From 14-27 February 2022, DBS is running a flash offer on new DBS/POSB credit card sign-ups, with S$300 cashback for new-to-bank cardholders.

|

| ❓ New-to-bank |

| DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not cancelled any in the past 12 months. |

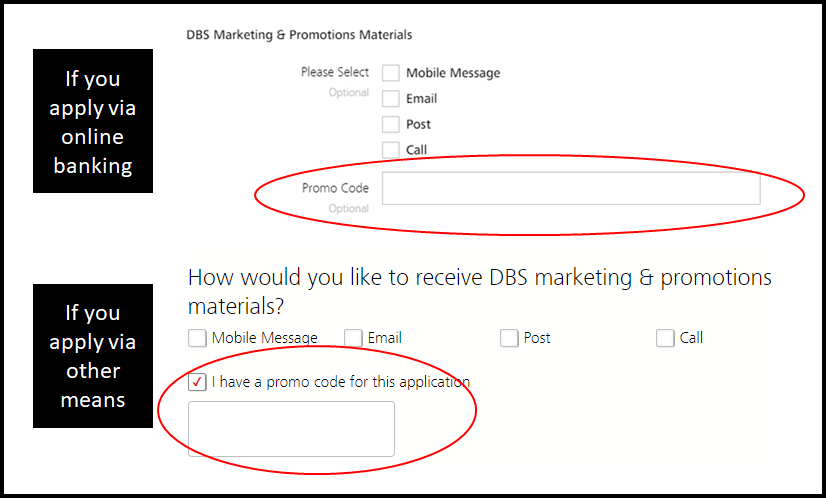

Applicants must apply with the promo code FEBFLASH and make a minimum spend of S$500 within 30 days of approval.

We haven’t seen a S$300 sign-up offer since September 2022, so this marks a welcome return- even if the terms have become stricter over time (it used to be that only a single transaction of any amount was required). Still, we’re talking 60% cashback (S$300/S$500) isn’t bad, which is hard to complain about!

Which DBS credit cards are eligible?

The following credit cards are eligible for this promotion.

| Card | Annual Fee | Key Features |

DBS Altitude Visa DBS Altitude VisaApply Review |

S$194.40 (FYF) |

3 mpd on airline and hotel spend, 2 lounge visits |

DBS Altitude AMEX DBS Altitude AMEXApply Review |

S$194.40 (FYF) |

3 mpd on airline and hotel spend |

DBS Live Fresh DBS Live FreshApply |

S$194.40 (FYF) |

Up to 5% cashback on online and contactless |

DBS Woman’s Card DBS Woman’s CardApply |

S$162 (FYF) |

2 mpd on online spending |

DBS Woman’s World Card DBS Woman’s World CardApply Review |

S$194.40 (FYF) |

4 mpd on online spending |

DBS yuu Card DBS yuu CardApply Review |

S$194.40 (FYF) |

Gurmit Singh thanks you |

POSB Everyday Card POSB Everyday CardApply |

S$194.40 (FYF) |

Up to 8% rebates on groceries, online food delivery and more |

If, for whatever reason, you don’t already have a DBS card, I’d highly recommend getting started with the DBS Woman’s World Card (review) so you can rack up 4 mpd on all online transactions (capped at S$2,000 per month). And yes, men can apply too.

Here’s what you need to do:

- Apply by 27 February 2023 with the code FEBFLASH (if you forget to enter the code, you can do so via this link)

- Receive approval by 13 March 2023

- Activate your card

- Make a minimum qualifying spend of at least S$500 within 30 days of approval

S$300 will be credited to your account within 60-80 days of meeting the qualifying spend requirement.

Qualifying spend is based on posted local and foreign retail sales and posted recurring bill payments, but excludes the following:

- posted 0% Interest Instalment Payment Plan monthly transactions;

- posted My Preferred Payment Plan monthly transactions;

- interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS;

- payments to educational institutions;

- payments to financial institutions (including banks, online trading platforms and brokerages);

- payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here);

- payments to hospitals;

- payments to insurance companies (sales, underwriting and premiums);

- payments to non-profit organisations;

- payments to utility bill companies;

- payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys);

- any top-ups or payment of funds to payment service providers, prepaid cards, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay and Singtel Dash);

- any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers);

- any transactions related to crypto currencies; and

- any other transactions determined by DBS from time to time.

Terms & Conditions

You can read the full T&Cs of this sign-up offer here.

Conclusion

From now till 27 February 2023, DBS is offering new cardholders S$300 cashback upon approval for a credit card and S$500 minimum spend- don’t forget to use the code FEBFLASH.

It’s as good as it gets for new-to-bank customers, although they may also want to consider an alternative offer for 21,000 bonus miles with a minimum spend of S$2,000 on the DBS Altitude AMEX. Which is better boils down to how much you value a mile, though personally I’d lean towards the cash.

DBS Altitude extends 21,000 miles sign-up offer; cuts minimum spend by 50%

Just got a WWMC last month for $200 cashback 🙁

i see tiberium wars reference i upvote.

pls watch sybert’s streams: https://www.youtube.com/watch?v=Y1uXM2jWuNg

any possible issues for NTB customers to get this offer (for say WWW), then subsequently get the DBS Altitude AMEX promo (ongoing till June 2023) as an existing customer? 😀

nope! in fact, that’s what i’d advise.

just noticed this in T&C:

“Each Eligible Cardmember is limited to 1 Welcome Gift during the Promotion Period regardless of the

number of Eligible Cards applied or approved during the same period. Eligible Cardmembers will not be

eligible for any other DBS/POSB Card sign-up promotions or in combination with any other promotions.”

https://www.dbs.com.sg/iwov-resources/media/pdf/cards/promotions/sg-milesaddon/sg-milesaddon-tnc.pdf

ah have already applied and spent though, so nothing to be done – hopefully still works!

I loled so hard at “Gurmit Singh thanks You” as the key feature for the yuu card

That said, suggest that you might want to provide the link if customers forget the code there’s always the form to fill up after. I think as you’ve said, hit or miss with this, ideally it shouldn’t get to this stage: https://www.dbs.com.sg/Contact/dbs/cards/flash-promo/default.page?pid=sg-dbs-pweb-cardscc-cards-dbscardsflash-textlink-flashpromo

thanks for sharing that! i know they had it for vantage, but didn’t know there was a separate just-in-case link for other cards too. will add.