If you haven’t paid your income tax bill yet, here’s some good news: CardUp has extended its 1.75% income tax payment promotion for Milelion readers, and removed the restriction on Citi and Standard Chartered credit cards.

Use CardUp to pay income tax with a 1.75% admin fee

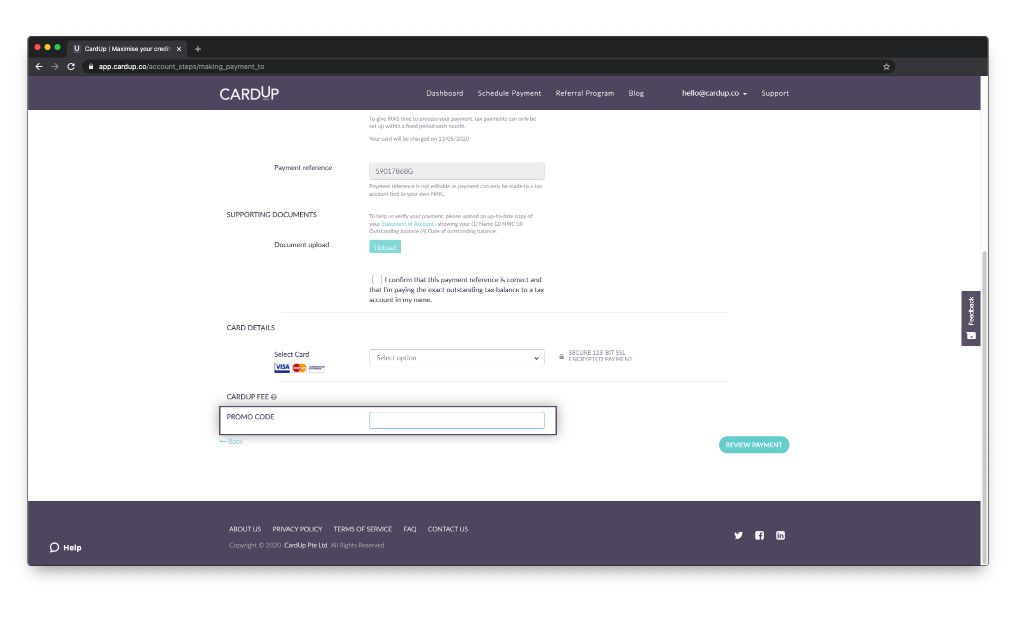

From now till 26 October 2020, readers can use the promo code ML175TAX20 to pay income tax with just a 1.75% admin fee.

This promo code is applicable to both new and existing CardUp customers. All Singapore-issued Mastercard and Visa cards can use this code.

Payment must be scheduled by 26 October 2020, with due date latest by 29 October 2020. The full T&C for this code can be found here.

What’s the cost per mile?

With the discounted admin fee, here’s how much buying miles will cost with the following credit cards, in terms of cents per mile (CPM).

| Card | MPD | CPM @ 1.75% |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

OCBC Premier OCBC Premier & PB VOYAGE |

1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.23 |

| 1.4 | 1.23 |

|

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.23 |

Citi Prestige Citi Prestige |

1.3 | 1.32 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

HSBC Visa Infinite HSBC Visa Infinite |

1.252 |

1.38 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.43 |

SCB X Card SCB X Card |

1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

OCBC 90N OCBC 90N |

1.2 | 1.43 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.43 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.72 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd 2. With minimum S$50K spend in previous membership year, otherwise 1.0 mpd. CardUp payments will be excluded from 1 July |

||

| A running list of all the cards which earn points with CardUp can be found here. Broadly speaking, any general spending card will earn points with CardUp. There are no 10X opportunities, however, so don’t use cards like the Citi Rewards or DBS Woman’s World Card. |

Most options here yield a cost of 1.5 cents per mile or less, which is a very good price to purchase miles.

Do note the following:

- If you hold a Citi PremierMiles Card, it’s cheaper to take advantage of the ongoing 1.5 mpd offer for Citi PayAll (1.33 cpm)

- If you hold a SCB Visa Infinite, it’s cheaper to pay via the bank’s tax payment facility, provided you spend at least S$2K in a statement month

- If you hold a HSBC Visa Infinite, it’s cheaper to pay via the bank’s tax payment facility

How do I use the code?

