Welcome to the 2022 edition of the $120K Credit Card Showdown, where we take an in-depth look at the finest pieces of plastic (or metal) money can buy.

2022 marks the fifth iteration of this guide, and thankfully we’re now a world away from 2020 and 2021, when COVID-19 border closures and lockdowns rendered many $120K benefits useless.

While I questioned the wisdom of applying for a $120K card during the height of the pandemic, I have no such concerns anymore. Normal life is fast returning, and whether you’re planning to hit the road or hit the town, a $120K card could be a very useful companion to have.

What is the $120K segment?

The credit card market in Singapore is broadly segmented into three tiers, which I’ve illustrated below with helpful band descriptors.

At the bottom are entry-level cards like the Citi PremierMiles, DBS Altitude and HSBC Revolution. The income requirement here is the MAS-mandated minimum of S$30,000, and benefits are limited to a few free lounge visits or generic bank discounts.

At the top are invitation-only cards like the AMEX Centurion, Citi ULTIMA, DBS Insignia, and UOB Reserve. Income requirements are in excess of S$500,000, and benefits include beck-and-call concierge services and invitations to black tie society events.

In between those two you’ll find the mass-affluent tier, otherwise known as the $120K segment (despite the name, income requirements of $120K cards actually range between S$120-150,000). These may not be as posh as cards in the $500K segment, but still come with useful perks like unlimited lounge access, complimentary airport transfers and exclusive hotel offers. Some of them sport metal cardstock too, for that extra premium feel.

The $120K candidates

| 💳 $120K Candidates | |

|

|

| AMEX Platinum Reserve | Citi Prestige |

|

|

| DBS Vantage | HSBC Visa Infinite |

|

|

| Maybank Visa Infinite | OCBC VOYAGE |

|

|

| SCB Visa Infinite | UOB VI Metal Card |

There’s eight candidates in this year’s $120K showdown, with the seven from last year joined by the new kid on the block: the DBS Vantage.

That obviously creates a whole new dynamic; the last time we saw a new entrant to the $120K segment was all the way back in July 2018 with the UOB Visa Infinite Metal Card, and even that was arguably more of a reboot than a new product per se.

Otherwise, I’m once again choosing to omit the Standard Chartered X Card in favour of the Standard Chartered Visa Infinite, since the former has faded almost to the point of irrelevance, and the latter is closer in income requirement and benefits to a true $120K card.

While the AMEX Platinum Charge will unofficially accept applications at the S$120-150,000 mark (versus the publicised S$200,000), I don’t include it in the $120K segment simply because its S$1,712 annual fee is 3X that of the competition, making it almost impossible to do a fair comparison. Its benefits are superior, but at that price, they better be.

I have also excluded $120K cards like the Bank of China Visa Infinite and CIMB Visa Infinite, because they earn cashback instead of points. Likewise, there’s no room for the UOB Lady’s Solitaire Card because it’s less of a general spending card and more of a specialised spending option.

What’s changed since last year?

Here’s a quick snapshot of what’s changed since the previous $120K showdown in May 2021.

AMEX Plat. Reserve AMEX Plat. Reserve |

|

| + Improvements | – Devaluations |

|

|

Citi Prestige Citi Prestige |

|

| + Improvements | – Devaluations |

|

|

HSBC Visa Infinite HSBC Visa Infinite |

|

| + Improvements | – Devaluations |

|

|

Maybank Visa Infinite Maybank Visa Infinite |

|

| + Improvements | – Devaluations |

|

|

|

OCBC VOYAGE OCBC VOYAGE |

|

| + Improvements | – Devaluations |

|

|

SCB Visa Infinite SCB Visa Infinite |

|

| + Improvements | – Devaluations |

|

|

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

| + Improvements | – Devaluations |

|

|

Annual Fees and Welcome Gifts

| Card | Annual Fee | Welcome Gift |

AMEX Plat. Reserve AMEX Plat. Reserve |

S$535 | 2N stay at Fraser properties + other dining & lifestyle vouchers^ |

Citi Prestige Citi Prestige |

S$535 | 25,000 miles^ |

DBS Vantage DBS Vantage |

S$588.50 | 25,000 miles^ |

HSBC Visa Infinite HSBC Visa Infinite |

S$650 (S$488 for HSBC Premier) |

35,000 miles |

Maybank Visa Infinite Maybank Visa Infinite |

S$600 (1st yr. free) |

None |

OCBC VOYAGE OCBC VOYAGE |

S$488* |

15,000 miles^ |

SCB Visa Infinite SCB Visa Infinite |

S$588.50 | 35,000 miles |

UOB VI Metal Card UOB VI Metal Card |

S$642 | 25,000 miles^ |

| ^Also given upon renewal *Alternative option: Pay S$3,210 for 150,000 miles |

||

If you want to join the $120K club, you’d better get used to the idea of paying annual fees- and not insignificant ones. The annual fee for a $120K card ranges from S$488 to S$650, and we were a whisker away from DBS setting a new all-time high with a S$736 fee for the DBS Vantage, before they backtracked and settled on a much saner S$588.50.

| 😂 Annual Fee Waiver? |

|

The general rule is that cards in the $120K segment don’t provide annual fee waivers. There are a few exceptions:

|

Fees are not insubstantial, but most cards cushion the blow by offering miles in exchange for the annual fee.

