Singapore is set to increase its GST from 7% to 8% on 1 January 2023, and then again from 8% to 9% on 1 January 2024. Depending who you ask, this is either a necessary step to meet our future needs, or a vote opposition! moment.

Either way, there’s going to be a tangible impact for all us miles and points chasers, from the annual fees paid on cards, to the price of staycations and more.

Here’s a breakdown of what you should expect in each of these areas.

Credit card annual fees

This is probably going to be the most annoying change for me as a writer, since I’ve more or less hardcoded all the existing annual fees into my mind. Having to remember one set of figures for 2023 and another for 2024 and beyond will take some getting used to.

Most of the entry-level miles cards like the Citi PremierMiles Card, DBS Altitude Card and KrisFlyer UOB Credit Card charge S$180 + GST, so that familiar $192.60 fee will go to S$194.40 in 2023, and S$196.20 in 2024.

Of course, there’s no reason why you shouldn’t be able to get that waived, so don’t pay annual fees unless you want to earn miles.

The impact will be more noticeable on premium cards where fees are higher and generally non-waivable, e.g. the $120K segment.

| 7% GST | 8% GST | 9% GST | |

OCBC VOYAGE OCBC VOYAGEApply |

S$488 | S$492.56 | S$497.12 |

Citi Prestige Citi PrestigeApply |

$535 | S$540 | S$545 |

SCB Visa Infinite SCB Visa InfiniteApply |

S$588.50 | S$594 | S$599.50 |

DBS Vantage DBS VantageApply |

S$588.50 | S$594 | S$599.50 |

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$600 | S$605.61 | S$611.21 |

HSBC Visa Infinite HSBC Visa InfiniteApply |

S$650 | S$656.07 | S$662.15 |

SCB X Card SCB X CardApply |

S$695.50 | S$702 | S$708.50 |

UOB VI Metal Card UOB VI Metal CardApply |

S$642 | S$648 | S$654 |

AMEX Plat. Charge AMEX Plat. ChargeApply |

S$1,712 | S$1,728 | S$1,744 |

You’ll notice that in cases where the annual fee “bakes in” GST (e.g. HSBC Visa Infinite, OCBC VOYAGE), the changes throw up some very ugly figures. I’m hoping common sense prevails and they round it down to the nearest whole number in that case, but we’ll have to see.

It’s also important to remember that annual fees are charged upfront, in respect of the upcoming 12 month period. The annual fee depends on the prevailing GST at the time the fee is paid.

Therefore, if your membership year happens to run from December 2022 to November 2023, your annual fee will be based on 7% GST notwithstanding the fact that 11 of your 12 month membership year takes place in 2023.

Mileage conversion fees

Unless you’re spending on a cobrand card that credits miles directly to your frequent flyer account, at some point you’re going to have to do a conversion from bank points into miles. This usually incurs an administrative fee, which varies depending on bank.

For the banks that levy fees per conversion, here’s how the figures change.

| ✈️ Charge Per Conversion |

|||

| 7% GST | 8% GST | 9% GST | |

|

S$30 | S$30.28 | S$30.56 |

| S$26.75 | S$27 | S$27.25 | |

| S$26.75 | S$27 | S$27.25 | |

|

S$26.75 | S$27 | S$27.25 |

| S$25 | S$25 | S$25 | |

| S$26.75 | S$27 | S$27.25 | |

| S$25 | S$25 | S$25 | |

If it’s any consolation, we’ll see round numbers for most banks next year, as the standard S$25 + GST becomes a nice S$27 on the dot. That will become S$27.25 in 2024, representing a grand total increase of S$0.50.

Do note that some banks will be unaffected by the change. I’ve confirmed with OCBC and UOB that there’s no intention at the moment to change their S$25 nett fee.

For the banks which charge an annual fee for unlimited conversions, here’s what changes.

| ✈️ Charge Per Year |

|||

| 7% GST | 8% GST | 9% GST | |

| S$42.80 | S$43.20 | S$ 43.60 | |

| S$42.80 | S$43.20 | S$ 43.60 | |

| S$50 | TBD | TBD | |

Do note that the fees are paid upfront, at the time of registration. If saving those few cents is that important to you, then registering before 1 January 2023 would be the way to go.

Flights and award bookings

GST is zero-rated for airfares, so there will be no impact on that component of your ticket.

However, there will be an impact on the fees and surcharges paid. Changi Airport currently levies three kinds of taxes for outbound passengers

- Passenger Service and Security Fee (PSSF)

- Airport Development Levy (ADL)

- Aviation Levy (AL)

This currently adds up to S$59.20.

| ❓ Why am I paying more than S$59.20? |

|

S$59.20 are the fees collected by Changi Airport from departing passengers. Some airports charge fees to arriving passengers as well. If you’re travelling to Australia, Myanmar, New Zealand, Russia, Thailand, the UAE or the USA, you will pay more than S$59.20 in fees for a one-way ticket out of Singapore |

Of the three, only the PSSF is subject to GST.

The PSSF is currently S$40.40, but will be increased to S$43.40 on 1 April 2023, and S$46.40 on 1 April 2024. These figures already include GST, and based on what I’m reading in the Changi fee guide, there will be no intermediate adjustment to S$40.78 on 1 January 2023 to cover the period till 31 March 2023.

