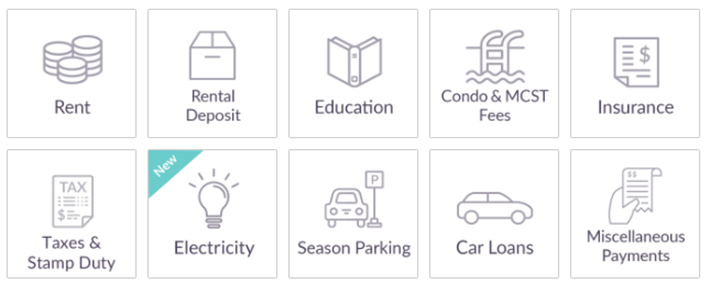

For the uninitiated, CardUp is a service that lets you pay rental, income tax, condo fees, insurance, car loans, electricity bills and more with your credit card, earning miles and points in the process.

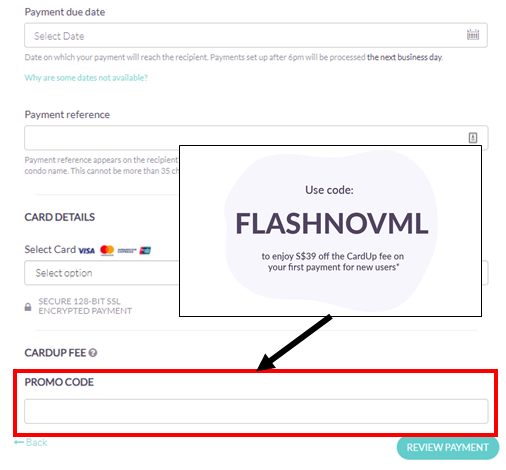

If you’re new to the platform, here’s some great news. From now till 30 November 2020, you can use the code FLASHNOVML to enjoy S$39 off the CardUp fee for your first payment. This applies to any payment of at least S$500.

Based on CardUp’s usual 2.6% fee, this means a chance to earn free miles on a payment of up to S$1,500.

How does it work?

To enjoy your free payment you simply need to sign up for an account and set up your first payment.

In the promo code field, enter FLASHNOVML to take S$39 off the CardUp fee. This is valid for the first 300 users who enter the code, but don’t worry- you’ll be able to see if the code is still valid before you make payment.

This applies to payments which are set up by 30 November 2020, with a due date of no later than 3 December 2020. A minimum payment amount of S$500 applies. This offer is valid for any Singapore-issued Visa or Mastercard.

The full T&C of this promotion can be found here.

How many miles can I earn with this promotion?

You can earn between 1 and 1.6 mpd with CardUp, depending on the card you use. Therefore, you’re looking at 1,500-2,400 of “free miles”, assuming you schedule a S$1,500 payment.

| Earn Rate | Payment | Miles |

| 1 mpd | S$1,500 | 1,500 |

| 1.1 mpd | S$1,500 | 1,650 |

| 1.2 mpd | S$1,500 | 1,800 |

| 1.3 mpd | S$1,500 | 1,950 |

| 1.4 mpd | S$1,500 | 2,100 |

| 1.5 mpd | S$1,500 | 2,250 |

| 1.6 mpd | S$1,500 | 2,400 |

But even if your payment is bigger than S$1,500, there’s still good reason to use this code as it significantly lowers your cost per mile.

| Payment | Fee |  1.2 mpd 1.2 mpd |

1.4 mpd 1.4 mpd |

1.6 mpd 1.6 mpd |

| S$500- S$1,500 |

S$0 | Free | Free | Free |

| S$2,000 | S$13 |

0.54 | 0.46 | 0.40 |

| S$3,000 | S$39 |

1.07 | 0.92 | 0.80 |

| S$4,000 | S$65 |

1.33 | 1.14 | 1.00 |

| S$5,000 | S$91 |

1.49 | 1.28 | 1.12 |

What about subsequent payments?

From now till 31 December 2020, CardUp is running two other offers for your subsequent payments:

- For rent payments: 1.9% admin fee (use code SAVERENT19)

- For all other payments: 2.25% admin fee (use code GET225)

This allows you to buy miles from as little as 1.17 cents each. That’s certainly worth it in my book, although it all comes down to how you personally value a mile.

| Card | MPD | CPM @ 1.9% |

CPM @ 2.25% |

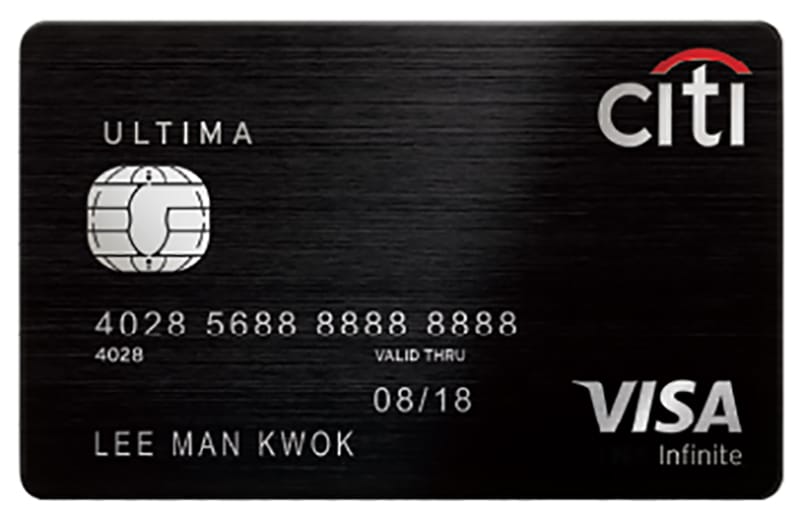

Citi ULTIMA Citi ULTIMA |

1.6 | 1.17 | 1.38 |

DBS Insignia DBS Insignia |

1.6 | 1.17 | 1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.17 | 1.38 |

OCBC Premier OCBC Premier & PB VOYAGE |

1.6 | 1.17 | 1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.33 | 1.57 |

| 1.4 | 1.33 | 1.57 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.33 | 1.57 |

Citi Prestige Citi Prestige |

1.3 | 1.43 | 1.69 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.43 | 1.69 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.55 | 1.83 |

SCB X Card SCB X Card |

1.2 | 1.55 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.55 | 1.83 |

OCBC 90N OCBC 90N |

1.2 | 1.55 | 1.83 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.55 | 1.83 |

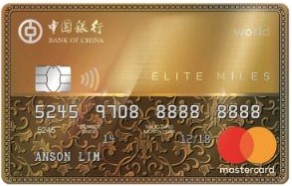

BOC Elite Miles BOC Elite Miles |

1.0 | 1.86 | 2.2 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd |

|||

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

This is an excellent deal from CardUp if you’re new to the platform, and an easy way to accrue some free or highly discounted miles. Do remember to set up your payments before 30 November 2020 to be eligible!

Most cards already exclude points for insurance and education, so CardUp may be your only option for earning rewards on such transactions.

Can I pay my utilities in advance?

thanks aaron, supporting you via using your ML promo code. =)

thanks a lot!