Milestone bonuses are common features in the airline and hotel loyalty space. The idea is to give customers an incentive for continued patronage, even after requalifying for elite status.

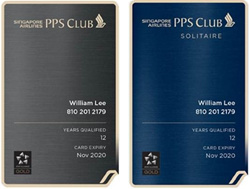

For example, Singapore Airlines offers the following milestone bonuses through its PPS Rewards scheme (there’s a similar scheme for KrisFlyer members called KrisFlyer Milestone Rewards).

|

|

| PPS Value | PPS Reward |

| 25,000: Qualify/Requalify for PPS Club | |

| 30,000 | Double KrisFlyer miles |

| 40,000 | 50,000 KrisFlyer miles redemption discount |

| 50,000: Qualify/Requalify for Solitaire PPS Club | |

| 60,000 | Advance upgrade |

| 75,000 | Advance upgrade |

| 100,000 | Advance upgrade |

Likewise, IHG One members can unlock milestone rewards for every 10 elite nights earned per calendar year, including bonus points, confirmable suite upgrades and an annual lounge membership.

But what about credit cards?

Credit card milestone bonuses

While they’re relatively more rare, milestone bonuses do exist for credit cards, and are typically tied to meeting a certain minimum spend.

Unfortunately, we don’t see a lot of this in Singapore. By the way, I’m not talking about fee waivers. Many cards have a “spend S$X and get a fee waiver” feature, but that’s not much of a milestone reward considering how you can often get a waiver even without hitting the threshold, and the fact you’ll need to forfeit any miles awarded for the payment of the annual fee.

I suppose you could consider the limo benefits offered by $120K cards to be a milestone bonus of sorts, but I’m thinking more along the lines of these:

| 💳 Credit Card Milestone Bonuses |

||

| Card | Spend Req. | Reward |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

S$5K on SIA/Scoot tickets or S$50K overall in first 12 months | KrisFlyer Elite Silver |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

S$12K in 12 months | S$150 SIA credit |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

S$15K on SIA tickets in first 12 months | KrisFlyer Elite Gold |

| S$15K on SIA tickets in 12 months | Double KrisFlyer miles accrual voucher | |

AMEX PPS Card AMEX PPS Card |

S$15K on SIA tickets in 12 months | Double KrisFlyer miles accrual voucher |

| S$75K in 12 months | 50% off KrisFlyer miles redemption | |

AMEX Solitaire PPS Card AMEX Solitaire PPS Card |

S$50K on SIA tickets in 12 months | Business to First/Suite upgrade |

| S$75K in 12 months | 50% off KrisFlyer miles redemption | |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

S$50K in 12 months | 20,000 miles |

None of these are terribly exciting, given their strict T&Cs.

I know I shouldn’t go down the rabbit hole of comparing Singapore cards to those in the USA, but the milestone benefits over there sure seem better: the Hilton Aspire Card offers a free weekend night with a minimum annual spend of US$60,000, while the Marriott Bonvoy Brilliant awards a choice of 5 Suite Night Awards, an 85,000-point free night reward or US$750 off a mattress with a minimum annual spend of S$60,000.

KrisFlyer UOB Credit Card: KrisFlyer Elite Silver

KrisFlyer UOB Credit Cardmember who opened their card between 1 May 2021 to 30 April 2022 will be eligible for an upgrade to KrisFlyer Elite Silver when they spend, in their first membership year:

- S$5,000 on SIA or Scoot tickets, or

- S$50,000 in total

I shouldn’t have to tell you that KrisFlyer Elite Silver is nothing to get excited about. There’s no lounge access, priority baggage, priority boarding or anything of consequence. What’s more, you’ll need to wait six weeks from the end of your membership year to get the upgrade!

This one-time benefit is only available to base KrisFlyer members; you can’t use this to extend an existing KrisFlyer Elite Silver membership.

AMEX KrisFlyer Credit Card: S$150 SIA cashback

AMEX KrisFlyer Credit Cardholders who spend S$12,000 from 1 July to 30 June of the following year will receive S$150 SIA cashback, redeemable on their next Singapore Airlines ticket purchase.

This needs to be fully utilised in a single transaction, and the credit will appear on your billing statement within 90 days of the purchase.

A S$150 rebate on S$12,000 spend (and a restricted rebate at that) is difficult to get excited about, but hey, it’s something.

AMEX KrisFlyer Ascend: KrisFlyer Elite Gold & Double KrisFlyer miles voucher

AMEX KrisFlyer Ascend cardholders who spend S$15,000 on SIA tickets in the first 12 months of approval will be upgraded to KrisFlyer Elite Gold.

Ticket purchases must be for travel originating in Singapore, and be in Singapore Dollars. This one-time offer is only available to a cardholder who is currently KrisFlyer Elite Silver or lower; you can’t use this to extend an existing KrisFlyer Elite Gold membership.

KrisFlyer Elite Gold is certainly useful, but if you’re spending S$15,000 on SIA tickets, you could probably qualify through flying anyway- unless perhaps you’re buying tickets for someone else (since you can only earn Elite miles on tickets with your name on it, regardless of who paid). Furthermore, the fast track offer is only available in the first year of card membership.

