| The following is a sponsored post by DBS Bank. Opinions remain those of The MileLion. |

We’re at a bit of an odd time right now.

On the one hand, travel is finally back after a two-year hiatus, which must be catharsis to anyone tired of circuit breakers, border closures and riveting trips to Sentosa.

On the other, spiking inflation (airfares out of Singapore are estimated to be 27% higher than pre-COVID) and the looming threat of a recession have given would-be revenge travellers reason to pause.

Or has it? According to a survey by TripAdvisor, 77% of Singaporeans are “extremely” or “very” concerned about rising travel costs, yet 84% plan on travelling this year. Nearly two in three said they’d be willing to spend less on dining out or shopping to fund their travel, and 76% said they’d spend at least the same or more on travel.

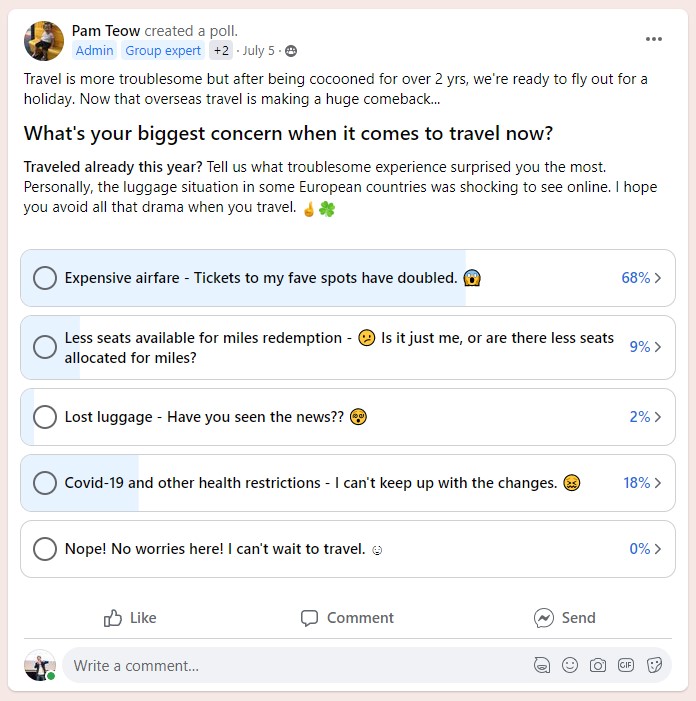

Likewise, a poll on The Burrow shows that expensive airfares are the foremost concern for would-be travellers.

So how do you scratch that itch without breaking the bank? In this two-part series, we’ll look at some of the tools DBS offers to beat travel inflation, whether it’s planning your trip in Singapore, or spending smart when overseas.

