CardUp has launched a series of offers for American Express cardholders, which run from now till 31 July 2022.

- New customers can enjoy a 1.6% fee on their first payment (AMEXNEW16), and a 2.2% fee for income tax payments (AMEXNEWTAX22)

- Existing customers can enjoy a 1.9% fee on their next payment (AMEXISTING19), and a 2.4% fee for income tax payments (AMEXTAX22)

These promo codes are available in limited quantities, so act quickly if you’re interested.

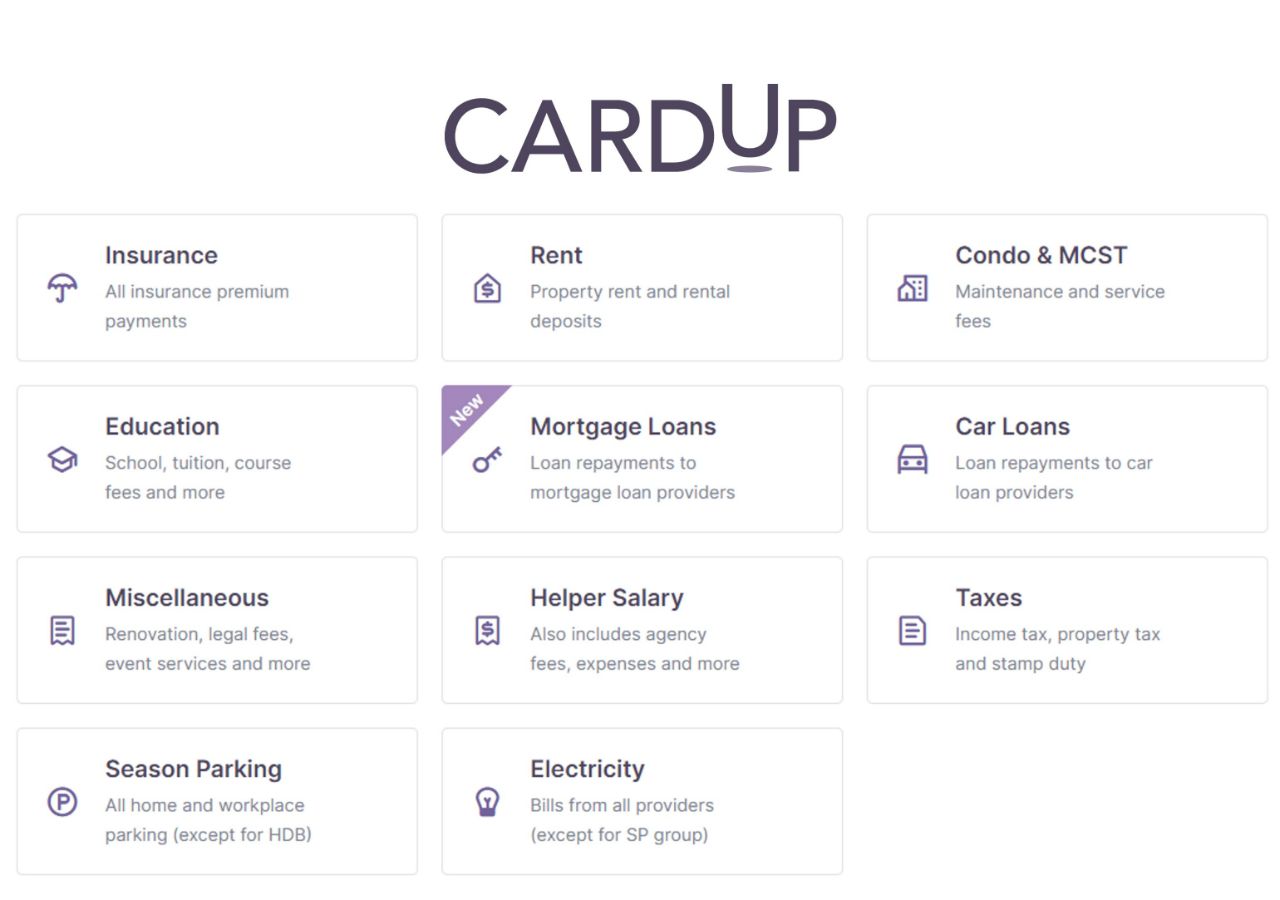

| ❓ What is CardUp? |

|

The standard CardUp fee is 2.6%, but is frequently lowered through various promotions |

New Customers

All payments except tax: 1.6%

New CardUp customers (defined as those who have signed up for a personal CardUp account and have yet to schedule a payment) can enjoy a 1.6% fee on the first payment with the code AMEXNEW16.

This is valid for all payments (except income tax) of at least S$500 and no more than S$7,000 scheduled by 31 July 2022 with a due date by 8 August 2022. An American Express consumer card must be used for payment, and AMEX cards issued by DBS and UOB are not eligible.

