Here’s The MileLion’s review of the UOB Preferred Platinum Visa, perfect for those of you with friends or family members who tune out every time you start lecturing them on which card to use where.

All you need is to shove this card into their hands (or more accurately, add it to their mobile wallet) and send them on their way, because this is one of the most idiot-proof cards in the whole miles game.

With some limited exceptions, it’s an easy route to 4 mpd everywhere, and a must-have in your collection.

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| With 4 mpd on in-store mobile payments, online shopping & entertainment, the UOB Preferred Platinum Visa is an absolutely essential card. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: UOB Preferred Platinum Visa

Let’s start this review by looking at the key features of the UOB Preferred Platinum Visa.

|

|||

| Apply | |||

| Income Req. |

S$30,000 p.a. |

Points Validity |

2 years |

| Annual Fee |

S$196.20 (First Year Free) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on mobile payments, online shopping & entertainment | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The UOB Preferred Platinum Visa is the last standing member of the UOB “Preferred Platinum” family, which includes such luminaries as the UOB Preferred Platinum AMEX (no longer available, sadly), and the UOB Preferred Platinum Mastercard (no longer available, happily).

All three cards have very different features, so don’t mix them up:

- The UOB Preferred Platinum Visa earns 4 mpd on mobile contactless payments, and online shopping & entertainment

- The UOB Preferred Platinum AMEX no longer exists, having been replaced by the UOB Absolute Card

- The UOB Preferred Platinum Mastercard is best used for removing spinach and other debris from between teeth after you’ve used your UOB Preferred Platinum Visa to settle the bill

But again, since the latter two are no longer issued, it’s unlikely you’ll have issues.

How much must I earn to qualify for a UOB Preferred Platinum Visa?

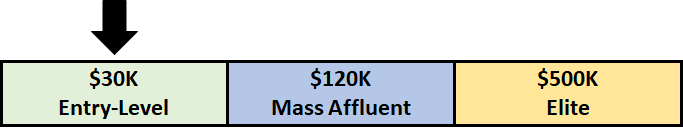

The UOB Preferred Platinum Visa is positioned at the entry level, with a minimum income requirement of S$30,000 per annum.

If you do not meet the minimum income requirement, it may be possible to place a S$10,000 fixed deposit with UOB to get a secured version. Contact your nearest UOB branch for more details.

How much is the UOB Preferred Platinum Visa’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free, S$98.10 for 2nd onwards |

| Subsequent | S$196.20 | Free, S$98.10 for 2nd onwards |

The UOB Preferred Platinum Visa has an annual fee of S$196.20, which is waived for the first year. The fee for the first supplementary card is waived in perpetuity, with the second card onwards charged at S$98.10 per year.

Waivers are fairly easy to get in my experience, but be warned that UOB’s default behaviour is to automatically deduct your UNI$ to cover the annual fee.

How do UOB’s automatic UNI$ deductions for annual fees work?

When the time comes for renewal, you will be charged either:

- 6,500 UNI$ for a full waiver

- 3,250 UNI$ + S$98.10 for a half waiver

If you have at least 6,500 UNI$ in your account, you will be charged (i). If you have less than 6,500 UNI$ but more than 3,250 UNI$, you will be charged (ii). And if you don’t have at least 3,250 UNI$, you’ll be charged the S$196.20 annual fee in cash.

It’s up to you to monitor your statement and request a fee waiver when this happens. Look at the expiry date on your credit card- the month corresponds to the month your annual fee will be charged.

For what it’s worth, if UOB subsequently grants you a fee waiver, the reinstated UNI$ will have a fresh 2-year validity, so that’s something I guess!

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 0.4 mpd | 0.4 mpd | 4 mpd on mobile contactless payments, online shopping & entertainment |

Regular SGD/FCY Spending

The UOB Preferred Platinum Visa earns:

- 1 UNI$ for every S$5 spent in Singapore Dollars (0.4 mpd)

- 1 UNI$ for every S$5 spent in FCY (0.4 mpd)

All foreign currency transactions are subject to a 3.25% fee.