| 📈 Beating Travel Inflation with DBS |

DBS Travel & Leisure Marketplace

|

| Travel & Leisure Marketplace |

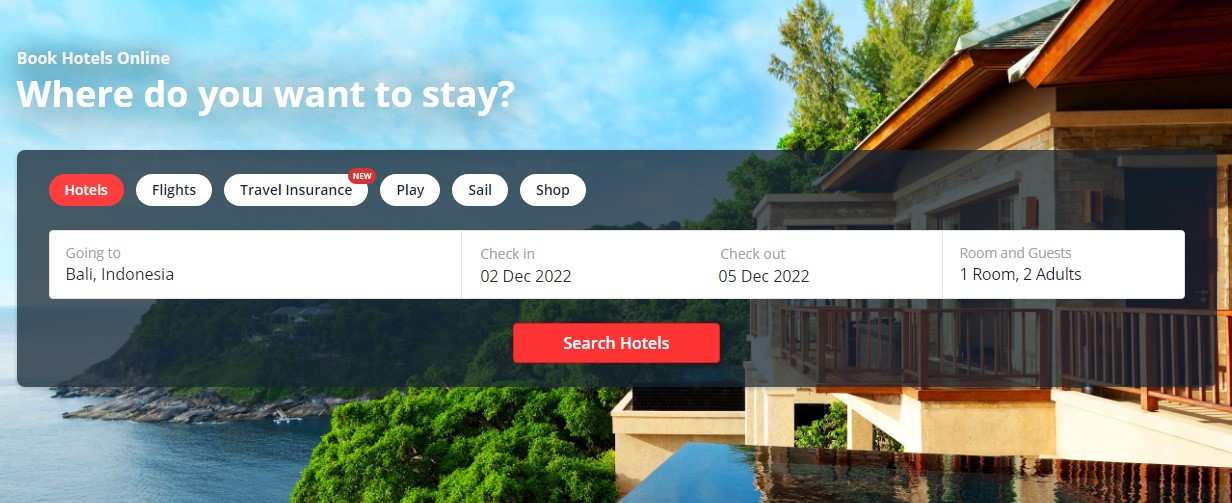

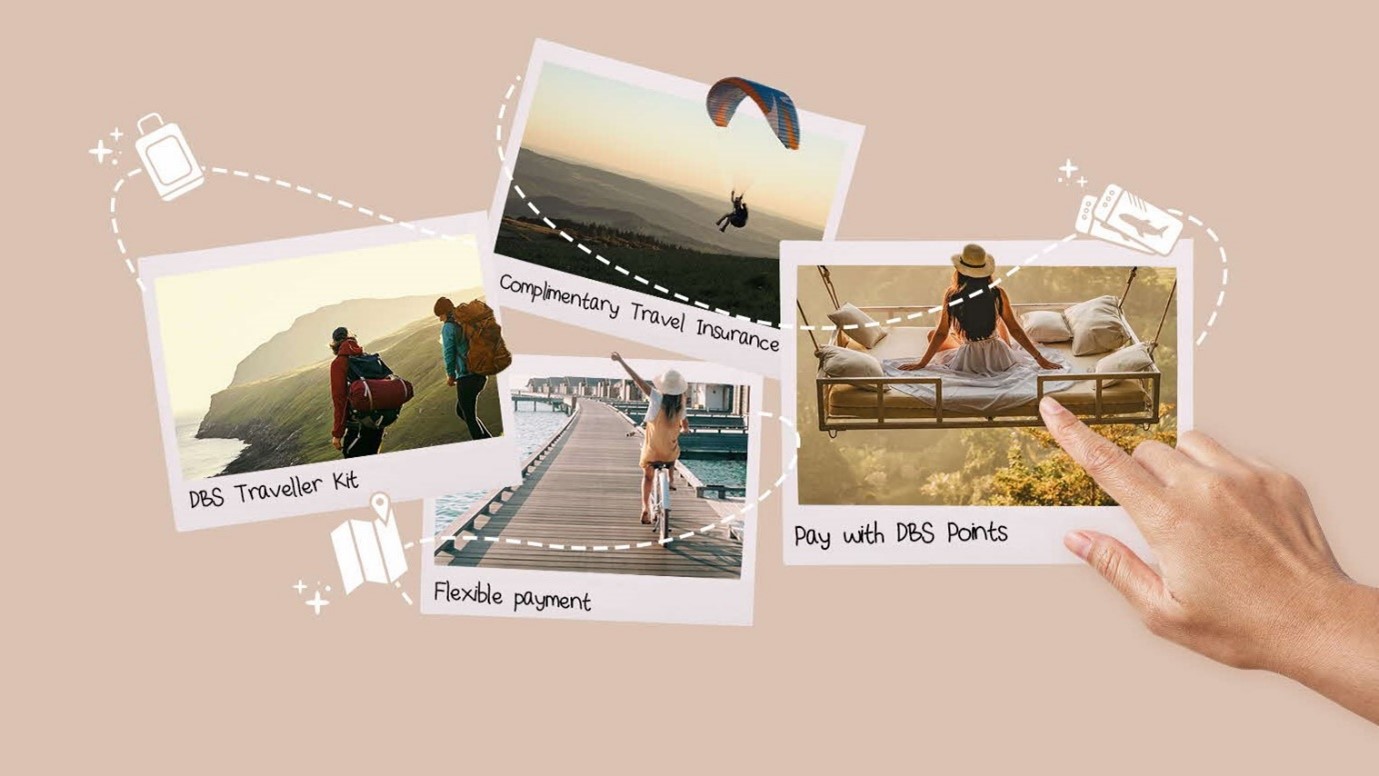

The DBS Travel & Leisure Marketplace (TMP) is a one-stop portal for planning a vacation, offering specially curated deals, flight, hotel and activity bookings, as well as travel insurance.

Travellers can also take advantage of the DBS Traveller Kit to ease their travel planning, with its travel tips, exclusive offers on air tickets, car rentals, hotel stays and experiences, as well as special rates for pre-departure testing where required.

Below, we’ll look at how the TMP can be used to settle the “big 3” of travel planning: booking flights, hotels and travel insurance.

