If you own a small or medium-sized business, getting an AMEX Singapore Airlines Business Credit Card (aka AMEX HighFlyer Card) should be at the top of your list.

Cardholders enjoy a complimentary Accor Plus membership (including one free hotel night and up to 50% off dining), two lounge visits and the highest general spending earn rate on the market (1.8 mpd).

A first year fee waiver is no longer offered, but subsequent year’s fees can still be waived depending on spend (you’ll still get the Accor Plus membership and lounge visits).

Apply Apply |

|||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$301.79 (First Year Free Option) |

Min. Transfer | N/A |

| Miles with Annual Fee |

None | Transfer Partners | SIA |

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn | 1.8 mpd | Points Pool? | N/A |

| FCY Earn | 1.8 mpd | Lounge Access? | Yes |

| Special Earn | Up to 8.5 mpd on SIA tickets* | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *Earn 2.5 mpd from AMEX HighFlyer Card, plus 6 mpd from HighFlyer account | |||

There’s also an ongoing sign-up bonus from now till 3 April 2023, where new applicants can enjoy 40,000 bonus HighFlyer Points with a minimum spend of S$5,000 in the first 3 months of approval and payment of the S$301.79 annual fee.

|

| Apply |

In this post, we’ll take a closer look at what you can do with the HighFlyer Points earned through this card.

Conversion to KrisFlyer miles

Conversion to KrisFlyer Conversion to KrisFlyer |

||

| HighFlyer Points | ➤ | KrisFlyer Miles |

| 1,000 | 1,000 | |

HighFlyer Points can be converted into KrisFlyer miles at a 1:1 ratio, in blocks of 1,000 points with no conversion fees.

There are some restrictions to note:

- Each HighFlyer account can only be linked to a maximum of five selected KrisFlyer accounts for the purpose of converting HighFlyer Points to KrisFlyer miles

- Each HighFlyer account is only allowed to convert HighFlyer Points to a maximum of 150,000 KrisFlyer miles per calendar year

- Each selected KrisFlyer account may receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer Points per calendar year, regardless of which HighFlyer accounts the points are converted from

This means a one-man business would be limited to extracting 30,000 KrisFlyer miles from his/her HighFlyer account per calendar year. If you run a family business, there’s also the option of adding family members as corporate travellers to extract the full 150,000 miles from the HighFlyer account annually.

How to do it

To convert HighFlyer Points to KrisFlyer miles, login to your Corporate Travel Manager account, click on Travellers > Add New Traveller.

Once you’ve added the details, click on Use Points > Convert into KrisFlyer miles. You’ll be able to see how many more points each corporate traveller is eligible to receive for the rest of the year.

Select the traveller you want to convert points for, as well as the number of points you wish to convert. All conversions will be processed instantly.

Offset Singapore Airlines expenses

Offset SIA Expenses Offset SIA Expenses |

||

| HighFlyer Points | ➤ | Credit |

| 1,050 | S$10 | |

HighFlyer Points can be used to offset Singapore Airlines expenses at a rate of 1,050 HighFlyer points = S$10 (0.95 cents/point).

This includes tickets, extra luggage, advance seat selection and cabin class upgrades.

With regards to tickets, here’s how paying with HighFlyer Points compares to converting to KrisFlyer miles and then redeeming an award. Paying with HighFlyer Points is conceptually similar to buying a cash ticket- you’ll have much better availability and accrue miles plus status credits, but the trade-off is a much lower value per point.