- The Citi Prestige, DBS Vantage, OCBC VOYAGE, and UOB Visa Infinite Metal Card offer bonus miles each year the annual fee is paid

- The HSBC Visa Infinite and Standard Chartered Visa Infinite offer bonus miles only as a one-time welcome gift. No miles are officially given upon renewal, but unofficially, customers who call up are usually placated with 20,000-25,000 miles; ymmv

- The AMEX Platinum Reserve does not offer miles with the annual fee, but you get another 2N Fraser Hospitality voucher upon renewal, plus other dining and spa vouchers

- The Maybank Visa Infinite does not offer miles with the annual fee, but waives the first year’s fee while still including an unlimited-visit Priority Pass

If we’re just looking at which card offers the most miles for paying the annual fee, the winner would be the HSBC Visa Infinite. Cardholders receive 35,000 miles in exchange for a S$488 annual fee, which works out to just 1.39 cents per mile. However, you need to be a HSBC Premier customer to enjoy the S$488 fee; if you’re just a regular joe, the annual fee is a much higher S$650, or 1.86 cents per mile.

Therefore, I’m inclined to give this to the Standard Chartered Visa Infinite, which offers 35,000 miles in exchange for a S$588.50 annual fee, or 1.68 cents per mile.

If we’re looking at this on a recurring basis though, the Citi Prestige still offers the best deal- S$535 for 25,000 miles is paying 2.14 cents each. That’s still more than I’m willing to pay, but we can’t view the figure in a vacuum, since there’s other benefits that help make up the difference.

Earn Rates

| Card | Local | FCY | Bonus |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd | 3.47 mpd on 10Xcelerator |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2.0 mpd^ | N/A |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd | 4 mpd on dining & petrol@ |

HSBC Visa Infinite HSBC Visa Infinite |

1.25 mpd* | 2.25 mpd* | 4 mpd on lux. shopping |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2.0 mpd | N/A |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd | N/A |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd# | 3.0 mpd# | N/A |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.0 mpd | N/A |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank @ Capped at S$2K per calendar month *With minimum S$50K spend in previous membership year. Otherwise (or if first year), 1 mpd for local, 2 mpd for overseas #With minimum S$2K spend per statement month. Otherwise 1 mpd for both |

|||

For the record: you don’t need a $120K card to rake in the miles. In fact, if your only concern is miles maximisation, you’re better off using a specialised spending card, many of which are available at the $30K income mark.

That said, my pick for the best earn rates is the newly-launched DBS Vantage and its beefy 1.5/2.2 mpd on local/foreign currency spending. From now till 31 December 2022, cardholders will also earn 4 mpd on all dining & petrol transactions, capped at S$2,000 per calendar month (the cap is shared between dining and petrol).

| 🍽️ Dining | ⛽ Petrol |

|

|

That’s more than enough firepower to beat the Standard Chartered Visa Infinite, which requires a minimum spend of S$2,000 per statement month to unlock its 1.4/3.0 mpd on local/foreign currency spending. Fail to hit that, and it’s a pathetic 1 mpd for everything!

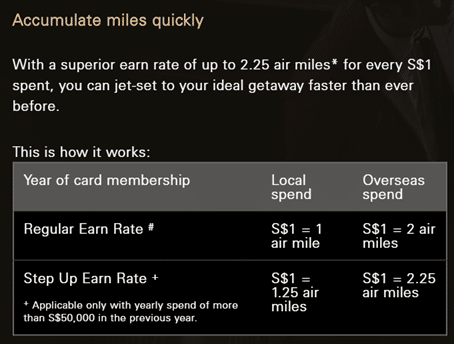

Minimum spends are annoying, but Standard Chartered Visa Infinite customers have it easy compared to HSBC Visa Infinite, which requires cardholders to spend at least S$50,000 in the previous membership year to unlock its 1.25/2.25 mpd on local/foreign currency spending. Fail to hit that (or if it’s the first year), and the earn rate is a ho-hum 1.0/2.0 mpd.

If you’d rather avoid minimum spend shenanigans and don’t want the DBS Vantage, then the OCBC VOYAGE or UOB Visa Infinite Metal Card would be the next best options.

At the bottom of the heap is the AMEX Platinum Reserve with an anaemic 0.69 mpd earn rate on local and overseas spending. You could earn 3.47 mpd at 10Xcelerator partners, but these aren’t exactly what I’d call everyday merchants.

Before you dismiss it, however, consider that American Express has the fewest rewards restrictions of any bank in Singapore- you can earn miles on government transactions, education fees and hospital bills, assuming AMEX cards are accepted. This makes it a good “card of last resort” when you suspect a particular payment might not earn points with another bank.

