately 27% of gross billings. Around 80% of accrued miles are redeemed, with 90% being redeemed into air tickets. The 10% balance is redeemed into hotel nights, merchandise and other rewards. |

Moody’s goes on to say that another downgrade would be likely if there were a further weakening of Avianca’s credit profile, so that’s all but certain now.

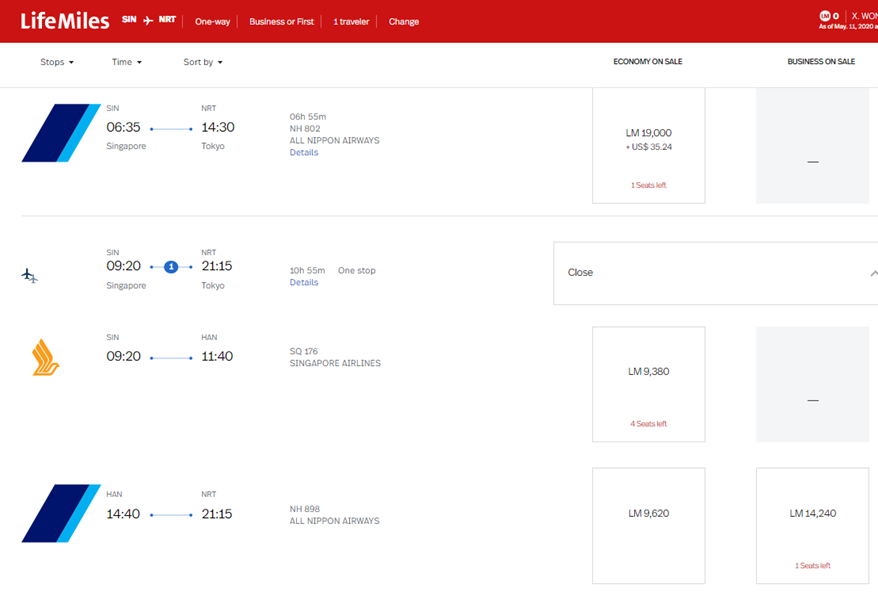

LifeMiles can still be earned and redeemed

While there’s no immediate need to worry about the fate of one’s LifeMiles, I would certainly be looking to cash out as soon as possible (the only programs I personally hold ongoing balances with are Asia Miles and KrisFlyer).

Members can still login to the website to search for and book awards as per normal. Tickets redeemed through LifeMiles will be exempt from penalty fees until 31 October 2020, so you can always change your dates/routes if needed.

The other reason why I’d advise you to redeem your miles ASAP is because it’s possible that partners may start blocking award space from LifeMiles if they become concerned about non-payment. Per my understanding, reimbursement for award tickets comes due after the flight is flown, so depending on the payment terms and volumes, some airlines may preemptively block redemptions to limit exposure.

It should be noted that redeeming your miles does not necessarily mean you’re out of the woods. There are a few scenarios that can play out here:

- Avianca does not survive, but LifeMiles does: Your future award tickets will still be honored to the extent that LifeMiles is able to pay for them.

- Neither Avianca nor LifeMiles survives: Your future award tickets are unlikely to be honored

- LifeMiles does not survive, but Avianca does: This would be a strange situation indeed, because Avianca would almost certainly have to rescue LifeMiles, or else never run a frequent flyer program again (who would it partner when the airline shows a willingness to abandon it?)

Although LifeMiles can theoretically survive without Avianca, it’s through Avianca that LifeMiles gets access to Star Alliance award space. Losing Avianca while LifeMiles survives would be very bad for anyone still holding LifeMiles (because future redemption opportunities will be severely limited), but not so bad for those who are holding unused award tickets (because they can still fly, so long as LifeMiles pays).

The closest example I can think of is Jet Airways and Jet Privilege- when Jet Airways went bust, Jet Privilege survived and rebranded as InterMiles. However, InterMiles flight redemptions are as good as useless in my book, and function more like a pay-with-points feature than a genuine frequent flyer program.

LifeMiles has issued its own press release on the matter, with a website and list of FAQs for members to refer to.

Conclusion

Filing for bankruptcy protection doesn’t necessarily mean the end of Avianca. It’s still possible the Colombian government comes up with a bailout, or its partners (like United Airlines) swoop in with a rescue deal.

| ⚠️ For the sake of full disclosure, LifeMiles has offered special bonuses to Milelion readers in the past. However, they do not pay any affiliate commissions on sales. |

If you’re holding on to LifeMiles right now, you’d best get busy looking for ways to spend them- the sooner you can fly, the better.

i look forward to the colombian government’s response