| The offers in this post have expired. For the latest Google Pay offers, refer to this post |

Google Pay launched P2P payments in Singapore back in April, and has steadily expanded its offerings since. Users can now order food, buy movie tickets, make in-store payments and send money to friends and family, all while earning cash rewards (in fact, it’s the only way to earn rewards on PayNow transfers).

Google Pay only supported OCBC bank accounts at launch, but now supports DBS PayLah and Standard Chartered Bank too. If you don’t already have a Google Pay account (available for both Android and iOS devices), you can get S$8 free when you sign up via the link below and make a payment of at least S$10.

Get S$8 free when you sign up for Google Pay here

The quickest way to unlock this is to simply send S$10 to a friend or family member.

Latest Google Pay Scratch Card Promotions

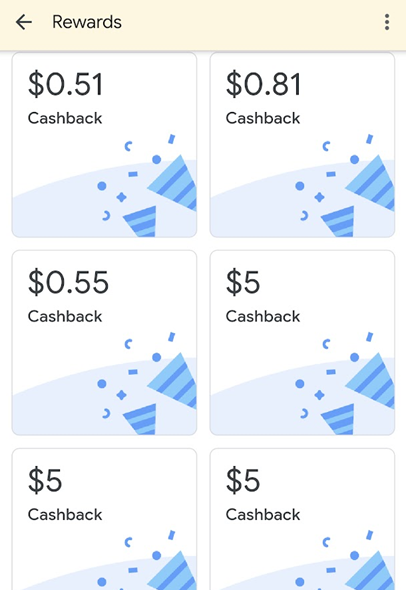

One of the best things about Google Pay are scratch cards, little “surprise mechanics” that you earn by sending money or making payments. These unveil cash prizes (guaranteed for some transactions, non-guaranteed for others) that are immediately credited to your bank account via PayNow.

How is Google financing this? Heck if I know, but I’m not about to start questioning a good thing. The latest set of Google offers allows you to earn up to 11 scratch cards per week till 31 December 2020, each one valued at up to S$10. A week is defined as Monday 8.30 a.m to the following Monday 8.29 a.m.

Send money to friends: 3 cards per week

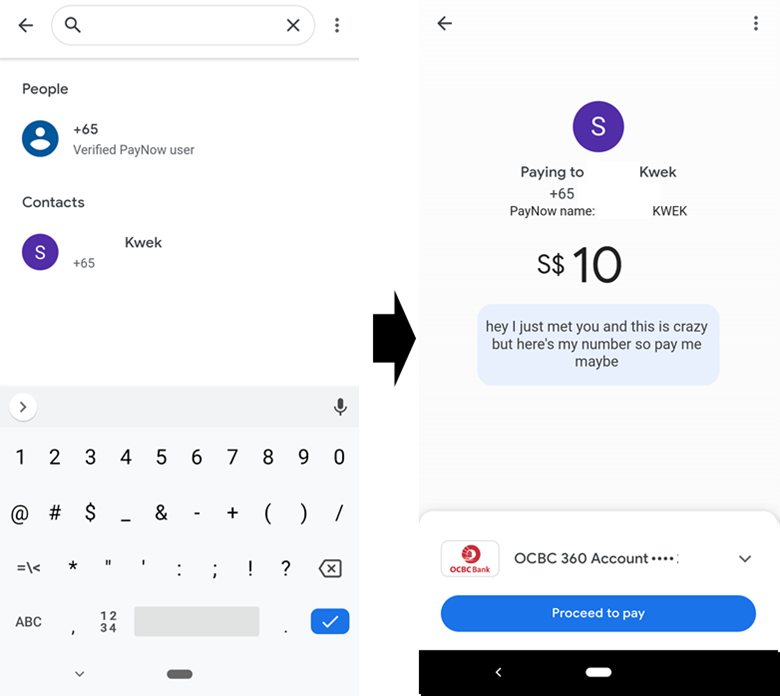

Google Pay remains the only way to earn rewards on PayNow transfers, and you’ll earn a scratch card worth up to S$10 when you either send or receive at least S$10 from another Google Pay user. Each transaction must be unique to receive a scratch card.