Points Flexibility and Expiry

| Card | Expiry | Partners | Xfer Fee |

Min. Xfer |

AMEX Plat. Reserve AMEX Plat. Reserve |

None | 11 | None | 250 miles |

Citi Prestige Citi Prestige |

None | 11 | S$26.75 | 10K miles |

DBS Vantage DBS Vantage |

3 yrs. | 4 | S$26.75@ | 10K miles |

HSBC Visa Infinite HSBC Visa Infinite |

37 mo. | 2 | S$42.80^ | 10K miles |

Maybank Visa Infinite Maybank Visa Infinite |

None | 4 | None | 5K miles |

OCBC VOYAGE OCBC VOYAGE |

None | 1 | None | 1 mile |

SCB Visa Infinite SCB Visa Infinite |

None | 10 | S$26.75 | 1K miles |

UOB VI Metal Card UOB VI Metal Card |

2 yrs. | 2 | S$25# | 10K miles |

| @Alternatively, pay S$42.80 for automatic conversions every quarter ^An annual fee that covers unlimited transfers during a 12-mth period #Alternatively, pay S$50 for automatic conversions each month |

||||

Quantity of points is one thing; quality is another. All things equal, credit card points are more valuable if they:

- don’t expire

- can be transferred to multiple airline partners

- don’t incur conversion fees

- have smaller minimum transfer blocks

Based on this criteria alone, the AMEX Platinum Reserve would be the winner. It has non-expiring points, a wide variety of transfer partners, no transfer fees, and a minimum transfer amount that starts from just 250 miles.

The problem is more the earn rates than the points quality; Membership Rewards points are high quality, but low quantity (see previous section).

Therefore, the Citi Prestige may be a more realistic option. Even though it carries a S$26.75 transfer fee, ThankYou points never expire and can be transferred to 11 different partners. The Standard Chartered Visa Infinite isn’t bad either, but remember, it applies different transfer ratios among its partners (e.g. 2.5 points= 1 mile for KrisFlyer, but 3.5 points= 1 mile for Emirates Skywards), which could be a stumbling block for anyone looking to earn more “exotic” miles.

If you don’t care so much about transfer partner variety because you’re a KrisFlyer or bust type of guy, then the next thing I’d focus on is transfer fees. It’s hard to believe in this day and age that processing a points conversion really costs S$25, but that’s what you’ll pay unless you have an AMEX Platinum Reserve, Maybank Visa Infinite or OCBC VOYAGE.

I’d really like to see banks offering waivers of these junk fees to their premium customers.

Miles Purchase Facilities

| Card | Buy Miles From | Limit |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A |

Citi Prestige Citi Prestige |

0.8 cpm (PayAll) |

Actual bill amount |

DBS Vantage DBS Vantage |

1.67 cpm (Tax payment) |

Actual tax amount |

HSBC Visa Infinite HSBC Visa Infinite |

1.2 cpm (Tax Payment) |

Actual tax amount |

Maybank Visa Infinite Maybank Visa Infinite |

N/A | N/A |

OCBC VOYAGE OCBC VOYAGE |

1.9-1.95 cpm (VOYAGE Pay) |

None |

SCB Visa Infinite SCB Visa Infinite |

1.14 cpm (Tax Payment) |

Actual tax amount |

UOB VI Metal Card UOB VI Metal Card |

1.8 cpm (UOB Payment Facility) |

None |

Most $120K cards offer a payment facility, which is basically a way of buying miles at a discount.

To recap, there are two types of payment facilities:

- Those which let you buy as many miles as you want, no questions asked

- Those which let you buy miles provided you have a rental, tax, insurance or some other bill to pay

(1) is available to OCBC VOYAGE and UOB Visa Infinite Metal Card cardholders, with prices ranging from 1.8-1.95 cents per mile. This is certainly cheaper than paying US$40 per 1,000 miles (what SIA charges if you top up when redeeming), but hardly cheap.

(2) is available to Citi Prestige, DBS Vantage, HSBC Visa Infinite and Standard Chartered Visa Infinite cardholders, with much lower prices.

Citi Prestige customers can earn an excellent 2.5 mpd on Citi PayAll, which given the 2% admin fee works out to 0.8 cents per mile. Even with KrisFlyer’s recent devaluation, I’d still be a buyer at that price!

What’s more, Citi PayAll supports so many different types of payments that most people should be able to find something to pay.

| 💰 Citi PayAll: Supported Payments | |

|

|

Compared to that, every other option pales in comparison. Standard Chartered Visa Infinite and HSBC Visa Infinite cardholders have decent tax payment facilities which offer miles at 1.14/1.2 cents each, but you’re limited by the amount on your IRAS NOA. If your tax is S$10,000, for example, you’re limited to buying 14,000 miles with the Standard Chartered Visa Infinite.

| ❓ Paying Income Tax? |

| Don’t forget to check out The MileLion’s full guide to earning miles on your 2022 income taxes. |

Lounge Access

In July 2021, Plaza Premium finalised its divorce from Priority Pass and LoungeKey, removing almost its entire network of 180 lounges. There are some airports (e.g. Penang, Siem Reap) where Plaza Premium lounges are the only contract lounge option, leaving Priority Pass members high and dry.