| Spend HighFlyer Points | Redeem for KrisFlyer miles | |

| Availability | Any seat available for sale | Award inventory only |

| Miles Required | Depends on cost of ticket | Fixed (based on award chart) |

| Taxes & Surcharges | Can be paid with miles | Must be paid in cash |

| Accrue Miles & Status Credits | Yes (on cash portion) |

No |

| Value | 0.95 cents per point | Variable |

How to do it

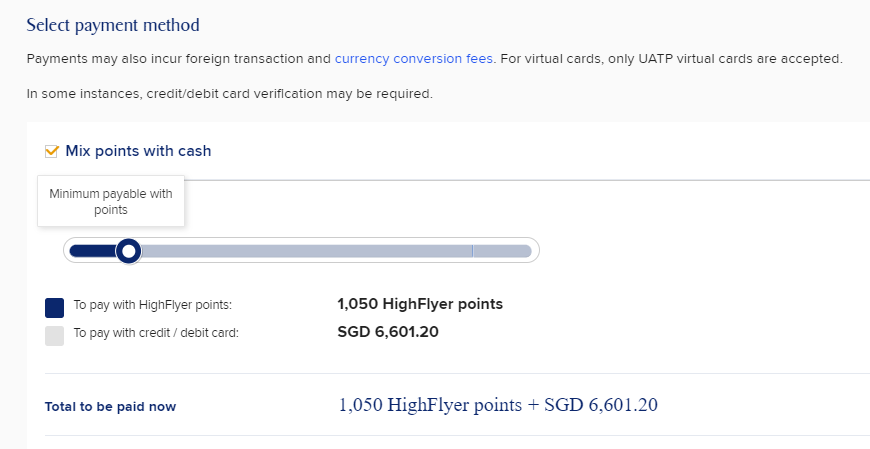

To use HighFlyer Points to offset Singapore Airlines expenses, simply make a booking as per normal when logged in to your Corporate Travel Manager account.

At check-out, you’ll see see a box labelled “mix points with cash”. Click the box and a familiar sliding bar (similar to Cash + Miles) will appear, allowing you to choose how many points you wish to redeem.

Redeem lounge passes

Redeem Lounge Passes Redeem Lounge Passes |

||

| HighFlyer Points | ➤ | Receive |

| 5,000 | 1x Lounge Pass | |

HighFlyer Points can be redeemed for lounge passes at Changi Airport. Unfortunately, this doesn’t give you access to Singapore Airlines’ SilverKris Lounges. Instead, you’ll receive a voucher valid for 3-hours’ use of the SATS Premier Lounge at Terminal 1 or 3.

The cost of entry is steep at 5,000 HighFlyer Points per lounge pass, and even if you take a rock bottom valuation of 1 cent per HighFlyer Point, S$50 is still paying well over the odds. I’d say this is an option to avoid.

In any case, don’t forget that the AMEX HighFlyer Card comes with two annual complimentary lounge visits courtesy of Priority Pass.

How to do it

To redeem lounge passes, login to your Corporate Travel Manager account, click on Points > Lounge pass.

This will generate a redemption letter, which you’ll need to present at the Singapore Airlines Ticketing Counter in Terminal 3 to collect a physical lounge pass from 0630 to 0000 hours daily.

That seems like an awful lot of steps to enjoy an awfully mediocre lounge…

Scoot vouchers

Scoot Vouchers Scoot Vouchers |

||

| HighFlyer Points | ➤ | Receive |

| 1,050 | S$10 voucher | |

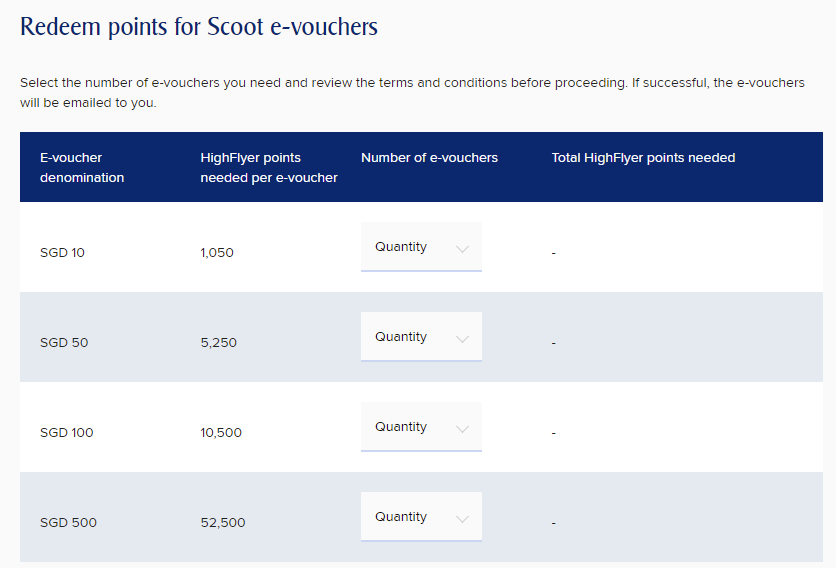

HighFlyer members can redeem points for Scoot e-vouchers, in denominations of:

- S$10 (1,050 points)

- S$50 (5,250 points)

- S$100 (10,500 points)

- S$500 (52,500 points)

Regardless of what denomination you redeem, the rate you get will be 1,050 HighFlyer Points= S$10 (0.95 cents/point), the same as if you were offsetting Singapore Airlines expenses.

e-Vouchers are valid for 180 days after issuance, and can only be used at flyscoot.com. Vouchers may not be used for e-visa, travel insurance, Scoot Protect, infant fares, and card processing fees.