For example:

- A sends S$10 to B = Both A and B get a scratch card

- B sends S$10 to A= No additional scratch card, as it’s not a unique transaction

- B sends S$10 to C= Both B and C get a scratch card

This is capped at three scratch cards per week.

Unlike the other two promotions below, this is not a guaranteed win. It’s possible you may receive the dreaded “better luck next time” message, although it all boils down to the random number generator.

Tap & Pay: 4 cards per week

By linking credit cards to your Google Pay wallet, you can earn bonus scratch cards whenever you make Tap & Pay transactions, on top of the regular credit card rewards (e.g 4 mpd with the UOB Preferred Platinum Visa).

For every Tap & Pay transaction of at least S$3, you’ll receive a scratch card worth anywhere from S$1-10. Do note that this is available for Android phones only, and excludes transit transactions. Each transaction must be unique to receive a scratch card.

For example:

- A uses Tap & Pay for S$3 at Merchant X= 1 scratch card

- A uses Tap & Pay for S$5 at Merchant X= No additional scratch card, as it’s not a unique transaction

- A uses Tap & Pay for S$3 at Merchant Y= 1 scratch card

This is capped at four scratch cards per week.

| ⚠️ You will not earn scratch cards for payments with American Express and Citibank cards, which do not participate in the Google Pay offers & rewards program in Singapore |

Scan & Pay: 4 cards per week

By using the Scan & Pay feature in the Google Pay app to make payments via SGQR, you can earn bonus scratch cards too.

For every Scan & Pay transaction of at least S$3, you’ll receive a scratch card worth anywhere from S$1-10. Unlike Tap & Pay, this is available for both Android and iOS users. Each transaction must be unique to receive a scratch card.

For example:

- A uses Scan & Pay for S$3 at Merchant X= 1 scratch card

- A uses Scan & Pay for S$5 at Merchant X= No additional scratch card, as it’s not a unique transaction

- A uses Scan & Pay for S$3 at Merchant Y= 1 scratch card

This is capped at four scratch cards per week.

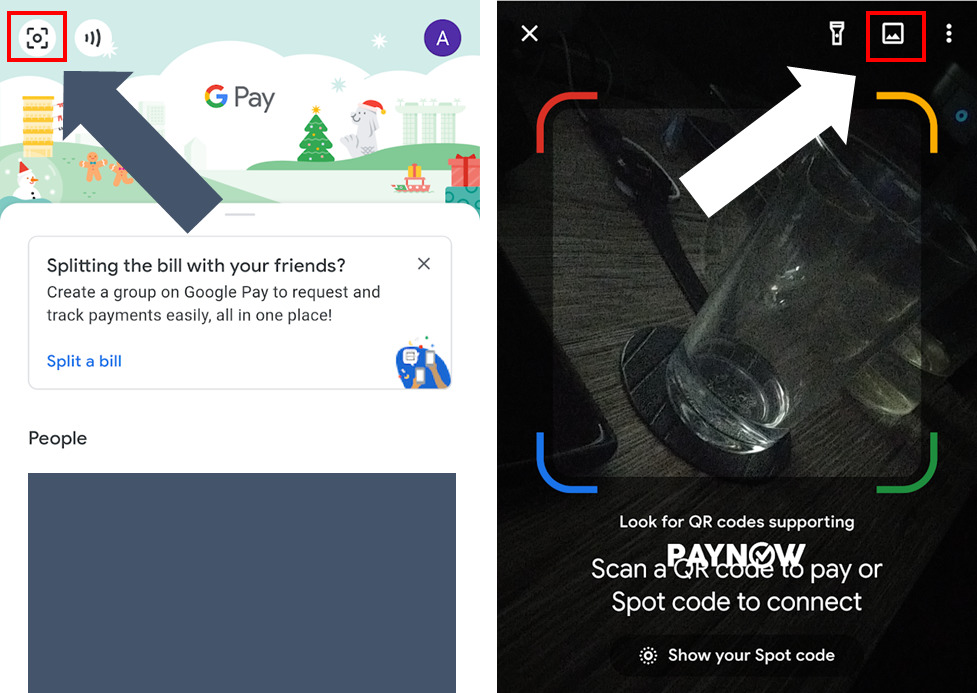

Here’s a little tip, courtesy of Ron in the Milelion’s Telegram Group. You can use Google Pay to top-up your GrabPay balance with just S$3, earning an easy scratch card without leaving the house.