Booking flights

|

| Book Flights on TMP |

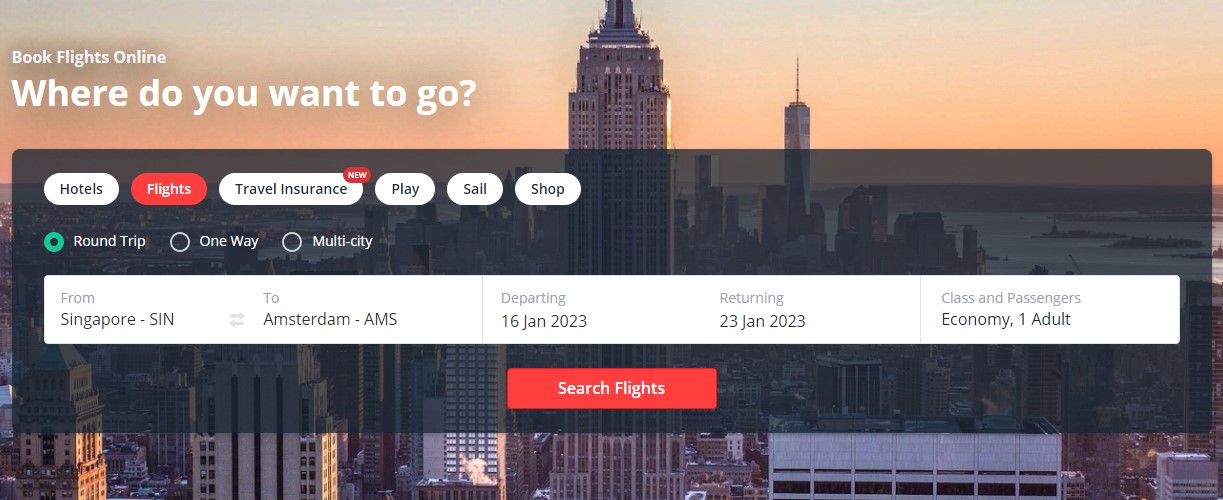

TMP partners with Singapore Airlines, PriceBreaker and Travel Trade Marketplace to offer flights from more than 250 airline partners.

Both one-way and round-trip tickets can be purchased, and if you’re planning to do some country hopping (why not, given that most countries in Southeast Asia and Europe have removed pre-departure testing), the interface also supports multi-city searches.

Why should you book your flights via TMP?

First of all it’s important to remember that airline tickets, unlike hotel rooms, are channel agnostic. That’s to say you’ll still accrue miles and status credits with your frequent flyer programme even if you book through a third-party website; all that matters is the fare class.

Second, flight bookings out of Singapore made through TMP enjoy complimentary travel insurance, enhanced with COVID-19 coverage (see below for more details).

Third, flights on Singapore Airlines will price the same whether you book through the official website or TMP. In fact, Singapore Airlines tickets purchased via TMP will be treated the same as those bought via Singaporeair.com, in that customer service will be provided directly by Singapore Airlines.

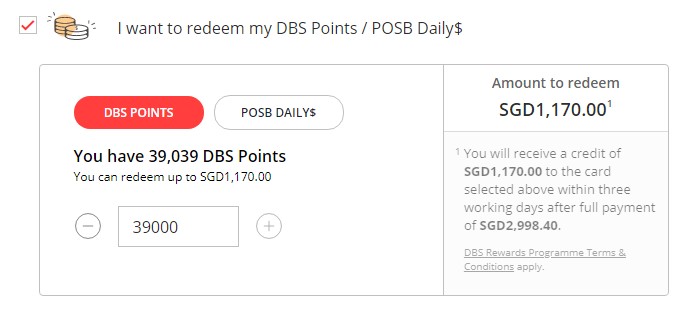

Fourth, TMP allows you to use your DBS Points or POSB Daily$ to offset the cost of flights (or hotels). Now, I normally wouldn’t be in favour of this, but there’s an ongoing promotion that’s very much worth considering.