Mobile Contactless

UOB Preferred Platinum Visa Cardholders will also earn 10X UNI$ per S$5 (4 mpd) on mobile contactless payments, whether in Singapore Dollars or FCY.

No minimum spend is required, but a cap of S$1,110 per calendar month applies. Any spend in excess of this cap earns 0.4 mpd.

| ⚠️Why S$1,110? |

|

UOB’s T&Cs state that “The total bonus UNI$ awarded to you from qualifying spend on Selected Online Transactions and Mobile Contactless Transactions is capped at UNI$2,000 for each calendar month“. It’s the bonus UNI$ component (9 UNI$ per S$5) that’s capped, so the maximum spend that will earn 4 mpd is S$1,110. |

UOB defines mobile contactless payments as in-store payments using the following methods:

| Payment Method | Eligible? |

| ✅ | |

|

❌ |

| ✅ | |

| ✅ | |

| ✅ | |

Tapping physical card Tapping physical card |

❌ |

Again, note the “in-store” requirement. Using Apple Pay or Google Pay for an in-app transaction will not trigger the mobile contactless bonus (though you may still be eligible for 4 mpd if the MCC falls under the online whitelist; see the next section for more details).

This flexibility makes the UOB Preferred Platinum Visa the Swiss Army knife of the miles & points game. So long as the transaction doesn’t run afoul of the UOB rewards exclusion list (e.g. education, government services), you’ll earn 4 mpd. Dentist’s appointment? Hairdresser? Stationery shop? Mini-mart? Car repairs? If there’s a contactless payment terminal, 4 mpd is yours.

A few important points to note:

- Tapping the physical UOB Preferred Platinum Visa card at a contactless terminal will only earn 0.4 mpd instead of 4 mpd, ever since May 2020. Once you get your card, add it to your mobile wallet and put it in the drawer!

- SimplyGo transactions (i.e. bus/MRT) will only earn 0.4 mpd, as they’re not considered mobile contactless transactions, even if paid with your mobile device

- The UOB Preferred Platinum Visa will not earn any UNI$ at UOB$ merchants. UOB$ is UOB’s card-wide cashback programme and includes Cold Storage, Crystal Jade, Giant, Guardian, Starbucks and Toast Box, among others. Memorise the bigger names and don’t use your card here

Online Shopping & Entertainment

UOB Preferred Platinum Visa Cardholders will also earn 10X UNI$ per S$5 (4 mpd) on online shopping and entertainment, whether in Singapore Dollars or FCY.

This is capped at S$1,110 per calendar month, and any spend in excess of this cap earns 0.4 mpd. Do note that cap is shared with mobile contactless payments.

Online shopping and entertainment covers the following MCCs:

| Category | Merchant Category Codes (MCCs) |

| Department and Retail Stores | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631,5641, 5651, 5661, 5691, 5699, 5732-5735, 5912, 5942, 5944-5949, 5964-5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5811,5812,5814, 5333, 5411, 5441, 5462, 5499, 8012, 9751 |

| Entertainment and Ticketing | 7278, 7832, 7841, 7922, 7991, 7996, 7998-7999 |

This includes online or in-app transactions at:

- Department and Retail Stores: Amazon, Book Depository, Courts, Harvey Norman, Lazada, Qoo10, Shopee, and Taobao

- Supermarkets, Dining and Food Delivery: Deliveroo, NTUC FairPrice, foodpanda, GrabFood, WhyQ

- Entertainment and Ticketing: Golden Village, SISTIC, Ticket Master

Since 5814 is also on the whitelist, you can use this card at XNAP merchants to earn 4 mpd at QR-code only places like hawker stalls.

However, my preferred strategy would be to use the DBS Woman’s World Card or Citi Rewards Card for such transactions, and save the UOB Preferred Platinum Visa’s 4 mpd cap for in-person contactless spending.

When are UNI$ credited?