Hotel bookings

For those of you looking to book staycations, the situation is a bit more confusing.

It ‘s my understanding that so long as your stay was paid in full before 1 January 2023, you’d pay 7% GST, notwithstanding the fact your stay took place from 1 January 2023 onwards. That would be consistent with IRAS’s guidance in Scenario 1 of its GST Rate Change for Consumers guide.

|

Scenario 1

If full payment is received by the supplier for the goods or services before 1 Jan 2023, GST will be chargeable at 7% irrespective of when the goods or services are provided to you. |

However, when I went to look at how hotels were actually pricing their rooms, it seems the following rule is being applied:

- If your stay is before 1 January 2023, you’ll pay 7% GST

- If your stay is from 1 January 2023, you’ll pay 8% GST

- If your stay straddles 2022 and 2023, you’ll pay 7% GST on the nights in 2022, and 8% GST on the nights in 2023

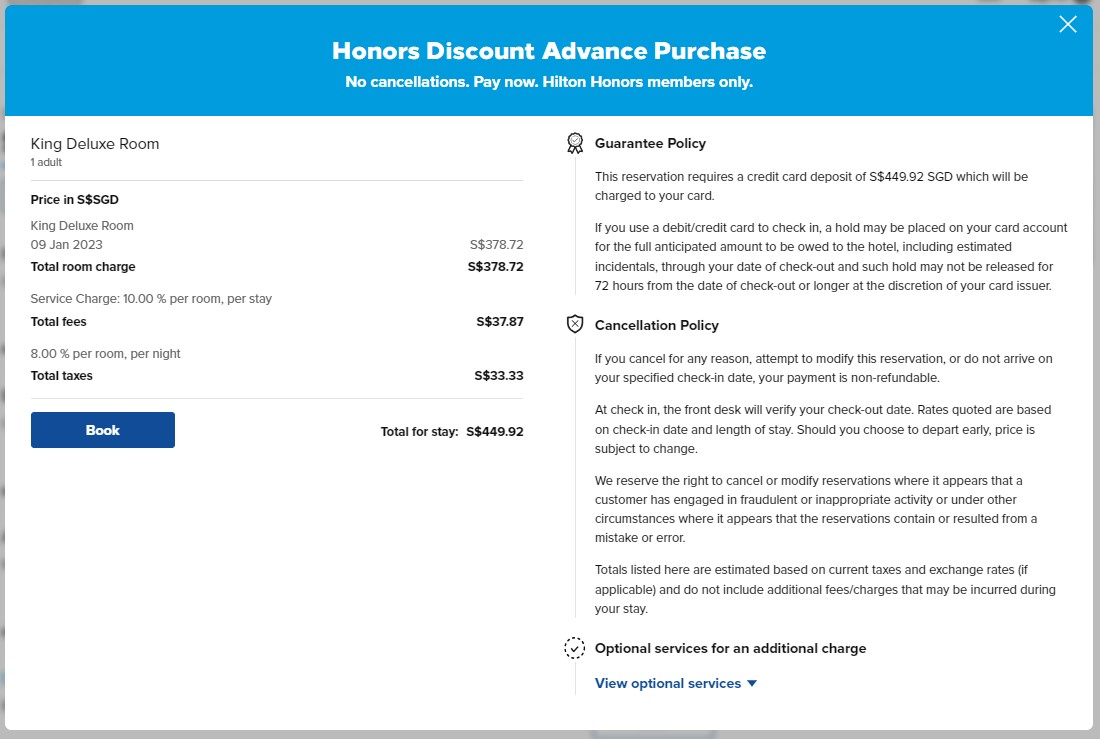

This is regardless of whether your stay is prepaid or not. In the screenshot below, I’m looking at a prepaid rate for the Hilton Singapore Orchard on 9 January 2023. Even though I’m making this booking in 2022, I’m still being billed 8% GST.

I checked Agoda, Marriott, Kempinski and IHG’s websites, and it was the same throughout.

One possibility is that hotels don’t actually charge you for prepaid rates at the time of booking. I’ve experienced that a few times with so-called prepaid rates for Hilton and GHA hotels, where my card was only charged the night before check-in or at the check-in desk itself (it just means you can’t cancel the booking, because one way or another your card is going to get charged).

I asked Kempinski about this, and was told that payment is not made upon online booking, even for a prepaid rate. Instead, the reservations team would send a separate payment link, and the GST rate would be based on which year the guest makes payment.

Therefore, if you want to lock in the 7% GST for a big-ticket stay, it’s worth calling the hotel and asking whether they can take payment by 31 December 2022.

Conclusion

The 2023 and 2024 GST hikes will lead to an increase in costs across the board, and miles chasers won’t be spared.

You’ll notice some minor adjustments to your credit card annual fees and the cost of mileage conversions, and somewhat larger (in absolute size at least) adjustments to big ticket items like staycations. If your stay is in early 2023 and you don’t mind locking in your funds, it may be worth considering an advance prepayment to enjoy the current 7% rate.