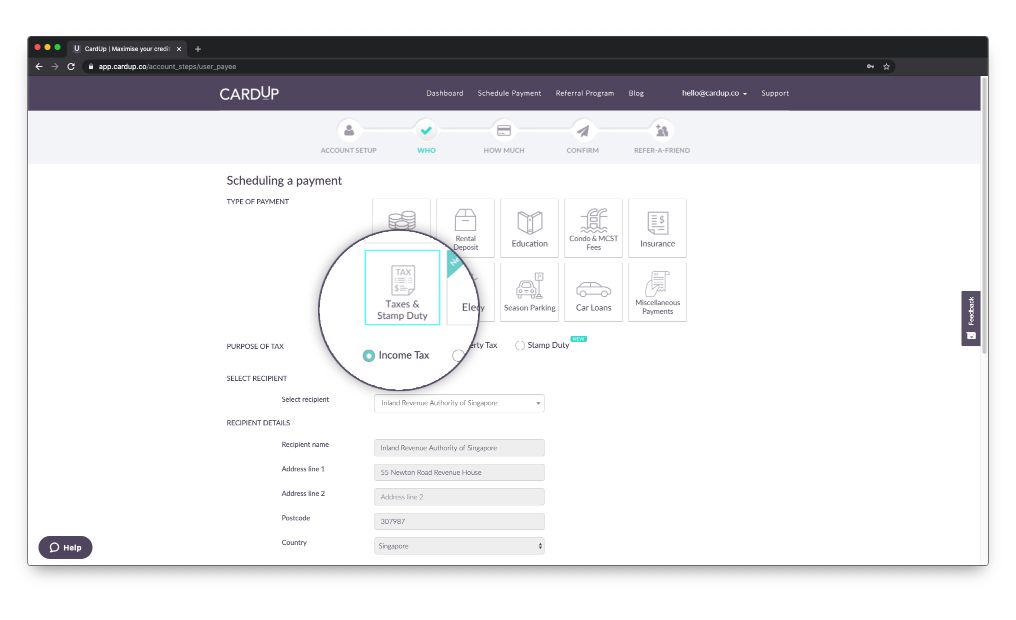

After you’ve logged in to your CardUp account, click the “Schedule Payment” button and select “Taxes & Stamp Duty”). Select “Income Tax”, acknowledge the terms and conditions and click “Next”.

Other things to note

This promo code can be used a maximum of once per user. In any case, you can only use CardUp to pay off your entire tax due amount, as IRAS doesn’t allow for installment payments via CardUp.

Also note that unlike the tax payment facilities offered by banks where funds are transferred to your account and you make the payment, CardUp makes payment directly to IRAS on your behalf.

CardUp transactions generally count towards sign-up bonus spending for most credit cards, but you’ll want to double check your T&Cs for specific exclusions. For example, the SCB X Card’s 100,000 miles sign-up bonus (since expired) excluded CardUp transactions.

| ❓ If you have doubts about whether CardUp spending will count towards any specific promotion, drop the team a line at hello@cardup.co, and they’ll reach out to check with the bank directly |

Conclusion

A 1.75% fee allows you to buy miles for some of the lowest prices in the market, so it’s great to see the promotion extended, and the restriction on Citi and Standard Chartered cards removed. Be sure to schedule your CardUp payments before 26 October 2020.

For more information on earning miles on income tax, be sure to have a read of The Milelion’s full guide here.

How about the rates for Citibank Ultima ?

follows the same math as insignia/reserve

Hi Aaron, any news on the rent promo that expires at the end of this month? It is the 25th already so need to make a quick decision between staying on or moving to Rent Hero. I wrote to the Card Up folks today morning but wanted to see if you had some inside dope

Let me circle back to them

https://milelion.com/2020/06/25/cardup-extends-1-9-fee-on-rental-payments-till-december-2020/

Is the promotion valid for the 1st time one-off payment ? It appears no giro option is available either which means you will have cardup will payoff the entire NOA due amount in one go ?

you will have to pay the full amount at one go.

Unfortunately this will not work for those who have been paying via GIRO since Apr/May, because we’ll end up overpaying, and I believe IRAS frowns on this.

Hi Richard – you can still use CardUp to pay off the balance amount as reflected on your Statement of Account.

When setting up your income tax payment, simply upload a copy of your up-to-date Statement of Account showing your Name, NRIC number, Outstanding Balance and Date of Outstanding Balance.

Let us know if you have any questions or need more clarifications – you can drop our team an email at hello@cardup.co!

The CardUp Team

Better of using it as one of the recurring GIRO to get bonus interest on UOB one account. I think this promo from cardup came too little too late

Furthermore miles r almost useless now