Trust Bank prides itself on being Singapore’s first digital bank, forgoing physical branches for an entirely online experience. A “digitally-native” platform, it uses “the best and latest technology to deliver a world-class customer experience and cutting-edge security”.

But as I recently discovered, all those buzzwords mean very little when something goes wrong and you can’t get hold of a human to sort things out. In fact, digital banks may present a special circle of hell when it comes to troubleshooting problems, since you’re absolutely helpless if the app doesn’t want to play nice.

I thought I’d share about my recent experience getting locked out of my Trust Bank account – a problem which might affect you too, should you be upgrading phones.

My Trust Bank misadventure

| ⚠️Update |

|

I first reported this issue on the night of 22 October, and on 25 October at around 1.45 p.m my account was finally unblocked. I can’t say whether it was the natural order of things or whether this article got matters expedited, but one thing’s for sure: a 2.5 day lockout is far from ideal. The CSO wasn’t able to share what triggered the block beyond “security reasons”, so I’m still in the dark as to whether installing the Trust app on a second device is what caused the problem, or whether the fact I was overseas at the time had anything to do with it. Proceed with caution. At the end of the day, I realise it’s a process issue, and process issues get fixed. Digital banking is obviously the wave of the future, but it’s things like this that make people hesitant to make the switch. |

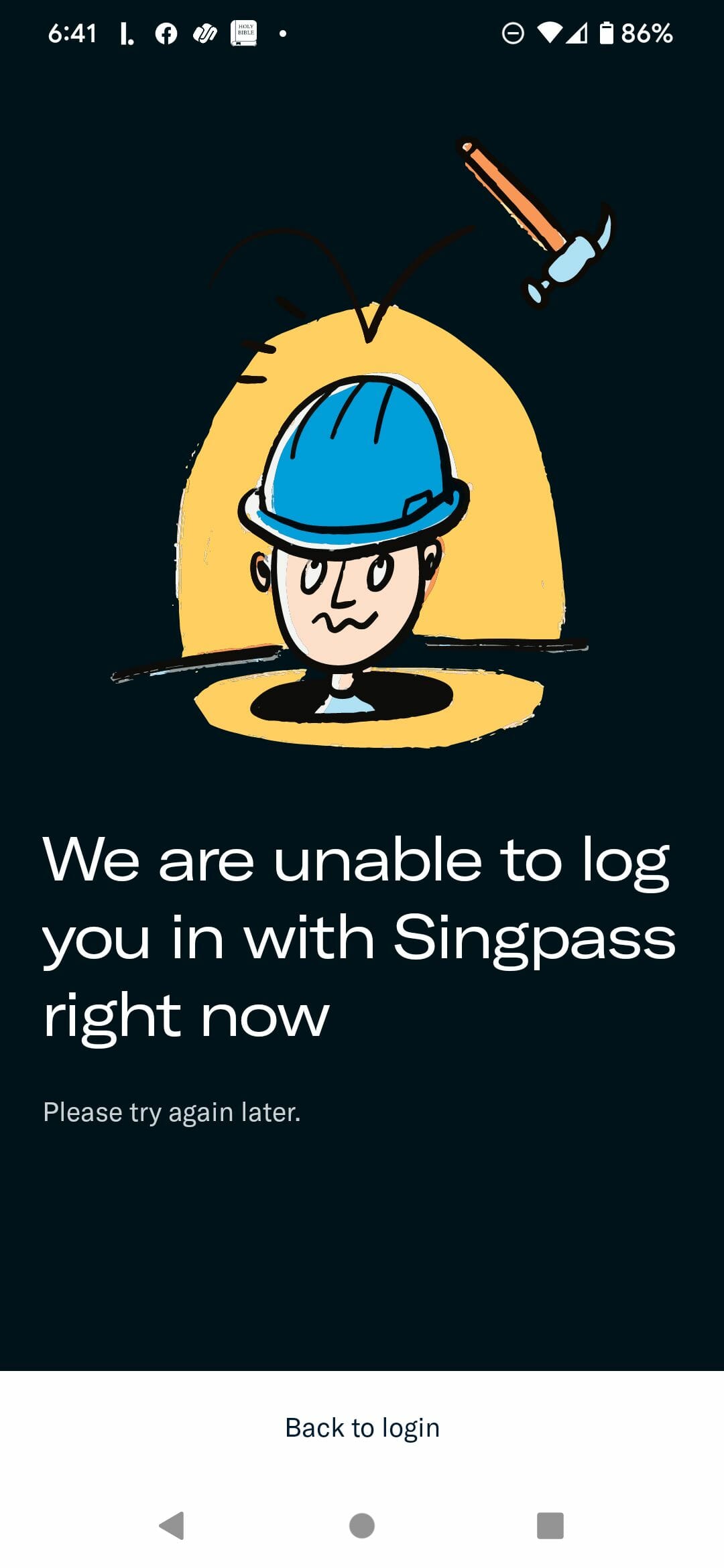

It all began when I traded in my Pixel 6 Pro for a Pixel 7 Pro (I know, I’m a sucker for the upgrade cycle). I installed the Trust Bank app on the new phone, but was unable to sign-in. I tried it on a few other Android devices as well, without success.

