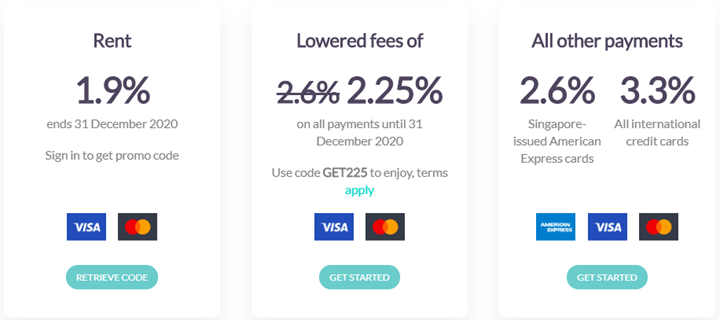

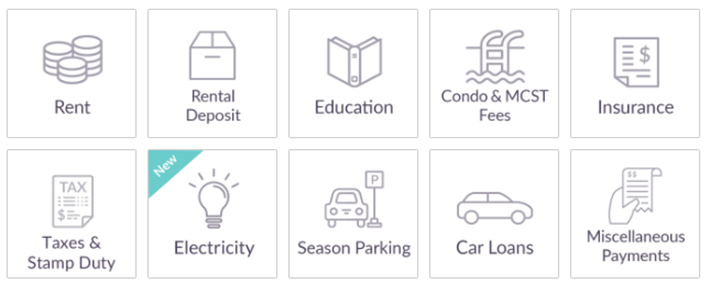

CardUp has extended their discounted 2.25% admin fee till 31 December 2020, allowing cardholders to buy miles from as low as 1.38 cents each when paying condo fees, insurance, car loans and more.

How does CardUp’s discounted fee work?

To enjoy the 2.25% fee, use the code GET225 when setting up your payment. If you have existing payments scheduled, there’s no need to cancel them- you can edit them in the dashboard to add this promo code instead.

A minimum payment of S$130 is required, and the payment must be set up on or before 31 December 2020 with a due date on or before 5 January 2021. This code is valid for any CardUp payment made with a Singapore-issued Visa or Mastercard.

If this is your first payment with CardUp, you can save S$20 off the admin fee for your first payment of S$1,000 or more with the promo code MILELION. You can subsequently schedule the rest of your payments with the GET225 code for maximum savings.

The full T&C of this promotion can be found here.

| 💡 Paying income tax or rent? |

|

Income tax: Use the code ML175TAX20 to enjoy a fee of 1.75%. Schedule payments by 25 August 2020, with due date by 28 August 2020 (Read More) Rent: Use the code SAVERENT19 to enjoy a fee of 1.9%. Schedule payments by 31 December 2020, with due date by 5 January 2021 (Read More) |

How much do miles cost with this promotion?

Here’s what a 2.25% fee means for your cost per mile with various credit cards. For more information on whether this is “worth it”, have a read of my guide to valuing miles.

| Card | MPD | CPM @ 2.25% |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.38 |

DBS Insignia DBS Insignia |

1.6 | 1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.38 |

OCBC Premier OCBC Premier & PB VOYAGE |

1.6 | 1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.57 |

| 1.4 | 1.57 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.57 |

Citi Prestige Citi Prestige |

1.3 | 1.69 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.69 |

HSBC Visa Infinite HSBC Visa Infinite |

1.252 |

1.76 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.83 |

SCB X Card SCB X Card |

1.2 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.83 |

OCBC 90N OCBC 90N |

1.2 | 1.83 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.83 |

BOC Elite Miles BOC Elite Miles |

1.0 | 2.2 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd 2. With minimum S$50K spend in previous membership year, otherwise 1.0 mpd. CardUp payments will be excluded from 1 July |

||

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

If you have an upcoming payment to make, it’s worth seeing if this promotional rate allows you to buy miles at a price you’re comfortable with.

Most cards already exclude points for insurance and education, so CardUp may be your only option for earning rewards on such transactions.

Now we wait for the one upmanship from ipaymy….

I tried to use your promo code “milelion” to pay but the error message is that “your card is not eligible to redeem this offer” I am using the platinum charge card

hi eric, the code is only valid for visa/mastercard. sorry for the confusion

CardUp has removed HSBC credit cards from their qualifying credit cards.

“Dear [name],

We’re writing to you as we noticed you have used a HSBC credit card for a payment on our platform before.

HSBC has updated their cards’ terms and conditions and from 1 July 2020, CardUp spend will not be eligible for rewards.”

Yup! Be sure to swap out cards from tomorrow. Wrote about this previously