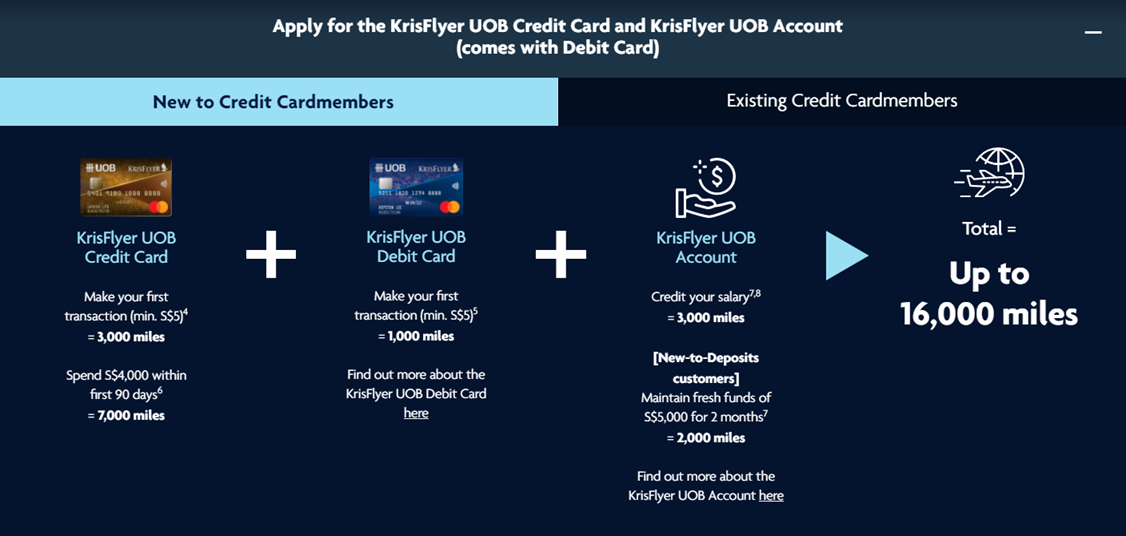

UOB has launched a new offer for the KrisFlyer UOB suite of products, offering applicants the opportunity to earn up to 16,000 KrisFlyer miles with just S$4,005 of spending.

This offer is valid until 31 July 2021 and is broken down into:

- KrisFlyer UOB Credit Card: Up to 10,000 miles

- KrisFlyer UOB Debit Card: Up to 1,000 miles

- KrisFlyer UOB Account: Up to 5,000 miles

KrisFlyer UOB Credit Card: Up to 10,000 miles

New first-time applicants of the KrisFlyer UOB Credit Card will receive 3,000 bonus KrisFlyer miles when they charge at least S$5 to their card. This is the same offer that’s been available since July 2019.

What’s new is that new-to-bank applicants who apply and get approved for a KrisFlyer UOB Credit Card from 22 April 2021 to 31 July 2021 will receive 7,000 bonus KrisFlyer miles when they spend at least S$4,000 within the first 90 days of approval. Mercifully, there is no cap on the number of eligible applicants, unlike UOB’s usual promotions.

| ❓ New-to-bank applicants are defined as those who do not hold any principal UOB credit cards now, and/or have not cancelled a KrisFlyer UOB Credit Card in the 6 months prior to 22 April 2021. Note that this doesn’t exclude former UOB cardholders who cancelled their cards recently, so long as it wasn’t a KrisFlyer UOB Credit Card. |

Qualifying spend excludes the usual suspects like insurance premiums, government payments, charitable donations, education bills and prepaid account top-ups. The full list of exclusions can be found in the card’s T&Cs at point 1.5.

Bonus KrisFlyer miles will be awarded as per the following timeline- be prepared to wait!

| Approval Date | Bonus Miles Credited |

| 22 April to 30 April 2021 | By 30 November 2021 |

| 1-31 May 2021 | By 31 December 2021 |

| 1-30 June 2021 | By 31 January 2022 |

| 1-31 July 2021 | By 28 February 2022 |

The T&C of this offer can be found here.