I assumed the system was under maintenance, but the issue persisted for a few days. Finally, I called up Trust Bank (mercifully, it does have a call centre, which is more than I can say for Instarem!) and explained the problem.

The CSO informed me that because I hadn’t uninstalled the Trust Bank app on my previous phone (I simply did a wipe before handing it over to the retailer for trade-in), I was now locked out of my account as a “fraud protection measure.”

I didn’t quite follow that logic, actually. Even if tokenisation is only supported on one phone, the usual procedure is that installing the banking app on a second phone simply deactivates functionality on the first, not lock you out of your account entirely. It seemed a bit extreme, like nuking a baby seal, or wearing crocs outside of a healthcare setting.

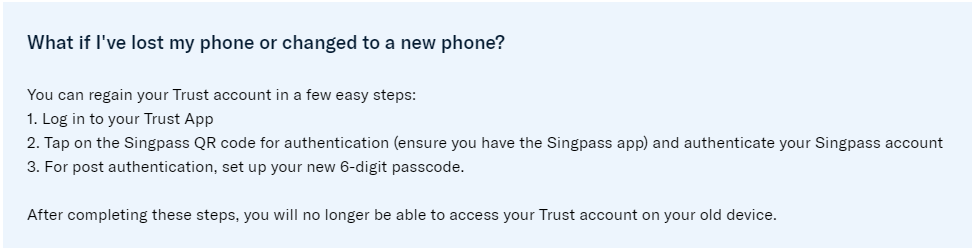

In fact, I’m not even sure that’s an accurate answer. As per Trust’s own FAQs, switching to a new phone should be as simple as downloading the app and setting it up again; no access to the previous device necessary.

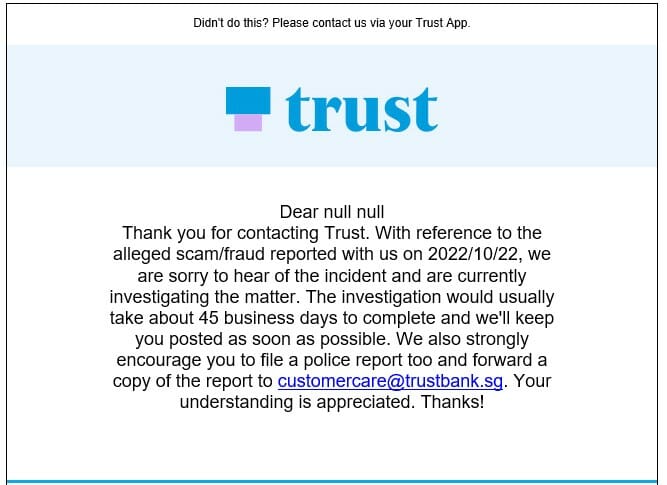

In any case, he told me he had raised a request with the relevant team, and my account would be unlocked within 24 hours. Shortly after the call, I received an automated email.

It’s never a good sign when a “digitally-native” company can’t do proper mail merging, never mind the fact that this was probably the wrong template (I don’t think changing your phone warrants filing a police report, unless perhaps your upgraded model is a bubble tea straw).

The 45 business days timeline sounded a bit much —British Prime Ministers have been sunk by icebergs in less time — but I decided to give Truss Trust the benefit of the doubt, since it was in all likelihood a poorly-composed form letter.

