American Express has extended its acquisition offer for the AMEX Singapore Airlines Business Credit Card, which now runs until 12 July 2021 (previously: 31 May 2021).

The good news is that the first year’s annual fee continues to be waived, and you still get a complimentary Accor Plus membership just by signing up. You’re literally getting a free hotel night without any spending required.

Also, from 13 July 2021, the value of HighFlyer points will be doubled, making this one of the best general spending cards on the market.

AMEX Singapore Airlines Business Card Acquisition Offer

AMEX Singapore Airlines Business Card members who receive approval by 12 July 2021 and spend at least S$5,000 in the first 3 months will receive a free night stay at the Fairmont Singapore (this is on top of the free stay that comes with Accor Plus).

| AMEX defines “first 3 months” as the first partial calendar month plus subsequent three full calendar months, so by applying early in the month, you effectively have almost four months to spend. |

The T&C are mum about the specific type of room you get, so it’s best to assume it’ll be the lead-in category, a 45 sqm Fairmont Room. Bookings must be made by 30 September 2021, and stays completed before 31 December 2021.

AMEX is fairly liberal with what counts towards sign-up bonus spending, and even more so with the AMEX Singapore Airlines Business Card. With the exception of the following, everything else will count towards the S$5,000 requirement.

|

This means GrabPay top-ups and insurance payments will earn points and count towards sign-up bonus spending (unlike with AMEX consumer cards). This makes it one of only two cards (the other being the AMEX True Cashback Card) that still award points for GrabPay top-ups.

In addition to this, AMEX Singapore Airlines Business Card members will also enjoy the following bonuses:

- 5,000 HighFlyer points with S$500 spent with the SIA group in the first year

- 15,000 HighFlyer points with S$10,000 spent each year with the SIA group

Overview: AMEX Singapore Airlines Business Card

Apply Here Apply Here |

|||

| Income Req. | S$30,000 p.a | Points Validity | 3 years |

| Annual Fee | S$299 (First Year Free) |

Min. Transfer | N/A |

| Miles with Annual Fee |

None | Transfer Partners | Singapore Airlines |

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn* | 1.8 mpd | Points Pool? | N/A |

| FCY Earn* | 1.8 mpd | Lounge Access? | Yes |

| Special Earn* | 8.5 mpd on SIA Group | Airport Limo? | No |

| Cardholder Terms and Conditions *From 13 July 2021 |

|||

AMEX Singapore Airlines Business Card members earn 8.5 HighFlyer points per S$1 on Singapore Airlines, SilkAir and Scoot transactions (this includes the 5 base HighFlyer points that all HighFlyer companies already earn), and 1.8 HighFlyer points per S$1 on transactions elsewhere.

| ✈️ What is HighFlyer? |

|

HighFlyer is Singapore Airlines’ loyalty program for SMEs. The program is free to join and does not require any minimum spend commitment; all you need to sign up is an ACRA business registration number.

HighFlyer is essentially a cash rebate scheme. Companies earn 5 HighFlyer points per S$1 spent on Singapore Airlines, SilkAir, Scoot, Lufthansa, and SWISS (excluding airport fees and government taxes), and can redeem them at a rate of 1,000 HighFlyer points= S$10. This is an effective rebate of 5%, which may not sound like a lot to consumers, but makes a world of difference for cash-strapped SMEs. HighFlyer points are valid for 3 years, and cannot be earned on Q, N, V and K booking classes (i.e Economy Lite fares). They can be converted into KrisFlyer miles for nominated employees at a rate of 2 HighFlyer points= 1 KrisFlyer mile (1 HighFlyer point= 1 KrisFlyer mile from 13 July 2021) |

Based on the conversion rates, you could see this as a cashback card with 8.5% rebates on Singapore Airlines, SilkAir, and Scoot transactions and 1.8% elsewhere (keep in mind it’s restricted cashback, insofar as it can only be spent with the SIA Group), or a miles card with earn rates of 4.25 mpd and 0.9 mpd respectively.

Purchases of Singapore Airlines tickets will enjoy 0% interest for six months, and other purchases get 51 days of interest-free credit. Employees who purchase tickets with the card will still be entitled to accrue miles for personal use, based on the fare class purchased.