KrisFlyer UOB Debit Card: Up to 1,000 miles

New first-time applicants of the KrisFlyer UOB Debit Card will receive 1,000 bonus KrisFlyer miles when they charge at least S$5 to their card.

This is the same perk that’s been around since July 2019.

KrisFlyer UOB Account: Up to 5,000 miles

3,000 miles for account opening

New-to-bank applicants who apply and get approved for a KrisFlyer UOB Account during any of the qualifying periods below will receive 2,000 bonus KrisFlyer miles when they deposit and maintain S$5,000 in fresh funds for at least two months.

- Period 1: 22 April to 31 May 2021

- Period 2: 1-30 June 2021

- Period 3: 1-31 July 2021

This is capped at the first 200 eligible applicants per qualifying period, so ideally you’ll apply as close to the start of each period as possible.

| ❓ New-to-bank applicants are defined as those who do not hold any UOB current or savings account now, or in the 12 month period prior to 22 April 2021. |

Bonus KrisFlyer miles will be awarded as per the following timeline. Thankfully, it’s slightly faster than the bonus for the KrisFlyer UOB Credit Card.

| Date of Fresh Funds Deposit | Bonus Miles Credited |

| 22 April to 30 April 2021 | By 30 September 2021 |

| 1-31 May 2021 | By 31 October 2021 |

| 1-30 June 2021 | By 30 November 2021 |

| 1-31 July 2021 | By 31 December 2021 |

2,000 miles for salary credit

New-to-bank applicants who apply and get approved for a KrisFlyer UOB Account from 22 April to 31 July 2021 will receive 3,000 bonus KrisFlyer miles when they credit their monthly salary of minimum S$2,000 at least once within two months of account opening.

Bonus KrisFlyer miles will be awarded as per the following timeline.

| Date of Account Opening | Bonus Miles Credited |

| 22 April to 30 April 2021 | By 30 September 2021 |

| 1-31 May 2021 | By 31 October 2021 |

| 1-30 June 2021 | By 30 November 2021 |

| 1-31 July 2021 | By 31 December 2021 |

The T&C of this offer can be found here.

Is it worth participating?

In my book, there’s absolutely nothing wrong with getting a KrisFlyer UOB Credit and Debit Card and spending S$5 on each just to get the 4,000 bonus miles as a welcome gift.

While the KrisFlyer UOB Credit Card’s sign up bonus of 7,000 miles with S$4,000 spend certainly isn’t among the best out there, it’s a “good for UOB” bonus, in particular because of the lack of a cap.

Opening and maintaining S$5,000 in the KrisFlyer UOB Account for two months will earn you paltry interest of just 0.05% p.a, but with bank accounts cutting interest rates all over, the opportunity cost isn’t as significant as before (you’ll still want to withdraw the funds as soon as the “lock-in” period ends, though). Likewise, assuming you can easily switch your salary crediting bank for just one month without annoying HR, there’s an easy 2,000 miles in it for you.

Conclusion

On the whole I’d say there’s a bit of work to be done to unlock the 16,000 miles, but ultimately you could get all this by spending a mere S$4,005 (S$4,000 on the KrisFlyer Credit Card and S$5 on the Debit Card). Remember, that’s on top of whatever base miles you’d earn from your spend.

Be sure to check out a full review of the KrisFlyer UOB Credit Card below.

How does KF UOB account compare to UOB One Account?

For one, the UOB One account only allows these cards to clock spending: One CC, YOLO CC, Lady’s CC, One Debit Mastercard and One Debit Visa. The UOB KF account only allows these cards to clock spending: PRVI CC (any of the 3), KF CC, Priority Banking VI, and KF Debit Card. Also, the UOB One account gives interest in cash, while the UOB KF account gives “interest” in the form of miles. For the UOB KF account, the mileage interest can be calculated as (0.05+0.6*(your valuation of a mile)) % per annum, assuming your limiting factor is your balance… Read more »

Hi Aaron, thanks for the reply. Mile valuation unit is in cent?

It’s not Aaron lol… Yeah in cpm

I’m not Aaron…yes in cpm

Thanks mate!

Will I be able to get up to 16k miles if I apply through the singsaver link in this page? I read somewhere in the T&C that need to apply through UOB website