24 hours passed and I was still locked out of my account. So I called back, and despite calling at 6 a.m, waited on hold for an hour, listening to the same pre-recorded message over and over.

“Our friendly customer team is still busy at the moment, please bear with us and we will attend to you as soon as we can. You may also access our in-app digital services to fulfil your banking needs. It has all the good stuff!”

Well, no I couldn’t, actually. The app was completely useless to me at the moment, because it offered no functionality to customers who were not signed in.

“Our customer care team is doing their best to attend to you. Alternatively, you may like to ring us later and we will do our very best to serve you then.”

Trust Bank does have a live chat feature, but you can’t use it without being logged in to the app, so that’s another chicken and egg problem.

And I haven’t even got to the best part yet. After holding for 65 minutes:

“Thanks for calling Team Trust. Bye!”

I swear, that “bye” had a tinge of malice in it. The line disconnected unceremoniously, reminding me why digital banking might be overhyped.

I called again later that morning and was eventually connected to a CSO who asked me three security questions. I told her I didn’t know the answer to the last one (ironically “when was the last time you logged in to your account”), but she must have decided 2 out of 3 was good enough and powered straight on.

Unfortunately, she couldn’t offer anything beyond “Have you tried uninstalling and installing the app again” (at least I wasn’t asked to restart the phone; that might have sent me over the edge), and when that didn’t work, she told me she’d need a screenshot of the error message, and it could take another 1-2 business days to get a resolution.

I asked her to arrange for a call back by 5 p.m to provide an update, which she agreed to. So naturally, no one called.

Fortunately, I have no actual money in my Trust Bank account. The only thing at stake are my NTUC vouchers. But if I did, I can’t imagine not having access to my funds for such an extended period of time, and with no physical branches to fall back on, I’d be completely handicapped.

Being locked out of your account means no fund transfers, no bill payments, no online card transactions (the physical Trust Card is completely numberless, so you need to consult the app for the details). If you haven’t set up a PIN in the Trust app, you won’t be able to withdraw cash from ATMs either. If you lose your physical card, you won’t be able to lock it without waiting on hold for a call that may or may not be answered.

It’s what happens when an app becomes a single point of failure.

Conclusion

Based on my experience so far, I’m left scratching my head as to what exactly digital banking is good for if you can’t even get the digital part working properly.

If anything, it’s a reminder that it’d be wise not to jump on the digital banking train entirely. Physical branches might conjure images of boomers rushing down to open fixed deposits, but they do have their uses. A digital bank is only as good as the app, and when the app goes AWOL, so do your funds.

Strange. I had no problems with iPhone. For what it’s worth, my steps were as follows. Did the iPhone transfer of data thing from old iPhone to new iPhone logged in to Trust (and all my other banking apps) as per usual on my new phone, to transfer the digital tokens and what not after making sure everything works on my new phone, followed the iPhone instructions to wipe it and log out. This didn’t require me to do anything specific with the Trust app. But yea your points about it being a digital banking certainly doesn’t make it look… Read more »

yup- i suspect it has nothing to do with upgrading phones actually, and the CSO just pulled that one out of nowhere. Otherwise we’d probably see a lot more reports about lockouts.

Aaron, my question is: what is a mile-chaser like you doing with the Trust account?

I used the Fairprice vouchers and didn’t touch the app anymore. Don’t even activate the card.

You hit the nail on the head: ntuc vouchers

“Fortunately, I have no actual money in my Trust Bank account. The only thing at stake are my NTUC vouchers.”

Good reminder to spend my last NTUC vouchers today and to cancel the card

Didn’t had any issue when I reset my phone. Trust prompt that old phone access will be deactivate.

But I can’t find the option to change login pin anywhere..

U should report them to MAS. Until action is taken nobody does anything especially on customer service front

Yes I agree. Their customer service sucks as you may never get through them. Any changes you need the customer service to do. You cant even see any info of your profile except your name. Extremely bad management. They should hire me

I got problems with Amex as a plat card……that’s worst right? 3days no one could help me with my problem and 3days of even getting thru to the contact Center as a new plat card holder…..

Digital banks still have a long way to go.

