Income tax season is here, and for those looking to pay their taxes with a credit card, CardUp has launched a promotion offering a 1.75% admin fee (discounted from the usual 2.6%). This rate is available for both new and existing customers, for payments scheduled by 26 December 2021.

Visa and Mastercard: 1.75% admin fee

All CardUp customers, whether new or existing, will be able to enjoy a special rate of 1.75% on income tax payments with the promo code MLTAX2021. This code is valid with all Singapore-issued Mastercard and Visa cards.

| 💡 Further discount for large payments |

| If your tax bill is at least S$30,000, you can write to CardUp and get a special promo code entitling you to a fee of 1.7% instead. A Visa card must be used for payment. |

There is no minimum or maximum payment to use this code. Payments must be scheduled by 26 December 2021, with a due date by 7 January 2022. The full T&C for this code can be found here.

This promo code can be redeemed a maximum of once per user. CardUp users can pay any amount, up to and including the total tax due amount on their NOA. Monthly payment options are also available for income tax, but the 1.75% admin fee will only apply to the first payment of a recurring tax payment series, so be advised.

| For AMEX users, CardUp has launched a separate offer of 2.4% or 2.2% |

What’s the cost per mile?

With the discounted admin fee, here’s how much buying miles will cost with the following Visa and Mastercard credit cards:

| Card | Miles per S$1 | Cost Per Mile (1.75% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.23 |

UOB PRVI Miles Visa or Mastercard UOB PRVI Miles Visa or Mastercard |

1.4 | 1.23 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.23 |

Citi Prestige Citi Prestige |

1.3 | 1.32 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.43 |

SCB X Card SCB X Card |

1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

OCBC 90N OCBC 90N |

1.2 | 1.43 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.43 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.72 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

| ❓ A list of all the cards that offer miles and points for CardUp payments can be found here. Broadly speaking, any general spending card will earn points with CardUp (except HSBC). There are no 10X opportunities, however, so don’t use cards like the Citi Rewards or DBS Woman’s World Card. |

Most options here yield a cost of 1.5 cents per mile or less, which is a very good price to purchase miles.