In terms of personal benefits, cardholders enjoy:

- Two complimentary visits to Priority Pass lounges

- A complimentary Accor Plus membership with one free stay every year and up to 50% off dining

- Hertz Gold status with 10% off best available rates and one class upgrades

- A fast track to KrisFlyer Elite Gold status with S$15,000 or more spent on Singapore Airlines group transactions in the first year of card membership

- Complimentary travel insurance when travel tickets are bought with the card

Complimentary Accor Plus Membership

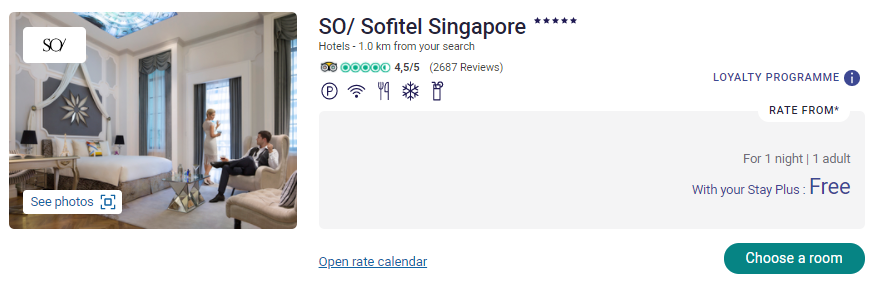

Here’s what I see as the main draw: AMEX Singapore Airlines Business Card members receive a free Accor Plus membership, which includes the “Stay Plus” benefit- one complimentary hotel night each year.

Even if you can’t go overseas right now, the Stay Plus benefit can be redeemed at local hotels such as:

- Sofitel Singapore City Centre

- SO/ Sofitel Singapore

- Sofitel Sentosa Resort & Spa

- Novotel Singapore On Stevens

- Ibis Singapore on Bencoolen

- Ibis Singapore Novena

Needless to say, you’ll want to redeem your Stay Plus certificate at a Sofitel to maximize its value. Accor Plus members also get access to the periodic Red Hot Rooms sale, which may be a good opportunity to book cheap staycation rates. I’ve seen the Fairmont Singapore going for S$143 nett!

The other big draw of an Accor Plus membership is the dining discounts. The discount structure works like this:

- 25% off dining – 1 member only

- 50% off dining – 1 member and 1 guest

- 33% off dining – 1 member and 2 guests

- 25% off dining- 1 member and 3 guests

- 15% off drinks in Asia

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni, Asian Market Cafe and Szechuan Court at the Fairmont, SKAI, Bar Rouge, Cafe Swiss and Kopi Tiam at Swissotel and The Cliff, The Garden, Kwee Zeen at the Sofitel Sentosa Resort.

For those who have already received their AMEX SIA Business Card, here’s how to go about activating your Accor Plus membership.

Conclusion

If you own a small or medium-sized business, this is a great way to get a free Accor Plus membership with its complimentary one-night hotel stay, up to 50% off dining at more than 1,400 restaurants across Asia Pacific, special rates on hotel rooms and more.

Once again, the annual fee is waived for the first year. Should you enjoy the benefits of an Accor Plus membership, it’s still cheaper to pay the AMEX Singapore Airlines Business Card’s second year S$299 fee, instead of buying an Accor Plus membership elsewhere (S$408 for the version with one free hotel night).

Novotel Clarke quay has closed.

thanks- have updated the list.

Hi Aaron, would I qualify for the above card in the following scenario.

I draw an income (above the card requirement of $30k) from a registered company A where I do not have executive authority. I register a new company B (which has no revenue) and become a business owner (sole-proprietor). Using the NOA (income from company A), I apply for the card in the capacity of owner of company B.

Please advise.

yeah that sounds like it would work to me, but keep in mind i’m not the one doing the approval!

Hi Aaron, do you know if I cancel my AMEX Business Card, will I still have the accor membership? I mean get card, get accor member, few months later, cancel membership. The accor membership and the staycation still available?

you *should* retain it based on what I know, but when i doubt it is always better to clarify with AMEX.