Citibank has just launched a year end promotion for the Citi PremierMiles Card, and it’s potentially lucrative for big-ticket spenders.

From now till 31 December 2020, registered Citi PremierMiles Card members can earn up to 4 mpd on eligible transactions after meeting a minimum spend requirement, capped at S$10,000 (i.e 40,000 miles). Registration is capped at the first 25,000 eligible cardholders.

Citi PremierMiles Card 4 mpd Promotion

First of all, note that this offer is only available for cardholders whose Citi PremierMiles Card was approved and issued on or before 31 July 2020. If you were approved after this date, you won’t be eligible for this promotion.

Assuming you meet that criteria, you’ll need to be among the first 25,000 cardholders to send the following SMS to 72484:

e.g PMSPEND 1234 |

You should receive the following acknowledgement that you have been successfully registered.

After registration, you’ll be able to take advantage of either one of the offers below.

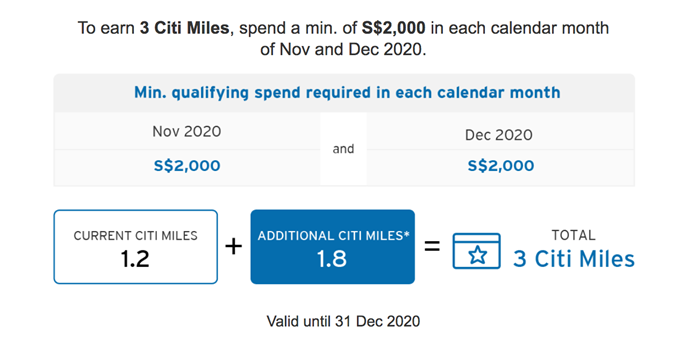

Tier A: Earn a bonus 1.8 mpd for a total of 3 mpd

Cardholders who spend at least S$2,000 in both November and December 2020 will earn a bonus 1.8 mpd on eligible transactions, for a total of 3 mpd on the first S$10,000 of eligible spending.

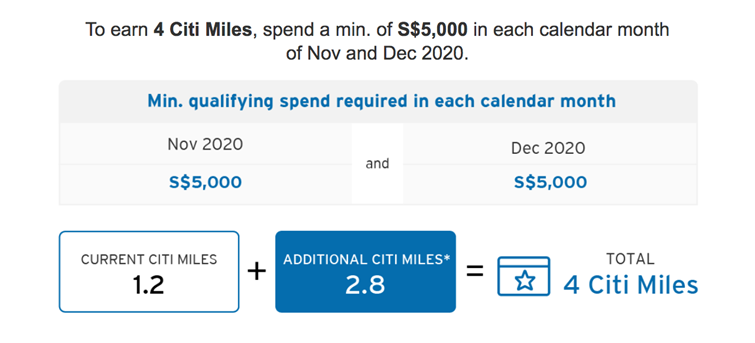

Tier B: Earn a bonus 2.8 mpd for a total of 4 mpd

Cardholders who spend at least S$5,000 in both November and December 2020 will earn a bonus 2.8 mpd on eligible transactions, for a total of 4 mpd on the first S$10,000 of eligible spending.

You cannot earn the Tier A bonus in one month and the Tier B bonus in another; if you meet the Tier A spending in one month and Tier B spending in another, you’ll receive the Tier A gift. For example:

| November 2020 | December 2020 | Bonus |

| S$2,000 | S$7,000 | 1.8 mpd (Tier A) |

| S$7,000 | S$2,000 | 1.8 mpd (Tier A) |

What counts as qualifying and eligible spend?