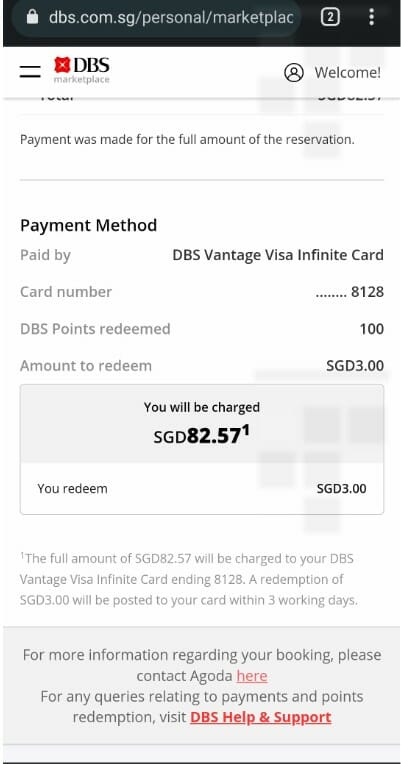

100 DBS Points are normally worth S$2 on the TMP, but for a limited time, DBS is upsizing the rate to 100 DBS Points = S$3. The option to offset with DBS Points will appear during check-out, and you can offset the entire balance or a partial amount.

Even better: customers will still earn DBS Points on the full transaction amount, pre-offset.

How does redeeming DBS Points on TMP differ from redeeming them for KrisFlyer miles and booking an award flight?

| Pay on TMP | Redeem KrisFlyer miles | |

| Seat Availability | Any seat available for sale | Award inventory only |

| Points/ Miles Required | Depends on cost of ticket (100 DBS Points= S$3) |

Fixed based on award chart (Variable value) |

| Taxes & Surcharges | Can be covered by points | Paid in cash |

| Earn Miles & Status Credits | Yes | No |

| Admin Fees | None | S$26.75 per transfer |

First, when you book flights through TMP you have access to any seat available for sale, but when you redeem miles you’re limited to award seats only. This means you may not be able to get the exact date, time or destination you were hoping for.

Second, each DBS Point commands a fixed value on TMP, so the number of points required will depend on the price of the flight- cheaper flight, fewer points; more expensive flight, more points. The number of KrisFlyer miles required follows an award chart, so regardless of the price of the flight, the number of miles remains the same.

Third, DBS Points can be used to cover taxes and surcharges when redeemed on TMP (since they’re folded into the total price). When redeeming KrisFlyer miles, you’ll need to pay taxes and surcharges in cash (SIA does not have fuel surcharges, but other partner airlines may).

Fourth, flights booked through TMP are similar to tickets bought with cash. That means you’ll earn miles and status credits according to the fare class. In contrast, award flights are not eligible to earn miles or status credits.

Fifth, there are no fees applicable when you offset DBS Points on TMP, but you’ll need to pay a S$26.75 admin fee when transferring DBS Points to KrisFlyer miles. This is a relatively minor point though, as I wouldn’t consider a S$26.75 admin fee to be a major deciding factor.

