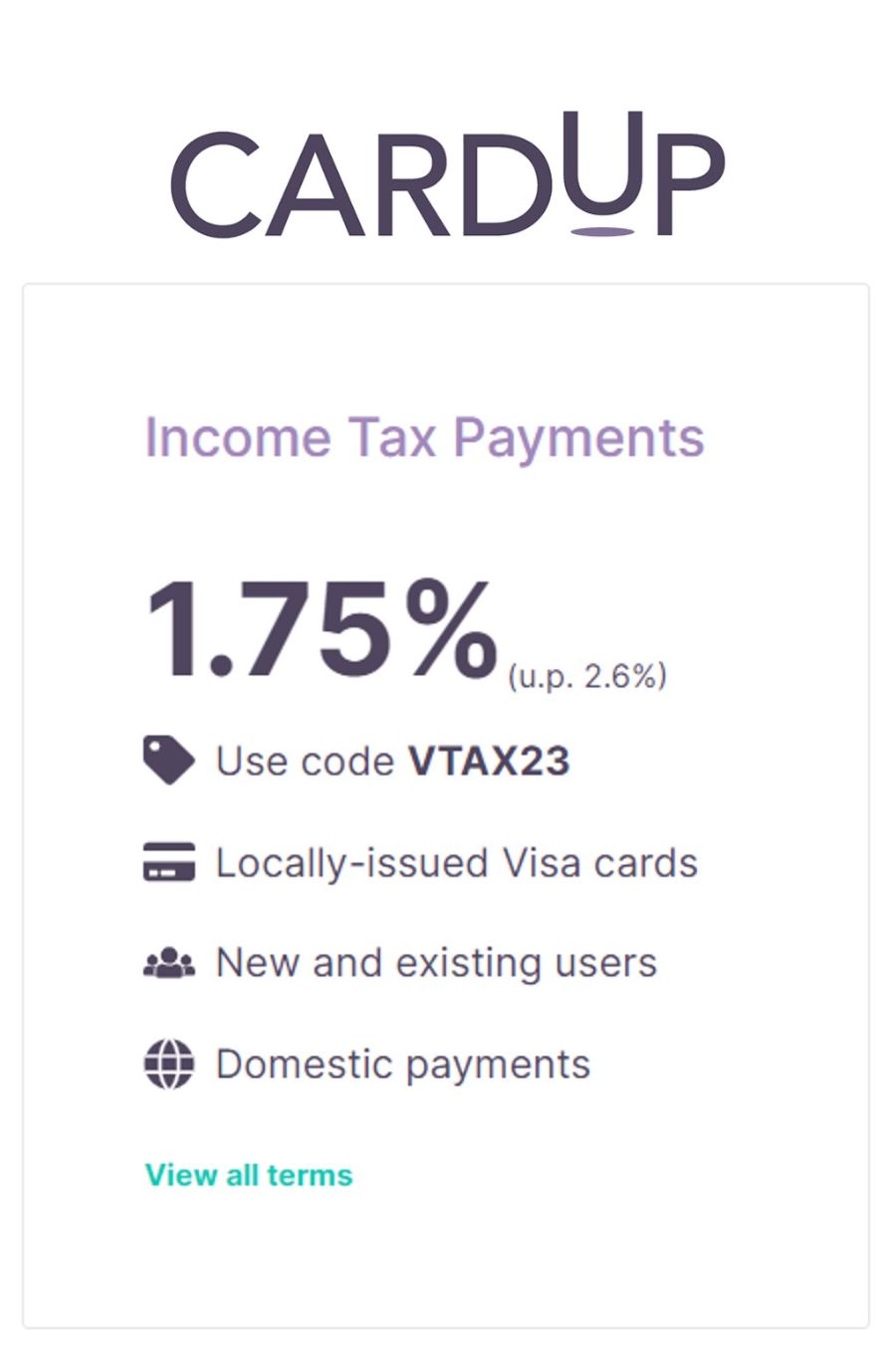

CardUp has become the first horse out of the gate this tax season by launching a 1.75% offer for income tax payments.

This promotion is valid for a one-off lump sum payment, or the first in a series of recurring income tax payments. A Singapore-issued Visa card must be used to pay, and you’re looking at buying miles from as little as 1.07 cents each.

