From now till 22 December 2022, Accor Live Limitless (ALL) is offering a 50% conversion bonus on points from selected partner programmes.

While there’s only one participating partner in Singapore (Standard Chartered), this could nonetheless be a good opportunity to cash out your orphan points balance.

Accor Live Limitless 50% conversion bonus

|

| ALL Conversion Bonus |

From 21 November to 22 December 2022 (8 p.m SGT), Accor will award a 50% bonus on all points conversions made from the following programmes:

- Ping An E-Wallet

- RewardCash Programme for HSBC HK Credit Card

- HSBC Taiwan Traveller’s Points

- Programa Más de HSBC

- Fliggy Members

- Cathay United Bank Reward Point Program

- Inbursa Rewards

- Standard Chartered 360˚ Rewards (Standard Chartered Singapore)

- Standard Chartered 360˚ Rewards (Standard Chartered Brunei)

- K Point (Kasikorn Bank)

- CIMB Member Rewards

- KTC FOREVER points

- Hana Money

- American Express Membership Rewards®(Hyundai Amex Centurion Design Card)

- JANA Rewards Program

No registration is required, and there is no cap on the maximum bonus that can be earned.

The only partner of interest to us in Singapore is Standard Chartered 360˚ Rewards (or SC Rewards, since I can’t be bothered to keep typing ˚).

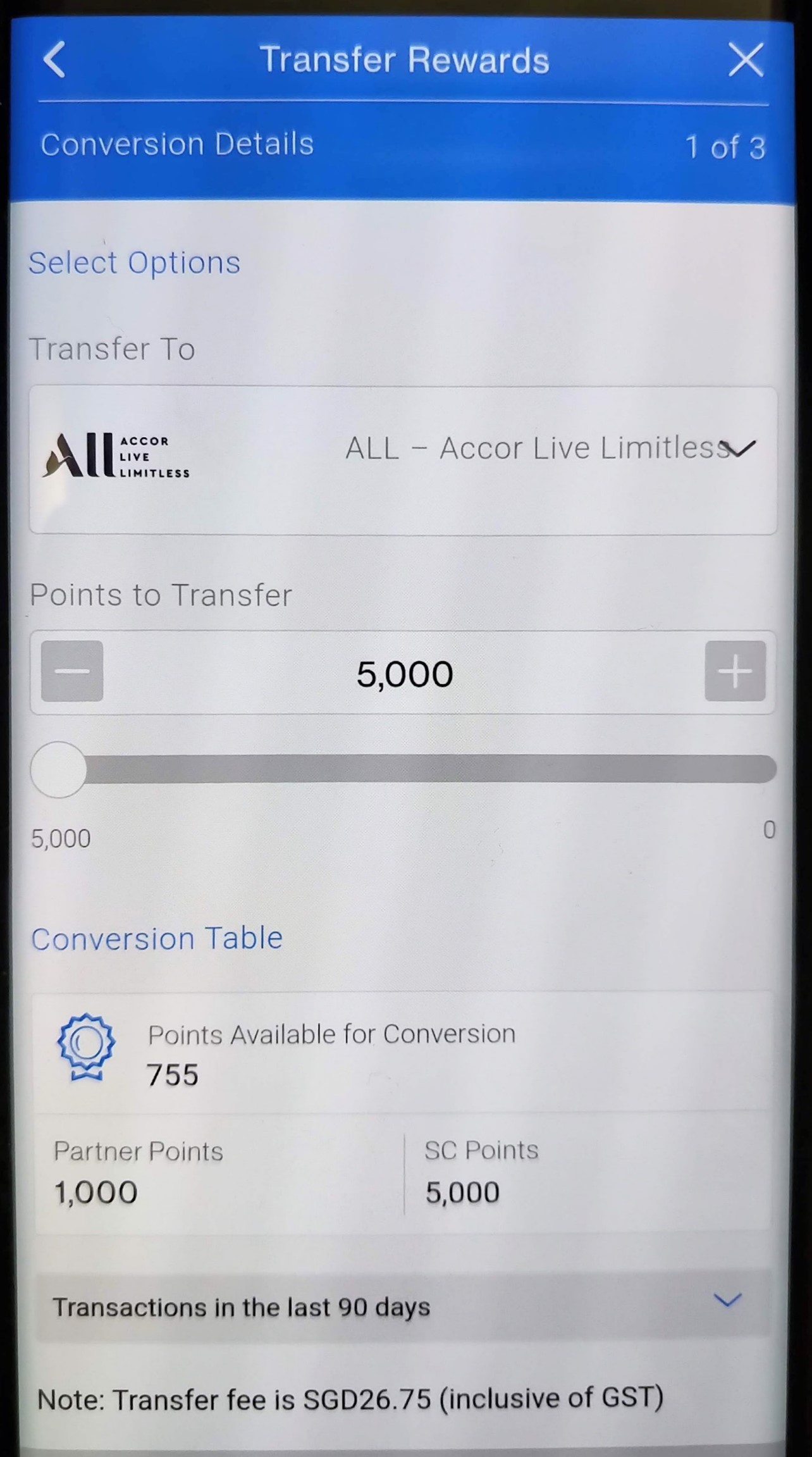

SC Rewards can normally be converted to ALL at a ratio of 5,000 to 1,000; with the bonus this becomes 5,000 to 1,500. A flat fee of S$26.75 per conversion applies.

Do note you won’t see the bonus reflected on the SC Mobile app when making a transfer. Accor will credit the bonus on its side within 10 days of the regular number of points posting.

Is it worth it?

Here’s how the math works:

- Under this conversion bonus, 5,000 SC Rewards points becomes 1,500 ALL points

- ALL points can be redeemed for rooms or dining/spa credit at a fixed rate of 2,000 ALL points= €40

- Therefore, you’re trading 5,000 SC Rewards points for €30 (~S$43)

- 5,000 SC Rewards points is also worth 2,000 KrisFlyer miles

- You’re implicitly taking a value of 2.15 cents per mile

I’d say this is a worthy valuation to cash out your SC Rewards points, since ALL points can basically be used like cash for Accor stays. You can book whatever rate you wish- regular room, club room, presidential suite, and use the points to cover breakfast, room service, spa treatments etc.

I’ve long since abandoned my StanChart X Card, but have 30,000 SC Rewards points left inside. I’ll be taking advantage of this bonus to cash out the balance.

Conclusion

Accor is offering a 50% conversion bonus from selected partner programmes till 22 December 2022. If you have SC Rewards points, it’s an opportunity to get the equivalent of 2.15 cents per mile in value, which is none too shabby.

Of course we did see a 100% ALL conversion bonus in March 2020, but that can probably be chalked up at least in part to COVID, and I doubt we’ll ever see it again.

(HT: Loyalty Lobby)

Any data points on how long transfers take from scb to Accor?

transferred yesterday, points in today + bonus.

Thanks that helps.

I realise Accor points can’t be redeemed at restaurants unless you are staying there, so slightly different compared to say Hyatt or GC..

Would we be able to make use of the free Accor Plus Explorer Membership from DBS Vantage to get further discounts then use less ALL points to redeem for a room?