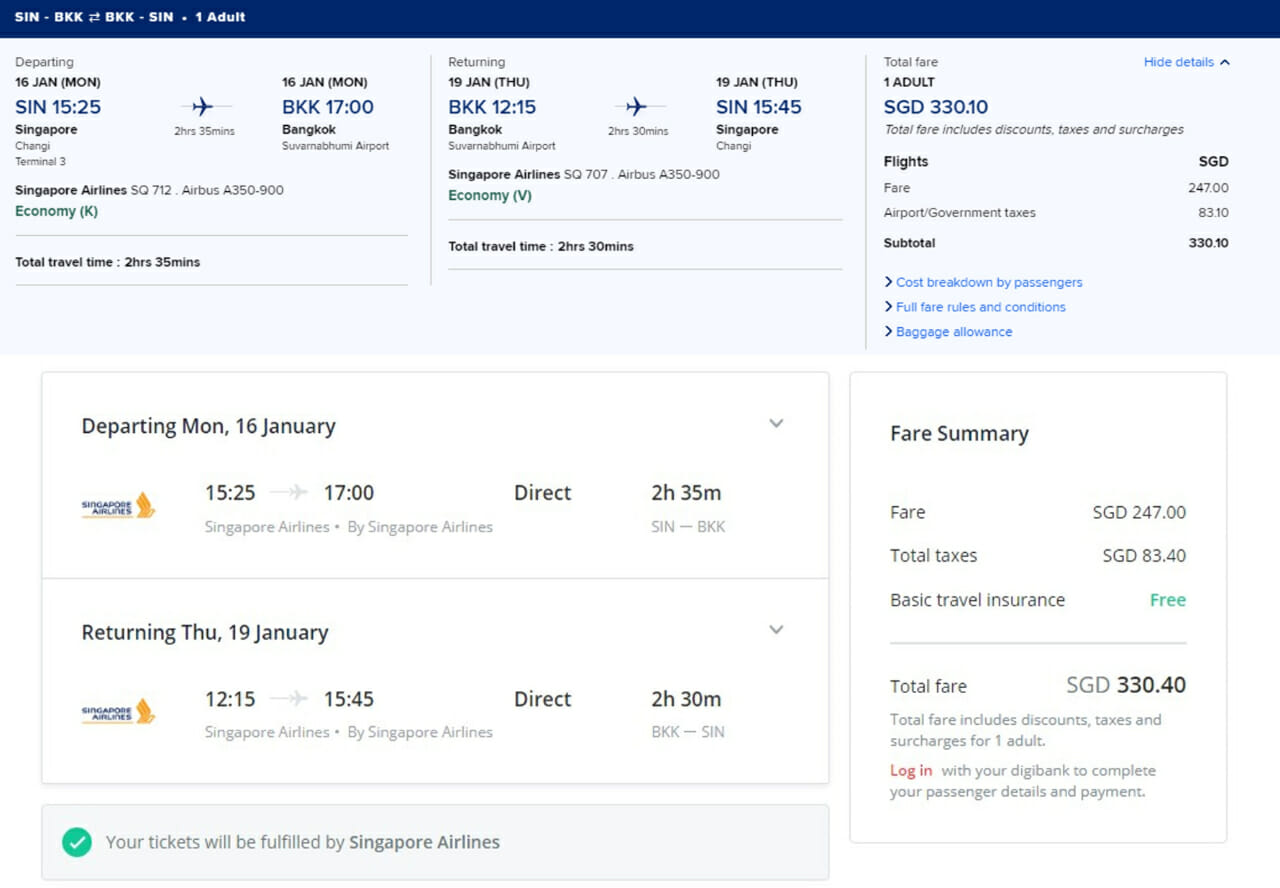

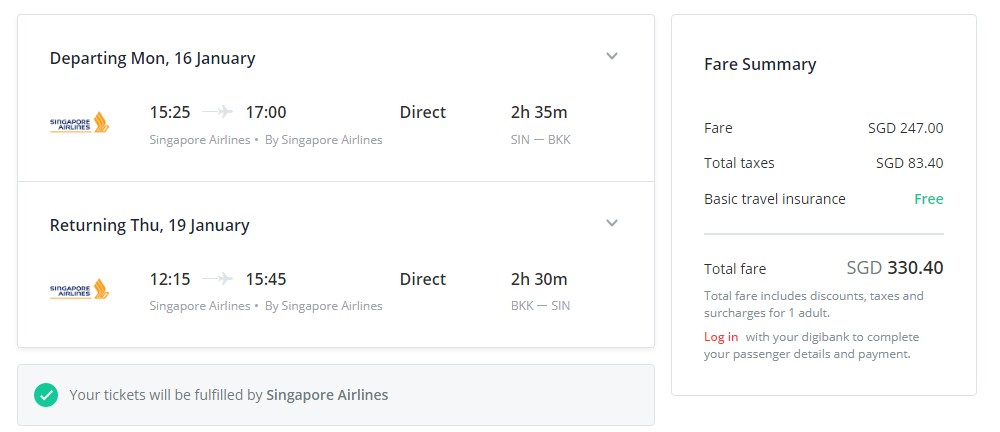

Here’s a simple example of how this can work in your favour. Suppose you want to fly to Bangkok. A Singapore Airlines ticket on TMP costs S$330.40, or roughly 11,000 DBS Points (equivalent to 22,000 KrisFlyer miles).

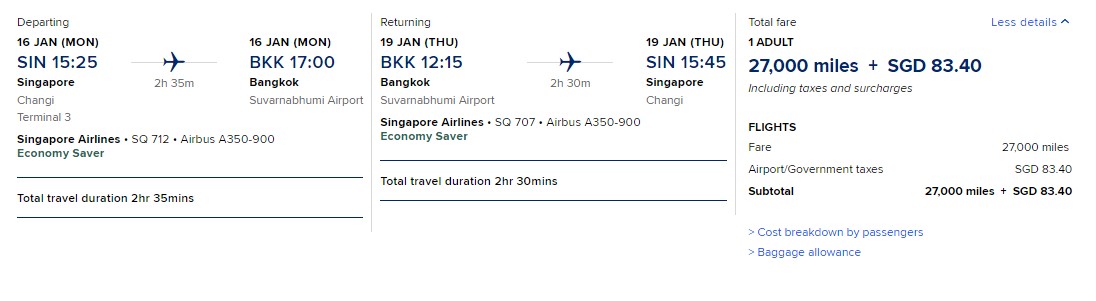

The same ticket redeemed via KrisFlyer would cost 27,000 miles + S$83.40!

