UOB has given the KrisFlyer UOB Credit Card a major shake-up by making it easier to qualify for bonus miles, adding a new fast track option for KrisFlyer Elite Silver, and offering up to 12 months additional validity for KrisFlyer miles.

Truth be told though, the only worthwhile enhancement is the first one. The new fast track option for KrisFlyer Elite Silver is extremely onerous with a dubious payoff, and the additional 12 months validity for KrisFlyer miles is so ham-fisted it’s almost funny.

Brief Recap: KrisFlyer UOB Credit Card

First, a brief recap on the KrisFlyer UOB Credit Card’s key features.

Cardholders earn 1.2 mpd on local and foreign currency general spending, and 3 mpd on SIA Group transactions (i.e with Singapore Airlines, Scoot and KrisShop).

Those who spend at least S$500 per membership year on SIA Group transactions will also earn 3 mpd on “Everyday Spend” categories, defined as:

- Dining

- Food delivery

- Online shopping

- Online travel

- Transport

While that’s a very wide range of bonus categories, there’s a major caveat attached. The 3 mpd is broken into:

- A base of 1.2 mpd, awarded when the transaction posts

- A bonus of 1.8 mpd, awarded two months after the card membership year

UOB calls the bonus component, with no small sense of irony, “Accelerated Miles”. These accelerated miles are awarded two months after your card membership year, but take a further month to post to KrisFlyer. This means that in some cases, you’ll be waiting up to 15 months to get the bonus component of your spending. For example, if you spend S$10 on dining on the first day of card approval, 12 miles will be credited now and 18 miles will be credited in 15 months’ time- enjoy!

While there may be some unintended benefits arising from the delayed posting of Accelerated Miles (the doublespeak feels positively Orwellian), the long and the short of it is that you won’t be seeing your bonus for a while.

Accelerated Miles spending threshold reduced from S$500 to S$300

The KrisFlyer UOB Credit Card has now reduced the minimum SIA Group spend required to trigger Accelerated Miles from S$500 to S$300, a 40% reduction.

This is applicable to cardmembers whose card membership year is ending between April 2021 and August 2022 (both months inclusive).

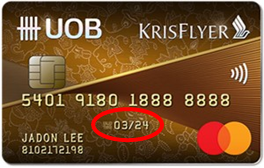

| ❓ How do I know my membership year? |

|

Take a look at the expiry date on your card and note the month. In the example above, the card expires March 2024. This means the cardholder’s membership year runs from 1 March to 28 February each year. He/she will be billed the annual fee every March. |

This raises the possibility that some cardholders may benefit from the lower spending threshold for two years. To illustrate, suppose my membership year runs from May to April:

- From May 2020 to April 2021, the min. spend required to trigger Accelerated Miles will be S$300

- From May 2021 to April 2022, the min. spend required to trigger Accelerated Miles will be S$300

Basically, so long as your membership year ends from April to August, you’ll be able to enjoy the reduced threshold for two years. This is certainly a welcome change, given how difficult it is to clock SIA Group spending at the moment.

Fast track to KrisFlyer Elite Silver with S$50,000 spend

The KrisFlyer UOB Credit Card currently offers a fast track to KrisFlyer Elite Silver for cardholders who spend at least S$5,000 on SIA Group transactions during the first card membership year.

Going forward, cardmembers whose card was approved between 1 May 2021 and 30 April 2022 (both dates inclusive) will have two fast track options for KrisFlyer Elite Silver:

- Spend at least S$5,000 on SIA Group transactions during the first card membership year (same as before)

- Spend at least S$50,000 in total during the first card membership year

The S$50,000 threshold includes all retail spend, save the usual exclusions such as insurance premiums, government transactions, charitable donations, education bills and prepaid account top-ups.

That said, “fast track” is a bit of a misnomer is because the account upgrade only takes place much later- six weeks from the last calendar month of the card membership year, to be precise.

For example, I could get my card approved on 1 May 2021 and spend S$50,000 on the same day (baller that I am). I would need to wait till mid-June 2022 before getting my KrisFlyer Elite Silver status!

In the meantime, I’m missing such lifechanging benefits as:

- A 25% tier bonus on miles flown with Singapore Airlines

- Complimentary standard seat selection when flying Economy Class

- Priority waitlisting & standby

- Waived or discounted KrisFlyer service fees

Truth be told, there’s very little to get excited about here. The fast track offer requires a hefty S$50,000 of spending, it isn’t really a fast track, and KrisFlyer Elite Silver is close to useless.

For those who really want KrisFlyer Elite Silver nonetheless (maybe you think it’d look good on your CV), let me propose a better fast track option:

- Spend S$31,250 on cards that earn you the equivalent of 4 mpd, such as the Citi Rewards or HSBC Revolution

- Take all those credit card points and convert them into 125,000 KrisFlyer miles

- Thanks to SIA’s current “earn on the ground” campaign, you’ll also earn 25,000 Elite miles, which will get you upgraded to KrisFlyer Elite Silver within seven working days

There- you’ve spent 37.5% less and got your upgraded status a million times faster.

Further 12 month validity for KrisFlyer miles

KrisFlyer miles are currently valid for three years (although Singapore Airlines is periodically offering extensions on account of the travel suspensions brought about by COVID-19).