To do this, navigate to your GrabPay Wallet and tap the “top-up” option. Scroll down and select “Banking app”. A QR code will be displayed. Tap “Save to photos”.

Now open your Google Pay app and tap the scan icon at the top left. Look at the top right for the upload image option, select the saved QR code and make a payment of at least S$3 to Gpay Network (I’m aware the GrabPay instructions say top-ups must be at least S$10, but S$3 still works for whatever reason).

That’s it! You’ll get a scratch card worth anywhere from S$1-10, and I must say I lucked out on this particular transaction…

Apparently you used to be able to do this multiple times, but Google has added a “unique” qualifier so now you’ll only get it on the first GrabPay top-up each week.

Other Google Pay offers

In addition to the scratch card offers, Google Pay users who take public transport rides and pay with their Visa card via Google Pay can win S$888 cashback.

All you need is a single Tap & Pay transaction with a Visa card at a bus or train gantry from now till 20 December 2020. If you’re eligible, you’ll earn a scratch card that will be activated on 21 December 2020. Scratch the card and see if you’re one of eight lucky winners of S$888.

How do I set up Google Pay Singapore?

To start, simply download the Google Pay app on either your Android or iOS device.

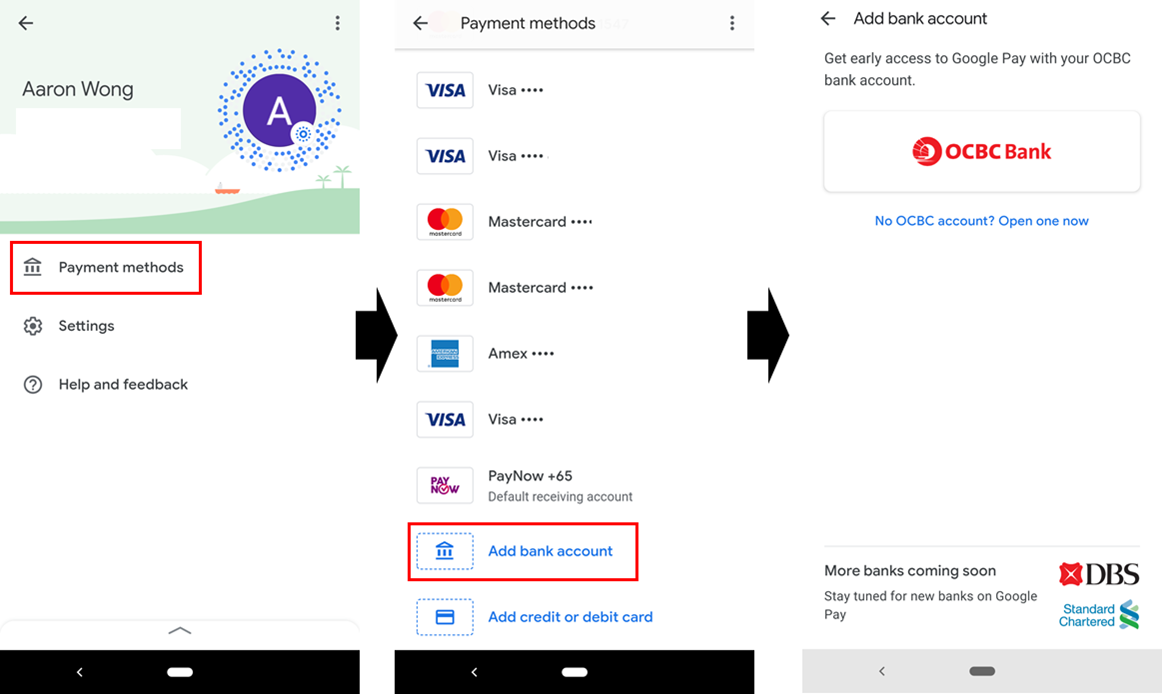

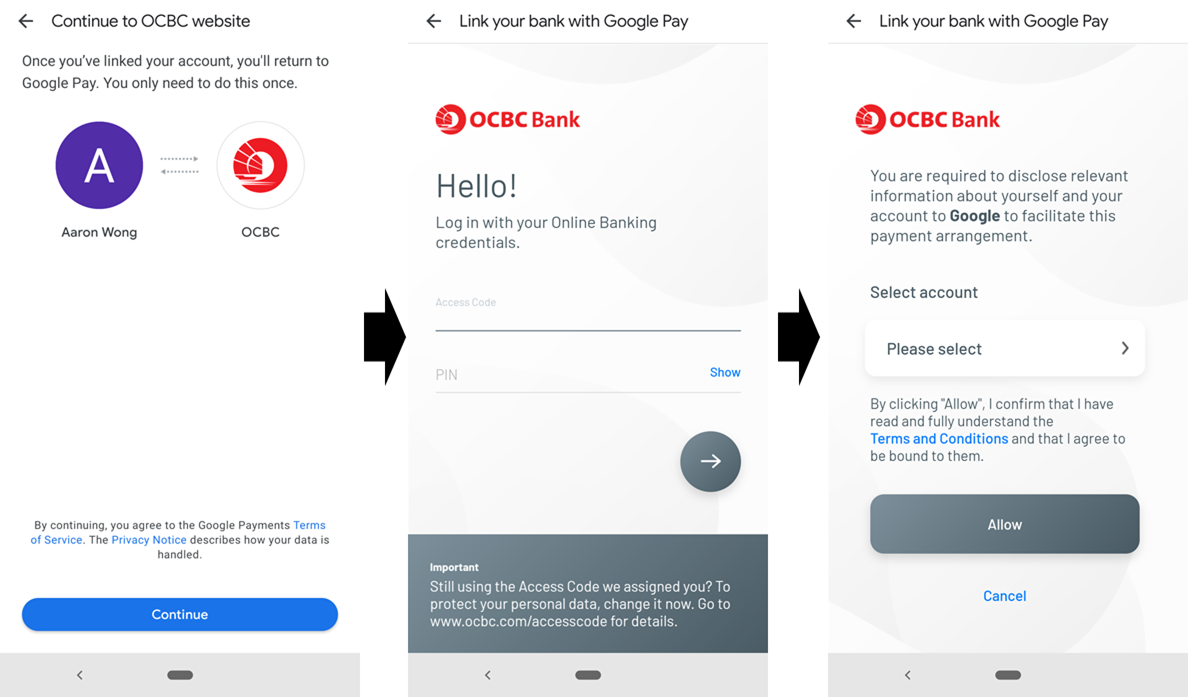

Navigate to your profile settings and tap “Payment Methods”. Then tap “Add bank account”, and select OCBC, DBS PayLah or Standard Chartered Bank. I’m going to show the process flow for OCBC below, but it’s very similar for DBS PayLah and Standard Chartered Bank.

