Last month, Citibank ran a 48-hour flash deal for its Citi PayAll bill payment service, offering S$100 of GrabFood vouchers to users who set up a minimum of S$2,000 worth of payments.

This month the deal is back, only the minimum spend has been increased to S$3,000 worth of payments. The reward stays the same at S$100 GrabFood vouchers.

This offer stacks with Citibank’s ongoing PayAll deal where customers receive either a 1% service fee (for existing users) or two fee-free payments (for new users).

Get S$100 GrabFood vouchers with Citi PayAll

To qualify for the GrabFood vouchers, Citi PayAll customers will need to set up at least S$3,000 worth of PayAll payments between 21 April 2021, 12.00 p.m and 23 April 2021, 11.59 a.m. The payment due date must fall before 30 June 2021.

Eligible customers will receive S$100 of GrabFood promo codes, capped at one gift per customer for the promotion period.

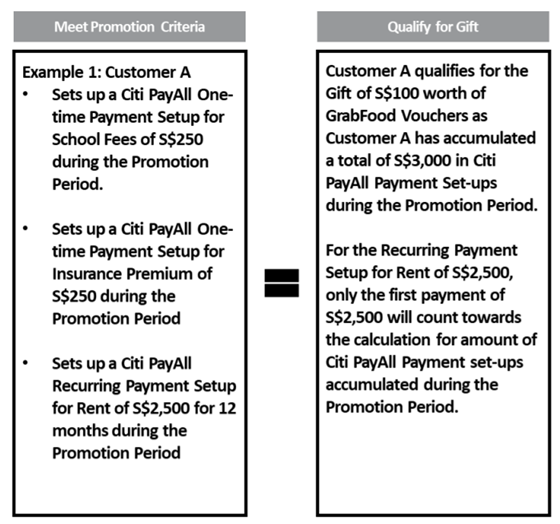

Customers may make more than one Citi PayAll payment to fulfill the promotion criteria. For recurring payment setups, only the first payment of the setup would count towards the S$3,000 calculation.

Here’s the sample scenarios provided by Citibank:

Eligible customers will receive their gift via SMS/email within 10 weeks from the end of 23 April 2021, i.e by 2 July 2021.

This promotion is only valid for the following Citibank cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Cash Back+ Card

The full T&C of this offer can be found here.

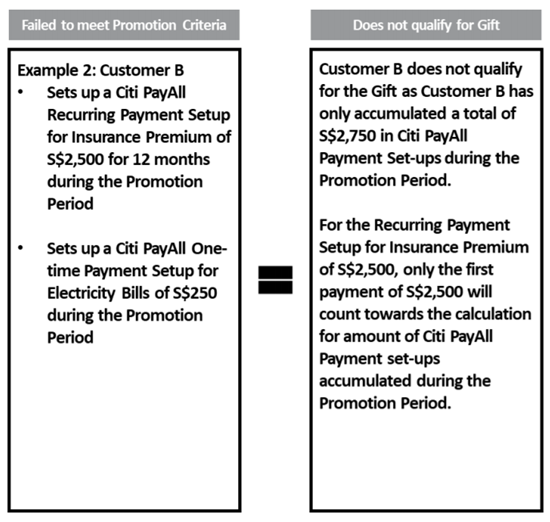

Stack this with Citi PayAll’s ongoing promotion

As mentioned earlier, the S$100 GrabFood vouchers can be stacked with the ongoing 1% service fee (for existing users) or two fee-free payments (for new users) that Citi PayAll is offering.

However, if your payments have already been set up, you’ll need to cancel and set them up again by 23 April 2021, 11.59 a.m, in order to meet the eligibility criteria.

Here’s a recap of the offers.

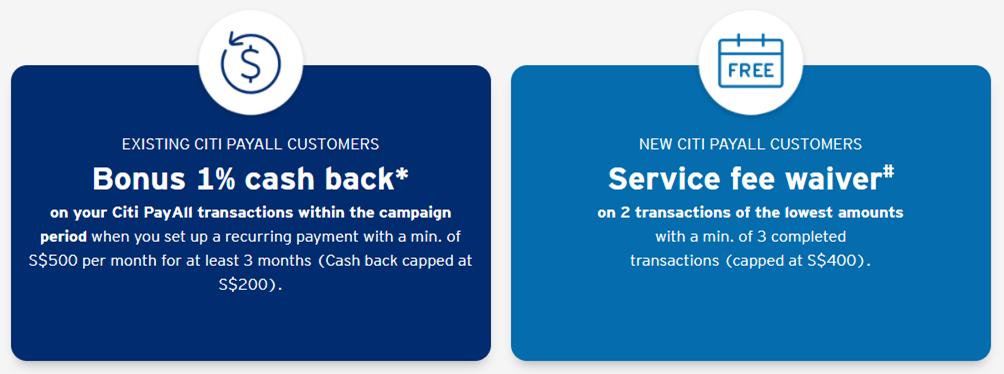

New Customers: 0% Citi PayAll fee for two payments

New customers can enjoy two fee-free Citi PayAll payments, provided they schedule at least three payments between 4 January to 30 April 2021.

