From 18-29 April 2022, DBS is running a flash offer on new DBS/POSB credit card sign-ups, with S$300 cashback or an Apple Watch SE for new-to-bank cardholders.

|

| ❓ New-to-bank |

| DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not cancelled any in the past 12 months |

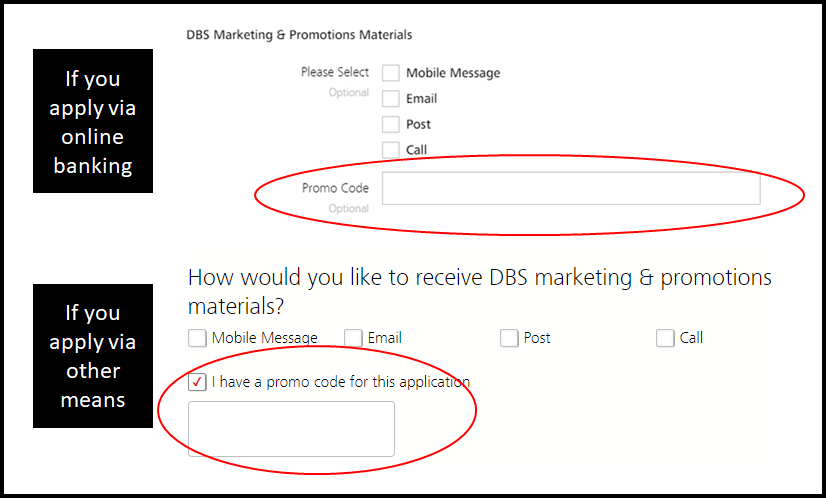

Applicants must apply with the promo code SSFLASH300 (for the S$300 cashback) or SSFLASH (for the Apple Watch SE) and make a minimum spend of S$500 within 30 days of approval.

While a S$300 reward is DBS’s best-ever sign-up offer, it’s worth noting that the conditions have been tightening up over the months:

- Cardholders were previously required to make just a single transaction of any amount

- This was later changed to a minimum spend of S$300

- The minimum spend has now been increased to S$500

In the cold light of day, 60% cashback (S$300/S$500) isn’t bad, but it’s certainly stricter than before.

Which DBS credit cards are eligible?

The following credit cards are eligible for this promotion.

| Card | Annual Fee | Key Features |

DBS Live Fresh DBS Live FreshApply here |

S$192.60 (First year free) |

Up to 10% cashback on online and contactless |

DBS Altitude Visa DBS Altitude VisaApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend, 2 lounge passes |

DBS Altitude AMEX DBS Altitude AMEXApply here Read Review |

S$192.60 (First year free) |

3 mpd on airline and hotel spend |

DBS Woman’s Card DBS Woman’s CardApply here |

S$160.50 (First year free) |

2 mpd on online spending |

DBS Woman’s World Card DBS Woman’s World CardApply here Read Review |

S$192.60 (First year free) |

4 mpd on online spending |

POSB Everyday Card POSB Everyday CardApply here |

S$192.60 (First year free) |

Up to 8% rebates on groceries, online food delivery and more |

Here’s what you need to do:

- Apply by 29 April 2022 with the code SSFLASH300 or SSFLASH (don’t forget to enter the code- no code, no cashback!)

- Receive approval by 13 May 2022

- Activate your card

- Make a minimum qualifying spend of at least S$500 within 30 days of approval

If you choose the cashback, S$300 will be credited to your account within 60-80 days of meeting the qualifying spend requirement.

If you choose the Apple Watch SE, a voucher code for redemption will be sent to your DBS PayLah! App within 14 days of meeting the qualifying spend requirement. You will then use this code to redeem an Apple Watch on the SingSaver website, with delivery within 40-60 days.

Qualifying spend is based on posted local and foreign retail sales and posted recurring bill payments, but excludes the following:

- posted 0% Interest Instalment Payment Plan monthly transactions;

- posted My Preferred Payment Plan monthly transactions;

- interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS;

- payments to educational institutions;

- payments to financial institutions (including banks, online trading platforms and brokerages);

- payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here);

- payments to hospitals;

- payments to insurance companies (sales, underwriting and premiums);

- payments to non-profit organisations;

- payments to utility bill companies;

- payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys);

- any top-ups or payment of funds to payment service providers, prepaid cards, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay and Singtel Dash);

- any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers);

- any transactions related to crypto currencies; and

- any other transactions determined by DBS from time to time.

For the avoidance of doubt, payments to CardUp will qualify, as will buying grocery vouchers.

Terms & Conditions

You can read the full T&Cs of this sign-up offer here.

Conclusion

DBS is offering new cardholders the choice of an Apple Watch SE or S$300 cashback when approved for a credit card, with a S$500 minimum spend.

I would certainly consider S$300 cashback for S$500 spend to be a better acquisition offer than the 21,000 miles for S$4,000 spend being offered on the DBS Altitude AMEX card, though you can explore that option in the article below if you’re interested.

DBS Altitude offering up to 21,000 miles sign-up bonus (existing customers welcome)

Either way, this is a great opportunity to get a DBS Woman’s World Card (men are eligible too!) for 4 mpd on online spending.

Remember to submit your applications by end of day on 29 April 2022 to be eligible, and use the code SSFLASH or SSFLASH300.

Really hate the use of special edition by so many companies especially when there’s nothing special about them. They should be called reduced editions.

Previously SE was for really special and limited rendition of a product. These days it’s used to sell a product to folks who won’t pay for the main stream and reduce its capabilities.

can call it Limited Edition. same same