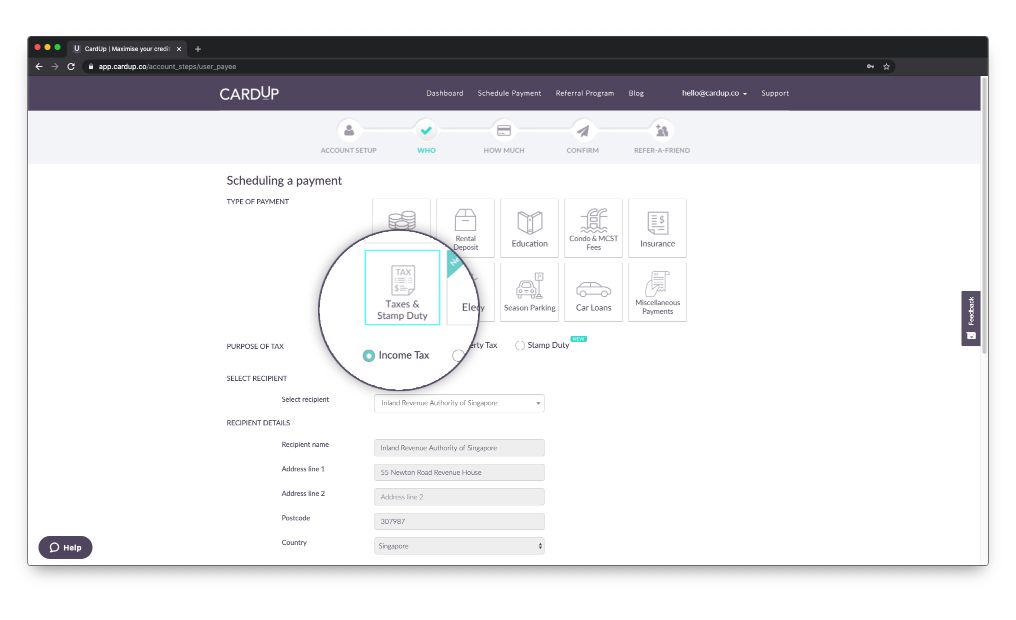

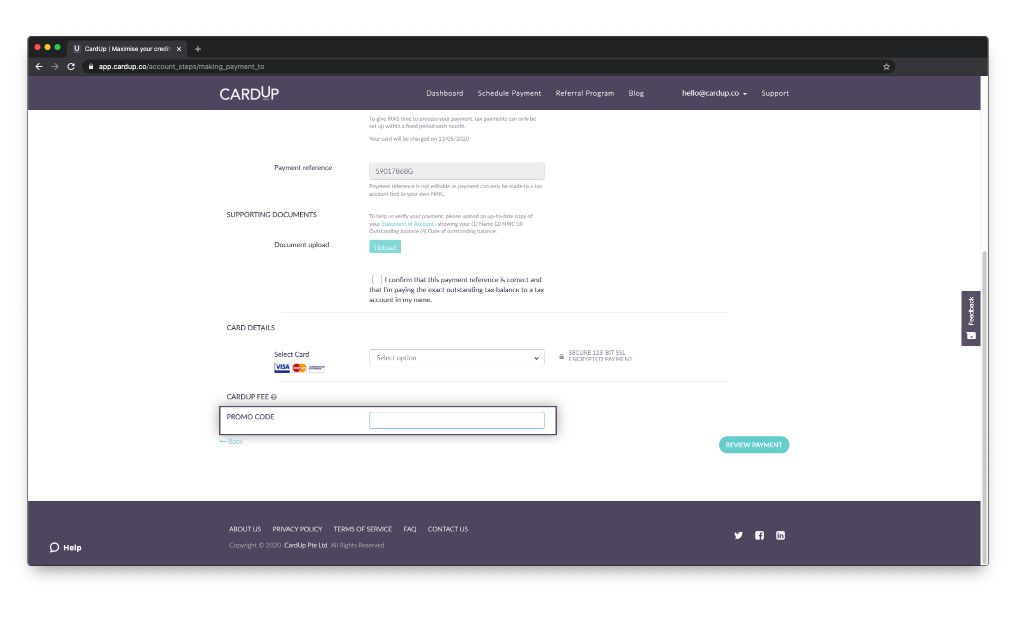

How do I use the promo code?

After you’ve logged in to your CardUp account, click the “Schedule Payment” button and select “Taxes & Stamp Duty”. Select “Income Tax”, acknowledge the terms and conditions and click “Next”.

Enter the amount you wish to pay. This should match the amount reflected on your NOA

Next, enter the date on which you wish to make payment.

You’ll also be prompted to upload your NOA and enter the relevant promo code (MLTAX2021)

Ensure the 1.75% fee reflects on the final screen, then submit your payment for approval.

What are my other options for paying tax?

I’ve published the updated Milelion guide to earning miles with income tax payments, so be sure to check it out for the full range of options.

2021 Edition: How to pay IRAS income tax with your credit card (and earn miles)

Conclusion

If you haven’t received your NOA yet, don’t worry- I promise you the government hasn’t forgotten! NOAs are sent out in batches from now till September 2021, so you’ll get yours sooner or later.

In the meantime, CardUp’s 1.75% fee matches their offer from last year, allowing you to generate a sizeable sum of miles for a competitive price when settling your tax bill.

Hi, I have never successfully use Cardup or any of the credit cards to pay the income tax. every year the application will be rejected. My current tax is paid via Giro. Do you know if I need to terminate the Giro first?

by right no- i’m on a giro arrangement and haven’t had any issues.

If you had previously tried to pay anything less than the full income tax amount on CardUp, it would have been rejected.

Not sure if this helps, but it seems that CardUp is offering a slightly cheaper option at 1.7% for some of OCBC cards:

https://discover.cardup.co/personal/generic-tax-2021/?utm_source=website&utm_medium=popup&utm_campaign=personal_incometax2021&utm_content=