It’s still early days and I’m sure there’ll be other offers to come, but so far things look good- a 1.75% fee matches the offer CardUp had for 2022.

Pay income tax via CardUp with a 1.75% fee

Here’s the key details of CardUp’s 1.75% income tax payment promotion:

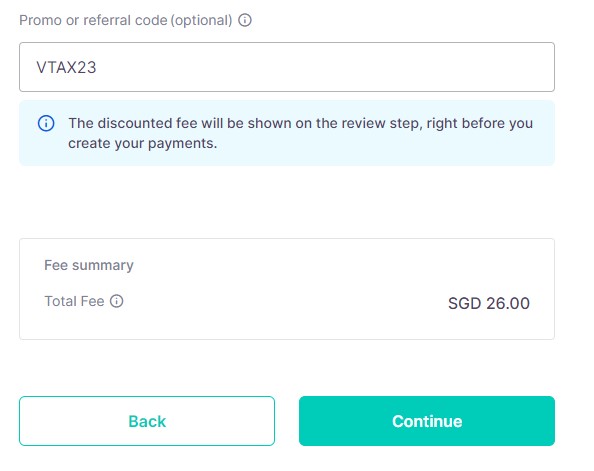

- Use code VTAX23

- Payments must be scheduled by 19 April 2023, with a due date on or before 24 April 2023

- Promo code can be used once per customer, either for a one-off payment or the first in a series of recurring payments

- No maximum or minimum spend

- Valid for Singapore-issued Visa cards only

If you don’t think you’ll get your NOA in time, don’t worry. CardUp tells me that this isn’t their main tax payment offer, more like a teaser for those who want to make early payment. They have a separate offer planned that will launch in April and run for the rest of 2023.

| ❓ First-time user? |

|

If this is your first time using CardUp, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). You can subsequently use the VTAX23 code to pay the rest of your balance, since VTAX23 is valid for both new and existing customers. |

The T&Cs of this offer can be found here.

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given the earn rates and a 1.75% admin fee.

| Card | Earn Rate | Cost Per Mile (1.75% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

1.4* | 1.23 |

DBS Vantage DBS Vantage |

1.5 | 1.15 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.23 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

OCBC 90°N Visa OCBC 90°N Visa |

1.3 | 1.32 |

OCBC Premier VI OCBC Premier VI |

1.28 | 1.34 |

SCB X Card SCB X Card |

1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd (1.72 cpm). CardUp spending counts towards the minimum |

||

| 💳 OCBC customer? |

|

OCBC cardholders can take advantage of a lower fee, provided they’re new to CardUp: |

Remember, both the tax payment amount and the CardUp fee are eligible to earn miles.

For example, someone who pays a S$1,000 tax bill via CardUp would pay S$1,017.50 after fees. If he uses a 1.4 mpd card, he will earn 1,425 miles (ignoring rounding), for which he has paid a fee of S$17.50. The cost per mile is therefore 1.23 cents each.

Depending on what card you use, the cost per mile can start from as low as 1.07 cents each, which is a very compelling price to pay. Assuming your tax bill is large enough, you could be buying a Business Class ticket to Japan or South Korea for just over S$1,110 plus taxes (Business Saver @ 104,000 miles @ 1.07 cents each).

Even if you have one of the more basic 1.2 mpd earning cards, you can still enjoy a relatively competitive price of 1.43 cents per mile.