Don’t forget, the ticket purchased via TMP would also earn KrisFlyer miles and status credits, and you’d have a free choice of dates and timings (award tickets may be waitlist-only or not available).

At a rate of 100 DBS Points= S$3, I’d say offsetting airfares with DBS Points is something you should definitely explore. That’s all the more because long-haul Business Saver space has virtually dried up for the rest of 2022, and unless you’re willing to pay the more expensive Advantage prices, this might be the next best option.

To sweeten the deal further, DBS is running a special contest exclusively for MileLion readers. From 16 September to 9 October 2022, customers who offset TMP purchases with DBS Points can win 20x S$50 Klook vouchers.

To participate:

- Offset a flight or hotel purchase on TMP using at least 10,000 DBS Points (valued at S$300 during the promo period)

- Take a screenshot of your confirmation page showing an offset of at least 10,000 DBS Points

- Post this screenshot on Facebook with the hashtags #dbstravelmarketplace #dbs3xvalue, together with a travel tip for your destination of travel. Remember to set this particular post to “public”

- For example, if you’ve booked tickets to Bangkok, Thailand:

- Sample 1: “Planning to dine at Jeh O Chula in Siam (Michelin Guide 2020)? Remember to book on Klook to skip the hour-long queues. Book at: https://www.klook.com/en-SG/activity/19089-jeh-oh-chula-bangkok/”

- Sample 2: “Pay like a local in Thailand at over 8 million merchants! Scan to pay at BTS Skytrain, weekend and night markets with DBS PayLah!”

- For example, if you’ve booked tickets to Bangkok, Thailand:

- DBS will pick 20 top entries and award each a S$50 Klook voucher

- Winners will be contacted by The MileLion via Facebook by 14 October 2022 and sent the voucher code for redemption

Book a hotel

|

| Book Hotels on TMP |

Once the flights are settled, it’s time to look for hotels.

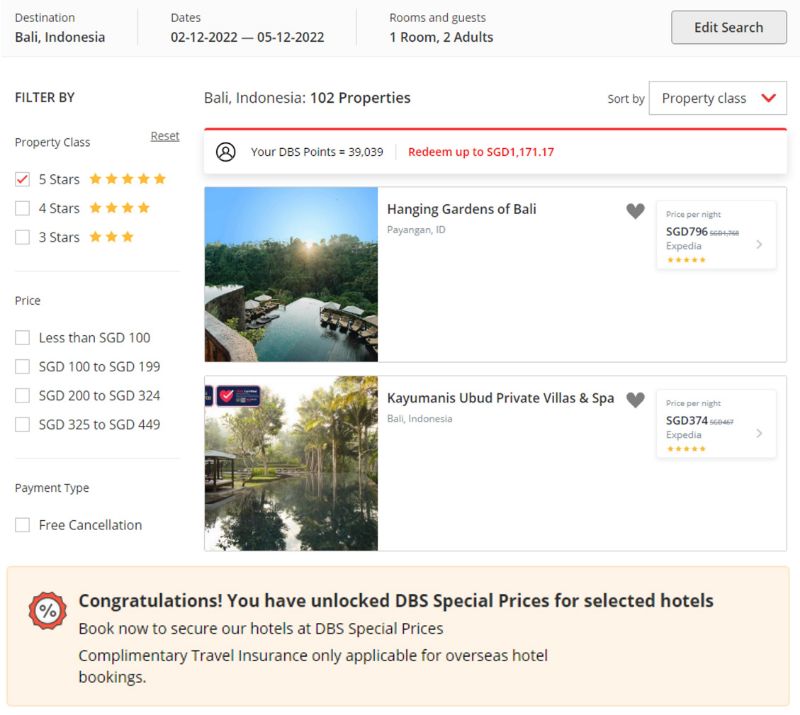

TMP partners with Agoda and Expedia to offer special rates on hotels worldwide. These can only be seen when you login to TMP, so be sure to do that before searching.