Because of that, every $120K card which relies on Priority Pass for its lounge access has automatically become weaker, to the advantage of the OCBC VOYAGE and UOB Visa Infinite Metal Card.

And yet, both those options are far from the best. The OCBC VOYAGE will only get you into Plaza Premium Lounges, which are far from omnipresent. The UOB Visa Infinite Metal Card uses the much-bigger DragonPass network, but caps you at a pathetic four visits per membership year.

Therefore I’m giving this title to the Citi Prestige and HSBC Visa Infinite. The former offers an unlimited-visit (+1 guest) Priority Pass to the principal cardholder, while the latter offers an unlimited-visit LoungeKey to the principal cardholder and up to five supplementary cardholders.

If you travel with different people all the time, the Citi Prestige will be more useful. If you travel together with family, you’d be better off giving each member their own supplementary card.

Airport Limo Transfers

The HSBC Visa Infinite remains the king of the limo benefit. By paying the annual fee, cardholders enjoy two complimentary airport transfers per calendar year (four if you’re a HSBC Premier customer), and additional rides (+expedited immigration, see below) can be unlocked with just S$2,000 spend.

A close second would be the Maybank Visa Infinite which gets you two rides with S$3,000 spend. It didn’t take the title because of its lower annual usage cap, and lack of free rides.

Unfortunately, everything after that is far from ideal. The OCBC VOYAGE requires S$5,000 per ride, the Citi Prestige a shocking S$12,000 (yes, I know they give you up to a quarter to do so but still), and the rest of the cards offer no limo rides at all.

This is a fading benefit indeed, and you might be better off with the UOB PRVI Miles AMEX- just S$1,000 of FCY spend in a quarter for two rides!

Travel Insurance

| Card | Accident | Medical | Travel Inconv. |

AMEX Plat. Reserve AMEX Plat. ReserveT&Cs |

S$1M | N/A | Yes |

Citi Prestige Citi PrestigeT&Cs |

S$1M | S$50K (+ COVID cover) |

Yes |

DBS Vantage DBS Vantage |

N/A | N/A | N/A |

HSBC Visa Infinite HSBC Visa InfiniteT&Cs |

US$2M | S$100K (+ COVID cover) |

Yes |

Maybank Visa Infinite Maybank Visa InfiniteT&Cs |

S$1M | N/A | Yes |

OCBC VOYAGE OCBC VOYAGE |

N/A | N/A | N/A |

SCB Visa Infinite SCB Visa InfiniteT&Cs |

S$1M | S$50K (+ COVID cover) |

Yes |

UOB VI Metal Card UOB VI Metal CardT&Cs |

US$1M | N/A | Yes |

While most $120K cards offer complimentary travel insurance, not all coverage is made equal. Some policies do not cover medical expenses, which means you’ll pretty much have to buy a stand-alone policy.

The table alone is only meant to be a quick summary, but based on my reading of the T&Cs, the AXA Travel Insurance policy offered by the HSBC Visa Infinite has the highest coverage of all. Cardholders are covered for up to US$2 million for accidental death, with S$100,000 of overseas medical expenses (including COVID), S$10,000 of post medical expenses in Singapore, and S$250,000 for emergency medical evacuation.

In terms of travel inconvenience, there’s S$10,000 coverage for trip cancellation, S$5,000 coverage for lost luggage, as well as coverage for loss of travel documents, rental car excess, and personal liability. Coverage even extends to family members travelling on the same trip. If you ask me, this is as good as any stand-alone policy.

Private Club Access

The AMEX Platinum Reserve continues to be the only $120K card with private club access via Tower Club. Bookings can be made through the AMEX concierge, and access is limited to five cardholders per day. All expenses will incur a 10% surcharge, as is Tower Club’s policy for affiliate members.

Although the Straits Bar is a nice place to have a drink, I find the overall Tower Club experience a bit stuffy and overrated. It’s certainly not a decisive factor for choosing a $120K card.

Dining Perks

| Card | Dining Perks |

AMEX Plat. Reserve AMEX Plat. Reserve |

|

Citi Prestige Citi Prestige |

|

DBS Vantage DBS Vantage |

|

HSBC Visa Infinite HSBC Visa Infinite |

|

Maybank Visa Infinite Maybank Visa Infinite |

|

OCBC VOYAGE OCBC VOYAGE |

|

SCB Visa Infinite SCB Visa Infinite |

|

UOB VI Metal Card UOB VI Metal Card |

|

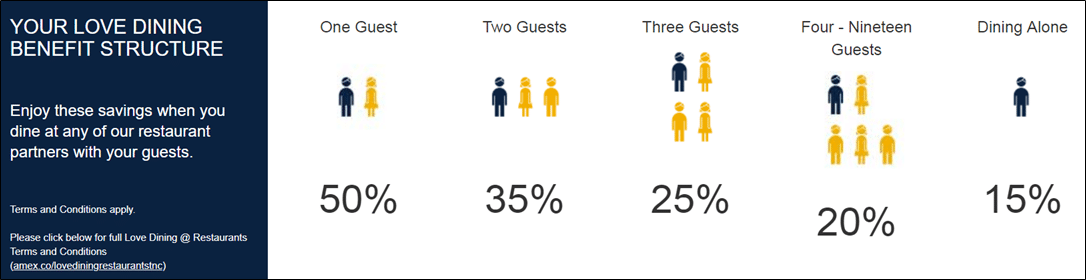

The AMEX Platinum Reserve may not have a lot going for it, but it does offer a solid dining proposition. Cardholders enjoy Love Dining benefits, which offers up to 50% off at a range of hotels and high-end restaurants around Singapore

