While Google Pay has become almost ubiquitous in Singapore (thanks in no small part to their willingness to throw around free money), not all card-issuers are supported.

The good news is that there’s one less name on the exclusion list, as HSBC has been added into the fold.

HSBC cards are now supported by Google Pay

At some point last month, Google Pay added support for HSBC credit cards issued in Singapore. Cardholders can now digitize their physical cards and add them to their Google Pay wallet, making in-store payments with any NFC-capable phone.

The obvious card of choice for digitization is the HSBC Revolution, which earns 10X points (4 mpd) on contactless payments made at hotels, department and boutique stores, supermarkets, restaurants and more. Both supplementary and principal cards can be digitized, although they’ll continue to share from the same S$1,000 monthly 4 mpd cap.

|

| Apply here and get S$200 cashback |

| Full Review |

Sure enough, the card’s T&Cs have been updated to explicitly include Google Pay in the definition of contactless payments.

| 6. “Selected Contactless Payments” refers to Qualifying Transactions made via Visa contactless through a contactless terminal mode which includes Visa payWave, Apple Pay and Google Pay. |

Digitizing the HSBC Revolution offers much more than just convenience; it can help avoid costly mess ups. The scenario I’m thinking of is restaurants, where your card is taken away at the end of the meal to pay the bill. As much as I remind the staff to use Paywave (4 mpd), it’s inevitable you’ll encounter the odd case where they don’t pay attention and use the chip instead (0.4 mpd).

Now that your card is on your phone, they’ll either bring the terminal to you, or you’ll follow them to the counter and make payment (I suppose you could always have done that with the physical card, but it’s kind of awkward like you’re saying you don’t trust them to do it right; now at least you have the excuse of accompanying your phone).

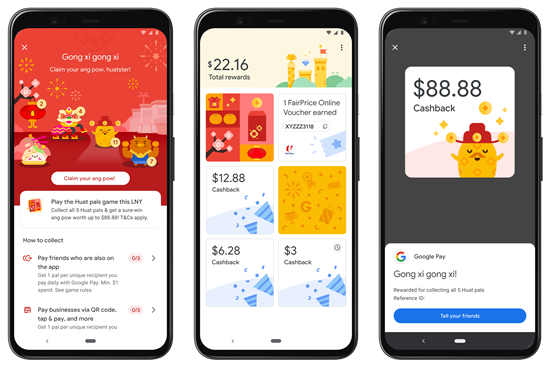

Unfortunately, HSBC is not eligible for Google Pay offers and rewards in Singapore (they’re not the only exclusion; AMEX and Citibank are notably absent too). It means that you won’t earn a scratch card when you pay with your HSBC credit card, and while that’s a bummer, let’s remember that Google Pay has dramatically scaled back its offers of late.

At the time of writing, the only offer available for in-store payments was 2 x scratch cards of up to S$10 per week, with a minimum payment of S$3. What’s more, it’s only available for scan and pay transactions, not tap and pay. Therefore, you’re not going to be missing out on too much here.

Which card issuers are supported by Google Pay?

With the latest update, here’s the full list of card issuers supported by Google Pay in Singapore.

| Supported? | |

| ✅ | |

|

❌ |

| ❌ | |

| ✅ | |

| ✅ | |

| ✅ | |

| ❌ | |

| ✅ | |

| ✅ | |

| ❌ | |

| ✅ | |

|

✅ |

|

✅ |

| ✅ | |

|

✅ |

| ✅ | |

|

❌ |

Certain exceptions do apply (e.g UOB American Express cards are not supported, so you can’t digitize your UOB Preferred Platinum AMEX), so be sure to refer to this article for the full details.

Conclusion

Now that HSBC cards are supported on Google Pay, the only missing miles and points player is Maybank (BOC issues miles cards too, but does anyone care anymore?). It certainly adds more convenience, and those of you lazy to apply for a supplementary card can simply digitize it on both your phone and your partner’s phone to the same end.

The lack of scratch cards is annoying, but you could easily earn those by simply shuffling a couple of payments each week to a different card.

just a note to add that it is applicable for android users only. Apple users can’t use google pay for credit card payment

apple pay users could always have added the hsbc revolution to their digital wallet though

Finally!!!!

The scratch card offers have been only for SGQR code scan and pay for a while now i.e. payment via bank accounts. GPay hasn’t been awarding cards for tap and pay.

thanks! have updated.

Digitizing the same uob card in 2 phones causes issues for me. 1 will be rejected eventually.