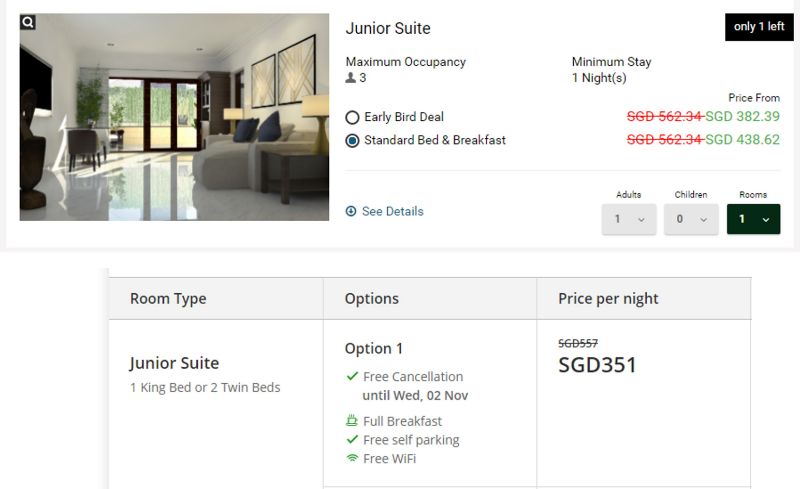

For example, I can find a three night, breakfast-inclusive refundable rate at the Viceroy Bali for S$351++ per night on TMP, versus S$439++ per night on the official website.

Rates on TMP are a mixture of prepaid and fully refundable; if you need the extra flexibility, be sure to look for one with a “free cancellation” label.

The main thing to note is that hotel bookings through TMP, like all third-party channels, will not be eligible to earn hotel loyalty points or elite status credit. This is less of a concern if you’re staying at an independent property or a chain without a loyalty programme.

As mentioned in the previous section, you can also use DBS Points to offset the cost of your hotel booking at a limited-time rate of 100 DBS Points= S$3. Given how hard it is to accrue hotel points in Singapore, this might be the next best alternative.

Purchase travel insurance

Countries may be easing their mandatory travel insurance requirements, but I’d still consider it to be absolutely essential. Simply put: if you can’t afford travel insurance, you can’t afford to travel.

All flights commencing in Singapore and overseas hotel bookings made through TMP come with complimentary travel insurance that includes COVID-19 coverage. Accompanying travellers on the same itinerary will be covered as well.

| Key Benefits | Maximum Coverage |

| Accidental Death and Disablement | S$200,000 |

| Journey Cancellation | S$1,000 |

| Overseas Medical Expenses (inpatient only) | S$500 |

| Travel Delay | S$300 |

| Baggage Delay | S$300 |

If this coverage is not sufficient for your needs, you can opt to purchase TravellerShield Plus, a comprehensive travel insurance policy with additional benefits such as coverage for non-COVID-19 related overseas medical expenses.

This is available for purchase through TMP at the following discounts:

| Standard discount | TMP customer discount | |

| Single-trip | 55% off | 60% off (check inbox for promo code) |

| Multi-trip | 30% off (use code TMP365) |

|

You can learn more about the various TravellerShield discounts here.

The Platinum plan of TravellerShield Plus covers up to S$1,000,000 of overseas medical expense coverage, up to S$8,000 of coverage for lost or damaged baggage (and given the travel chaos we’re seeing at overseas airports now, it’s a good idea not to pack anything valuable in your check-in!), as well as trip cancellation protection. COVID-19 related medical expenses and trip cancellation is also covered within specified limits.

A summary of TravellerShield Plus benefits is included below. The full list of 47 benefits can be viewed here.

| TravellerShield Plus |

|||

| Classic | Premier | Platinum | |

| Accidental Death | S$150K | S$200K | S$500K |

| Overseas Medical Expenses | S$300K | S$500K | S$1M |

| Loss or Damage to Baggage | S$3K | S$5K | S$8K |

| Journey Cancelation | S$5K | S$10K | S$15K |

| Personal Liability | S$500K | S$1M | S$1M |

| Rental Vehicle Excess | N/A | S$1K | S$1.5K |

| COVID-19 Coverage | |||

| Classic | Premier | Platinum | |

| Overseas Medical Expenses | S$50K | S$100K | S$200K |

| Quarantine or Hospital Benefit | S$100 per day (max S$700) |

S$100 per day, (max S$1.4K) |

S$100 per day (max S$1.4K) |

| Emergency Medical Evac | S$50K | S$100K | S$200K |

| Journey Cancelation or Curtailment | S$2.5K | S$5K | S$7.5K |

| Policy Wording |

|||

What card should I use on TMP?

