Google Pay was running some extremely generous offers for December 2020, but unfortunately is kicking off 2021 by dramatically scaling them back.

While you could previously earn up to 11 scratch cards per week, that’s now been cut to just four. Further restrictions have been added on scratch cards for money transfers, and the referral bonus has been cut from S$8 to S$3.

|

| Get S$3 free when you sign up for Google Pay here |

| Simply make a Google Pay transaction of min. S$10 value |

All in all you’re looking at a lot less free money this month, but hey, it’s still free. Let’s break it down.

Latest Google Pay Scratch Card Promotions

For the uninitiated, Google Pay awards scratch cards for sending money or making payments. These unveil cash prizes (guaranteed for some transactions, non-guaranteed for others) that are immediately credited to your bank account via PayNow.

The latest set of Google offers allows you to earn up to four scratch cards per week till 24 January 2021, each one valued at up to S$10. A week is defined as Monday 8.30 a.m to the following Monday 8.29 a.m.

Send money to friends: 2 cards per week

| Up to 31 Dec 20 | From 1 Jan 21 | |

| Max Cards Per Week | 3 | 2 |

| Min. Transfer | S$10 | S$10 |

| Max Times You Can Transfer to Same Person | Once/ week | Once/ month |

| Who Receives? | Sender & Receiver | Sender |

| Scratch Card Value | Up to S$10 | Up to S$10 |

It’s pretty grim on the money transfer front. Google Pay has cut the maximum scratch cards that can be earned each week from three to two, further restricted the number of times you can send money to the same person, and changed its rules such that only the sending party gets a scratch card.

For every send money transaction of at least S$10 made to another Google Pay user, you will earn one scratch card worth up to S$10. This is capped at two cards per week.

Transactions must be unique; for example:

- A sends S$10 to B = A gets a scratch card

- B sends S$10 to A= B gets a scratch card

- A sends S$10 to B again= No scratch card, because A has already sent to B this month

Tap & Pay OR Scan & Pay: 2 cards per week

| Until 31 Dec 20 | From 1 Jan 21 | |

| Max Cards Per Week | 8 | 2 |

| Min. Transaction | S$3 | S$3 |

| Scratch Card Value | S$1-10 | Up to S$10 |

Here’s a major nerf. Tap & Pay and Scan & Pay used to be separate categories for Google Pay, and each was eligible for up to four scratch cards per week. Google has now grouped them together, and reduced the maximum scratch cards for this category to two.

For every Tap & Pay/ Scan & Pay transaction you make of at least S$3, you’ll earn a scratch card worth up to S$10. This is capped at two cards per week. Do note that Tap & Pay transactions are only available for Android phones, and exclude transit transactions.

Transactions must be unique; for example:

- A uses Tap & Pay for S$3 at Merchant X= 1 scratch card

- A uses Tap & Pay for S$5 at Merchant X= No additional scratch card, as it’s not a unique transaction

- A uses Tap & Pay for S$3 at Merchant Y= 1 scratch card

| ⚠️ You will not earn scratch cards for Tap & Pay transactions with American Express and Citibank cards, which do not participate in the Google Pay offers & rewards program in Singapore |

Other Google Pay offers

Google Pay is continuing its weekly public transport offer, where users who take bus/MRT rides and pay with their Google Pay-linked Visa card can win S$888 cashback.

All you need is a single Tap & Pay transaction with a Visa card at a bus or train gantry from now till 3 January 2021 (this typically gets extended each week). If you’re eligible, you’ll earn a scratch card that will be activated on 4 January 2021. Scratch the card and see if you’re one of eight lucky winners of S$888.

Unfortunately, Google Pay has nerfed its food ordering promotion. Previously, you’d receive S$5 with a minimum food order of S$10, capped at once per week. That’s been cut to S$2.50 until 24 January 2021.

How do I set up Google Pay Singapore?

To start, simply download the Google Pay app on either your Android or iOS device.