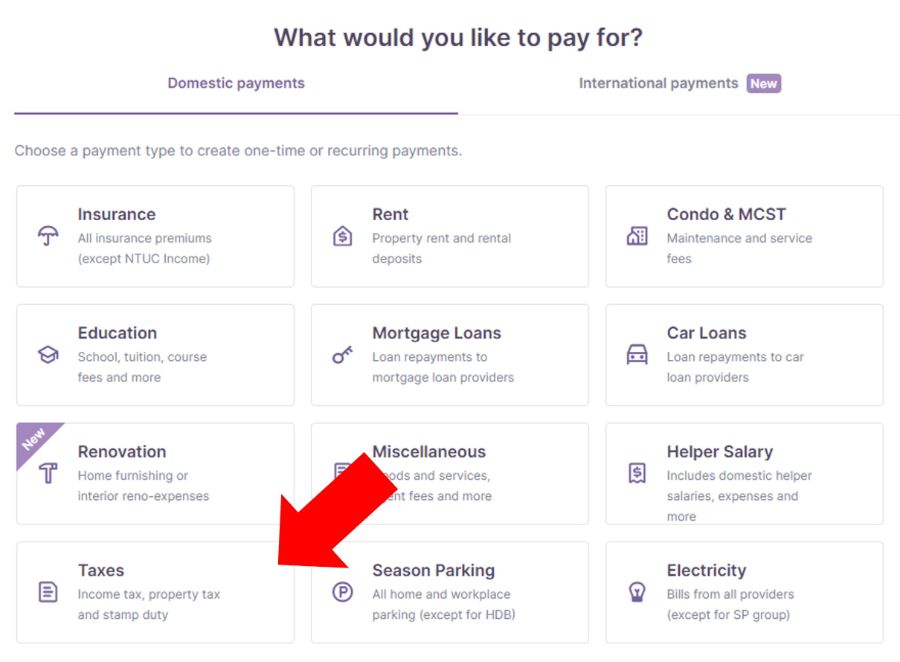

How to setup income tax payments

To schedule an income tax payment, login to your CardUp account and click on Create Payment > Taxes > IRAS-Income Tax

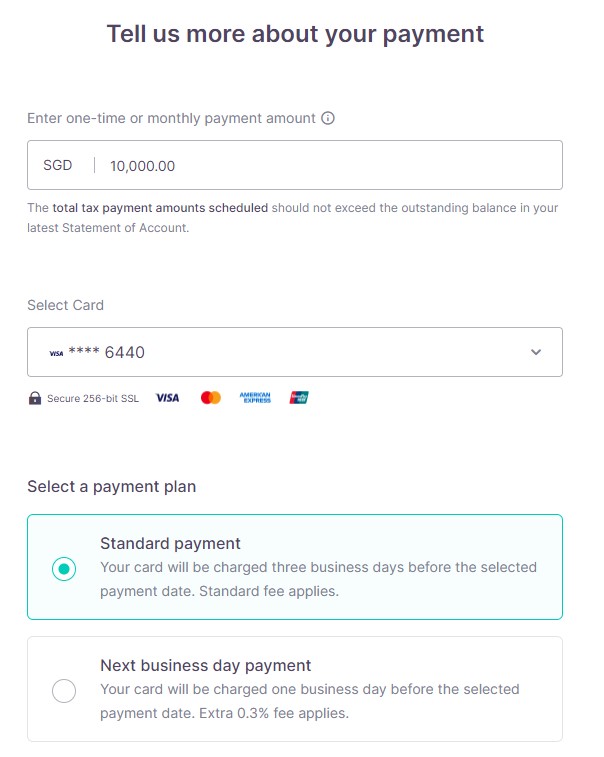

On the next screen, you’ll be prompted to enter the payment amount, choose a card (remember: Visa only), and a payment plan (the code is only valid for Standard payments).

Your payment reference number will be automatically filled based on the NRIC number registered to your CardUp account (this also means you can’t use CardUp to pay someone else’s taxes).

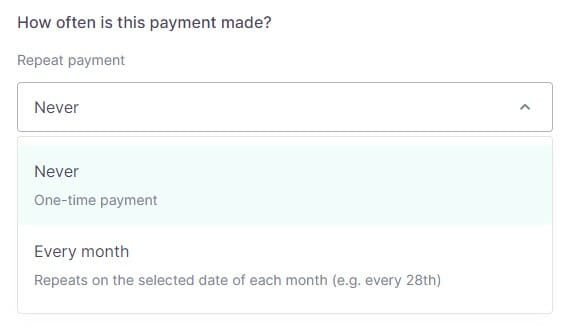

You’ll also be prompted to choose whether you want this to be a one-time payment, or recurring payment.

One-time payment

Under this option, you can pay any amount up to the total tax due on your NOA.

In other words, if your tax bill is S$10,000, you can pay any amount up to S$10,000.

Recurring payment

Under this option, you can use CardUp to pay your monthly instalment under a GIRO plan with IRAS.