When booking hotels and flights on TMP (or anywhere online, really), be sure to use the DBS Woman’s World Card or DBS Altitude Card to maximise your rewards.

| 💳 Online Flights and Hotel Bookings | ||

| Card | Earn Rate | Cap |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | S$2K per month |

DBS Altitude Visa Signature Card DBS Altitude Visa Signature Card |

3 mpd | S$5K per month |

DBS Altitude American Express Card DBS Altitude American Express Card |

3 mpd | S$5K per month |

DBS Woman’s Card DBS Woman’s Card |

2 mpd | S$1K per month |

DBS Altitude Cardmembers will earn up to 3 mpd on online hotel and flight bookings, capped at S$5,000 per calendar month. DBS Altitude Visa Cardmembers will enjoy two complimentary lounge visits through Priority Pass- and yes, the airport lounges at Changi have reopened.

DBS Woman’s World Cardmembers will earn 4 mpd on all online transactions, capped at S$2,000 per calendar month.

Conclusion

|

| Travel & Leisure Marketplace |

DBS Travel & Leisure Marketplace is a great place to start planning your trip, especially if you have a stash of DBS Points to burn- the ongoing promotion of 100 DBS Points= S$3 is very compelling indeed.

Pay with your DBS Altitude Card or DBS Woman’s World Card for maximum miles, and upgrade your travel insurance coverage if necessary with the ongoing discount of up to 60%.

Look out for the next post where we’ll talk about how to save on your foreign currency transactions and manage your overseas expenses effortlessly.

|

Complimentary Travel Insurance and TravellerShield Plus is underwritten by Chubb Insurance Singapore Limited (“Chubb”) and distributed by DBS Bank Ltd (“DBS”). It is not an obligation of, deposit in or guaranteed by DBS. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by Chubb. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (“SDIC”). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Chubb or visit the General Insurance Association or SDIC websites. |

prices are ridiculous on the DBS portal, though — on the route I’m interested in it’s $1,299 on DBS vs. $717 on SQ

weird- SQ ticket prices should be the same on DBS portal compared to official website because there’s an API link between the two. It’s basically pulling inventory from the SQ side. Same fare class, same everything?

strange … i didn’t check fare class, just cabin class/route/date

When the 100pts=$3 offer will end?

no publicised end date.

Interesting direction that DBS is taking, first the vantage and now with the TMP it seems DBS is trying out the route OCBC Voyage went with flexible rewards in that the points are good for both cashback and miles.

Although, the current iteration on TMP being 1DBS Point = $2 or $3 = 1cpm or 1.5cpm is inferior to TravelByOCBC. OCBC gives more decent cpm for its miles when used for flights, or 1cpm when used for cashback. Why DBS piloted a product that sets out less attractive than the incumbent is strange though…

Travel with OCBC is currently offering a value of 1.09 cents per Travel$ (for economy) and 1.41 cents per Travel$ (for business), so the DBS valuation of 1.5 cpm is better (I don’t have VOYAGE miles so I can’t check the rates for that).

the other important thing to consider: it’s far easier to earn DBS points than travel$ because of the 4 mpd earn rate on the WWMC. with Travel$ the best you can do is 2.1 mpd.

Oh true, I’d not considered travel$ and was considering Voyage Miles. Good point with the 4mpd option on certain cards, it’d be that balance between 4mpd with cap and unlimited 1.6 general spend with Voyage.

For Voyage Miles, travel with OCBC tends to be 2.2-2.4 cpm (SQ Business) and 2.8 – 3 cpm (SQ First) based on my last few bookings. There are slight variations as Return yields better cpm than One-Way.

Haven’t checked out the TMP, but I was struggling to understand why I should redeem using voyage miles instead of transferring the miles to krisflyer and redeeming from SQ. Random flight to SFO direct, business class:

SQ revenue ticket: $6783

Krisflyer miles: 257,000 (cpm 2.6)

Travel with OCBC website: $7361

Voyage miles: 327,812 (cpm 2.1)

Am I doing something wrong? Is the status and miles accrual worth the additional 70,000 miles?

Sin to SFO (return) earns you 50,000 kf miles, deduct that from 327k and you’re paying 277k VM (tax inclusive) as opposed to 257k KF + taxes.

The most important point is that availability is much better for VM redemptions as they are considered revenue tickets by SQ. Whereas KF redemptions have to be drawn from the award bucket.

On top of that you get 6k+ PPS Points, depends on you whether the status is worth anything.

Using TMP to book for hotel required payment at the time of booking even though when making the same booking from partner website, no payment is required till certain date. Do you know if the payment at TMP is a hold or debit on the credit card? Also, given free cancellation option and partially redeemed with points, how does the refund work?