N26, a similar digital bank in Europe has been blocking accounts incorrectly as their anti-fraud AI went trigger happy, with dozens of people being locked out of their legitimate funds since the beginning of the year with nowhere to go.

And unlike Trust this N26 “bank” exists already since 2013…

https://www.businessinsider.com/n26-bank-europe-customers-account-closures-access-savings-2022-4?amp

The reactions under their official LinkedIn statement on this speak for itself.

https://www.linkedin.com/posts/n26_why-does-n26-block-accounts-activity-6923659681269743616-T9nz

Exactly. Couldn’t pay my bill and the instructions didn’t help at all. Turned out it was because I didn’t link the credit card to the credit account. Manual didn’t mention that as well. So much for being digitally native!

Aaron, you have been classified as a scammer by the CSO.

Others on Apple & Android hp has no problem when changing hp.

Good job, Trust Bank CSO 😝

A little random but is the pixel pro 7 a worthy upgrade fr the pro 6

I fully agree Aaron. Digital and physical are not binary. If you are in banking, you need branches. If you are in digital banking, you need branches

I had the same issue as you. I upgraded my phone to a new one when overseas. I did a complete data transfer from my old phone and was met with the same message when tried to use Trust. After a week or so when I was back, I rang up Trust and they gave me the same reason as you: “fraud protection”. Addition to your questions, they also confirmed if my latest txns was made by me. In the end, they said they would raise the issue and should resolve within 24hrs. The same CSO called me back within… Read more »

Yup that sounds identical to what I encountered. Did a data transfer at the Google store overseas via cable. I wonder if that copying triggered something?

I think the trigger was “overseas”

Another reason not to trust, Trust Bank. Feels more like a start up than a proper bank. Btw HSBC also locked me out of my acct when I forgot to disable the app token on my old phone, before installing it on a new phone.

I didn’t disable the old HSBC token on old Samsung Galaxy hp but no issue using HSBC app straightaway on new hp. Maybe cause Samsung has SmartSwitch which transferred everything from old to new hp seamlessly.

Had same issue with HSBC though they did resolve it very quickly. So I’ve learnt it is worth checking all finance apps to see if they’ve got a deactivate/transfer type feature when switching devices

Best way to fix anything – from ground up, be the user.

Imagine all their pay is credited to the app only, pretty sure they’d be more motivated to answer if CEO cannot get help at 6am.

they knew you were there just for the vouchers, their anti mile chaser AI kicked in.

It’s NOT digital banking issue, it’s your digital bank. Alibaba has been around forever n never hear of this type of 45 days lockout or for that matter at any digital bank. Problems are aplenty as at any banks, mobile banking at local banks in the early days were nightmare. Even today still teething issues. Add on CSO r really new n don’t understand the bank systems n u get run around. Try shouting really loud n u may get attention from some serious people at your bank. That’s how I solve all my problems with internet n mobile banking… Read more »

Try posting about a bridge and/or a certain city square and see what happens.

This is the digital age, I can feel your frustration, this happens to me every time I order food on Grab, so very often I received the notification that my food had arrived when it hadn’t and there is no CSO I can call.

Back to digital bank, I suggest don’t be too quick write off all the pros of TB with just one bad experience. Furthermore from what I read, you only created the account for the free NTUC vouchers right? It’s a pretty new org, give them some time to settle in.

Absolutely loved the analogies and the puns!!! Well…the content too!

😅…

It doesn’t happen only with Trust bank. This is how the Shopee Account also works, we have shopee pay with it. It’s also our money. If you change the device without uninstalling the app from the old device then you have to struggle the same way!

Trust has an office you can visit…

at 77 Robinson Road

Neh you can’t go to their office lol unless you are the media or something other than that no.

Dash Pet from Singtel also having similar problems. I uninstalled from my original phone and installed on a new phone. The new phone couldn’t access my Dash Pet investment money, eventually I have to switch back to my old phone to access my funds. Immediately I withdrew all my funds. I have learned a good lesson.

I am unable to withdraw my funds! Called their hotline and like u said….got hit by the dreaded “65-min Bye”! It has lost my “Trust!”

You would get similar experience with the SCB banking app. Had the issue of setting up the token on a new Android 13 device, the setup failed, and it refused to let you log in due to the 12-hour cooling period, and you’re stuck for that period.