This can be set up via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

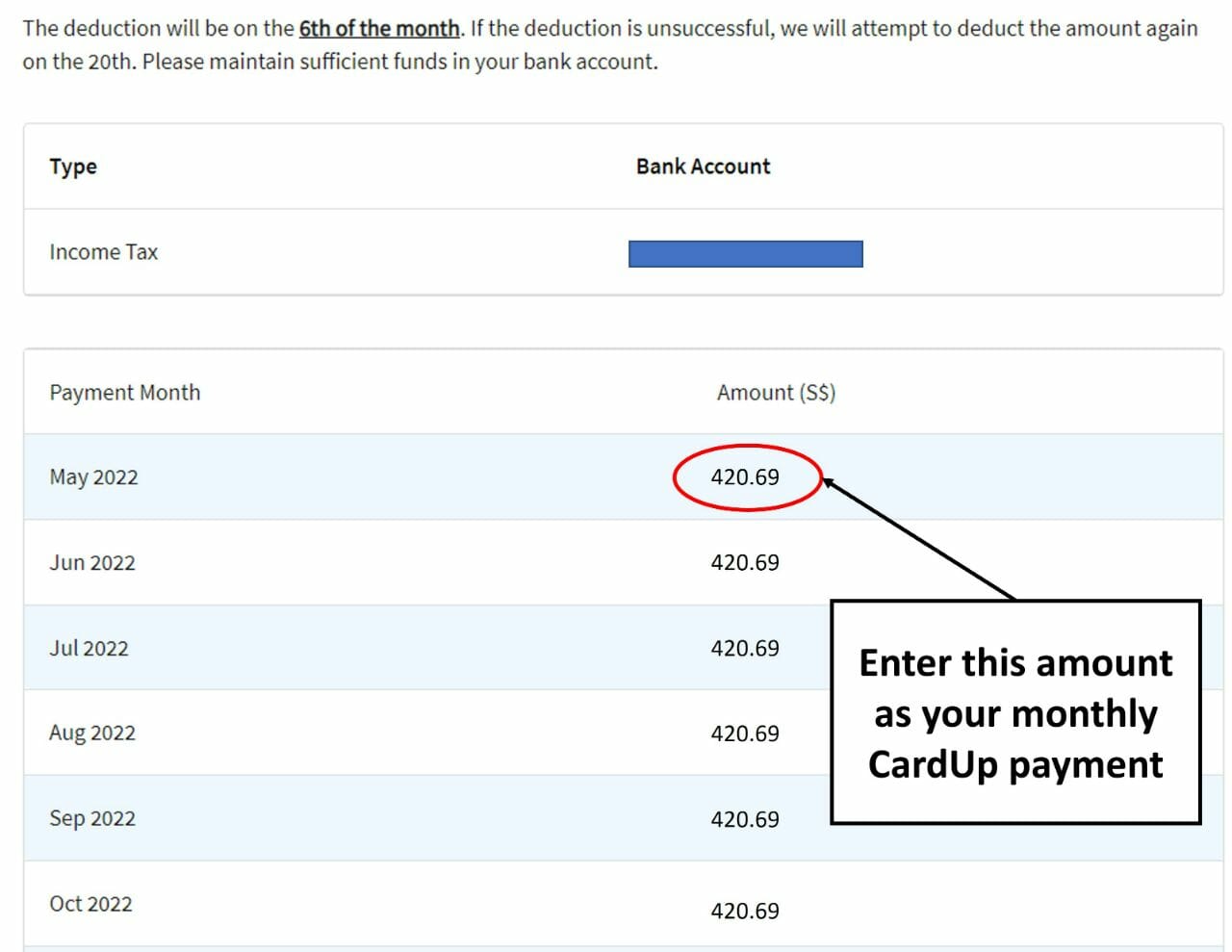

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal.

You’ll also need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

Regardless of whether you choose one-time or recurring, don’t forget to enter the promo code VTAX23. Don’t worry that the total fee doesn’t reflect the discount yet- that will appear on the final screen.