In addition to this, there’s also Chillax, which gives 1-for-1 drinks at selected bars islandwide. The full list of Love Dining and Chillax partners can be found below:

|

|

I think it speaks volumes about how good Love Dining and Chillax are that even though they’ve lost more members than gained in the past year (goodbye Fullerton Hotels), it’s still one of the better dining programmes in Singapore.

AMEX Platinum Reserve cardholders also receive a S$100 Tower Club dining credit plus assorted discount and free wine vouchers.

| 💡 Love Dining Alternative |

|

You don’t actually need the AMEX Platinum Reserve to enjoy Love Dining and Chillax benefits; they’re also available on the entry-level AMEX Platinum Credit Card (AF: S$321). For a limited time, you can enjoy an annual fee waiver when you sign up for a POEMS account. |

The UOB Visa Infinite Metal Card has lost its Gourmet Collection membership, but replaced it with additional weekday lunch discounts at Pan Pacific and PARKROYAL hotels, as well as The Fullerton Hotels. Parties of two will save 50% off the food bill:

| Hotel | Participating Outlets |

| Grand Hyatt |

Do note that Pete’s Place has been removed- not that anything of value was lost there! |

| Fullerton Hotels |

|

| Pan Pacific Hotels |

|

Likewise, HSBC Visa Infinite cardholders can enjoy 50% off the bill for two (or 33% off for three, or 25% off for four, or 20% off for five or more) at the following hotel restaurants:

| Hotel | Participating Outlets |

| Goodwood Park Hotel |

|

| Mandarin Oriental Singapore |

|

| Singapore Marriott Tang Plaza Hotel |

|

Citi Prestige and OCBC VOYAGE offer periodic 1-for-1 dining packages with selected upscale restaurants, while Standard Chartered Visa Infinite offers up to 30% off dining at MBS restaurants.

DBS Vantage has tied up with Dining City to offer 15-50% off dining at various restaurants (though the typical discount is much closer to 15-20%). However, it also has an Accor Plus membership that offers up to 50% off dining at Accor hotel restaurants across Asia Pacific.

Unique Perks

In addition to the benefits above, some $120K cards have unique perks which are well worth discussing.

Citi Prestige: Fourth Night Free

The 4th Night Free (4NF) benefit is no doubt one of the best perks of the Citi Prestige card. Used judiciously, cardholders can recover large chunks of their annual fee.

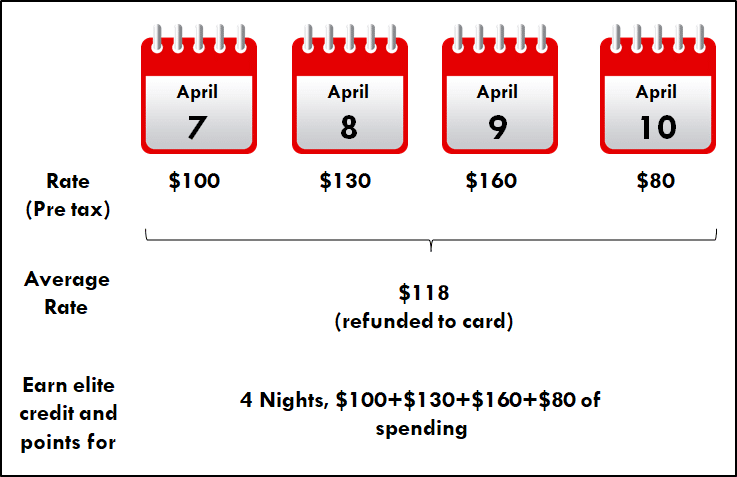

With 4NF, cardholders can request the Prestige concierge to book any publicly-available hotel rate and receive four nights for the cost of three. The average nightly pre-tax room rate is calculated and refunded to the card. This refund is done on the back end, so you’ll still earn hotel points and elite credit (where applicable) for four night’s worth of spending.

However, Citi has been tightening the screws on 4NF, and in March 2020 added some additional exclusions in terms of eligible rates and types of rooms covered. The benefit can no longer be used for suites or villas, nor can it be used on any half-board stays. That said, there’s no cap on the maximum uses (yet- the US version is now capped at two free stays per year), and a potential deal-maker if your travel schedule allows you to use it.