Both base and bonus UNI$ are credited when the transaction posts, usually within 1-3 working days.

| Base Points (1X) | Credited when transaction posts |

| Bonus Points (9X) |

Credited when transaction posts |

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB Preferred Platinum Visa:

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 1 |

| Bonus Points (9X) |

Round down transaction to the nearest S$5, divide by 5, then multiply by 9 |

Do note that UOB rounds your transactions down to the nearest S$5 before awarding points, which means a S$9.99 transaction earns the same as a S$5 one, and a S$4.99 transaction earns no points at all.

To illustrate the effect of rounding, consider the following:

UOB Pref. Plat Visa UOB Pref. Plat Visa |

Citi Rewards Citi Rewards |

|

| S$5 | 20 miles | 20 miles |

| S$9.99 | 20 miles | 36 miles |

| S$15 | 60 miles | 60 miles |

| S$19.99 | 60 miles | 76 miles |

| S$25 | 100 miles | 100 miles |

| S$29.99 | 100 miles | 116 miles |

For what it’s worth, the impact of rounding gets less severe as your transaction size increases, though you’ll definitely want to take care with smaller transactions.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points (1X) | =ROUNDDOWN (X/5,0)*1 |

| Bonus Points (9X) |

=ROUNDDOWN (X/5,0)*9 |

| Where X= Amount Spent |

|

Don’t forget that UOB makes it very easy to check your points breakdown thanks to the TMRW app, which will show transaction-level points for the UOB Preferred Platinum Visa.

UOB TMRW: Get transaction-level credit card rewards points breakdowns

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found in the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- Insurance

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- Utilities

UNI$ will be awarded for CardUp, but not ipaymy. However, the UOB Preferred Platinum Visa will only earn 0.4 mpd on such transactions, so you’re much better off using the UOB PRVI Miles or another general spending card instead.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | S$25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) |

3 | 48 hours (KF) |

Expiry

UNI$ expire 2 years from the last day of each periodic quarter in which the UNI$ was earned.

Each UNI$ period is calculated commencing from January to December of each calendar year. Expired UNI$ cannot be replaced or reinstated.

Pooling

UNI$ pool across cards. If you have 10,000 UNI$ on the UOB Lady’s Card, and 5,000 UNI$ on the UOB Preferred Platinum Visa, you can redeem 15,000 UNI$ at one shot and pay a single conversion fee.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB Preferred Platinum Visa, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fees

UNI$ transfer to frequent flyer programs at a 1:2 ratio, with a minimum transfer block of 5,000 UNI$ (let’s ignore AirAsia, because converting points there is like throwing them away):

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 2,500: 4,500 |

Transfers cost S$25 per conversion, regardless of how many points are transferred.

UOB also has an auto-conversion option for KrisFlyer, which costs S$50 per year. UNI$ will be automatically converted on the last day of the calendar month, in blocks of UNI$2,500 (half the regular conversion block).

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

However, you’ll need to keep a minimum balance of UNI$15,000 (30,000 miles) in your account at all times. This is a hefty working capital balance! Make what you will of UOB’s reason for this policy…

|

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Cardmembers who wish to make ad-hoc conversions can still do so, subject to the payment of the usual S$25 fee per conversion, in standard blocks of 5,000 UNI$ (10,000 miles).

Here’s the pros and cons of the automatic transfer scheme:

Pros

- Pay a single fee for 12 automatic conversions a year

- Reduces the minimum conversion block from 5,000 UNI$ (10,000 KrisFlyer miles) to 2,500 UNI$ (5,000 KrisFlyer miles)

Cons

- The 3-year expiry on your KrisFlyer miles starts as soon as they are converted. Had you kept your UNI$ on the UOB side, you’d enjoy two extra years of validity

- Ad-hoc conversions still cost you S$25

- Only balances in excess of 15,000 UNI$ are converted

- Effectively locks you into KrisFlyer, as opposed to UOB’s other transfer partners (you can still make ad-hoc conversions to Asia Miles between quarters, but it’s likely you’ll need to end participation in the automatic conversion programme to acquire a critical mass)

Transfer Times

UOB transfers to KrisFlyer are typically completed within 48 hours.