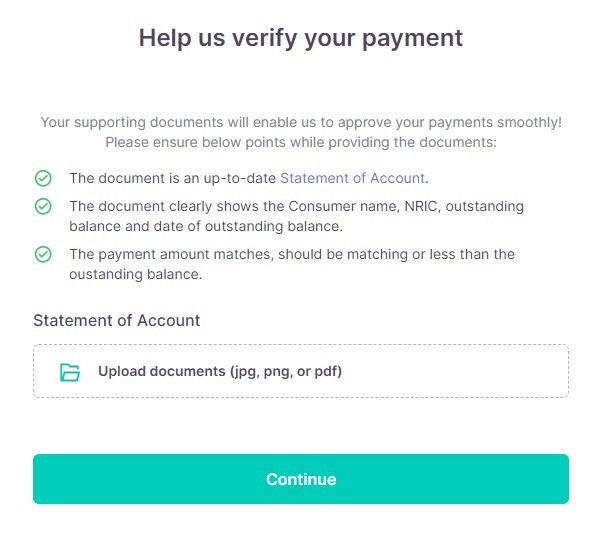

On the next screen, you’ll be prompted to upload a copy of your NOA for verification. This is to ensure you aren’t using CardUp to overpay your tax bill, which is a big no-no from an IRAS point of view.

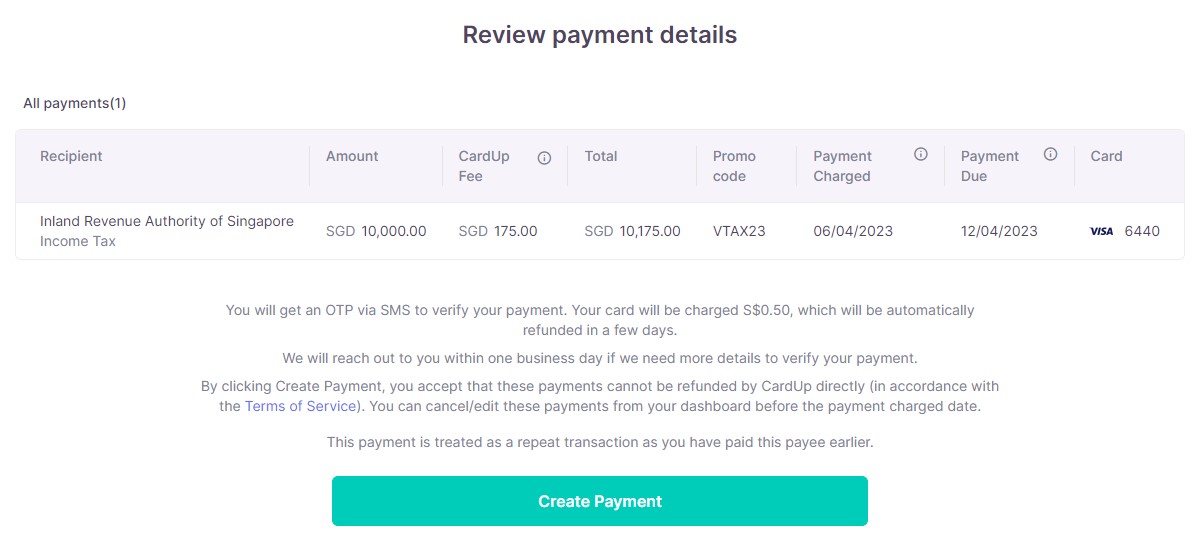

Finally, you’ll be able to review the payment schedule before confirming it.

If you chose a one-time payment, you’ll see this:

