OCBC has launched a new offer with CardUp for 90°N, Premier Visa Infinite and VOYAGE cardholders, allowing them to make payments with just a 1.7% fee. Depending on which card you hold, the equivalent cost per mile could be as low as 1.04 cents each.

This offer can be used with any supported CardUp payment, including insurance premiums, condo MCST fees, car loans, helper salary, electricity bills and more.

1.7% CardUp fee with OCBC credit cards

Both new and existing CardUp personal account users are eligible for this offer, so long as they schedule a payment between 19 May and 24 August 2021 (both dates inclusive). The payment due date must be on or before 27 August 2021.

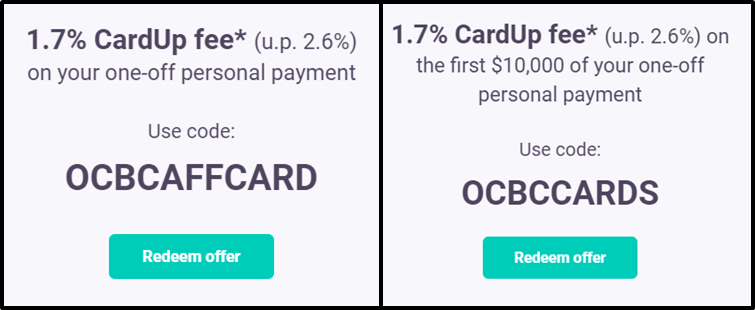

Using the following promo codes will reduce the CardUp fee from 2.6% to 1.7%.

| Card | Code | Fee |

OCBC VOYAGE OCBC VOYAGE OCBC Premier VI OCBC Premier VI |

OCBCAFFCARD | 1.7% |

OCBC 90N OCBC 90N |

OCBCCARDS | 1.7% |

The main difference is that the OCBCAFFCARD code has no cap on the maximum payment that can be made, while the OCBCCARDS code is capped at S$10,000. If your payment is more than S$10,000, a 2.6% fee will apply to any amount above S$10,000. OCBC illustrates it as follows:

For clarity, for a charge of S$10,900, the first S$10,000 will be based off the fee of 1.70% (Total fee charged = S$10,000 X 1.70% = S$170) and the remaining S$900 will be based off the effective fee of 2.6% (Total fee charged = $900 X 2.6% = 23.4). Only the final fee S$193.4 will be reflected.

Both codes are valid for single use each, but if you have an OCBC 90N and an OCBC VOYAGE for example, you may use each code once.

The full T&Cs for both promo codes can be found here.

What’s the cost per mile?

Here’s what the cost per mile looks like, depending on the card you hold.

| Card | Miles per S$1 | Cost Per Mile (1.7% fee) |

OCBC Premier, PPC and BOS VOYAGE OCBC Premier, PPC and BOS VOYAGE |

1.6 | 1.04 |

OCBC VOYAGE OCBC VOYAGE |

1.3 | 1.29 |

OCBC Premier VI OCBC Premier VI |

1.28 | 1.31 |

OCBC 90N OCBC 90N |

1.2 | 1.39 |

The range of 1.04 to 1.39 cents per mile is very enticing indeed, although do remember that if you have selected Citibank credit cards, you can earn 2.5 mpd on any Citi PayAll payment with a 2% fee- effectively 0.8 cents per mile. That’s the best offer on the market right now, bar none.

Don’t forget that CardUp is currently offering a 1.75% fee for income tax payments made by 24 August 2021 (use code MLTAX2021), so you might want to take advantage of that instead and save the 1.7% fee for another payment.

For a full summary of earning miles while making income tax payments, be sure to refer to the article below.

2021 Edition: How to pay IRAS income tax with your credit card (and earn miles)

Conclusion

With OCBC’s latest offer, there’s no shortage of opportunities to pick up some miles on the cheap. If the only bill on your hands is income tax, then by all means use this code, but otherwise, I’d recommend taking the 1.75% income tax promotion (MLTAX2021) and saving the 1.7% fee for a different type of payment.

Remember to schedule your payment by 24 August 2021 to be eligible.