If you need your points credited instantly, you can do so via Kris+. 1,000 UNI$ can be transferred to 1,700 KrisPay miles, which can then be transferred to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer UNI$ to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than seven days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Summary Review: UOB Preferred Platinum Visa

|

| Apply |

| 🦁 MileLion Verdict |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The UOB Preferred Platinum Visa may not be marketed as a miles card, but it’s one of the best out there.

Simply put, there’s no other card on the market that offers what the UOB Preferred Platinum Visa does (I suppose you could make a case for Amaze + Citi Rewards, though that involves two cards instead of one). Given the ubiquity of contactless terminals, this is pretty much a 4 mpd anywhere solution, making it suitable for those who struggle to memorize what card to use where.

Used judiciously, a cardholder could earn slightly over 53,000 miles per year with ~S$13,000 spending, enough for a one-way Singapore Airlines Business Class flight to Japan or South Korea.

The fact that UOB pools points makes the UOB Preferred Platinum Visa even more useful, because you can pair it with a UOB Lady’s Card and/or UOB Visa Signature, creating a card portfolio that earns 4 mpd on a large proportion of your overall spending.

Hi Aaron! I realised you put MST for Samsung Pay. May I know what is that?

Magnetic Secure Transmission

Aaron, why don’t you compare this with the new HSBC revo, I personally prefer HSBC revo though, just 5 dollar block and UNI$ makes me sick aldy~

I am waiting for 1 Aug to come closer. Hsbc revo is no doubt excellent, but it’s not as broad as uob ppv (whitelist vs blacklist approach)

Hi, would u know if SGH payment is considered govt services?

So what on earth happens with the ‘minimum balance of UNI$15,000′?

Is it just stuck there? When can you actually transfer it? I imagine only if/when you cancel the card?? Can someone confirm you can transfer this when you cancel the card?

Such a weird mechanism but how this works is the break or make of this card

That’s only a concern if you want the auto conversion option.

There’s a minimum spend of S$5 or it’s zero mpd

i find it challenging as my default GooglePay card as sometimes buy an item like a loaf of bread or a carton of milk and will earn nothing if less than $5

Hsbc revolution will make you very happy from 1 Aug then!

Aaron do you know if the professional VISA cards are considered UOV PP Visa cards?

UOB issues platinum visa cards free for life to the professions below:

Reason for asking: Supplementary cards for the the professional cards are issued as PP Visa cards. Would stand to reason that the principal card is PP Visa as well???

*Upon approval, a UOB Preferred Platinum Visa Card will be issued as the Supplementary Card as the respective Professional Platinum Cards can only be issued to principal cardholders who are members of the various associations. The Supplementary Card has the same benefits/privileges as the Principal Professional Platinum”

This is interesting…i’ll have to do a bit more research.

It really would be, considering that UOB Professional Platinum cards enjoy perpetual fee waivers as long as you transact with it once in three months. Please do look into it :3

No need for transaction. I haven’t used it in 2 years and I’m still got the autorenewal principal card and the PPV supplementary card.

Hi Aaron + above commenter – so does the principal professionals platinum work the same way as the preferred platinum visa?

To confirm, my ACCA card would be considered ppv, and accorded the same bonus miles as such??

Hi there, Can i check whether you got any updates on this matter ???? i tried reading around yet dont get the information.

Great Post — UOB never told me that PayWave no longer gets 10X. Maybe they forgot!

Physical paywave of the card does not get you the bonus 9x. Only Mobile contactless gets the bonus 9x.

Hi Aaron,

You might want to take out Cathay Cineplexes from the Entertainment and Ticketing section of the MCC table, as it is a Smart$ merchant (which you’ve covered too). Just a suggestion in case people forget.

Cheers!

But there’s no issue if you buy online, as noted in the post

Used the PPV card at Cathay website once. No UNI$, No SMART$. That was weird.

Sorry to comment on an old post, just to confirm the above as I just got off the line with UOB CSO. SMART$ merchants will not earn UNI$, be it online or offline, the CSO appealed on my behalf and I got the UNI$ adjustment for a Guardian online order as an exception.

thanks for the data point, will take note of that

I just got docked UNI$6,500 (=13,000 miles) as annual fee payment with my appeal for waiver rejected. Not sure how this card received 5 stars.