Moreover, the concierge has become a lot more strict about the types of rates that can be booked. Currently, only rates that appear on Expedia and non-member rates on the official website can be booked. Yes, even though it costs nothing to sign up for a Hilton/Marriott/Hyatt etc. membership, you won’t be able to enjoy the extra 10% or so they offer to their own members because it’s not a “publicly-available” rate.

It’s getting harder and harder to extract outsized value from this perk, though it can still save big money for those who hit the road often.

HSBC Visa Infinite: Priority Immigration

HSBC Visa Infinite cardholders who spend at least S$2,000 in a calendar month receive complimentary fast-track immigration service at selected airports for themselves and a guest. Just like the limo benefit, two complimentary uses are provided each year with no minimum spend (four for HSBC Premier customers).

Depending on the airport, fast-track immigration may also include meet and assist services, which escort you to/from the airplane.

Maybank Visa Infinite: JetQuay access

JetQuay is a private terminal at Changi for CIPs (commercially important people). You get dropped off at a private driveway, your check-in is handled by the terminal staff while you relax in the lounge, and the only time you mingle with the unwashed masses is en route to your flight in an electric buggy.

All that sounds great, but having tried it first hand, I can say it’s rather underwhelming. The JetQuay facility is dated, the food selection is poor, and although the service is excellent, there’s no reason why you should choose it over an airport lounge.

The full-fledged JetQuay Quayside experience normally costs ~S$428, but Maybank Visa Infinite cardholders can get it for free. Spending S$3,000 a month unlocks a choice of either two limo rides or a single JetQuay use

Take the limo rides.

OCBC VOYAGE: Redeem miles for any flight

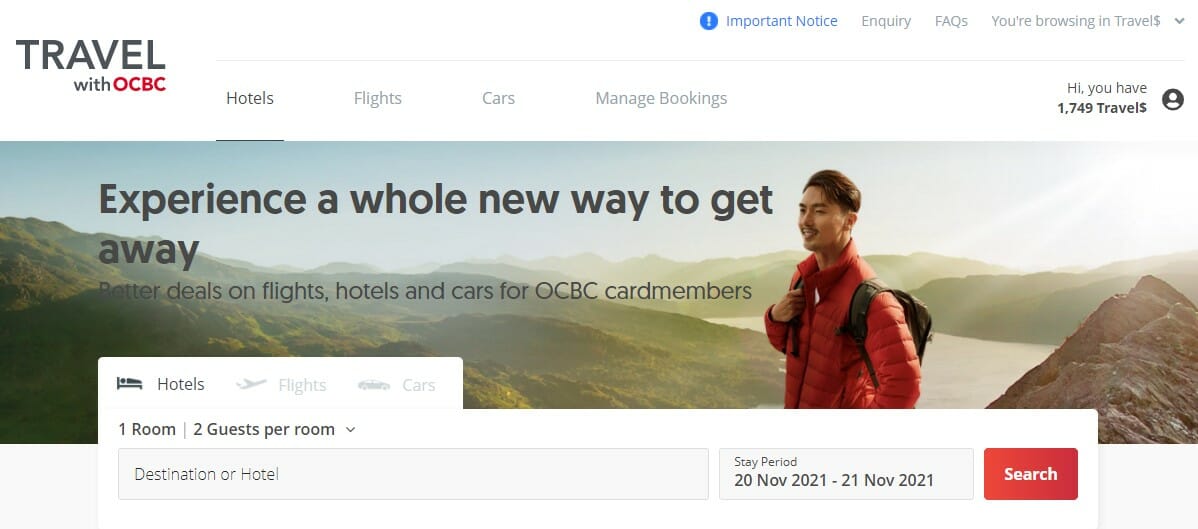

A unique feature of OCBC VOYAGE is that VOYAGE Miles can be used to pay for any flight in any cabin on any airline. It’s basically buying a commercial ticket, freeing you from the vagaries of award inventory and waitlisting, plus the opportunity to earn elite status credits on your flight.

Cardholders can get outsized value for their VOYAGE Miles via the Travel with OCBC portal.

|

| Travel with OCBC |

| Value per point for airfares on Travel with OCBC |

|||

| Travel$ | VOYAGE Miles | OCBC$ | |

| Economy | 0.87 | 0.90 | 0.36 |

| Premium Economy | 1.22 | 1.35 | 0.36 |

| Business | 2.52 | 2.52 | 0.36 |

| First | 2.88 | 3.06 | 0.36 |

| Valuations are accurate as of date of publishing and may be subject to change in the future |

|||

To illustrate, I once found a S$2,419 Turkish Airlines Business Class fare from Singapore to Barcelona. If paid entirely with VOYAGE Miles, this would cost 95,718 VOYAGE Miles.

For perspective, you’d need 207,000 KrisFlyer miles + S$105 in taxes (post-July 2022 devaluation) to redeem a similar ticket on Singapore Airlines. Given that 1 Travel$= 1 KrisFlyer mile, you’re paying ~50% of the miles normally required, and saving on the cash component!

