It’s not quite income tax payment season yet, but here’s a heads up for those of you holding HSBC credit cards: HSBC will be terminating its Income Tax Payment Programme from 1 April 2023, and has already ceased accepting new application requests.

Per an update on the HSBC website:

HSBC Income Tax Payment Programme will be discontinued by 1 April 2023. Please note that any new application requests received after 16 January 2023 will not be accepted. The final deduction for the monthly instalment payment option will be made by 30 March 2023. Thereafter please make the necessary arrangements for your income tax payment with IRAS from April 2023 onwards.

-HSBC

This poses a particular problem because HSBC cards already do not award miles for bill payment platforms like CardUp or ipaymy, giving their customers nowhere else to turn.

HSBC ending tax payment programme

HSBC cardholders can currently pay their income taxes via credit card using the Income Tax Payment Programme. An admin fee of 0.5-1.5% applies, resulting in a cost per mile ranging from 1.2-1.75 cents.

| 💰 HSBC Tax Payment Options |

|||

| Card | Earn Rate | Admin Fee |

CPM |

HSBC Visa Infinite HSBC Visa Infinite |

1.0/1.25 mpd* | 1.5% |

1.2/ 1.5 |

HSBC Premier Mastercard HSBC Premier Mastercard |

0.4 mpd | 0.5% |

1.25 |

HSBC Revolution HSBC Revolution |

0.4 mpd | 0.7% |

1.75 |

| *Spend min. S$50K in previous membership year to earn 1.25 mpd; otherwise 1 mpd |

