I came across this a little late, but here’s an easy way to pick up S$250 cash without a whole lot of hoop jumping.

New-to-bank customers who apply for a DBS/POSB credit card by 8 November 2020 will receive S$250 cashback when they apply with the promo code FLASH250. All they have to do is make at least one transaction of any amount within 30 days of approval. It’s that simple.

| ⚠️ DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not done so in the past 12 months |

Which DBS cards are eligible?

The following credit cards are eligible for this promotion.

| Card | Annual Fee | Key Features |

DBS Live Fresh DBS Live FreshApply here |

S$192.60 (First year free) |

Up to 10% cashback on online and contactless |

DBS Altitude Visa DBS Altitude VisaApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend, 2 lounge passes |

DBS Altitude AMEX DBS Altitude AMEXApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend |

DBS Woman’s Card DBS Woman’s CardApply here |

S$160.50 (First year free) |

2 mpd on online spending |

DBS Woman’s World Card DBS Woman’s World CardApply here Read Review |

S$192.60 (First year free) |

4 mpd on online spending |

POSB Everyday Card POSB Everyday CardApply here |

S$192.60 (First year free) |

Up to 15% rebates on groceries, online food delivery and more |

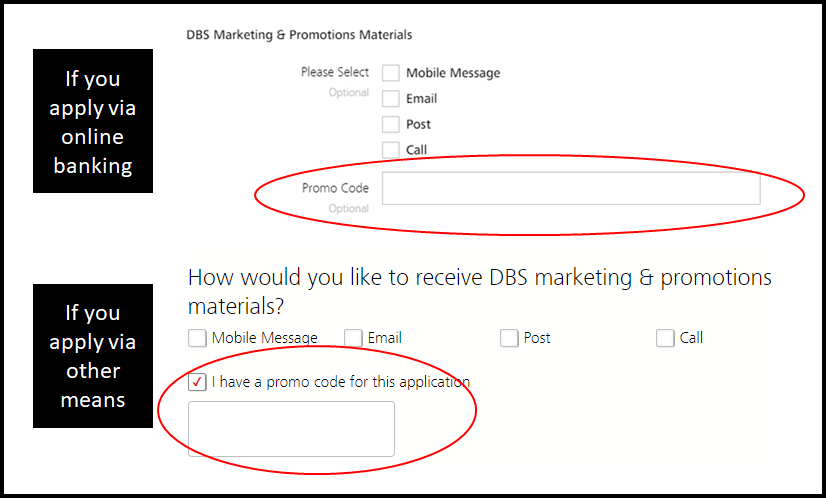

You must enter the code FLASH250 in the promo code box when applying. This is extremely important so don’t overlook this step– no code, no cash.

Applications must be received by end of day on 8 November 2020, and approval given by 15 November 2020. Successful applicants will need to make at least one qualifying transaction of any amount within the first 30 days.

Qualifying spend does not include the following:

| a. posted 0% Interest Instalment Payment Plan monthly transactions; b. posted My Preferred Payment Plan monthly transactions; c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); l. any top-ups or payment of funds to payment service providers, prepaid accounts and any prepaid accounts (e.g. EZ-Link, NETS FlashPay, Singtel Dash); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; and o. any other transactions determined by DBS from time to time |

The cashback gift will be credited to your card account balance within 120 days of the date of card approval.

The full T&C of this promotion can be found here.

Conclusion

DBS frequently runs these acquisition offers, but more often than not they’re tied to a certain minimum spend. This represents a better deal, insofar as you just need to make one transaction of any amount.

If you’re new to DBS cards, definitely consider applying for the DBS Woman’s World Card (men can apply too) and using it for the first S$2,000 of online spending every month. Alternatively, the DBS Altitude Visa/AMEX can serve as a good all-round general spending cards, and earn 3 mpd on online hotel and airfare bookings.