There’s two concepts to wrap your head around here. The first is qualifying spend, i.e the S$2,000 (Tier A) and S$5,000 (Tier B). This refers to any retail transactions (including Citi PayAll) that do not arise from :

| (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/ disputed/ unauthorised/ fraudulent retail purchases, (iii) Quick Cash/Ready Credit PayLite and other instalment loans, (iv) Paywise/ cash advance/ quasi-cash transactions/ balance transfers/ annual card membership fees/interest/goods and services taxes |

(v) betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel; (vi) bill payments made using the Eligible Card as a source of funds, (vii) late payment fees and (viii) any other form of service/ miscellaneous fees |

The second is eligible spend, i.e the spending that is eligible to earn the bonus 1.8 mpd (Tier A) and 2.8 mpd (Tier B). This refers to all online transactions (except the usual exclusion categories, like insurance, donations, government payments), plus the following offline transactions:

| Eligible MCCs | |

| Dining | 5811, 5812, 5813, 5814 |

| Department & Clothing Stores | 5262, 5309, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5661, 5691, 5699 |

| Computer, Electronics & Furniture | 5045, 5712, 5732 |

So to put it another way, you could meet the qualifying spend requirement through insurance premiums, government transactions and charitable donations, if you were so inclined. However, these would not earn either the base 1.2 mpd or the bonus 1.8/2.8 mpd.

Since it’s almost impossible to earn credit card rewards on insurance premiums, an argument could be made to put them on the Citi PremierMiles Card, where they’ll at least count towards the minimum spend. For example, if I spend S$2,000 on insurance premiums in both November and December 2020, I won’t earn any miles on that. However, I’ll have unlocked the Tier A bonus, which means I could then earn 3 mpd on up to S$10,000 of dining and shopping spend.

When will bonus miles be credited?

Bonus Citi Miles will be credited by two months from the end of the promotion period, i.e 28 February 2021.

The full T&C of this offer can be found here.

Citi Miles are one of the most valuable points currencies in Singapore

Citi PremierMiles cardholders get access to 11 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

| Transfer Ratio | |

|

1:1 |

| 1:1 | |

| 1:1 | |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

| 1:1 |

A S$26.75 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

The flexibility of Citi Miles means they’re a great way to enjoy sweet spots in programs like Etihad Guest, British Airways Avios and Turkish Miles&Smiles.

For example, you could redeem a Singapore to Europe round-trip Business Class flight for just 90,000 miles with Miles&Smiles. That’s half the price that Singapore Airlines charges (albeit with fuel surcharges), which means you could fly two people with Miles&Smiles for the cost of flying one with KrisFlyer.

Conclusion

While I’d much rather put my online spending on a card like the DBS Woman’s World Card or Citi Rewards for an easy 4 mpd with no minimum spend, this offer may be useful for those looking to shop offline.

A wide range of dining and shopping merchants will be covered under this promotion, such as Crystal Jade, Harvey Norman, even Robinson’s (if you fancy going down for one last hurrah). Moreover, you could potentially stack this with the ongoing Kris+ 9 mpd promotion, depending on the merchant you’re visiting.

Remember to register quickly, because it’s capped at the first 25,000 registrations.

grabpay can?

Is this stackable with the 1% Citi PayAll rebate promotion that is currently running?

Does iPaymy Count as online spend?

anyone tries using ipaymy can got it included in the online spend?

Why not use HSBC revolution for 4 mpb?

yup, you could use that too. ocbc titanium rewards as well, depending on the merchant.

Looks like spend on supplementary card is not eligible for this promotion.

Nice!

@Aaron: DBS WWC still capped at 2K per calendar month?

does gain city and those renovation shops fall in the offline spending category?

I mean courts/harvey norman etc plus ikea and a few shops for lights etc.

Just wanting to confirm whether the spending is based on transaction or posting to qualify for this promotion?

T&C has a clause stating the following:

Qualifying Spend will be determined by its transaction date based on Singapore Timing (UTC+08:00) and Citibank bears no liability for any late submission or transaction posting of any purchase by any merchant that might affect the Promotion.

The reason I am asking as I have 1 significant spending amount of $3k that is still pending right now despite transacting on 29 December 2020.