How to do it

To redeem lounge passes, login to your Corporate Travel Manager account, click on Points > Airline-evouchers.

You’ll then see the different denomination options and points required.

A maximum of 10 vouchers can be issued in the same transaction, and all redemptions are processed instantly.

KrisFlyer Elite Gold status

KrisFlyer Elite Gold membership KrisFlyer Elite Gold membership |

||

| HighFlyer Points | ➤ | Receive |

| 150,000 | 12-month membership | |

Companies with HighFlyer Silver, Gold or Platinum status have the option of redeeming HighFlyer Points for a KrisFlyer Elite Gold upgrade for any corporate traveller. The rate is 150,000 HighFlyer Points for a 12-month membership.

| Tier | Min. Spend |

| HighFlyer | None |

| HighFlyer Silver | US$25,000 |

| HighFlyer Gold | US$200,000 |

| HighFlyer Platinum | By invitation |

KrisFlyer Gold is nice and all, but I highly doubt it’s worth spending 150,000 HighFlyer Points. Moreover, if your company is spending that much on travel, odds are the employees are flying frequently enough to earn it in their own right.

It’d be another thing entirely if you were able to redeem HighFlyer Points for PPS status, but I highly doubt we’ll ever see that.

Do note that Singapore Airlines only issues 1,000 KrisFlyer Elite Gold memberships via the HighFlyer programme per calendar year, so the option may not even be available should you apply later in the year.

Conclusion

|

| Apply |

In my opinion, the best use of HighFlyer Points remains conversions to KrisFlyer miles. However, since you’re limited to cashing out 30,000 miles each year per corporate traveller, it’s good to be familiar with the alternatives too.

As a reminder, all HighFlyer Points expire three years after accrual, so be sure to use them before that.

are the annual fees for the amex corp card waivable like personal credit cards (after the 1st free year)?

they have a promotion at the moment. link your telco bill as a recurring payment to it and you get the fees waived for another year.

wait, what? got a link for this?

I called the Amex hotline for a waiver, and got this response too. They linked up my telco to put it on recurring, and the annual fee was refunded in full quite quickly after.

I did it via phone. I called them to cancel my card. and they told me that they have this option and if I would consider it. and of course I did, since it comes with all the benefits.

Hi everyone, I’m curious, so if the conversion limit is 150k HFPts per year to KFmiles, what’s the point of spending more than that?

Received email to redeem the capital mall vouchers today! Thank you Aaron! 🥳🥳

can the points be directly used to redeem flights? else 30k a pax a year seems pretty useless.

that is still 30k miles you couldn’t otherwise have earned, because ideally you’ll be using this card to earn miles on tax + insurance + government bills + all other excluded payments (axs +grabpay)

The Highflyer Points Transfer option does not seem to be available on the Corporate Account. I am not able to offset the airfare using the points either. Do you know what the issue may be? Is there a minimum number of months that I must have the SQ Corporate Account before I can use the points? I seem to be able to redeem lounge passes and Scoot/Swiss Air Vouchers though.

System has been down for a while now. No update yet when it’ll be fixed

Does anyone know if the validity period of 3 years run concurrently for HF points and KF miles? If I keep HF points in my HF account for 3 years and then transfer it to my KF account will the timer for KF miles validity only then? (so in actuality I get 3+3 = 6 years)

they have independent validities, so in your example you will have 3 +3

Anyone have a link to the Corporate Travel Manager account? Cant find a login page anywhere. Thank you

is the 2 x lounge pass tied to individuals? can i bring in extra guests? or even pass it on to a stranger to make use of the lounge?

you can bring in a guest, but a stranger cannot use your priority pass

new to this card – is there an auto-sweep of highflyer points in AMEX to SQ on a monthly basis? I see HF points in AMEX but not in SQ website

yes, once a month.

Cool thanks

When you add another person as a corporate traveller, must you show proof that the person is an employee of the business? Wondering how you can extract as many miles as possible if you are a 1-man business.

i’ve not been asked so far. i suppose they have the right to ask if they decide to

If we pay with Highflyer points, does that contribute to PPS?