DBS Vantage: Accor Plus membership

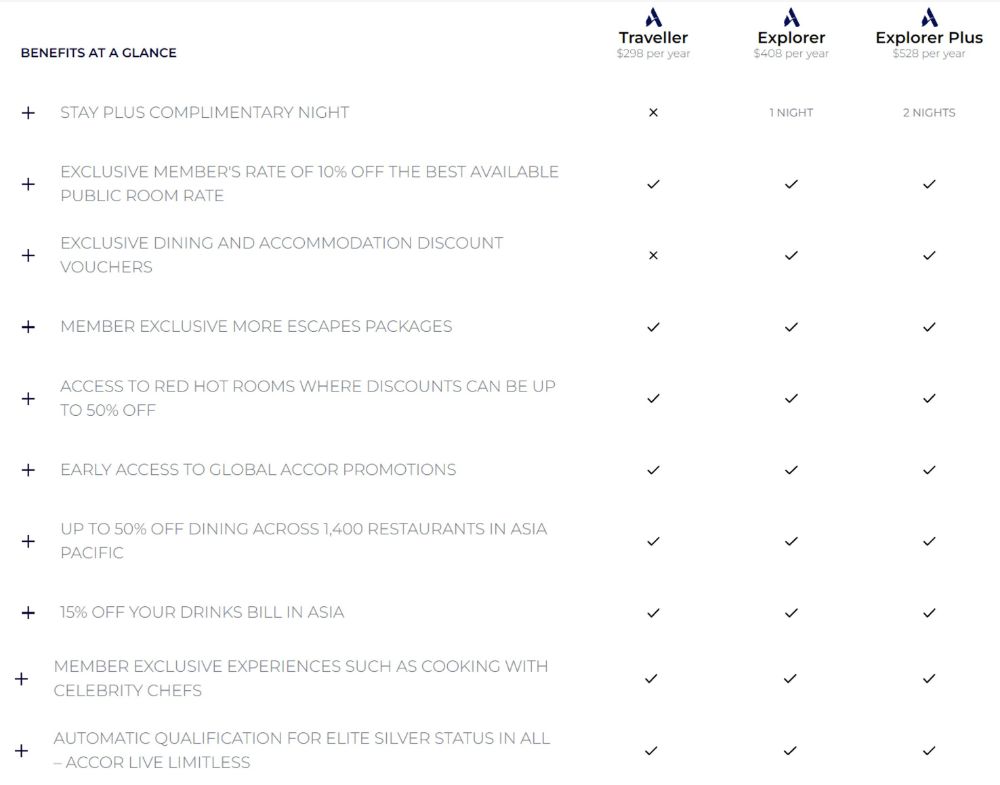

DBS Vantage cardholders receive a complimentary Accor Plus Explorer membership with one complimentary hotel night each year.

This retails for S$408, and includes benefits such as:

- Up to 50% off dining at participating Accor hotels across Asia Pacific

- 15% off drinks bill in Asia

- 10% off the best available public rate

- Access to Red Hot Room sales with up to 50% off

- Accor Live Limitless Silver status

The full list of benefits can be found below.

Ok, but which one’s the heaviest?

How on earth could I forget this? No one will admit it, but the visceral thrill of plonking down a laser-engraved piece of metal is great for fragile masculinity.

Unfortunately, only the DBS Vantage, Citi Prestige, OCBC VOYAGE and UOB Visa Infinite Metal Card use metal cardstock; the rest are plastic cards that weigh in at a whimpy average of 5g each.

| Card | Weight |

AMEX Plat. Reserve AMEX Plat. Reserve |

~5g |

Citi Prestige Citi Prestige |

8g |

DBS Vantage DBS Vantage |

10g |

HSBC Visa Infinite HSBC Visa Infinite |

~5g |

Maybank Visa Infinite Maybank Visa Infinite |

~5g |

OCBC VOYAGE OCBC VOYAGE |

10g |

SCB Visa Infinite SCB Visa Infinite |

~5g |

UOB VI Metal Card UOB VI Metal Card |

9g |

The DBS Vantage and OCBC VOYAGE are the heaviest of the segment, tipping the scales at 10g. But it’s still a far cry from the likes of the AMEX Platinum Charge (17g) and the UOB Reserve (28g).

Verdict: Which $120K card?

With COVID restrictions mostly lifted and normal life returning, the path to recouping the annual fee of a $120K card is much clearer.

Which option is best for you depends on your lifestyle and travel patterns, but could I be so bold as to suggest the following…

For the road warrior: Citi Prestige or HSBC Visa Infinite

Both the Citi Prestige and HSBC Visa Infinite offer unlimited lounge access and airport limo benefits, plus relatively generous travel insurance coverage, making them well-suited to frequent flyers.

The Citi Prestige has the edge on hotels with its 4NF benefit, as well as a wider variety of transfer partners and 25,000 miles each year, but the HSBC Visa Infinite strikes back with a much lower limo spend requirement, expedited immigration clearance, and up to five unlimited lounge passes for supplementary cardholders.

For the miles accumulator: DBS Vantage

$120K cards are generally held more for their benefits than their miles accumulation potential, but the DBS Vantage flips the script.