|||

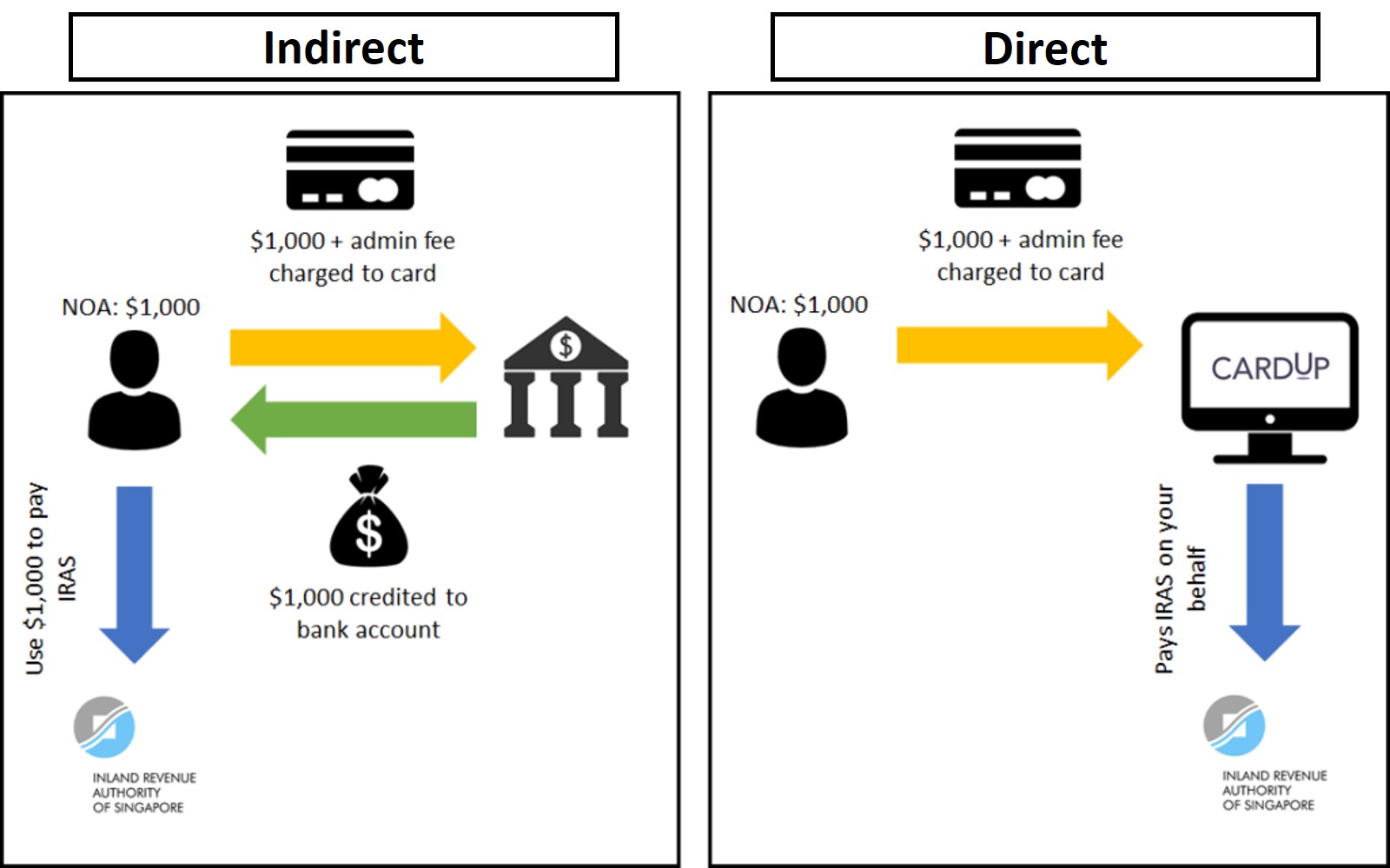

This is an indirect tax payment facility, which means that upon approval, HSBC charges the credit card for the applicable amount plus an admin fee, deposits funds into the cardholder’s designated bank account, and the cardholder is then responsible for paying IRAS himself. Even better, the cardholder could apply for a GIRO arrangement with IRAS and still enjoy the cash flow benefits of instalment payments.

| ❓ Worked Example |

|

John has an income tax bill of S$12,000, and a HSBC Revolution. He applies for the Income Tax Payment Programme and chooses the one-time payment option. His HSBC Revolution will be charged S$12,084 (S$12,000 + 0.7% admin fee), and S$12,000 will be deposited into his bank account with 12,000 HSBC points (4,800 miles) credited. His net out of pocket cost is S$84, for which he received 4,800 miles, therefore the cost per mile is 1.75 cents each. Alternatively, John could opt for the monthly instalments option, whereby his HSBC Revolution will be charged S$1,007 (S$1,000 + 0.7% admin fee) per month, and S$1,000 will be deposited into his bank account with 1,000 HSBC points (400 miles) credited per month. Either way the cost per mile is the same. |

Since the bank does not pay IRAS directly, cardholders can “churn” their tax payments by applying for other indirect tax payment facilities with other banks, avoiding a scenario where their tax bill is overpaid (which triggers a refund and telling off from IRAS).

Unfortunately, HSBC stopped accepting new Tax Payment Programme application requests on 16 January 2023. Any customers on the monthly instalment scheme will have one final deposit made on 30 March 2023, and the Programme will be discontinued from 1 April 2023.

What are the alternatives?

If you only hold HSBC credit cards, this development leaves you in a bit of a pickle.

HSBC already excludes CardUp and ipaymy from earning rewards with its cards, and I don’t have any data points indicating whether AXS Pay Any Bill (formerly known as AXS Pay+Earn) works with HSBC cards (though with a fee of 2.6%, you wouldn’t bother using it anyway)

It seems the best solution is simply to apply for Citibank card and wait for one of their periodic Citi PayAll promotions to come along. The current offer, which runs till 31 January 2023, offers customers 1.8 mpd with a 2% fee when paying income tax and many other bills. This works out to 1.11 cents per mile each, much better than HSBC.

Sadly, it’s no longer possible to earn free miles from paying income taxes ever since GrabPay started blocking AXS transactions on 16 January 2023.

Conclusion

HSBC is calling time on its Income Tax Payment Programme from 1 April 2023, and has already stopped accepting new applications. This effectively cuts off all opportunities to earn miles for tax payments with HSBC credit cards, since CardUp and ipaymy are also excluded.

HSBC cardholders should instead look get a Citibank card so they can take advantage of Citi PayAll, or else wait for income tax season where CardUp will no doubt run another offer like previous years.

(HT: YC Wong)