If you think you’re going to earn 4mpd with this card, you’re being misled. From $5 rounding to no option UNI$ deductions, I’m cashing out my remaining miles and canceling this card.

The annual wavier is dependent on the bank afaik. Some only wavier if you are a big spender (to reward you), others waiver only if you don’t spend much (to keep you around longer). Try calling again for waiver and hope to get another operator who can help you to get it, is the best you can do. As for the $5 spending block, I would normally use this card to top-up Lazada/shopee wallet so it is easy to achieve that. This is why it is better to have multiple card and use another card when paying for things nowhere… Read more »

Lazada/Shopee wallet top ups do not give miles tho

My appeal for waivers have been rejected multiple times, but eventually pulled through after about 3 weeks of trying. Be sure you’re getting through to the CSO instead of sticking with the automated waiver hotline. Keep at it and hope for the best

with this card, whats the point of still working using uob prvimiles mastercard? The base earn miles rate would be the same isnt it?

Clearly not the same. Read the article how much base you will get! Privi mc is good for place without contactless payment.

Privi Master is a generic miles card since it earns 1.4mpd. But given that most places do accept contactless payments, I’d think usage of this card would be quite minimal (at least personally for me).

That’s only true for people who spend less than $1k monthly. Remember PPV has a cap.

PPV base rate is just 0.4mpd, however you can pool your points between both cards and to round up your block of 5k UNI$ for redemption.

is the cap shared with supp card?

yes

Hi Aaron, thanks for this amazing article. One question, if I spend SGD 100 on 31 Aug, and posted on 01 Sep, will this contribute the the cap of Aug or Sep? Thank you.

Which card would u recommend at smart$ merchants? Thanks

Online payment for Universal Studio Singapore Tickets are likely processed under a different MCC code… the resort/hotel. Not awarded 4mpd….

Might want to take note for readers intending to do that. I spent $400 for a peasy 0.4mpd☹️

Others obviously know PPV online MCC are very limited. Never bother to use PPV on online transactions also.

thanks for taking the time to report back on this!

Hi, any kind souls here know whether insurance payment counts towards the qualifying 1.5k spending for the sign-up gift? Thanks.

https://www.uob.com.sg/personal/cards/credit-cards/rewards-cards/uob-preferred-platinum-visa-card.page

UOB has updated in its website that secured credit card is no longer available under for this card.

Terms and Conditions

Only available for application via uob.com.sg. Not eligible for Secured Card Applications.

merci, will update

hi aaron, do you know the latest limits for paywave transactions? if i recall, it was 100/transaction?

Always seems to fail when i need it; then would panic swipe other cards.

No more limits really. 100 was long time ago

Hi,

How long does it normally take for the miles to be credited into my Krisflyer account after I have redeemed them with my UNI$? I’m aware the website indicated 15 days, but is that usually the case as that is a rather long time.

i’d say no more than 3-4 working days based on personal experience.

Thanks Aaron for the prompt reply! I would also like to express my gratitude to you for the travel hacks and tricks you have shared since the inception of milelion. It is from this platform that I will be able to fly business class for the very first time. Really appreciate all the effort you have put into the site!

Hi @Aaron, in the petrol section, you listed Shell as being excluded from earning bonus UNI$ even using ApplePay, how about SPC? Isn’t SPC also a SMART$ merchant?

upvoting this question. wondering the same.

I did my own test. SPC spending doesn’t earn point

I can’t apply for card online and also on hard copy form – not listed as an option. Could it be nerfed?

what error message do you get?

sorry – not error msg. When i login to my uob account and tried to apply, there is no option to apply for this card (other cards will show up). When i contacted the bank via phone, they ask me to go to branch. When i contacted them via watsapp, the officer sent me a hardcopy form with many cards to apply but no option to apply for this card. Hence, I suspect that they have stopped application for this card.

Can’t apply online either.

