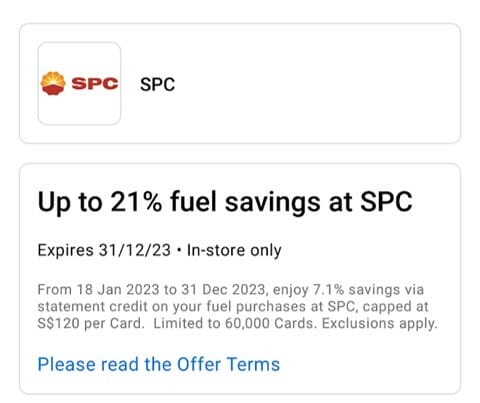

For the past few years, American Express has been running a popular offer with petrol chain SPC that allows registered cardholders to save up to 21% off petrol. With no updates for the first few weeks of 2023, there were concerns that the partnership had been retired for good.

But now comes some good news: the offer has popped up on the AMEX Offers portal once again, valid for the rest of 2023. Registration is capped, and each card can enjoy a maximum statement credit of S$120.

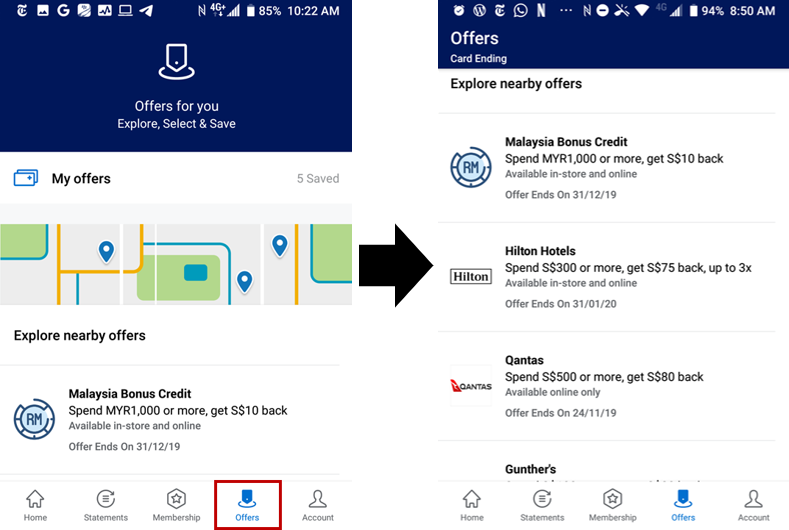

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles, Membership Rewards points, or discounts in the form of statement credits. They can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS, Citi or UOB AMEX cardholders. |

Enjoy up to 21% off petrol at SPC

From 18 January to 31 December 2023, American Express cardholders can save up to 21% off petrol at SPC. This is broken down as follows:

- 10% discount for SPC&U Members

- 5% discount for American Express cardholders

- 7.1% rebate for registered American Express Cards

The mathematically-inclined amongst you might notice that 10+5+7.1=22.1%, so why are the savings quoted as 21%? It comes down to discounts versus rebates. Cardholders will receive a 15% discount upfront, with a further 7.1% rebated to them via statement credit.

For example, if you purchase S$100 worth of petrol:

- You’ll pay S$85 at the counter (15% discount)

- You’ll receive a 7.1% rebate from S$85 (S$6.04) credited to your account

- All in all, you’ve paid S$78.96 for S$100 of petrol, a discount of ~21%

The maximum statement credit that can be received per registered card is S$120, which means you’d max this out with ~S$1,690 of petrol spending (after the 15% discount).

If you use more petrol than that, you can register more than one card. I see the SPC offer available across my AMEX KrisFlyer Ascend, AMEX Platinum Reserve, AMEX Platinum Charge and AMEX HighFlyer Card. Out of consideration to other cardmembers, however, please only register as many cards as you need since there’s a registration cap of 60,000 cards per type (e.g. 60,000 AMEX KrisFlyer Ascend, 60,000 AMEX HighFlyer Card etc.; the only outlier is the AMEX True Cashback Card with a cap of 5,000).

Statement credits should reflect on your account within five business days from qualifying spend. The full T&Cs can be found below:

Terms and Conditions for 15% On-site Fuel Savings at SPC at amex.co/spc15percent

Terms and Conditions for 7.1% savings via statement credit, on all purchases at SPC

|

No miles or points for SPC transactions

Back in March 2020, American Express updated their rewards T&Cs to exclude SPC altogether. This was a surprising move, given that up till then it was possible to enjoy the 21% discount together with regular miles or points accrual. While American Express is not alone in excluding rewards at SPC (UOB does it too), it does mean that using your AMEX card will be a purely money-saving play.

Is it worth forgoing miles/points at SPC in favour of a larger discount? It comes down to your personal valuation of a mile, really, but in general given the discounts on offer I’d say yes.

There are two exceptions to this rule:

- AMEX True Cashback Cardholders will still earn 1.5% cashback as per normal

- AMEX HighFlyer Cardholders will still earn 1.8 mpd as per normal

Pay with Points+ at SPC

| 💳 AMEX Pay with Points+ |

||

1,000 MR points 1,000 MR points |

⇒ | S$6.00 |

In 2021, American Express launched an enhanced Pay with Points programme, aptly called Pay with Points+ (or PWP+ for short). This scheme allows cardholders to redeem Membership Rewards points at an enhanced rate at selected merchants.

SPC has been added to the PWP+ programme, which means you can redeem 1,000 MR points for S$6, instead of the usual S$4.80. But this represents poor value still, because by choosing PWP+, you’re accepting an implicit value of

- For Platinum Charge/Centurion members, 1 mile= 0.96 cents

- For all other AMEX card members, 1 mile=1.08 cents

I’d pass on it.

What other cards can you use for petrol?

If we’re approaching the question from a simple “which card gives the most miles, period” perspective, then the answer is pretty straightforward:

| ⛽ Highest Miles Earning Cards for Petrol |

||

| Card | Earn Rate | Remarks |

Maybank World Mastercard Maybank World MastercardApply |

4 mpd | No cap |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd* | Max S$1K per c. month. Must choose transport as 10X category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd* | Max S$3K per c. month. Must choose transport as 10X category Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd* | S$1K-2K on petrol + contactless per s. month Review |

| C. Month= Calendar Month, S. Month= Statement Month *Excludes SPC, Shell |

||

Where it gets complicated is that the best card from a miles perspective may not necessarily be the best card from a discounts perspective. I’m in the midst of updating my “best cards to use for petrol” article for 2023, which takes into account both miles and discounts, so stay tuned.

Conclusion

American Express has renewed its partnership with SPC, offering a 21% discount for registered cardholders throughout 2023. A total of 60,000 slots are available, so drivers will want to get registered as soon as possible.

Just keep in mind that the discount comes at the expense of earning miles (unless you have an AMEX HighFlyer Card), and if miles are what you primarily you care about, then the UOB Preferred Platinum Visa and Sinopec’s no-questions-asked discount scheme are your best friend.

I still use UOB Visa Signature Card for petrol. Even though it’s not on the Caltex website, the receipt shows that I have been getting 16% discount consistently for 95 grade petrol. It helps me to cross the $1000 per month required for 4 mpd on this card. If you value a mile 1.5 cents, 4 mpd works out to a 6% rebate. On top of that, you get 2 linkpoints per litre. I pump about 50 litres each time, so that is 100 linkpoints=$1. That is about 0.86% for 95 grade petrol at $2.75 (before discount) per litre. That… Read more »

I currently use SPC+POSB everyday card. The promo of 20.1% + 2% is better.