The code can be used a maximum of once per customer, with 80 redemptions available (you’ll be able to see if the code is still available at the time of payment)

| 👍 Alternative Offer: Free miles for S$1,154 of payments |

|

If this is your first-ever CardUp payment, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). To save you the math: If your payment is >S$3,000, the AMEXNEW16 code is better. If your payment is<S$3,000, the MILELION code is better. |

Income tax: 2.2%

For those wanting to pay income tax specifically, new CardUp customers can enjoy a 2.2% fee with the code AMEXNEWTAX22.

This is valid for income tax payments of at least S$1,000 scheduled by 31 July 2022 with a due date by 8 August 2022. An American Express consumer card must be used for payment, and AMEX cards issued by DBS and UOB are not eligible.

The code can be used a maximum of once per customer, with 80 redemptions available (you’ll be able to see if the code is still available at the time of payment)

Cost per mile

| Card | Earn Rate | CPM @ 1.6% Fee |

CPM @ 2.2% Fee |

AMEX PPS Card AMEX PPS Card |

1.3 mpd | 1.21 | 1.66 |

AMEX Solitaire PPS Card AMEX Solitaire PPS Card |

1.3 mpd | 1.21 | 1.66 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.31 | 1.79 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.43 | 1.96 |

AMEX Centurion AMEX Centurion |

0.98 mpd | 1.61 | 2.20 |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd | 2.02 | 2.76 |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 2.28 | 3.12 |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd | 2.28 | 3.12 |

Based on the cost per mile (CPM), AMEX KrisFlyer cards are obviously much superior to the Platinum series. In my (subjective) opinion, anything less than 1.5 cents per mile is a good price to pay, though it all boils down to how much you value a mile.

Even though the CPM may be higher with the Platinum cards, it might be worth considering if you’re just shy of a small amount to hit your sign-up bonus (although you’d be better off buying no-fee grocery vouchers in that case).

Existing Customers

All payments except tax: 1.9%

Existing CardUp customers can enjoy a 1.9% fee on the first payment with the code AMEXISTING19.

This is valid for all payments (except income tax) of at least S$500 and no more than S$7,000 scheduled by 31 July 2022 with a due date by 8 August 2022. An American Express consumer card must be used for payment, and AMEX cards issued by DBS and UOB are not eligible.

The code can be used a maximum of once per customer, with 80 redemptions available (you’ll be able to see if the code is still available at the time of payment)

Income tax: 2.4%

For those wanting to pay income tax specifically, CardUp customers can enjoy a 2.4% fee with the code AMEXTAX22.

This is valid for income tax payments of at least S$1,000 scheduled by 31 July 2022 with a due date by 8 August 2022. An American Express consumer card must be used for payment, and AMEX cards issued by DBS and UOB are not eligible.

The code can be used a maximum of once per customer, with 80 redemptions available (you’ll be able to see if the code is still available at the time of payment)

Cost per mile

| Card | Earn Rate | CPM @ 1.9% Fee |

CPM @ 2.4% Fee |

AMEX PPS Card AMEX PPS Card |

1.3 mpd | 1.43 | 1.80 |

AMEX Solitaire PPS Card AMEX Solitaire PPS Card |

1.3 mpd | 1.43 | 1.80 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.55 | 1.95 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.70 | 2.13 |

AMEX Centurion AMEX Centurion |

0.98 mpd | 1.90 | 2.39 |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd | 2.39 | 3.00 |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 2.70 | 3.40 |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd | 2.70 | 3.40 |

The CPMs here are obviously higher than for new CardUp customers, but if you’re determined to pay bills with an AMEX card, this is as good as it gets. Likewise, it may be worth considering if you’re just shy of hitting your sign-up bonus, although buying grocery vouchers could be a better no-fee alternative.

Terms & Conditions

The T&Cs for these offers can be found below:

Income tax guide

If you’ve received your NOA and are wondering how to earn miles on your tax bill, do check out my detailed guide to all the options available.

2022 Edition: Earning miles when paying IRAS income tax with a credit card

AMEX cards clearly aren’t the cheapest way of going about things; in fact neither is CardUp for that matter. If you’re looking for the absolute cheapest option, nothing can beat Citi PayAll’s 2.5 mpd offer, which represents buying miles at 0.8 cents each (admin fee: 2%).

The only catch is that you’ll need to clock at least S$5,000 of PayAll payments by 31 July 2022 (it need not just be income tax; you can combine different types of payments like rent and insurance so long as the minimum spend is met). This July deadline also means that if you want to stretch your cashflow by taking full advantage of IRAS’s interest-free instalment plans, this may not be right for you.

Conclusion

CardUp is offering new and existing AMEX cardholders special admin fees of 1.6% and 1.9% respectively, though if you wish to pay income taxes the rates increase to 2.2% and 2.4% respectively.

If you’re determined to pay your bills or taxes with an AMEX card, this is the cheapest option available.

Can you use the AMEX Singapore Airlines Business credit card for this? That has an earn rate of 1.8mpd

Exactly, able to advise?