From 5-18 October 2021, DBS has brought back its largest-ever offer for new DBS/POSB credit card sign-ups.

New-to-bank customers will receive S$300 cashback when they apply with the promo code OCTFLASH and make a minimum spend of S$300. While previous S$300 offers involved making just a single qualifying transaction, it appears that a minimum spend of S$300 is the new normal going forward.

| ⚠️ DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not done so in the past 12 months |

Which DBS cards are eligible?

The following credit cards are eligible for this promotion.

| Card | Annual Fee | Key Features |

DBS Live Fresh DBS Live FreshApply here |

S$192.60 (First year free) |

Up to 10% cashback on online and contactless |

DBS Altitude Visa DBS Altitude VisaApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend, 2 lounge passes |

DBS Altitude AMEX DBS Altitude AMEXApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend |

DBS Woman’s Card DBS Woman’s CardApply here |

S$160.50 (First year free) |

2 mpd on online spending |

DBS Woman’s World Card DBS Woman’s World CardApply here Read Review |

S$192.60 (First year free) |

4 mpd on online spending |

POSB Everyday Card POSB Everyday CardApply here |

S$192.60 (First year free) |

Up to 8% rebates on groceries, online food delivery and more |

Here’s what you need to do:

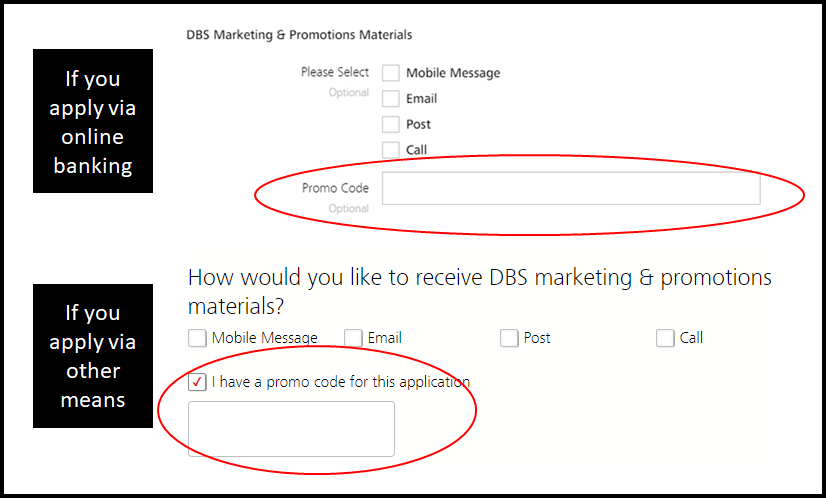

- Apply by 18 October 2021 with the code OCTFLASH (don’t forget to enter the code- no code, no cashback!)

- Receive approval by 25 October 2021

- Activate your card

- Make a minimum qualifying spend of at least S$300 within 30 days of approval

The S$300 cashback will be credited to your account within 50-75 days of card approval.

Qualifying spend is based on posted local and foreign retail sales and posted recurring bill payments, but excludes the following:

- posted 0% Interest Instalment Payment Plan monthly transactions;

- posted My Preferred Payment Plan monthly transactions;

- interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS;

- payments to educational institutions;

- payments to financial institutions (including banks, online trading platforms and brokerages);

- payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here);

- payments to hospitals;

- payments to insurance companies (sales, underwriting and premiums);

- payments to non-profit organisations;

- payments to utility bill companies;

- payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys);

- any top-ups or payment of funds to payment service providers, prepaid cards, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay and Singtel Dash);

- any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers);

- any transactions related to crypto currencies; and

- any other transactions determined by DBS from time to time.

| 👍 Remember: If you’re curious about the MCC of any particular merchant, you can look it up using the Visa Supplier Locator |

For the avoidance of doubt, payments to CardUp will qualify, as will buying grocery vouchers.

You can read the full T&C of this promotion here.

Conclusion

S$300 cashback is the biggest acquisition offer we see DBS run for new-to-bank customers, and is a great opportunity to get a DBS Woman’s World Card (men are eligible too!) for 4 mpd on online spending.

Remember to submit your applications by end of day on 18 October 2021 to be eligible, and use the code OCTFLASH.

Aaron, do you think there will be another krisflyer transfer bonus this year or should I just transfer miles out of both Titaniums and reset the 12 month countdown?

Am I eligible if I just got the DBS Takashimaya AMEX? I forgot to apply another DBS card before applying Takashimaya AMEX

DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not done so in the past 12 months

Nope- hence the reminder to apply for the taka card second 🙂