Back in January, I wrote about a new service that popped up on the AXS mobile app called Pay+Earn. This appeared to be a Citi PayAll/SC EasyBill/CardUp competitor, allowing customers to pay their bills with a credit card, earning miles and points in exchange for a small admin fee.

Well, it seems that Pay+Earn has gone live, and you can now see it as an option when selecting your payment mode.

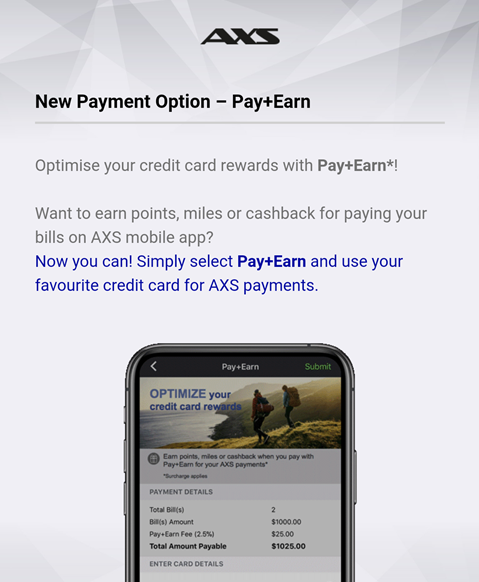

Tapping on it brings up a landing page with the following information:

How does AXS Pay+Earn work?

Pay+Earn is available for all services on the AXS mobile app except credit card bills and loan payments. Customers will pay a 2.5% admin fee, for which they’ll earn points, miles or cashback on their Singapore-issued Visa or Mastercard credit cards.

We’ll get to the 2.5% admin fee in a bit, but what confused me was this: almost every bank excludes AXS transactions from earning points. So how does AXS ensure that Pay+Earn transactions earn what’s promised? Are they processed over a different MCC? Does AXS have special tie-ups with the banks? DBS, OCBC and UOB are mentioned as “participating banks”, so does it mean rewards are guaranteed if you use their cards?

I put the question to AXS, which came back with this rather vague response. Curiously enough, they said that Citibank cards are excluded, but I don’t see that mentioned in any of the FAQ or T&C.

The FAQ section wasn’t exactly helpful either.

|

Q: How do I know if the points, miles or cashback is credited to the card? A: The rewards will be credited based on the discretion of your card-issuing Bank. Please check with your Bank |

Thankfully, someone at the bank was more on-the-ball. I reached out to my contact at OCBC, who confirmed that Pay+Earn transactions are processed through a different MCC, and therefore will earn rewards.

|

Update: DBS has updated their rewards T&C to state that Pay+Earn transactions are eligible to earn points. OCBC has also updated their T&C for the 90N and VOYAGE cards to state that Pay+Earn transactions will only earn 1 mpd |

Is AXS Pay+Earn worth it?

But perhaps all this is a moot point, because the 2.5% admin fee isn’t competitive compared to what’s out there. Here’s how much you’d be paying per mile if you compared Pay+Earn with CardUp, or Citi PayAll.

| AXS 2.5% Fee |

CardUp 2.25% Fee |

PayAll 2% Fee |

|

DBS Altitude Visa DBS Altitude Visa OCBC VOYAGE OCBC VOYAGE Citi PremierMiles Visa Citi PremierMiles Visa SCB X Card SCB X Card OCBC 90N Card OCBC 90N Card |

2.03 (2.5 for OCBC cards) |

1.83 | 1.67 |

Citi Prestige Citi Prestige |

N/A | 1.69 | 1.54 |

UOB PRVI Miles UOB PRVI Miles SCB Visa Infinite SCB Visa Infinite UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.74 | 1.57 | N/A |

BOC Elite Miles Card BOC Elite Miles Card |

1.63 | 1.47 | N/A |

UOB Reserve UOB Reserve DBS Insignia DBS Insignia Citi ULTIMA Citi ULTIMA |

1.52 | 1.38 | 1.25 |

In light of this, it’s hard to think of why people would opt for Pay+Earn, unless

- They’re unaware of alternatives to Pay+Earn, or

- They want to make payments not supported by competitors

With regards to point (2), AXS does offer a significantly wider variety of payments compared to CardUp/PayAll/EasyBill. For example, you could pay for fines and government services through AXS, as well as storage bills and country club membership fees. So that’s a potential use case for Pay+Earn, if you’re in that situation.

Conclusion

A 2.5% admin fee isn’t particularly compelling, but it’s always good to see another option for earning miles. Plus, it’s entirely possible that AXS may run promotions to drive adoption.

Will you be using AXS Pay+Earn?

Maybe if WWMC counts this as a qualified payment, then the situation will tip in AXS’ favour?

GPMC does not work – it says it’s not a valid card. Can someone verify this?

I think as long as the payment processor is AXS, GPMC won’t work.

yeah, i think so given that GrabPay is no longer accepted for AXS

Does this count towards the spending requirements (i.e Min spend)?

NTUC income is a valid use case, I think. It does not accept payments from Cardup/IPaymy etc.

UOB One?

This is a miles, not cashback website. But UOB One may be a good use case… Assuming you hit exactly the tier. If you go over, not useful anymore.

Aaron, how did you narrow down to the cards listed above? Did you choose them as they are the best general spending cards? Sidenote, do wwmc & citi rewards earn 4mpd on axs mobile app?

Those are for points comparison only, I believe. Do note that the screenshot reply stated “excluding Citibank” but there is Citibank cc in the listed cards.

they are for points comparison purposes. citibank is there so you can compare payall/cardup options

AXS’s reply to you said “excluding Citibank”. So, entry for the Prestige card under AXS should be NA?

yup, have updated. i dont know where the no citibank thing came from though- i dont see it in the FAQ or the T&C.

Pay+Earn is not eligible for Credit Card bills and Loan bills.

Too bad it doesn’t work for HDB loan installments as it is under “Loans” category, but at least it works for Town Councils and Utilities.

Good Case for NTUC Income Life Insurance

Try using CRMC – won’t work.