The fee waiver will be applied to the two smallest payments scheduled, and rebated in the form of cashback. A maximum cap of S$400 applies.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$10,000 | S$200 |

| Payment 2 | 7 Feb 21 | S$10,000 | S$200 |

| Payment 3 | 7 Mar 21 | S$10,000 | S$200 |

| Total | S$30,000 | S$600 | |

| Cashback | S$400 (smallest two payments) |

||

| Net Fee | S$200 | ||

Your actual cost per mile will depend on the amounts you’re paying. I’m assuming you’re maxing out the S$400 rebate on the dot, which means you can buy miles from just 0.42 cents each- a complete no-brainer.

| Earn Rate (Miles) |

Fee | Cost Per Mile | |

Citi ULTIMA |

1.6 mpd (48,000 miles) |

S$200 | 0.42 cents |

Citi Prestige Citi Prestige |

1.3 mpd (39,000 miles) |

S$200 | 0.51 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd (36,000 miles) |

S$200 | 0.56 cents |

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the new customer offer can be found here.

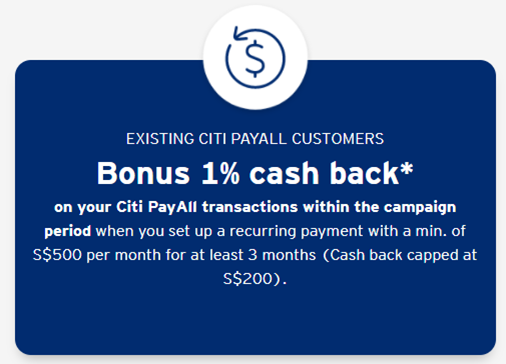

Existing Customers: 1% Citi PayAll fee

Existing customers can enjoy 1% cashback on Citi PayAll payments between 4 January to 30 April 2021. At least three payments must be scheduled in total.

| 💡 Citi defines existing customers as those who have made at least 1 Citi PayAll transaction prior to 4 January 2021. |

You might recall a similar 1% cashback offer for PayAll back in September 2020. This one’s arguably better, because the minimum payment is just S$500 per month (versus S$3,000 previously).

| Current Offer | September 2020 Offer | |

| Admin Fee | 1% | 1% |

| Min. Spend | S$500 per month | S$3,000 per month |

| Duration | 3 consecutive months | 4 months (need not be consecutive) |

| Cap | S$200 | S$1,800 |

That said, there is an overall cap of S$200 (down from S$1,800 previously), which means you’ll exhaust the offer with a total payment of S$20,000.

The set up date and charge date for your first Citi PayAll payment must fall within the promotion period (4 January to 30 April 2021) to qualify, and a minimum payment of S$500 must be made for three consecutive months.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$5,000 | S$100 |

| Payment 2 | 7 Feb 21 | S$5,000 | S$100 |

| Payment 3 | 7 Mar 21 | S$5,000 | S$100 |

| Total | S$15,000 | S$300 | |

| Cashback | S$150 (1% of S$15,000) |

||

| Net Fee | S$150 | ||

Unfortunately, it’s a bit late in the game now for these customers, since we’re already approaching the end of April. The shortest payment interval Citi PayAll supports is weekly, so there’s no way you’d be able to make all three payments within the promotion period.

You can choose to set up a series of payments with some falling inside the promotional period and others outside, but you’ll only earn the cashback for the payments within the promotional period. For example, if the series is 30 Apr 21, 30 May 21, 30 Jun 21, only the 30 Apr 21 payment will earn 1% cashback

Based on a 1% admin fee, you could potentially be buying miles from as little as 0.63 cents each, depending on the Citi card you use.

| Earn Rate | Cost Per Mile @ 1% | |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.63 cents |

Citi Prestige Citi Prestige |

1.3 mpd | 0.77 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 0.83 cents |

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the existing customer offer can be found here.

Are the offers worth it?

Definitely.

Simply put, this is the cheapest price I’ve ever seen miles sold for, and remember: it’s not just KrisFlyer. Citibank points can be transferred to 11 different frequent flyer programs, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles.

| Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

I realise that flying isn’t on anyone’s agenda right now, but just imagine what you could do with miles bought at 0.42-0.83 cents each:

- Singapore to Koh Samui on Bangkok Airways in Business Class for S$84-S$166 round-trip

- Singapore to Europe on Qatar Airways Business Class for S$630-1,245 round-trip

- Singapore to Bangkok on Cathay Pacific Business Class for S$134-266 round-trip

But even if you opt for plain vanilla KrisFlyer, buying miles at less than 1 cent each is flat out arbitrage. For example, you could use KrisFlyer miles to pay for air tickets at a rate of 1.02 cents each, so buying miles at 0.42-0.83 cents is like locking in a travel discount of 19-59%.

Alternatively, you could convert those miles into Shangri-La Golden Circle points at a ratio of 12:1. Golden Circle points can be used for F&B credit at a rate of 10 points= US$1 or US$1.25 (for Jade/Diamond members), so you’d be enjoying quite the discount on dining too.

Conclusion

The addition of $100 GrabFood vouchers to the ongoing Citi PayAll promotion make an already great deal almost impossible to pass up.

As a reminder, Citi PayAll now supports the following types of payments:

|

|

It’s possible to pay other miscellaneous invoices, but if you’re planning to pay a friend or family member, keep in mind there may be tax implications (at least if the person earns more than S$20,000 per annum).

Unfortunately, it’s a bit late in the game now for these customers, since we’re already approaching the end of April. The shortest payment interval Citi PayAll supports is weekly, so there’s no way you’d be able to make all three payments within the promotion period.

I guess can still qualify for new users to Citi PayAll? Since can quickly make 3 ad-hoc payments?

Yes, exactly

Can i set up multiple one-time PayAll payment for rental instead to split the $3000 criteria ?

I’m will be a new Citi Payall member. Can I pay 3x$10k of taxes to qualify for the promotion ? Ie same payee