The KrisFlyer UOB Credit Card is now offering cardholders an additional 12 months of validity.

“That’s great,” you say. “And since the 3-year KrisFlyer expiry countdown starts immediately for cobrand cards, this helps ease of the main pain points.”

Well…not really.

UOB has once again gone and completely UOB-ed this, turning what should be a simple policy change into a Kafkaesque nightmare. I hope you’re sitting down, because there’s a lot to dig into here.

First, the 12-month extension only applies to a maximum of 60,000 KrisFlyer miles earned on the card between 1 January to 31 December 2021. This makes little sense to me, because it actually disincentivizes people from spending more.

Second, the extension is not automatic. You will need to manually opt-in via SMS if you want your KrisFlyer miles extended, because, y’know, there may be people out there who dislike such a perk and we don’t want to tick them off by extending miles without their consent.

| 📱 Send SMS to 77862 |

| MILESEXTENSION<space>Last 4 digits of Principal Card number<space>10- digit KrisFlyer membership number<space>number of Eligible Miles to extend |

Third, you’ll need to send this SMS between August 2023 and December 2024 (I’m all for advance notice, but good luck remembering), in accordance with this complicated timeline.

| Earn Month | Expiry Month | SMS submission period |

| Jan 2021 | Jan 2024 | Aug 2023 to Jan 2024 |

| Feb 2021 | Feb 2024 | Sep 2023 to Feb 2024 |

| Mar 2021 | Mar 2024 | Oct 2023 to Mar 2024 |

| Apr 2021 | Apr 2024 | Nov 2023 to Apr 2024 |

| May 2021 | May 2024 | Dec 2023 to May 2024 |

| Jun 2021 | Jun 2024 | Jan 2024 to Jun 2024 |

| Jul 2021 | Jul 2024 | Feb 2024 to Jul 2024 |

| Aug 2021 | Aug 2024 | Mar 2024 to Aug 2024 |

| Sep 2021 | Sep 2024 | Apr 2024 to Sep 2024 |

| Oct 2021 | Oct 2024 | May 2024 to Oct 2024 |

| Nov 2021 | Nov 2024 | Jun 2024 to Nov 2024 |

| Dec 2021 | Dec 2024 | Jul 2024 to Dec 2024 |

“No problem”, you think. “I’ll just text them monthly.”

Wrong again. You can only submit a maximum of two SMS requests (the third one onwards will be disregarded), and each request can consolidate the miles to be extended in blocks of up to six months.

In other words, don’t jump the gun by sending the SMS in August 2023. The only logical way of doing this is to send one SMS in January 2024 (to extend miles expiring from January to June 2024) and another one in July 2024 (to extend miles expiring from July to December 2024).

Each SMS request will be processed within 3 months, and extended miles will be valid for another 12 months from the extension date-not their original expiry date.

Oh, you thought we were done? Not quite. While your KrisFlyer account will show you how many miles are expiring in the upcoming months, it won’t give you a breakdown of where those miles came from.

So how the heck am I supposed to know which of these came from my KrisFlyer UOB Credit Card, and which came from other sources? The T&Cs reserve the right to reject your extension request if your SMS is “inaccurate”, and good luck back calculating how many miles to request extension for in your SMS.

In other words, the entire process is stacked against the customer, from the need to remember to send the SMS, to the limited number of SMSes that can be sent, to the virtual impossibility of accurately calculating how many miles to request extension for.

Surely it would be simpler for all concerned if the miles were just tagged and automatically extended on the back end, but hey, that wouldn’t be the UOB way.

KrisShop and GrabFood discounts

UOB has added a couple of miscellaneous offers for KrisShop and GrabFood which I’ll just cover briefly.

From 1 May to 31 December 2021, KrisFlyer UOB Credit Card members will enjoy S$12 off a minimum spend of S$70 nett (Before GST) in a single transaction on products under KrisShop’s With Love, SG website with the promo code UOBKFSG12.

This is capped at the first 200 redemptions per month.

From 22 April to 31 December 2021, KrisFlyer UOB Credit Card members will enjoy 3x S$5 GrabFood vouchers with the promo code KFUOBCC. These promo codes are valid with a minimum spend of S$30, and redemptions are limited to the first 15,000 throughout the promotion period.

Conclusion

While the reduction in the spending threshold for Accelerated Miles is very welcome, the new KrisFlyer Elite Silver fast track option and the 12 month extension for KrisFlyer miles will be much less useful (the latter so convoluted it verges on insulting).

So mark your calendars to renew your KrisFlyer miles in January 2024, when hopefully SMS communication will still be around…

Lol @ “UOB has once again gone and completely UOB-ed this”

Feedback to anyone at UOB reading this – this is exactly why UOB has not got a cent of credit card fees or banking commission off me in the past five years. I’d rather go to MBS (better odds) than try to actually benefit from a UOB “promotion”.

Typical UOB BS. What were they thinking when they were drafting the perks. Its hopelessly annoying and annoyingly hopeless (pun intended).

I believe if S$50000 are all spent on SQ transpacific premium economy class you’ll be KF Gold already.

Spend 50k in business you will have PPS club

Ya. Thought PPS Club had mileage requirement as well but apparently only $ matters

OMG…..time to cash out and stop renewing this. :O

Nothing about the new sign up bonuses?

see the latest post!