Cardholders who spend S$15,000 on SIA tickets from 1 July to 30 June of the following year will receive a double KrisFlyer miles accrual voucher.

Ticket purchases must be for travel originating in Singapore, and be in Singapore Dollars. This can be applied to a Singapore Airlines booking of the member’s choice, and is capped at 5,000 KrisFlyer miles.

Unlike KrisFlyer Elite Gold, this benefit is available each year of membership.

AMEX PPS Card: Double KrisFlyer miles voucher & KrisFlyer redemption discount

AMEX PPS Cardmembers who spend S$15,000 on SIA tickets from 1 July to 30 June of the following year will receive a double KrisFlyer miles accrual voucher. This can be applied to a Singapore Airlines booking of the member’s choice, and is capped at 10,000 KrisFlyer miles.

AMEX PPS Cardmembers who spend at least S$75,000 on the card from 1 July to 30 June of the following year will receive a 50% discount on a KrisFlyer miles redemption.

This sounds exciting, but it’s capped at 50,000 miles. Don’t get me wrong- that’s a good amount to save, but you’ll need to spend S$75,000 for the privilege, and the opportunity cost (compared to if you had used a 4 mpd card) would almost certainly be much more than 50,000 miles.

Both these benefits are available each year of membership.

AMEX Solitaire PPS Card: First Class upgrade & KrisFlyer redemption discount

AMEX Solitaire PPS Cardmembers who spend S$50,000 on SIA tickets from 1 July to 30 June of the following year will receive an upgrade voucher from Business Class to Suites or First Class.

The catch is that you’ll need to buy a paid Business Class ticket to enjoy the upgrade (award tickets don’t count), but if you’re spending S$50,000 on SIA tickets, you’re probably buying Business Class anyway.

The upgrade voucher can only be used for a single segment on a flight operated by Singapore Airlines, and the Business Class ticket must be in the J, C, U or Z booking classes.

AMEX Solitaire PPS Cardmembers who spend at least S$75,000 on the card from 1 July to 30 June of the following year will receive a 50% discount on a KrisFlyer miles redemption. The same terms apply as for the AMEX PPS Card.

Both these benefits are available each year of membership.

UOB PRVI Miles AMEX: 20,000 bonus miles

UOB PRVI Miles AMEX cardholders who spend S$50,000 in a membership year will receive 10,000 bonus UNI$ (equivalent to 20,000 miles) and a waiver of the S$256.80 annual fee.

This is a nice change from the usual mechanic, where cardholders need to pay an annual fee in order to receive miles.

Milestone bonuses: tied to tenure?

While there are credit card milestone bonuses tied to spend, one thing we haven’t seen yet are milestone bonuses tied to tenure; in other words, rewards for holding a card for a certain number of years.

Now, this would presumably be more suitable for $120K cards with mandatory annual fees. A cardholder might be more inclined to renew if they knew they were working towards something significant, or that they’d have to start from scratch if they cancelled and reapplied another year (sunk costs, after all, are a powerful motivator of decisions even if they shouldn’t).

I’m just spitballing here, but some possible tenure-related bonuses might be:

- A higher earn rate unlocked after a certain number of years (the Citi Prestige already has such a feature via its relationship bonus)

- Increasing the number of renewal miles given each year for paying the annual fee (there’d obviously need to be a cap of some sort)

- Upgrading plastic cardholders to a metal version of the card (don’t underestimate the vanity factor!)

- Waiving points conversion fees for cardholders of a certain tenure (might be difficult to implement on the back end for less tech-forward banks)

- Complimentary one-time use lounge passes (even if the card offers a lounge benefit, guests may not be included so the passes could be used for them)

While I’m sure you can think of much more exciting features, economics could be the limiting factor. A product manager for a $120K card once told me that the annual fee is barely sufficient to break even, and that cards are viewed as loss leaders to sell wealth products. If that’s true, there might not be a whole lot of wriggle room, but we can always dream…

Conclusion

Milestone rewards are a relatively uncommon feature for credit cards in Singapore, but I do think they could help drive customer usage and retention. A combination of spend and tenure-related bonuses could be a good way of gamifying a credit card, provided the bonuses are actually worth earning!

What kind of credit card milestone rewards would you like to see?

Amex Krisflyer Blue. Spend $12K 1 July – 30 June to get $150 rebate for ex SIN SQ online flight bookings.

oh yes, forgot about this one. will get it added!

I think the DBS Vantage $60k spend to get annual fee waived is “meaningful” milestone. If pay AF, get 25k miles + Accor Plus, which broadly equals the AF paid. But if AF is waived, doesn’t get the 25k miles but still get Accor Plus for free. And the pleasure of metal card and other minor benefits.

good point, actually! i’d say the accor plus falls within the wheelhouse.

Question: does paying Amex cc using Vantage (through DBS online banking) counts towards the 60k spend to waive AF? Me trying and will only know later. For sure it counts towards the DBS Mulitplier amount thresholds. Thus Amex –> GPMC –> AXS = 1.5% on Amex + one more month cash in hand count towards Multiplier + possibly count towards AF waiver.

How do you pay Amex cc with vantage ?

Please let us know if the credit card bill payment it is counted