In addition to its best-in-class earn rates of 1.5/2.2 mpd on local/FCY spend, cardholders can make hay with its 4.0 mpd on dining and petrol spending for the rest of 2022. What’s more, a sign-up bonus of up to 80,000 miles awaits those who hop on board by 27 June 2022, offering excellent value to early adopters.

The Accor Plus membership doesn’t hurt either.

For the value hacker: OCBC VOYAGE

VOYAGE Miles are one of the most interesting loyalty currencies out there, and thanks to Travel with OCBC, OCBC VOYAGE cardholders can score great value redemptions on commercial tickets. This makes it a good option for those willing to spend the time researching fares and finding the cheapest cities to book tickets out of.

The main issue may be that VOYAGE Miles are relatively hard to come by, since the card lacks a bonus category.

Conclusion

At the risk of repeating myself: you don’t need a $120K card to play the miles game. If all you want is to accumulate miles as quickly as possible, you’d be better off with the basic cards I prescribe in my annual credit card strategy post.

But for those who like to enjoy the finer things in life, a $120K card can represent a good investment, provided you’re confident in your ability to recoup the annual fee.

Which $120K card is your weapon of choice?

DBS Vantage

DBS Vantage

Good overview as evey year!

My only 2 comments: With KF having devalued by 10-15% while the bulk of Citi/Amex transfer partners haven’t, the “earn rate” section as well as the “miles accumulator” conclusion becomes a little trickier.

Also: Is there an overview of all the status matches the cards come with?

By that same token, however, programmes like British airways executive club and Qatar have done their own devaluations during this period. Cx award space almost impossible to book now. It’s not been smooth sailing for members of other ffps either

For ocbc voyage, won’t the miles required be vastly higher now since prices for business class flights are now back to pre covid levels?

And if you could find a business class ticket for 2.5k I would prefer to pay with a card, earn the miles on both the fare and the flight then use the miles to redeem… just my thoughts

You can still find cheap Turkish airlines business class fares. And when you redeem voyage miles you earn miles on the flight

We applied for DBS Vantage, got approved and wanted to apply for a Supp card. DBS call centre advises we must fill in “paper forms” to be able to apply for a Supp card (what a hassle, why can’t we do it online?)

Btw, regarding lounge access, DBS call centre confirmed that the Main cardholder can bring in a guest and 2 passes out of 10 will be deemed used. I usually travel with my hubby who is a Main cardholder, so I am relieved that I can still access the lounges as long as I travel with him.

Citi Prestige had some amazing staycation offers recently (Valley Wing for 220 nett with 50 credit in 2021, or 290 nett earlier this year), but not sure if we’ll see these back again.

It gives also the Mastercard World Elite benefits/status matches, which I find usually much better than the Visa Infinite ones.

good point re: world elite mastercard. I remember they even offered rental car protection for a while, which SG cards don’t have!

Excellent post! Could you do a post on Airport Limo rides please? Is it an actual limo limo, can you choose a bigger van… do you tip the driver?

+1 on the request! 🙂

https://milelion.com/2022/01/03/2022-edition-best-credit-cards-for-airport-limo-rides/

As always a fantastic review, Aaron. I have disagreements with the recommendations but can’t argue with the reasoning. Here goes my color commentary: 1) Citi should be the solo winner in the first category. Limo rides are so overrated and a sprinkling of expedited immigration at airports hardly match up to 4NF and variety of partners. PP for supplementary card holders is a differentiator for sure but doesn’t tilt the scale IMHO. 2) For the second category, SCB VI is my winner. Admittedly the $2K minimum spend is not welcome but for a $120K+ earner, that kind of spend happens… Read more »

SCB VI is great for the first year but from the second year onward you’d have to beg for the renewal miles and I don’t like that. Also, any card ecosystems without a decent 4mpd powerhouse is a definite no-no as it’s gonna take an eternity to accumulate a sizeable stack of miles. Partner variety is indeed useful but it’s so hard to extract value from SCB’s hodgepodge of transfer partners — I’m not sure if I’ve misunderstood United MileagePlus this entire time but the program doesn’t even have that many sweet spots to begin with, does it?

The SCB VI 20K renewal miles are automatic. I’ve gotten them every year. And it has $100 Les Amis and I think $20/$50 off other LesAmis group restaurants. And if you shop at Tangs then you will know about the voucher bonus. I’ve easily made back my annual fee every year within the first few months. I used to do the income tax at 1.14 mpd but with the surfeit of miles now I haven’t in the last 2 years. I don’t bother with it’s other benefits though.

ocbc premier voyage doesn’t get you into tower club, you need the premier private or BOS voyage card.

fixed that, thanks

I think it’s good to mention if those points earned by the $120K segment card pool with the point earned by other regular cards

https://milelion.com/2021/12/18/which-banks-pool-credit-card-points/

I thought the DBS Vantage comes with Accor Plus Explorer (free 1 night stay + dining privileges comparable to love dining). Should that be considered in your analysis?

good point. I have added it under the dining and unique perks section.

hotelux membership is open to all Mastercard world members so Citibank prestige in the list is entitled to the membership along with a whole range of travel cards.