You’ll be prompted to login to your online banking account to do a one-time setup. Select the account you want to pair with Google Pay Singapore, enter the OTP and you’re good to go.

Google Pay Singapore harnesses the PayNow platform, so you can send money to anyone’s mobile number as you would with any other banking app. There’s no need for the receiving party to use Google Pay- so long as they have a registered PayNow account, they’ll receive the funds.

| ⚠️ However, if you wish to earn the scratch card under the “send or receive money” promotion, both parties must be Google Pay users |

Standard Chartered customers have a daily transfer limit of S$1,000, while OCBC customers have a cap of S$2,000. For DBS PayLah, you are limited by the wallet limit of your account. Google Pay itself has a daily transfer limit of S$2,000.

Conclusion

Google Pay continues to splash out the scratch cards and sign-up bonuses, something I’m sure won’t last forever- but hey, make hay.

There’s really no reason not to use it. You normally don’t earn anything on your PayNow transfers, and you can stack this with your regular credit card rewards for in-store payments.

Apart from topping up GrabPay, you could also qualify for the “Scan & Pay” by topping up your TransferWise account or making an online donation (both using SGQR code)

Aaron, this looks like it last only until end of year. Was the promotion offered earlier (11 weeks prior)?

google pay has been consistently offering promotions since april this year actually

Cheers, good quality posts as always