1. No option to apply via UOB app

2. If apply through site, Error message is ” we are unable to complete this request as you do not have a valid current or savings account to perform this transaction.”. hmmm

Can apply online under Credit Cards/ Rewards Card of UOB website.

Doesn’t work for me – maybe I am unique. Was informed that my card is still in system as I cancelled in May 2022. Have to do the painful way of going down to the branch. But kind of weird why this particular card is not available on the hard copy form while all other cards are.

I just checked my UOB app and the card isn’t listed either, yet all the other rando cards like UnionPay and Singtel/Metro are. I wonder if they are looking to discontinue it soon.

I hv the card & it doesn’t appear for me on the UOB mobile app either. Online at UOB website it appears under Rewards Card.

Hard to keep track of UOB$ merchants, is there any giveaway at the shop or restaurants? Like BreadTalk and Toast Box, what about Sheng siong vs Giant?

Is SPC a Uni$ Merchant? Cos I’m always asked if I wanna redeem my $ with them.

Just spent a bit on Agoda last month on this card and found out from CSO today that the MCC is 4722 (travel agent) and not included as UNI$10 but only UNI$1. Too much pain using UOB cards now esp the PPV

Hi Aaron, can i confirm with you that using the card at physical Cold Storage outlets will earn you UOB$ but purchasing from Cold Storage online will award you 4mpd instead? (Since you mentioned Cold Storage under the online category). Thanks!

Can I confirm, UOB PPV will NOT earn bonus rewards on Grab rides or GrabFood delivery?

Seems impossible to get this card as a secured card. Bank teller said this isn’t offered offline, and online there’s no way to apply for a secured card. The call center told me this card likely can’t be had with a security deposit.

The salary requirement is the lowest 30k. If you can’t hit that, then maybe you need to reconsider getting a CC.

But anyway one method (albeit convoluted) is to set up a fixed deposit first, probably put 10k in. Go to a branch a submit a physical form and self write “Preferred Platinum Visa” (it isn’t one of the option). Wait for the card centre to call you back so you can discuss with them in details. Hoepfuly you can pledge ur fixed D immediately.

Great Post — Always worried the UNI deduction will slip under my radar, but you pointed out it will happen around expiration date. Just checked my card. That’s this month! Will be on the look out now. Thanks!!!

Used this card for more than 5 years and managed to waive annual fee every year until this year. Transfer all the points to miles and cancelled the card already.

Look at the losers bitching like little girls with tiny hands.

Hi, I would like to use the card for beauty and health screening services (via Mobile Contactless). Does anyone know if it is still 4mpd for both services?

I would like to know too!

If link to WeChat or Alipay, will earn 4mpd?

does uob ppv give the 9x bonus for grab rides and grab food orders? (non top up of course)

I think grab food it does but grab rides, not so sure.

Hi, just checking whether this card on mobile contactless payments can earn the 4mpd on Kris+ (say dining

or any other) transactions since Kris+, also uses apple pay to pay.

and if it does not earn the 4mpd for Kris+ because Kris+ is considered in-app payments and such payments are excluded, then can we still earn the 4mpd (from the UOB pref plat) thru Kris+ payment, at a restaurant with say MCC 5814?

I cancelled this card recently. Using apple pay doesn’t always get registered as mobile contactless payment. It happened to me a few times and the bank claims is the merchants side issue. I’ve used the card at the same clinic and supermarket and sometimes i don’t get bonus points. It’s like play roulette. online shopping using Apple pay payments don’t get bonus point either. So i gave up…

I had an online transaction and only got base reward points without bonus reward points. The CSO confirms that my transaction is eligible for the bonus, but they only credit bonus reward points next month, which is contrary to “Bonus Points (9X) Credited when transaction posts”

CSO has misinformed you. bonus points post when the transaction posts. you can see it yourself in the uob tmrw app.

Would this work for Google Drive spend?

i think its better to track by UNI$ points instead of the $1,110.00 since not every transaction will hit the $5 block exactly. The Uni$ cap therefore is 2,220 right?

LOL. The UOB Preferred Platinium Mastercard is good for removing debris between the teeth!!

May I know if spending at night spots are considered entertainment expenses?