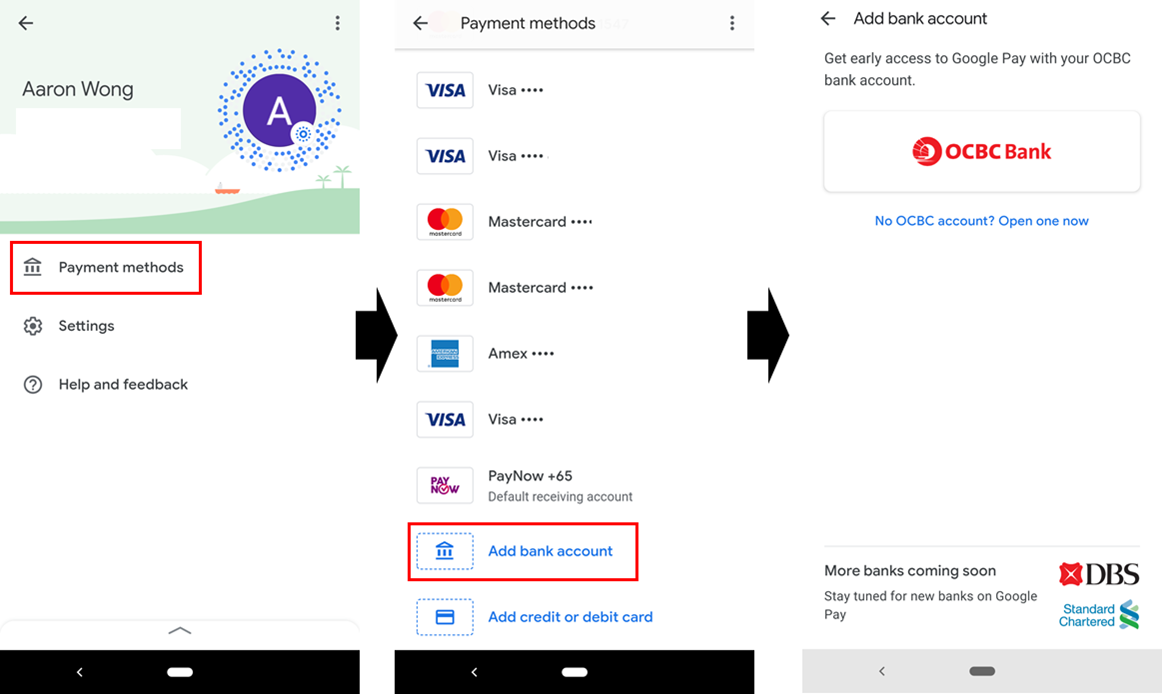

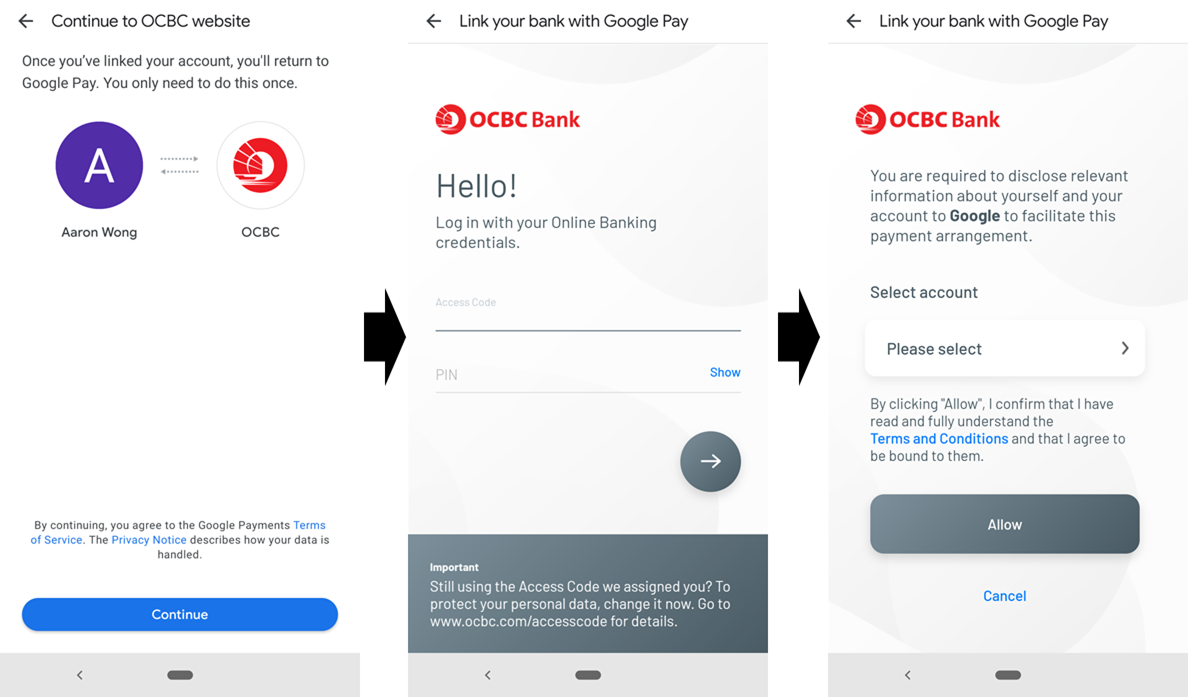

Navigate to your profile settings and tap “Payment Methods”. Then tap “Add bank account”, and select OCBC, DBS PayLah or Standard Chartered Bank. I’m going to show the process flow for OCBC below, but it’s very similar for DBS PayLah and Standard Chartered Bank.

You’ll be prompted to login to your online banking account to do a one-time setup. Select the account you want to pair with Google Pay Singapore, enter the OTP and you’re good to go.

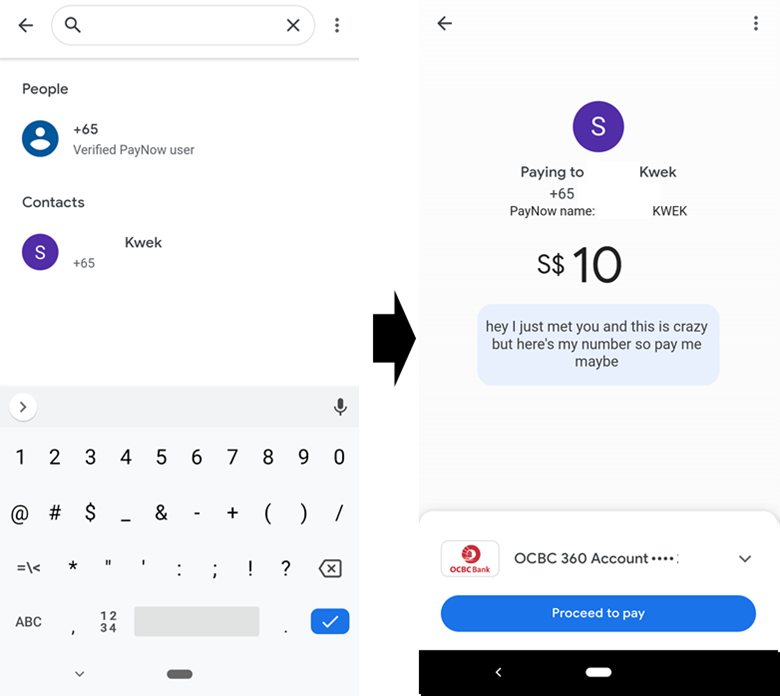

Google Pay Singapore harnesses the PayNow platform, so you can send money to anyone’s mobile number as you would with any other banking app. There’s no need for the receiving party to use Google Pay- so long as they have a registered PayNow account, they’ll receive the funds.

| ⚠️ However, if you wish to earn the scratch card under the “send or receive money” promotion, both parties must be Google Pay users |

Standard Chartered customers have a daily transfer limit of S$1,000, while OCBC customers have a cap of S$2,000. For DBS PayLah, you are limited by the wallet limit of your account. Google Pay itself has a daily transfer limit of S$2,000.

Conclusion

Google Pay’s January offers are much less generous than those last month, but hey, we knew it couldn’t last forever.

In any case, there’s really no reason not to use Google Pay. You normally don’t earn anything on your PayNow transfers, and you can stack this with your regular credit card rewards for in-store payments.

In the interest of transparency, it would be good to mention that referrors also enjoy cashback of the same amount that referrals get. People may wish to get their own friends to refer them.

I tried to use Google paynow transfer linked to my ocbc account. however was unable to process despite my bank paynow limit being much higher. I did a virtual chat with the Google rep, it was told all paynow default agreement with bank and Google was set at $1000 only.