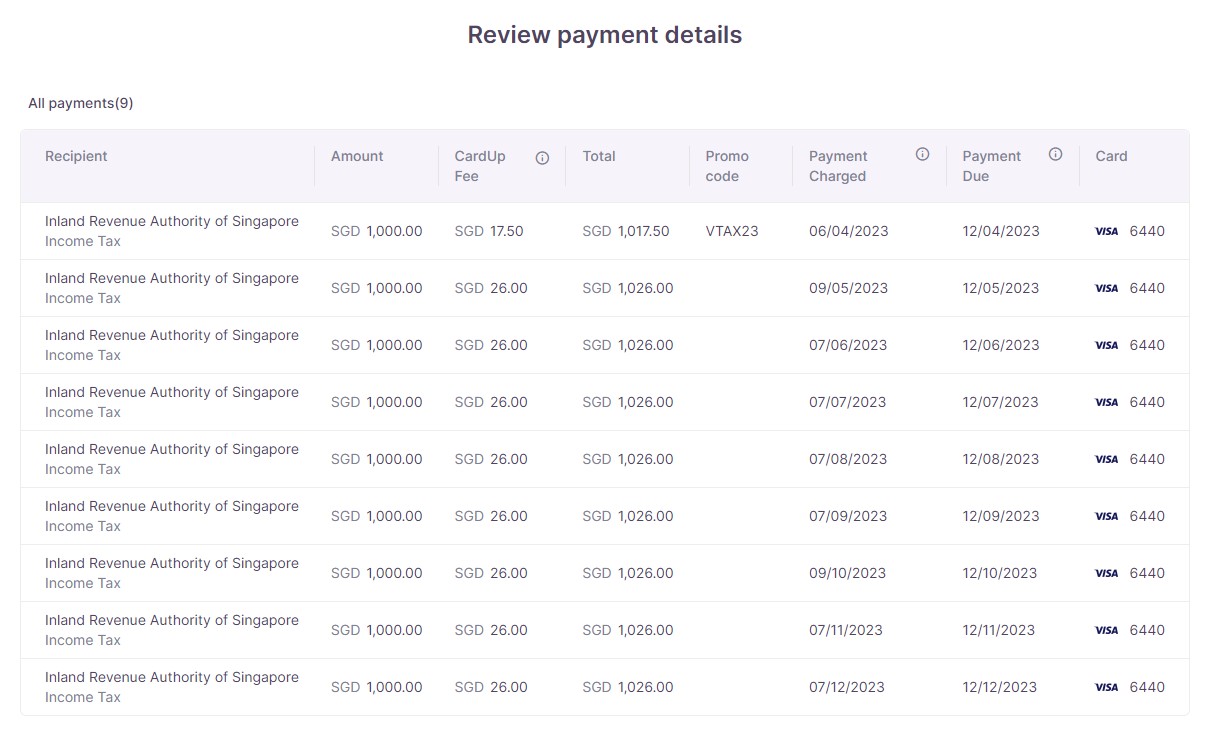

If you chose a recurring payment, you’ll see this.

Notice how only the first payment in the recurring series enjoys the 1.75% rate; other payments default to CardUp’s regular 2.6% fee.

However, there’s nothing stopping you from cancelling the rest of the payments, or editing them after the first payment has been made to add a new promo code like GET225, for a 2.25% fee.

Income tax guide 2023

I’ve received a lot of questions about this, so let me just say that yes, I am working on The MileLion’s Income Tax Guide 2023, which I hope to publish very soon. Inside, you can expect a full rundown of the best options for earning miles while paying income tax with various cards.

Stay tuned!

Conclusion

CardUp has launched a 1.75% promotion for income tax payments made with Visa cards, allowing customers to buy miles from as little as 1.07 cents each.

Payments need to be set up by 19 April 2023, but there’s no real rush, because:

- CardUp will be launching another income tax payment promotion in April, that will cover payments made till the end of 2023

- It’s worth seeing what competing services like Citi PayAll have in store for tax payment season too

If you’re one of the “lucky” ones to get an early NOA, however, it probably won’t hurt to use this promo code to cover your first instalment payment. You can then see what CardUp’s year-round offer is next month, or else look at what other competitors have in store.

Income tax guide coming your way soon!

Hi Aaron, would like to confirm if using CardUp to pay taxes allows one to earn miles. I called up DBS and they mentioned CardUp transactions are excluded, hence why I am confused.

Same, I have checked with DBS too. “Thank you for reaching out to us.

Please note that payments via CardUp will not be considered eligible and is not a qualified spend to earn points.”

Hello Joan – Could you drop us an email at hello@cardup.co with the DBS card that you are using, so we can look into this for you? From what we know, DBS credit cards do earn base rewards but have no guarantee of bonus rewards.

Hello Jack – Could you drop us an email at hello@cardup.co with the DBS card that you are using, so we can look into this for you? From what we know, DBS credit cards do earn base rewards but have no guarantee of bonus rewards.